Founded in 1922, Canadian Tire is one of the more venerable retail institutions in Canada.

Offering a range of products, from hardware through sports gear, “CT” makes frequent appearances on Canadian shopping lists, whether you’re doing home renovations, yard work, stocking up on cleaning supplies, or actually working on your car.

But Canadian Tire is more than just another typical retail outlet, as it is also an umbrella corporation for a number of other Canadian brands, including SportChek, Mark’s, and Party City.

Canadian Tire also offers one of Canada’s most popular rewards programs – Canadian Tire Triangle Rewards – as well as a trio of credit cards offered through Canadian Tire Bank.

Wondering how to save money at Canadian Tire? You’ve come to the right place.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

How to shop at Canadian Tire

Obviously, shopping at Canadian Tire is pretty straightforward. If you’re Canadian, chances are you’ve probably already done it a hundred times, you know exactly where the closest stores are, and which has the better garden centre in the summer.

But there are some newer options that you might not be as familiar with – Canadian Tire online and the Canadian Tire app.

Canadian Tire stores

There are currently over 500 Canadian Tire-branded stores across Canada, including in cities like Calgary, Edmonton, Ottawa, Winnipeg, and Laval.

The easiest way to find the ones closest to you are through the Canadian Tire store locator on their website.

When you visit a Canadian Tire store, grab the Canadian Tire flyer and take your time and look around a bit. They will often have in-store sales and clearance items clearly marked, and you can save some money just by poking around a bit and seeing what’s available.

If you’re more pressed for time, the best way to find out what’s currently on sale at Canadian Tire is to check Canadian Tire online or the Canadian Tire app.

Canadian Tire online

The Canadian Tire online website clearly advertises their current sales and clearances right on the main page. There’s also a handy link to the Canadian Tire flyer. For example, at the time of writing this article, the front page of the website included:

- a new welcome bonus for Triangle Mastercards,

- their annual Thanksgiving sale,

- sales in each of 8 different store departments, and

- a link to their online clearance sale.

Finding specific items on sale

That said, the Canadian Tire online website can be a bit tricky to navigate. If you know what you’re looking for, their search feature works pretty well, but browsing for things is a bit hit and miss.

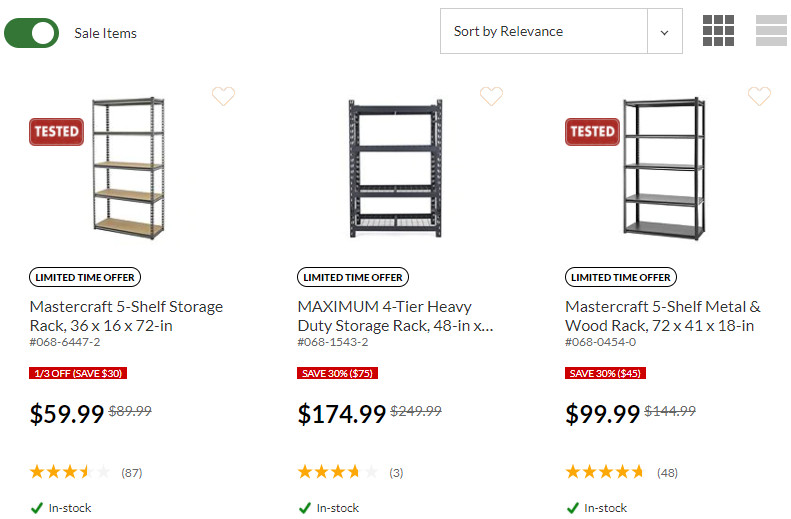

Our top tip: Use the search feature to at least narrow things down a little. For example, we’re in the market for some new utility shelving, so searched for “shelf.”

And, since the website search feature includes the ability to filter by sale items, we were quickly able to find exactly the sort of things we were looking for (and saved a bundle, to boot).

Delivery options

If you find something you want to buy through Canadian Tire online, you have 3 options. You can:

- arrange for in-store pickup if the item is in stock at your local store,

- have it delivered to your local store for free, if the item is not in stock, or

- have the item delivered directly to your house for a fee.

No free home delivery options

Unfortunately, Canadian Tire online doesn’t offer free delivery, and given the size and weight of some of the items they sell, shipping can be pretty expensive.

