Credit card price protection is a type of credit card insurance that allows you to receive a refund of the price difference when an item you've already purchased goes on sale. Not all credit cards offer this insurance, but it's a valuable feature of those that do.

The claim process takes just a few minutes, but requires supporting documentation. It can definitely be worth the time and effort, especially if it's a particularly large price difference.

Here, we'll discuss what price protection insurance is, what it covers, how to make a claim, and other related topics.

Key Takeaways

- Credit card price protection is a kind of insurance that pays you the difference if an item you already purchased goes on sale.

- You can make a claim via telephone or online.

- You'll need to provide your original receipt, credit card statement, and a flyer with the advertised reduced price of the item in question.

- Two of the best credit cards for price protection insurance are the MBNA Rewards World Elite Mastercard and MBNA Smart Cash World Mastercard

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What is credit card price protection insurance?

In cases of an after-purchase price drop, credit card price protection allows you to submit an insurance claim and receive a refund for the price difference.

As long as your claim is submitted within the required timeframe, typically within 60 days of the initial purchase, it will be considered. You'll need to provide certain information regarding the purchase, but once approved, you'll receive a refund of the price difference, usually in the form of a cheque.

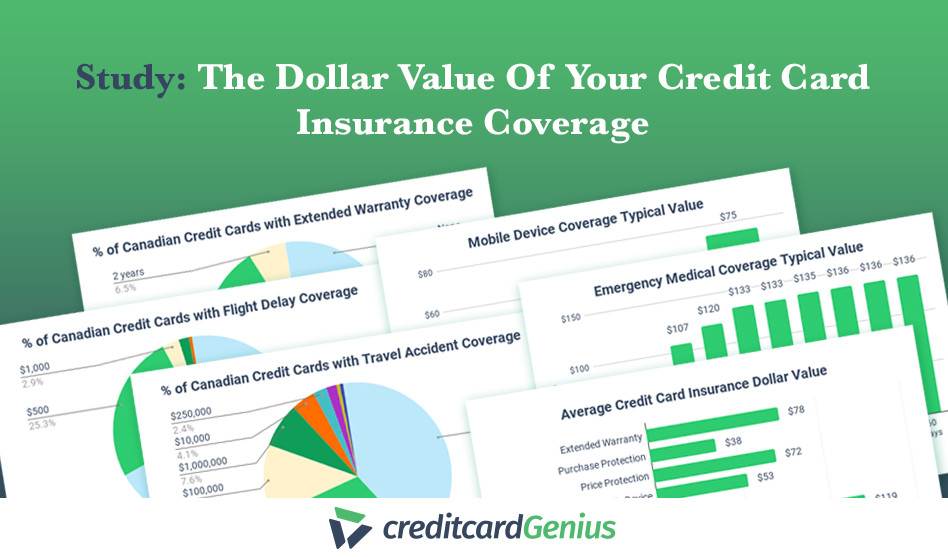

Price protection insurance is just one of the

That said, price protection can be a way to save a little money – or a lot! – especially if your credit card offers it.

What does credit card price protection cover (and not cover)?

Although exact price protection details can vary by card, there are some general limitations. To give you an idea of what to expect, we’ll go over the price protection insurance details for the MBNA Rewards World Elite Mastercard.

First off, realize that price protection is only possible if:

- You use your credit card to pay for the product

- Your credit card is in good standing

- You keep your receipt.

Plus, credit cards place a cap on how much you can claim per item and per year. For instance, the max for a single claim might be $500 and the annual limit is $1,000.

It’s probably easier to list what’s excluded rather than the overwhelming number of things that are covered. Here’s an overview of what’s excluded for the MBNA card:

There's nothing really out of the ordinary here. Groceries and fuel make sense to exclude, as otherwise, cardholders would be submitting claims every week. However, we should point out that electronics, such as computers and cell phones, are not covered (although products like video games are).

Note: If your item is on sale outside the country, you must factor in the shipping cost to determine whether the item is actually cheaper.

