Please note that Rona is now the owner of Lowe’s Canada, and the Lowe’s credit card is no longer available. The information here is still accurate, though all Lowe’s stores in Canada will eventually be rebranded to Rona.

Lowe’s Canada is a major home improvement retailer located in many parts of Canada. While a part of the Rona group, for now Lowe’s will remain as a separate brand.

What can you do to save money at Lowe’s, and what are your best credit card choices? Here’s our guide to this major home improvement store.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Best credit cards to use at Lowe’s

Let’s start with the best credit cards to actually use at Lowe’s. Lowe’s used to offer their own credit card for financing large purchases, but it has since been discontinued.

First, we can state that you can use the following credit cards at Lowe’s in store and at Lowe’s online:

- Visa

- Mastercard

- American Express

So what should you look for? For the most part, Lowe’s will fall under the “all other purchases” earn rate, with one exception as you’ll see.

This means you’ll want a credit card with a high base earn rate on all your purchases.

Or, if you’re doing a major reno and want an easy form of financing, you can take a look at a low interest credit card instead.

Here are some choices you can look at.

| Category | Credit Card | Average Earn Rate At Lowe’s | Annual Fee | Apply Now |

|---|---|---|---|---|

| Best cash back credit card | SimplyCash Preferred Card from American Express | 2% | $119.88 | Apply Now |

| Best no fee credit card | Tangerine Money-Back Credit Card | 2% | $0 | Apply Now |

| Best rewards credit card | RBC Avion Visa Infinite | 2.33% | $120 | Apply Now |

| Best low interest credit card | MBNA True Line Gold Mastercard | 0% | $39 | Apply Now |

1. Best cash back credit card

If you prefer cash back rewards, the SimplyCash Preferred Card from American Express earns a flat 2% cash back on all purchases, including at Lowe’s Canada. Something that makes this one of the best cash back credit cards in Canada is that your cash back rate is increased to 4% on gas and groceries.

You’ll also enjoy 9 types of included purchase protection and travel insurance, access to American Express Invites and Amex Front of the Line ticket sales, and Amex Offers.

With a lower annual fee of $119.88, this card is also easier on your wallet, and easier to get. While you’ll still need a good credit score to qualify, this Amex credit card has no income requirements at all.

2. Best no fee credit card

If you’d rather not pay an annual fee for your credit card, the Tangerine Money-Back Credit Card is a good choice for shopping at Lowe’s.

You can pick 2 categories for a 2% earn rate (3 if you get your rewards deposited into a Tangerine savings account as well), and you’ll earn 0.5% on all other purchases, besides.

The best part? Lowe’s qualifies as a “hardware store” for this Tangerine Mastercard, meaning you can earn 2% cash back on all your purchases if you choose that as one of your bonus earning categories.

Here are all of your choices for earning 2% cash back.

If you’re planning some major renovations or other projects that involve spending some money at Lowe’s, you might think about getting one of these cards to rack up some rewards.

Since this is a no fee Mastercard, you’re not going to get a whole lot of other perks and benefits, of course, but it does have extended warranty and purchase protection, giving you some added peace of mind on those big purchases.

3. Best rewards credit card

For rewards cards, the RBC Avion Visa Infinite is an excellent contender for shopping at Lowe’s.

It earns a simple 1 point per $1 spent on all purchases (increased to 1.25 on travel purchases).

Not seemingly much. But when you factor in that each RBC Avion Rewards point is worth up to 2.33 cents, you’re looking at a return of up to 2.33% everywhere.

And, it has a standard annual fee of $120.

4. Best low interest credit card

For those bigger purchases you know you’re not going to be able to pay off all at once, you might consider a low interest credit card to save some money.

The MBNA True Line Gold Mastercard is a top low interest credit card in Canada, with a low 10.99% rate on purchases and balance transfers. This is 12% lower than what you’ll find with most Canadian credit cards.

It doesn’t offer any rewards or special features, instead saving you loads of interest – for a $39 annual fee.

Alternative Lowe’s credit cards compared

So, how do these credit cards compare? Well, it turns out they cover a pretty broad range of features and benefits, so we’re a bit into apples and oranges territory here. That said, let’s take a look.

Annual fee

Ranging from the no fee Tangerine Money-Back Credit Card to the premium RBC Avion Visa Infinite, the annual fees cover a pretty wide range.