For example, to have the shelf shipped to our house would have cost an additional $27.99, completely negating the savings we got for purchasing it on sale.

In most cases, you’ll want to arrange for in-store pickup, since this is the best way to save money when shopping through Canadian Tire online.

Canadian Tire app

Another quick and easy way to shop at Canadian Tire is through the Canadian Tire mobile app. This app is available for both iOS and Android, and gives you a way to look up deals while you’re on the go.

You can also order items through the Canadian Tire Triangle app, just like through Canadian Tire online, specifying either in-store pickup or home delivery.

5 ways to save money at Canadian Tire

Being long-time Canadian Tire shoppers, we’ve put together a quick list of the best ways to save money when shopping at Canadian Tire.

1. Check the Canadian Tire flyer

The Canadian Tire flyer is published once a week. You’ll usually get it with your local newspaper if you subscribe, or you can find it online at the Canadian Tire website.

Not only is the current Canadian Tire online flyer on the website, you’ll also find any special Canadian Tire sale flyers that might be available, and often they’ll also have a preview version of the next Canadian Tire weekly flyer.

All in all, it’s a great place to keep tabs on what Canadian Tire deals are available now, and what special sales might be coming up in the near future.

2. Shop the Canadian Tire sales

Of course, the whole point of keeping a close eye on the Canadian Tire weekly flyer is so you know what sale items are available.

Our top tip: Unless you need a particular item immediately, put it on a list and watch for it to eventually come up in one of the Canadian Tire online sales or in the Canadian Tire sale flyer. In particular, watch out for:

- paint and home renovation sales,

- seasonal sales (the best time to buy gardening equipment is at the end of gardening season, for example), and

- holiday sales (Halloween, Thanksgiving, Christmas, etc.).

With a little patience and by scouring the Canadian Tire sale items on a regular basis, you can save a huge amount of money on high-ticket items over the course of a year.

One example? We’ve been looking to upgrade our cooking gear for a while, so we’ve been watching for some of the higher end items to go on sale for the past few months. And it paid off, with a 12 piece set that is normally $1,199.99 currently on sale for $239.99.

Just by being patient and waiting for a serious deal, we saved $960 (80%) off the cost of a brand new set of premium cookware.

Canadian Tire online clearance sales

Canadian Tire online not only has the flyer, it also has a special online clearance section, which is a great place to save even more.

The online clearance section link changes text every so often, but it’s usually highlighted and at the right hand side of the Canadian Tire website menu.

In-store Canadian Tire clearance sales

There are also in-store clearance sales, but these can be a bit trickier to take full advantage of, since you’re limited to what’s available in your local store.

You can look these deals up on the website as well, but you’re probably better off just going into the store and shopping in person. That way, if you see a fantastic deal, you can just grab it and go, instead of jumping in the car and hoping it’s still available when you get there.

3. Earn Canadian Tire Triangle Rewards

Did you know Canadian Tire Money is the most successful loyalty rewards program Canadian retail history? It’s true. Canadian Tire Money was originally introduced in 1958, and the old paper money was actually produced by the British American Banknote Company and the Canadian Bank Note Company, just like real money.

Those days of collecting wads of Canadian Tire Money in the back of your junk drawer are all but over, however, as Canadian Tire has transitioned to a digital rewards program called Triangle Rewards.

Canadian Tire Triangle Rewards

With a Canadian Tire Triangle Rewards card or the Canadian Tire app, you can collect Triangle Rewards at any of Canadian Tire’s various brands and locations, including:

- Canadian Tire Gas+,

- SportChek,

- Mark’s,

- Atmosphere,

- Party City,

- Sports Experts, and, of course,

- Canadian Tire.

Triangle Rewards earn rate

How quickly you earn Triangle Rewards depends on whether you’re buying merchandise or gas.

You’ll earn:

- 0.4% back in Canadian Tire Money on pre-tax purchases for merchandise, and

- 3 cents in Canadian Tire Money per litre at Gas+ or Husky gas bars when you pay with cash or debit.

Want to boost your Triangle Rewards earn rate significantly? Get yourself a Canadian Tire Triangle Mastercard.