How to make a credit card price protection claim

If you’ve read through the exclusions and found that your item is eligible, you can make your claim by calling customer service (for the MBNA card, it’s 1-877-654-7511) or by submitting a claim online through Assurant insurance.

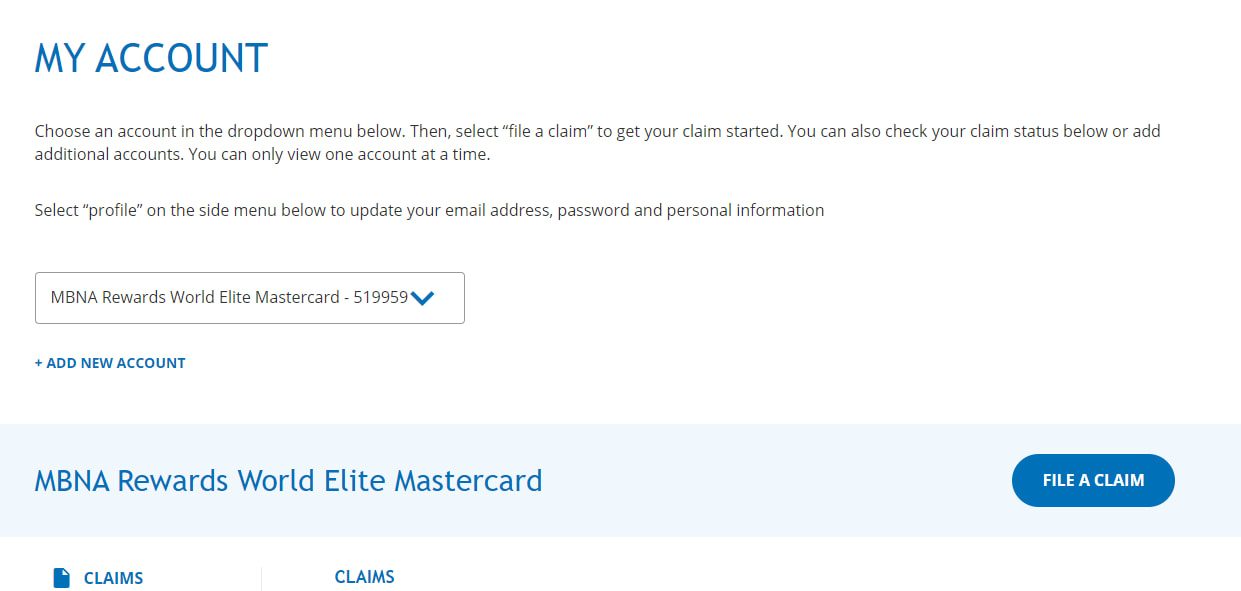

Start by making a free Assurant account or logging in. Next, we’ll walk you through the steps with an example.

We used the MBNA Rewards World Elite Mastercard to purchase a video game, Super Mario Odyssey. Just a few weeks after purchasing it, the price dropped, but since we bought it at Walmart (where they don’t price match), we had to use the card’s price protection.

Pro tip: When you make a purchase and have tagged it as a potential claim, keep your receipts safe. Take a photo on your phone or scan the receipt and upload it to a cloud service.

1. Find your reduced price

You can continue to check the price of the item in the days and weeks after your purchase. You might even see a Google ad pop up showing you the price drop.

If you don’t feel like obsessively checking prices, you can also set up price alerts on Google Shopping or use price tracking apps like Keepa or CamelCamelCamel.

2. Submit your claim

Log into your Assurant account and click on "File A Claim".

Assurant provides two different insurance coverages for the MBNA Rewards World Elite Mastercard. On the next screen, pick Price Protection from the drop-down menu and select "File A Request For Payment."

Next, we enter the purchase details for the video game.

