Mastercard offers an impressive lineup of 35 credit cards in Canada, with 13 of them charging no annual fee. The list of the best Mastercards includes 13 no-fee options – all of which offer more than just fee savings.

Whether you’re looking for flexible redemption options, high cash back earn rates, low interest rates, good insurance coverage, or something else entirely, the following reviews will help you understand your best Mastercard options.

Key Takeaways

- The best no fee Mastercards include the Rogers Red World Elite Mastercard, MBNA Rewards Platinum Plus Mastercard, and the Tangerine Money-Back Mastercard.

- The BMO CashBack Student Mastercard is an excellent no-fee option for students.

- The MBNA True Line Mastercard has no annual fee, low interest rates, and an amazing promo balance transfer offer.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Summary of the best no fee Mastercards in Canada

Let's take a look at the best no fee Mastercards, regardless of what type of rewards you prefer.

| No Fee Mastercard | Welcome Bonus | Learn more |

|---|---|---|

| Rogers Red World Elite Mastercard | None | Learn more |

| MBNA Rewards Platinum Plus Mastercard | after spending $500 in the first 90 days and signing up for paperless e-statements | Learn more |

| Tangerine Money-Back Credit Card | Earn an extra 10% cash back for the first 2 months, up to $1,000 spent | Learn more |

| BMO CashBack Mastercard for students | 5% cash back for the first 3 months, up to $2,500 in spend | Learn more |

| MBNA True Line Mastercard | 0% interest on balance transfers for 12 months (terms) | Learn more |

Rogers Red World Elite® Mastercard®

Why we love it: Of the no fee Mastercards on our list, the Rogers Red World Elite Mastercard gives you the best rate of return on your purchases, even though it doesn’t come with a welcome bonus.

This flat rate card, which rewards you handsomely for USD purchases, allows you to request your cash back whenever you like. And, it’s the only no fee card that gives you World Elite Mastercard Benefits that include Mastercard Travel Pass, World Experiences, Priceless Cities, concierge service, and more.

Rewards:

- Earn 2% unlimited cash back on all eligible non-U.S. dollar purchases if you have 1 qualifying service with Rogers, Fido, Comwave, or Shaw

- Earn 1.5% unlimited cash back on eligible non-U.S. dollar purchases

- Earn 3% unlimited cash back on all eligible purchases made in U.S. dollars

MBNA Rewards Platinum Plus® Mastercard®

Why we love it:

MBNA might be a lesser-known credit card issuer, but it's a hidden gem. The MBNA Rewards Platinum Plus® Mastercard® is our top no fee Mastercard for flexible rewards, and it comes with a valuable sign-up bonus: you could earn 10,000 points.

When you want to use your MBNA points, you can put them towards travel, gift cards, merchandise, charitable donations, and cash. Travel gives you the best return on your points, and you don’t have to worry about blackout dates.

Rewards:

- 2 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $10,000 spent annually per category)

- 1 point per $1 spent on all other purchases

Tangerine Money-Back Credit Card

Why we love it:

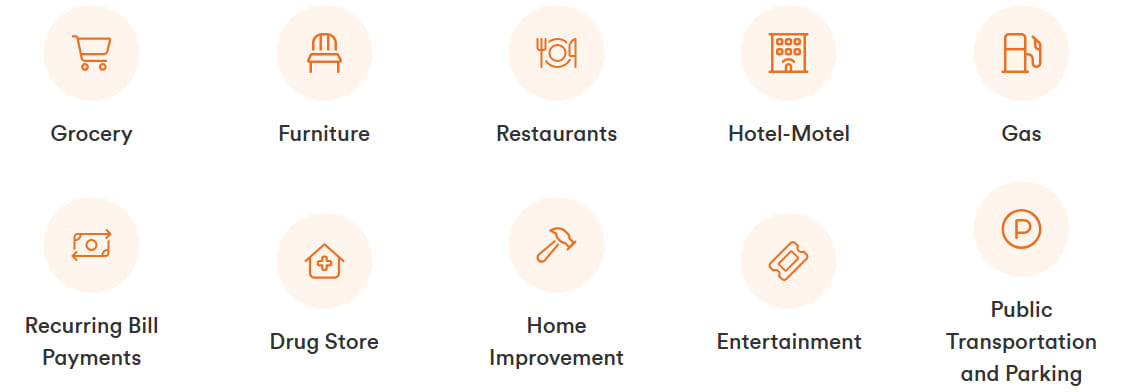

The Tangerine Money-Back Credit Card is totally unique in that you get to choose your top-earning rewards categories. You can choose your top two earning categories from a list of 10 options. If you set it up so your cash back is deposited into a Tangerine savings account, though, you can choose a third cash back category too.

