Rakuten is an online platform that lets you earn cash back on purchases when you shop online through their website.

When you make qualifying purchases with their retail partners, you'll earn a percentage back on your purchase. Cash back is only paid out a few times a year, but you can maximize your earnings in the meantime by using the right credit card.

You might remember Ebates Canada, a popular platform for earning cash back on purchases. Although Ebates is no more, the company was purchased and rebranded as Rakuten.

Key Takeaways

- Rakuten rebranded Ebates in 2019 and expanded into Canada.

- By shopping on the Rakuten website or app, users can earn cash back that's paid out quarterly (every three months).

- Shoppers can earn more by using Rakuten with a high-earning cash back credit card.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What is Rakuten Canada?

Rakuten is a cash back platform with partners in over 30 countries, allowing you to earn cash back on purchases made through its website or app. You can shop with big brand names like Expedia, Apple, Ticketmaster, and more.

Rakuten Canada advertises earnings of up to 10% cash back, but it also offers bonus cashback offers, coupons, and referral bonuses. Users are paid quarterly for purchases made during the previous 3-month time frame. The company makes its money by collecting a referral fee from retailers when it gets a sale.

How Rakuten works

The first step is to sign up using your email address, Facebook profile, or Apple ID.

Once you've got the green light, you'll be bombarded with pop-ups asking you to:

- Install the official Rakuten browser extension. This notifies you about cashback offers you can apply for while you're browsing the web.

- Select your favourite retailers. This allows Rakuten to deliver personalized offers to you.

- Choose your payment method. You can receive payments by Interac® e-Transfer, PayPal or cheque.

You can skip these pop-ups and just get to shopping if you prefer. Use the search bar to search stores, products, and coupons.