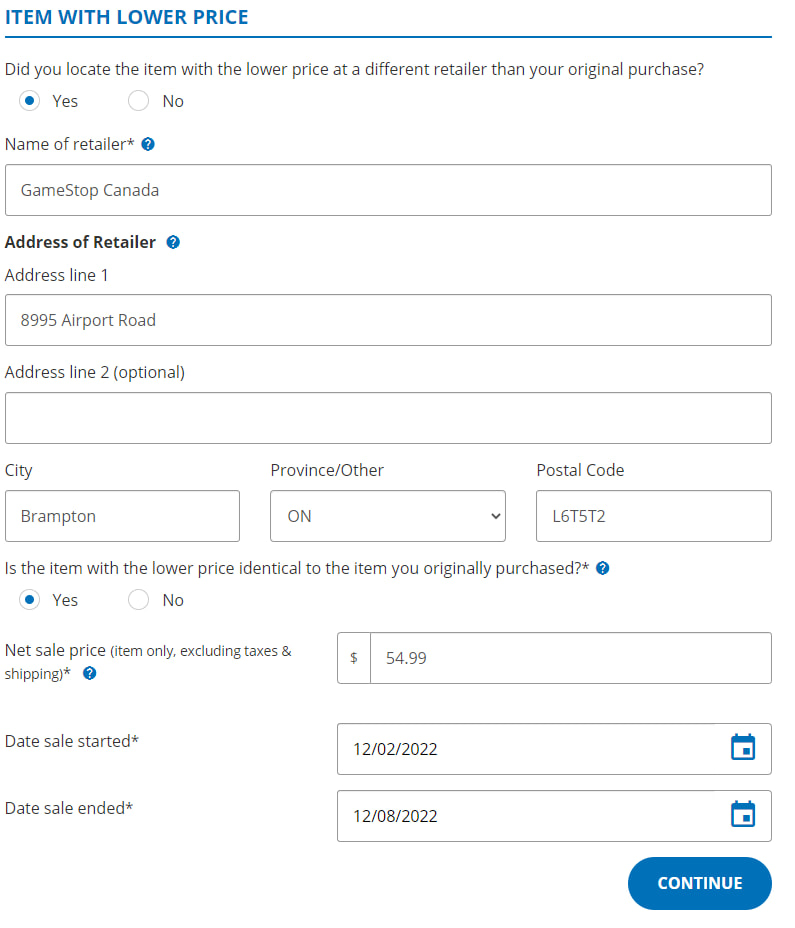

The next page was dedicated to where we found the lower price.

Most of this is standard. However, there are dates to consider. Price protection insurance is primarily based on a flyer having a lower price within a short window of time, usually up to 30 or 60 days.