Triangle Rewards value

Canadian Tire Triangle Rewards have a 1:1 value to Canadian dollars, meaning that $1 in Triangle Rewards can be redeemed for $1 worth of purchases at participating Canadian Tire stores.

There are some restrictions, of course, in that you can’t use Triangle Rewards to pay for:

- gift cards,

- prepaid cards,

- phone cards,

- hunting and fishing licenses, and

- tobacco products or alcohol.

So, while Triangle Rewards are still fairly flexible, since you can use them to buy almost anything Canadian Tire sells, they’re still not as good as cash. One great thing about it? There’s no minimum redemption requirement – you can redeem as often as you like.

Want to maximize your Canadian Tire Triangle Rewards? Look no further.

4. Save on gas at Canadian Tire gas bars

It’s pretty easy to save some serious money on gas at Canadian Tire Gas+ or Husky gas bars. Savings are in the form of earning Triangle Rewards, which can be redeemed 1:1 when making purchases at participating Canadian Tire stores.

As we mentioned above, if you collect Triangle Rewards, you’ll normally earn 3 cents in Canadian Tire Money per litre when you show your Triangle Rewards card. But, if you also have a Canadian Tire Mastercard, you’ll earn 5 cents in Canadian Tire Money per litre.

5. Get the lowest price with Canadian Tire’s price match policy

While there are a decreasing number of major Canadian retailers who have kept their price match policy (Walmart, for example, ended theirs in late 2020), the Canadian Tire price match guarantee still exists and can save you time and/or money.

Before you purchase an item at Canadian Tire

If you know of a local competitor that offers a lower price for an identical item that’s available at Canadian Tire, Canadian Tire will match the competitor’s price if you bring in the competitor’s flyer or can show them on the competitor’s website.

There are restrictions to this, of course. To qualify for the Canadian Tire price match guarantee, the item has to be:

- new and in stock, and either

- available at a physical store within a 200 km radius, or

- available from any Canadian online retailer website, ending in “.ca”, but

- for automotive wheels and tires, retailer websites can end in “.com.”

So, if you’re in the market for a big ticket item that’s available at Canadian Tire, keep an eye on competitor sales. While they won’t beat the price, they’ll match it, and you’ll at least save yourself a drive, and earn some Canadian Tire Money to boot.

If you have already purchased an item at Canadian Tire

Canadian Tire also offers a form of purchase protection insurance.

If you have already purchased something at Canadian Tire and you see a competitor (or Canadian Tire themselves) has a better price on it within 30 days of purchase, you can get a refund for the difference.

Similar restrictions apply, but if you hang on to your receipts and keep an eye on the local sales, you can get some of your money back from time to time.

Walmart, Costco, or Canadian Tire? Where should you spend your money?

Canadian Tire Triangle Mastercard and alternatives

We’ve mentioned the Canadian Tire Triangle Mastercard a few times already, but let’s take a closer look at what this rewards credit card has to offer.

| Annual fee: | $0 |

| Type of reward: | Store rewards in the form of Canadian Tire Money |

| Reward details: | * 4% Canadian Tire Money at Canadian Tire stores * 1.5% Canadian Tire Money on groceries (up to $12,000 spent) * 0.5% Canadian Tire Money on all other purchases * 5 cents per litre in Canadian Tire Money at Gas+ and Husky gas bars |

| Average rate of return %: | 0.82% |

| Purchase interest rate: | 19.99% |

| Income requirement: | None |

The

With it, you’ll earn:

- 4% Canadian Tire Money at Canadian Tire stores,

- 1.5% Canadian Tire Money on groceries (up to $12,000 spent),

- 0.5% Canadian Tire Money on all other purchases, and

- 5 cents per litre in Canadian Tire Money at Gas+ and Husky gas bars.

Based on our typical $2,000 a month spend, you could earn the equivalent of $223 in annual rewards, based on a 0.82% average rate of return.

Other than that, however, this Canadian Tire Bank credit card really doesn’t have a lot to offer. It has no additional perks and benefits, and, unlike most credit cards, it doesn’t include any types of complimentary insurance coverage.

With its paltry rewards earn rate and lack of any other features of value, we think there are better credit cards you can use to earn more valuable and more flexible rewards on all of your purchases (not just on stuff you buy at Canadian Tire).

