So you’ve done your credit card homework and decided you’d like a World Elite Mastercard. Now comes the next step in research – choosing between card issuers and specific cards. If you’ve narrowed your options to the BMO Ascend WEM and MBNA Rewards WEM, you’re in luck!

The MBNA Rewards card won our Best Mastercard in Canada award and offers more benefits and rewards. However, BMO Ascend comes out on top for insurance and has a higher welcome bonus. Ready to find out which credit card is worthy of your wallet? Let’s weigh the differences, big and small.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

BMO Ascend vs. MBNA World Elite Mastercard at a glance

Take a look at how these 2 cards compare when it comes to basic details:

| Feature | BMO Ascend World Elite Mastercard | MBNA Rewards World Elite Mastercard |

|---|---|---|

| Annual fee | 150 | 120 |

| Welcome bonus | Up to 100,000 points (terms) | Up to 30,000 points (terms) |

| Maximum rewards | Up to 5 points per $1 | Up to 5 points per $1 |

| Highest earning categories | Travel | Restaurants, groceries, and select recurring bills |

| Insurance types included | 14 | 12 |

| Special feature | * Redeem points for investments at almost the same value as travel * Card earns Air Miles * Mastercard Travel Pass, including 4 annual complimentary passes | * Access to the MBNA flexible payment plan * Up to a 10% discount on car rentals at Avis or Budget locations * 10% bonus points every year on your birthday |

| Best for | People who participate in the Air Miles program | People who want more value from their rewards |

| Get started | Apply now | Apply now |

What we love about the BMO Ascend World Elite Mastercard

Pros:

- Up to 100,000 bonus points

- 4 lounge passes with Mastercard Travel Pass membership

- 14 types of insurance included

- Save up to 7 cents per litre at Shell

Cons:

- Low point value of 0.67 cents per point

- High income requirements of either $80,000 personal or $150,000 household

Although this card gives you up to 5 points per $1 spent on travel, the BMO Ascend card really stands out for its insurance and perks. You’ll get one of the most comprehensive insurance packages along with airport lounge access through Mastercard Travel Pass.

If you’re not flying, you’ll get an instant discount on fuel when stopping at Shell.

Yes, the card’s annual fee is slightly higher than the MBNA card, but the first year is waived. Think of this as a free opportunity to see how much value you can get out of the card.

What we love about the MBNA Rewards World Elite Mastercard

Pros:

- Up to 30,000 bonus points

- 10% bonus points every year on your birthday

- Includes 12 types of insurance

Cons:

- High income requirements of either $80,000 personal or $150,000 household

The MBNA Rewards card won Best Mastercard overall in our best Mastercard in Canada list for good reason. The card also earns up to 5 points per $1, but it’s not limited to travel purchases. Instead, you’ll earn the enhanced rate for restaurants, groceries, and select recurring bills.

We also love that this card gives you a 10% birthday bonus every year (which can really offset the annual fee). The card also packs a hefty insurance package, which makes it great for use as a travel credit card.

How do they compare?

Now that we’ve highlighted some of the best features of each card, it’s time to go head to head.

Best benefits: MBNA Rewards World Elite Mastercard

As World Elite Mastercards, both of these credit cards come with the basic World Elite benefits package, which includes Mastercard Priceless Cities, World Experiences, and concierge services.

The BMO Ascend has several benefits going for it: membership in Mastercard Travel Pass provided by DragonPass and 4 annual passes along with a fuel discount at Shell and rental car discount through Alamo and National Rent a Car.

However, the MBNA card gives you a 10% birthday bonus up to 15,000 points (worth $150) and you have access to the overlooked MBNA Payment Plan. If you know you’re going to make a large purchase, but don’t want to charge it all to your card at once, you can set up a 6, 12, or 18 month payment plan.

Oh, and you’ll also get a nice rental car discount through Avis and Budget.

Best insurance: BMO Ascend World Elite Mastercard

This category is close since both cards offer a dozen or more types of insurance coverage, but if we’re looking at which offers more, BMO wins with 14 to 12.

However, we like to check the details of coverage to see which card offers the best coverage with the highest limits. Although the MBNA includes mobile device coverage and a higher limit on travel accident insurance, the BMO card includes trip cancellation, personal effects coverage, and hotel burglary insurance, all of which tip the scales in this card’s favour.

Best rewards: MBNA Rewards World Elite Mastercard

Since we’re comparing 2 different rewards programs (MBNA Rewards and BMO Rewards), it helps to compare them based strictly on value.

To do this, we estimate how much you’d earn if you spent $2,000 a month. Since the BMO card only gives a 1.09% average return, you’d get about $262 in annual rewards.

On the other hand, the MBNA card has a much higher return – 2.86%, which gives you a whopping $686 in annual rewards.

Highest acceptance: tie

This is a bit of a trick category – since both cards are World Elite Mastercards, you should have no problem finding retailers that accept either card.

Highest welcome bonus: BMO Ascend World Elite Mastercard

You can earn up to 100,000 bonus points with the BMO Ascend card, valued at $670, compared to just 30,000 bonus points with the MBNA Rewards card, valued at $300.