While the Tangerine is the only no fee option here, the MBNA True Line Gold Mastercard has relatively low annual fees, and even the $120 fee for the RBC and Amex cards is the average for that tier of rewards credit card.

Estimated rate of return at Lowe’s Canada

Of course, if you’re looking to save money at Lowe’s, you’re going to want the highest rewards earn rate you can get. Of the 4 cards we look at here, 3 give you a solid 2% earn rate on all your Lowe’s purchases.

Of course, if you’re making a large purchase that you won’t be able to pay off completely in a month, you may want to opt for the MBNA True Line Gold Mastercard – the money you save with its lower interest rate will MORE than make up for not earning rewards.

Remember – no credit card rewards are worth carrying a balance for – the interest rates will always cost more than you’ll earn.

No Lowe’s Canada locations near you? Learn how to save more at Canadian Tire instead.

Shopping at Lowe’s Canada

Never been to Lowe’s? Turns out it’s pretty much like every other giant hardware store, with huge box stores in multiple locations in several Canadian provinces.

Shopping at Lowe’s online

One of the easiest ways to shop at Lowe’s is to order online at Lowes.ca. Unfortunately, they don’t seem to offer home delivery service for the most part. You can order online for in store pickup, or arrange for truck delivery, but this option is generally reserved for large or heavy orders, such as building supplies.

Lowe’s locations

Lowe’s Canada has locations in Ontario, British Columbia, Alberta, Manitoba, and Saskatchewan.

To find the Lowe’s nearest you, head over to the Lowes.ca Store Locator and punch in your postal code, city, or exact address. They’ll show you all of the Lowe’s locations within 100km.

Lowe’s hours

As with similar big box hardware and building supply stores, Lowe’s hours start very early in the morning (catering to professional contractors), and they stay open fairly late.

By and large, Lowe’s Canada is open from 7am to 8pm every day, with special hours on holidays.

Lowe’s Canada prices compared

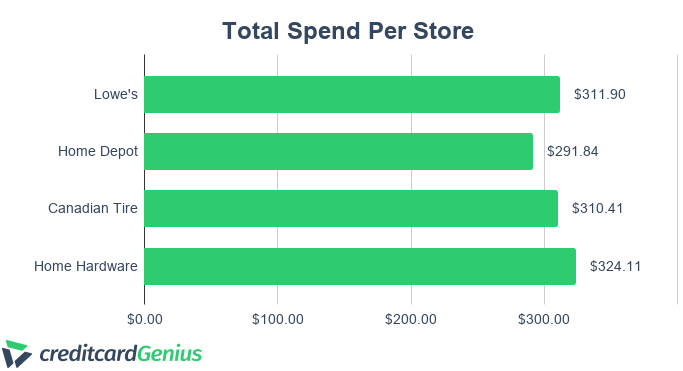

Wondering how Lowe’s Canada prices compare to other big retailers in Canada?

It turns out that comparing many products at these stores is complicated, because each sells different brands much of the time.

For simplicity’s sake, we’ve looked at similar products available at each store, although often these were produced by different companies, and quality may vary.

| Item | Lowe’s Canada | Home Depot Canada | Canadian Tire | Home Hardware |

|---|---|---|---|---|

| Pine-Sol 4.25L Original Multi-Surface Cleaner | $13.98 | $12.39 | $13.99 | $15.99 |

| 1 Gang Toggle Wall Plate (for a light switch) | $1.49 | $0.39 | $1.49 | $1.39 |

| Ortho Wasp B Gon Spray | $8.99 | $8.98 | $7.99 | $8.29 |

| 14 Tines Bow Rake | $24.99 | $15.94 | $24.99 | $19.99 |

| Flat White Interior Ceiling Paint (3.78L) | $31.99 | $14.97 | $24.99 | $38.99 |

| 6 Piece Premium Painting Kit | $27.99 | $31.97 | $26.99 | $29.99 |

| Broom + Dust Pan (Vileda) | $11.48 | $11.48 | $11.99 | $12.49 |

| Flexible Dryer Duct (4 in x 20 ft) | $31.99 | $36.72 | $37.99 | $36.99 |

| Weber 22 in Charcoal Grill | $159.00 | $159.00 | $159.99 | $159.99 |

| Total | $311.90 | $291.84 | $310.41 | $324.11 |

As you can see, the difference between these stores is fairly minimal. The biggest difference is in the cost of paint, which is a big ticket item for these stores. Unfortunately, paint quality and price can differ radically from brand to brand, so you may want to do some research before making a decision.