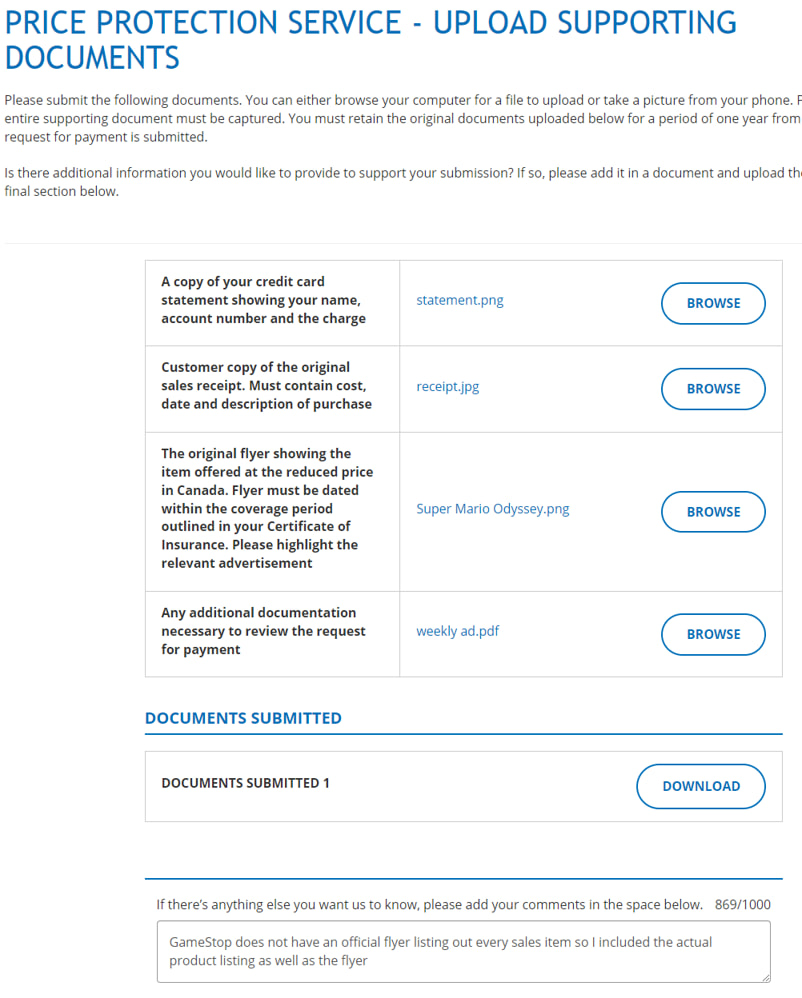

You'll also need to upload supporting documentation:

- The original receipt

- Credit card statement

- The flyer that shows the reduced price

Then check the box stating that you want to add something. In our example, we don't have the monthly credit card statement, so we took a screenshot of the most recent transactions to show the purchase.

Once all the details are entered, we submit the claim. In total, this process only takes a few minutes.

3. Wait for your approval

Assurant states that it takes 5 to 10 business days to process a claim, but our test shows that it can be as early as just two days later.

It can take about two weeks to receive a cheque in the mail, but since it only takes 10 minutes to make the claim, this seems reasonable. Not bad for $25.

Credit cards with price protection coverage

Interested in getting a credit card with price protection? Like we said before, there aren't many of them.

Here are your best options:

| Credit Card | Welcome Bonus | Length Of Time To Make A Claim | Coverage Limits | Apply Now |

|---|---|---|---|---|

| MBNA Rewards World Elite Mastercard |  $20 GeniusCash + 30,000 bonus points (terms) $20 GeniusCash + 30,000 bonus points (terms) | 60 days | * $500 per claim * $1,000 per year | Apply Now |

| MBNA Smart Cash World Mastercard | 5% cash back on gas and groceries for the first 6 months, up to $500 spent per month (terms) | 60 days | * $500 per claim * $1,000 per year | Apply Now |

1. MBNA Rewards World Elite Mastercard

Let's start with the card that we used for our example – the MBNA Rewards World Elite Mastercard. This coverage is available on any World and World Elite MBNA Mastercard.

With these cards, you have 60 days to make your claim, with a $500 limit per claim and $1,000 limit per year.

For this MBNA credit card, here's what you earn for rewards:

- 5 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $50,000 spent annually per category)

- 1 point per $1 spent on all other purchases

That's a lot of rewards, and comes out to a return of 2.86% return on your spending when redeemed for travel through MBNA Rewards.

You’ll also enjoy World Elite Mastercard benefits, 10% bonus points every year (up to 15,000 points), and 12 types of insurance.

All this is for an annual fee of $120.

2. MBNA Smart Cash World Mastercard

There's one more MBNA Mastercard that includes price protection – the MBNA Smart Cash World Mastercard. It has the same claim limits as the MBNA World Elite card, but has a much lower annual fee, only $39.

You won’t get as many types of insurance coverage, but you’ll get price protection and decent rewards:

- 2% cash back on gas and groceries, up to $500 in combined spend monthly

- 1% cash back on all other purchases

FAQ

What is credit card price protection?

Credit card price protection is a credit card perk that refunds the difference if an eligible item you bought goes on sale soon after purchase. You simply file a claim through your card’s insurance provider and wait for the refund.

How do you use credit card price protection?

You can submit a claim over the phone or online, providing proof of the amount spent and the current selling price of the item. If your claim is approved, you’ll receive a refund for the difference, usually as a cheque.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×7 Award winner

×7 Award winner

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.