Other Canadian Tire Triangle Rewards Mastercards

There are 2 other Canadian Tire Triangle Rewards credit cards: the Canadian Tire Triangle Rewards World Mastercard, and the Canadian Tire Triangle Rewards World Elite Mastercard.

Right now, however, the World Mastercard is only available by invitation, and the World Elite Mastercard isn’t accepting new applications, so there’s not a lot to talk about for those at the moment.

3 Canadian Tire Mastercard alternatives

So, what are our top picks for alternatives to the Triangle Rewards Mastercard issued by the Canadian Tire Bank? We’ve got 3 of our top no fee credit card picks here for you.

| Category | Credit Card | Average Earn Rate % | Types Of Included Insurance | Apply For Card |

|---|---|---|---|---|

| Best no fee credit card | MBNA Rewards Platinum Plus® Mastercard® | 1.40% | 3 | Apply now |

| Best no fee cash back credit card for groceries | BMO® CashBack® Mastercard®* | 1.01% | 2 | Apply now |

| Best no fee credit card for gas | MBNA Smart Cash Platinum Plus® Mastercard® | 0.87% | 7 | Apply now |

1. Best no fee credit card

Our #1 pick for best no fee credit card is the

With this card you’ll earn valuable and flexible MBNA Rewards, which can be redeemed for a variety of things, including:

- travel,

- gift cards,

- merchandise,

- cheques,

- direct deposit cash back, and

- statement credits.

As for earn rates, you’ll receive:

- 2 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $10,000 spent annually per category)

- 1 point per $1 spent on all other purchases

You can also earn up to 10,000 points as a welcome bonus, after spending $500 in the first 90 days and signing up for paperless e-statements.

Overall, you’ll see an average rate of return around 1.40% with this credit card, and you’ll be able to take advantage of 3 types of complimentary insurance coverage.

2. Best no fee cash back credit card for groceries

If you’re looking for a simple cash back card that has a great earn rate for groceries, the

You’ll start by earning 5% cash back for the first 3 months, up to $2,500 in spend. After that, you’ll earn:

- 3% cash back on groceries, up to $500 spent per month,

- 1% cash back on recurring bill payments, up to $500 spent per month, and

- 0.5% cash back on all other purchases.

For no annual fee, based on our typical spend of $2,000 per month, you’ll see an average rate of return around 1.01% cash back, with the added benefits of included extended warranty and purchase protection coverage.

3. Best no fee credit card for gas

If you’re primarily interested in saving on gas, the

To start, you’ll get 5% cash back on gas and grocery purchases for the first 6 months (up to $500 spent combined, per month), after which you’ll earn:

- 2% cash back on gas and groceries (up to $500 spent combined, per month), and

- 0.5% cash back on all other purchases.

With our hypothetical $2,000 spend, this credit card has an average rate of return of 0.87%. This is slightly higher than the Canadian Tire Triangle Mastercard’s average rate of return, and the MBNA Smart Cash Platinum Plus has the advantage of:

- earning actual cash back, which you can spend anywhere, and

- including 7 types of complimentary insurance coverage.

You’ll be getting more flexible rewards, and some significant value in terms of the included insurance package.

4 credit cards head to head

Let’s take a closer look at these cards, head to head.

Average rate of return

Set side by side, it’s clear that, of these 4 credit cards, the MBNA Rewards Platinum Plus Mastercard is going to give you the best average rate of return on your spending.

That said, you’re earning MBNA Rewards with it, which vary in value based on how you redeem them.

If you’re looking for the pure simplicity of good old cash back, the BMO CashBack Mastercard gives you a solid rate of return, with the flexibility of being able to use your rewards anywhere you like, not just at Canadian Tire stores.

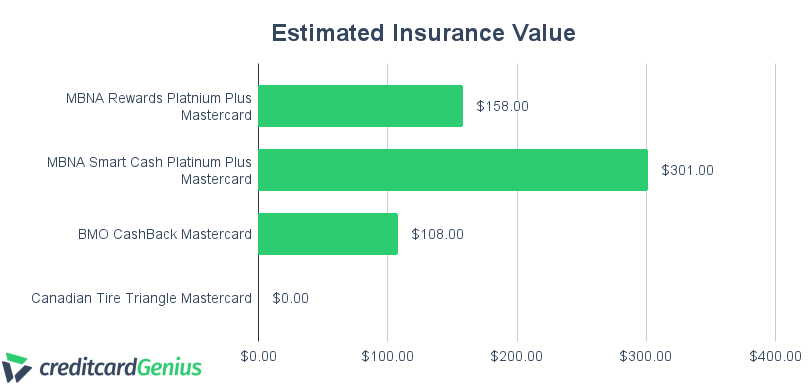

Estimated insurance value

And rewards aren’t the only value you get with credit cards.