With paint, you generally get what you pay for, so cheaper isn’t necessarily going to be better.

In terms of total spend for the items we researched, Home Depot wins the race, with Lowe’s and Canadian Tire close behind.

But what about rewards?

Here at creditcardGenius, we’re big on rewards programs, and it turns out that you can earn rewards at only 2 of these stores:

- Triangle Rewards at Canadian Tire, and

- Scene+ at Home Hardware (coming soon).

Given how close these regular price totals are, if you collect either of these types of rewards, you’ll probably want to spend your money at that store.

Collect Triangle Rewards? Learn how to maximize your Canadian Tire Money.

5 ways to save money at Lowe’s

Want to save even more money at Lowe’s Canada? It turns out there are some basic strategies you can use.

1. Use the right credit card

Lowe’s used to be an Air Miles partner, but that ended some time ago. This means the only way you can earn rewards at Lowe’s is by using the right credit card. We cover a few of our top picks here.

2. Shop the seasonal sales

Big box hardware and building supply stores like this generally have seasonal sales every quarter. These will often include things like paint, decking, and similar big ticket items. If you’re planning to do some redecorating or renovations and aren’t in a hurry, you can save a huge amount of money by waiting for the right sale to come along.

3. Lowe’s flyer

Lowe’s publishes a weekly flyer, where you can find the current sales for everything from building supplies, to cleaning supplies, to gardening tools, and more. It’s always a good idea to flip through the Lowe’s flyer to see where you might be able to save a few dollars, or to stock up on things while they’re discounted.

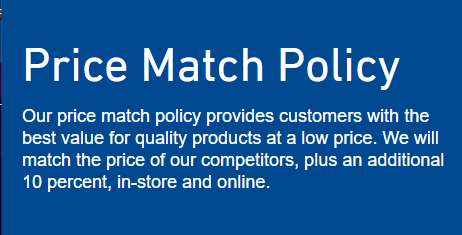

4. Take advantage of the Lowe’s price match policy

Want to save at least 10% on everything? Lowe’s price match policy doesn’t just match competitors prices, they’ll beat them by an additional 10%. This sort of thing can take a bit of time and research, but if you can take advantage of it, you can save some serious cash. And this policy applies both in store and online.

5. Shopping at Lowe’s via Rakuten

Rakuten Canada currently offers 2.5% cash back for shopping at Lowe’s online through the Rakuten website. This is on top of any credit card rewards you’ll earn, boosting how much you can save. Just note you won’t earn anything on appliances. You can get started here: Lowe’s at Rakuten.

Bottom line on Lowe’s

Are you a Lowe’s fan, or do you prefer to shop at one of the other big box hardware stores?

Were you annoyed when Lowe’s dropped Air Miles?

Let us know in the comments.

FAQ

What’s the best credit card to use at Lowe’s Canada?

Which card is better depends on what you’re looking for. If you want to earn cash back rewards, the SimplyCash Preferred Card from American Express might be a good choice for you. However, if you would prefer travel rewards, we suggest taking a look at the RBC Avion Visa Infinite. We go over this card and a few other options here.

How can I save money at Lowe’s Canada?

You can save money at Lowe’s Canada by using the right credit card (and earning rewards), shopping the seasonal sales, keeping an eye on the flyer, and shopping at Lowe’s online through Rakuten.

Does Lowe’s have a seniors discount?

Unfortunately, Lowe’s Canada does not offer a seniors discount. That said, however, Lowe’s Canada does have a price match policy that will beat their competitors’ prices by 10%, so you may be able to save more that way.

Who is cheaper – Lowe’s or Home Depot?

Lowe’s Canada and Home Depot Canada are pretty much neck and neck in terms of prices. From the rudimentary research we did, Home Depot came out slightly ahead, but it will really depend entirely on what you’re purchasing. If you collect rewards, however, you might want to shop at Canadian Tire (Triangle Rewards) or Home Hardware (Aeroplan points) instead. These stores were similar in terms of base pricing, but the rewards programs might give them a bit of an edge.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×2 Award winner

×2 Award winner

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 4 comments