Best interest rates: tie

If you’re looking for the lowest interest rate on purchases, the MBNA card takes the lead with 19.99%. That said, the BMO card has the lowest cash advance rate (23.99%). Both cards charge the same balance transfer fee (22.99%), so this category is a bit of a wash.

Lowest annual fee: BMO Ascend World Elite Mastercard (for the first 5 years at least)

These credit cards both have annual fees that are typical of World Elite Mastercards, which generally range from $120 to $150 per year.

While the BMO Mastercard has a higher annual fee, that fee is waived for the first year you have the card. This means, dollar for dollar, you'll pay less overall for the BMO Ascend World Elite Mastercard until you've had it for 5 years.

This also gives you a chance to take the BMO Mastercard for a test drive for a full year without having to shell out for an annual fee. If you're not 100% certain if a credit card is right for you, this can be a huge benefit.

Lowest eligibility requirements: tie

Premium credit cards tend to be targeted at the wealthier among us. Banks like people who spend lots of money on their credit cards, so the higher value cards tend to have more stringent requirements.

To qualify for either of these cards, you'll need an excellent credit score and a very high income of either $80,000 personal or $150,000 household per year.

Unfortunately, this puts both of these cards out of reach for most Canadians.

Learn more about the World Elite program.

The winner: MBNA Rewards World Elite Mastercard

Overall, it's a pretty close race between these 2 World Elite Mastercards, but we have to go with the MBNA Rewards card for the sheer fact that it offers far more rewards.

Both cards have great insurance and benefits, but the MBNA Rewards card also gives you more value for your points when it’s time to choose a redemption option. And, the annual birthday bonus has the potential to completely offset the card’s annual fee.

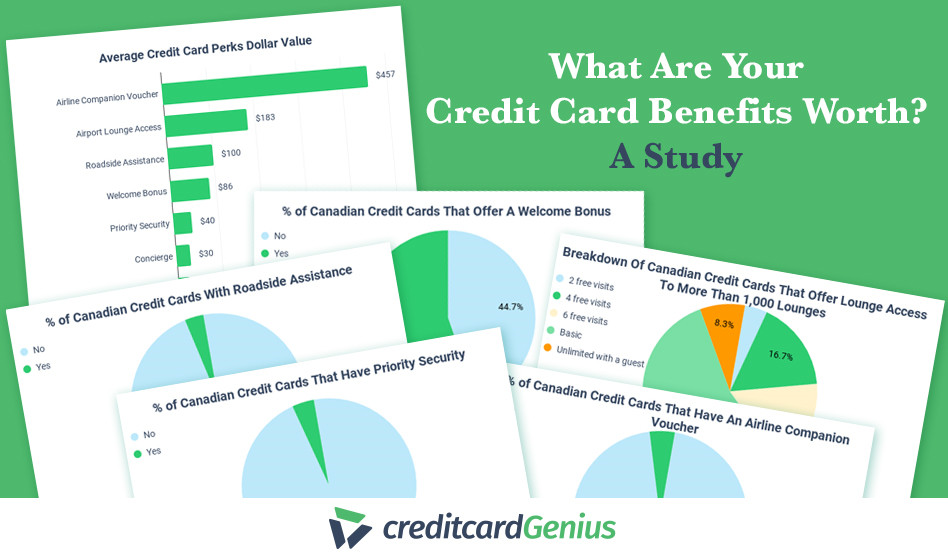

Ever wonder what your credit card benefits are really worth? We crunched the numbers.

FAQ

What is a World Elite Mastercard?

World Elite Mastercards are a type of premium travel credit card offered by several banks and credit card issuers in Canada. Although they’re slightly different depending on the issuer, they come with a basic set of World Elite benefits.

Is a World Elite Mastercard worth it?

If you meet the steep income requirements and don’t mind paying an annual fee, the benefits and rewards are generally worth it. Plus, the great insurance that comes with a World Elite Mastercard is handy when travelling.

What are the benefits of a BMO World Elite Mastercard?

The BMO Ascend World Elite Mastercard has several benefits, including airport lounge access, a huge welcome bonus, 14 types of insurance coverage, a fuel discount, and the flexibility to choose how you redeem your points.

Does the BMO World Elite Mastercard have free lounge access?

Yes! The BMO Ascend gives you a Mastercard Travel Pass membership along with 4 free lounge passes per year. If you use all 4, you’ll have to pay for each additional visit. A single pass will cost you USD$32.

What is the difference between World Mastercard and World Elite?

Card details will vary by issuer, but in general, World Elite Mastercards have higher earning rates, better insurance coverage, and more perks in exchange for a higher annual fee. World Elite cards are a step down in terms of what they offer.

What rewards does the MBNA Rewards World Elite Mastercard offer?

The MBNA Rewards World Elite Mastercard offers 5 points for every $1 spent on dining, grocery shopping, and select recurring bills. Plus, you get a 10% birthday bonus up to 15,000 points.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×7 Award winner

×7 Award winner

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 5 comments