While some premium credit cards come with hundreds of dollars worth of travel perks and other benefits, this is usually offset by a high annual fee and are really only of true value if you travel frequently.

On the other hand, most credit cards come with some sort of complimentary included insurance, and this is true of the 3 alternative credit cards we have mentioned here.

The Canadian Tire Triangle Rewards Mastercard doesn’t include any sort of complimentary insurance – not even extended warranty or purchase protection for items you buy at Canadian Tire. This really decreases the overall value of the card as a whole.

You can learn more about the estimated value of the insurance packages that are included with Canadian credit cards in our study: The Dollar Value Of Your Credit Card Insurance Coverage.

Canadian Tire roadside assistance

Canadian Tire started its life as a gas bar before growing into the retail behemoth it is today. Harkening back to those days of yore, however, they still offer a competitive roadside assistance service, which can save you money over other services, such as CAA.

Here’s a quick rundown comparing Canadian Tire’s Silver Member Plan to CAA’s Classic Plan.

| Feature | Canadian Tire Silver Member | CAA Classic |

|---|---|---|

| Emergency road service | Free | Free |

| Lockout service | Free | Free (up to $50) |

| Emergency towing | 10km per service call (or 25km to a Canadian Tire service centre) | 5km per service call |

| Service calls per year | 3 | 5 |

| Emergency fuel delivery | Free delivery | Free delivery |

| Flat tire service | Yes | Yes |

| Mobile battery service | Yes | Yes (limited availability) |

| Price per year | $69.95 | $82.75 |

| Secondary member per year | $37.95 | Starts at $45.00 per year |

As you can see, Canadian Tire offers generally the same level of service (or slightly better) for a lower price. The savings are even more drastic if you look at the pricier plans each service has available.

Want to save on roadside assistance? Maybe you can get what you need for free.

Bottom line

Canadian Tire is a solidly entrenched (and deeply nostalgic) part of the Canadian retail landscape.

If you have the patience to watch and wait for those sales, and to keep tabs on what competitors are offering, you can save a pile of money by shopping at Canadian Tire, given the tips and tricks we’ve outlined for you here.

Do you have any tips for saving at Canadian Tire that we haven’t touched on? Let us know in the comments so everyone can take advantage.

FAQ

Who owns Canadian Tire now?

Canadian Tire Corporation Limited is a publicly traded company headquartered in Toronto, Ontario. It isn’t so much owned by anyone else, as it owns other companies such as SportChek, Mark’s, and Party City. There is also a Canadian Tire Bank that issues a handful of Triangle Rewards Mastercards, and it also owns the Canadian Tire Triangle Rewards program (also known as Canadian Tire Money).

How can I save money at Canadian Tire?

We outline our top money saving tips in this article, including strategies for using the weekly Canadian Tire flyer, shopping at Canadian Tire online, keeping a close eye on Canadian Tire sales, and how to maximize your Canadian Tire Triangle Rewards.

How much Canadian Tire Money do you earn?

If you just have a regular Canadian Tire Triangle Rewards card, you’ll earn 0.4% Canadian Tire Money back on purchases at participating Canadian Tire stores, and 3 cents per litre in Canadian Tire Money back on gas at Gas+ and Husky gas bars. If you have a Canadian Tire Triangle Rewards Mastercard, that earn rate is boosted significantly.

What is a Triangle Rewards card?

A Triangle Rewards card is how you collect Canadian Tire Triangle Rewards at Canadian Tire stores. This is the digital replacement for Canadian Tire Money, which is being phased out across Canada.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×1 Award winner

×1 Award winner

$20 GeniusCash + Up to 5% cash back + No annual fee.*

$20 GeniusCash + Up to 5% cash back + No annual fee.*

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 4 comments