While this card doesn’t offer much in the way of insurance coverage or perks, 2% cash back is nothing to sneeze at. It’s also relatively easy to qualify for, making it an ideal option for students, newcomers to Canada, and those with less-than-stellar credit scores.

Rewards:

- 2% cash back on purchases in up to 3 Money-Back Categories

- 0.5% cash back on all other purchases

You can make your selections from any of these categories:

BMO CashBack® Mastercard®* for students

Why we love it:

The BMO CashBack® Mastercard®* for students is a top-notch Mastercard option for students, with a decent welcome offer and no annual fee. To start, you'll earn 5% cash back for the first 3 months, up to $2,500 in spend. After that, you'll earn 3% cash back on groceries, 1% on recurring bills, and 0.5% on everything else.

Student credit cards are important for building credit and learning financial responsibility, but it's even better when you find a student card like this that offers some sweet rewards.

Rewards:

- 3% cash back on groceries (up to $500 per month)

- 1% cash back on recurring bill payments (up to $500 per month)

- 0.5% cash back on all other purchases

MBNA True Line® Mastercard®

Why we love it: Of all the no-fee cards on our list, the MBNA True Line Mastercard offers the lowest interest rates across the board. You'll enjoy a permanently low interest rate of 12.99% on purchases, which is a fantastic deal compared to the average 20% APR.

This card has been the top balance transfer credit card for several years now, as its 17.99% regular rate is quite low – but its the balance transfer promo offer of 0% for 12 months that's truly amazing and can be a huge help for those who carry credit card debt.

Comparing the top 5 no fee Mastercards

Here's a look at how these five no fee Mastercards compare:

Average rate of return

The Rogers Red World Elite Mastercard gives the highest average rate of return, but you’ll only get maximum value out of it if you have a qualifying Rogers service like internet, TV, or phone plans.

Of course, the MBNA True Line Mastercard doesn't offer rewards, as it focuses on low interest rates.

Interest rates

If you plan on carrying a credit card balance or transferring existing credit card debt, you should be paying attention to a card’s interest rate. Fortunately, one Mastercard stands out for its low rates: the MBNA True Line Mastercard.

For those looking for cash advances, the Tangerine Money-Back Credit Card credit card has slightly better advance rates.

Insurance coverage

No fee cards are notorious for poor insurance packages. Case in point: The MBNA True Line Mastercard doesn’t offer any coverage, and the Tangerine Money-Back Credit Card and BMO CashBack® Mastercard®* for students only offer two types of basic coverage.

Of those on our list, the Rogers Red World Elite Mastercard is your best pick. It comes with a respectable seven types of insurance, including the rare emergency medical coverage for those over 65.

FAQ

What is the best free Mastercard in Canada?

Really, the best no fee Mastercard depends on your needs. The MBNA True Line Mastercard is great for balance transfers, the BMO CashBack Mastercard for students suits students, and the Tangerine Money-Back Credit Card shines for customizable rewards categories.

Is it better to have a Visa or a Mastercard?

This is mostly a matter of personal preference. Visas and Mastercards are both widely accepted across Canada and internationally. Take a look at each issuer’s benefits and income requirements to decide which one would work best for you.

Is the Costco Mastercard worth it?

While the CIBC Costco Mastercard is also a no fee Mastercard, it doesn't earn extra rewards for Costco shopping, so it's not really the best option. The MBNA Rewards World Elite Mastercard, though, is excellent for loyal Costco shoppers.

What is the best credit card to have in Canada?

The American Express Cobalt Card is the best card in Canada, and has been for the last eight years. There are no income requirements, but a generous welcome bonus, and users enjoy some of the highest rates of return possible.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×1 Award winner

×1 Award winner

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 2 comments