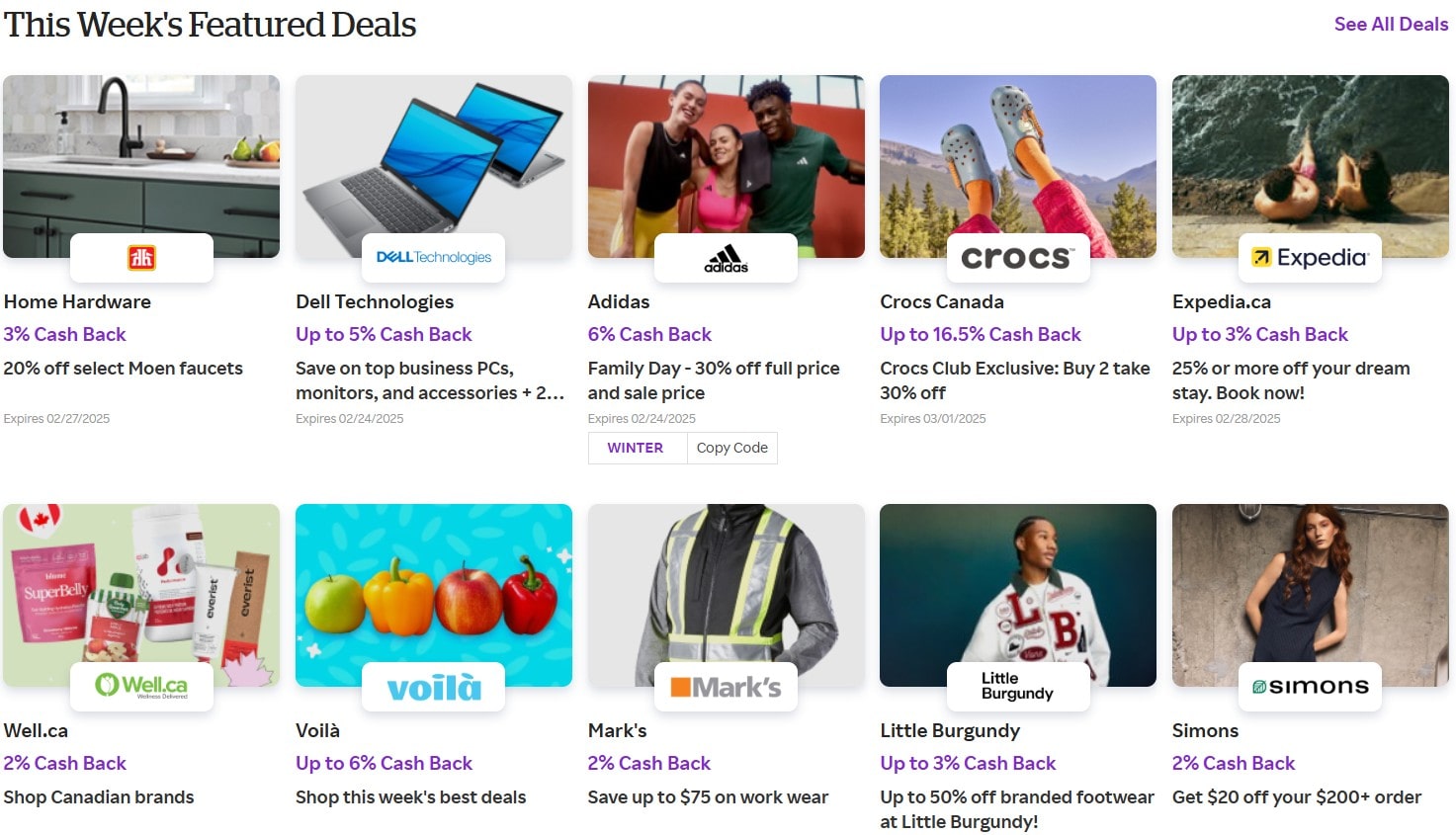

On the homepage, you'll see popular offers and deals, including which retailers are offering above-average cashback rates for the month.

To claim an offer, click on it (or choose "Shop Now" on the app) and you'll be whisked away to the retailer's website, where you can make your purchase. To receive your cash, Rakuten must be able to verify your purchase – for this reason, it's best to complete your purchase in the same session.

Rakuten gets paid a small sum for bringing customers to its partner's retail sites. That's where the money for your cashback bonuses comes from.

Take Note: It typically takes about 48 hours to receive your credit following a purchase, but some retailers won't confirm purchases with Rakuten right away. For instance, travel sites might wait to credit your account until after you've completed your trip.

Rakuten sends out payments every 3 months as long as you have at least $5.01 in your account. If you have less than that, your balance rolls over into the next payment period. Note that Bonus Rewards don't count towards your $5.01 minimum.

Pros and cons of Rakuten Canada

Over 7 million members use Rakuten Canada, so it's obvious that there are some good benefits:

- Get cash back to shop: You'll earn anywhere from 1% to 10% cash back from some of the most popular merchants in the world.

- Earn money with the Rakuten Referral program: Make an easy $50 by referring a friend to sign up for Rakuten Canada. Just share a custom referral link that your friend uses to sign up. Once they sign up and spend $50 within 90 days, you get $50!

- The Cash Back Button extension helps you catch partner deals: Never miss a Rakuten deal by shopping online with the Rakuten Cash Back browser extension.

- Get coupons in addition to cash back: Search the Rakuten site by coupon to see deals offered by each retailer. You'll get the discount and earn cash back on your purchase.

There are also some drawbacks to consider:

- Payments are infrequent: You'll only get paid four times a year and you must meet the minimum $5.01 balance before you get paid. Otherwise, you'll have to wait another three months.

- The cash back amounts fluctuate: Until you make your purchase, you never know when the cash back percentage from a retailer can change. This makes it hard to research an item or comparison shop. Wait too long and you might not get as much cash back.

- The payouts can be pretty small: Unless you do a lot of online shopping or make big-ticket purchases, you probably won't see huge payouts from Rakuten.

- Not all products qualify for cash back: Read the fine print when you shop online, since not all purchases earn you cash back with Rakuten.

Earn more cash back with the right credit card

If you want to double-dip on the rewards, use a cash back credit card to earn even more. Here are some of our top picks.

| Category | Credit card | Current offer | Rewards | Annual fee & income requirements |

|---|---|---|---|---|

| Best for cash back | BMO CashBack World Elite Mastercard |  $125 GeniusCash + Up to $480 cash back in the first year, first year free (terms) $125 GeniusCash + Up to $480 cash back in the first year, first year free (terms) | * 5% cash back on groceries, up to $500 in monthly spend * 4% cash back on transit, up to $300 in monthly spend * 3% cash back on gas, up to $300 in monthly spend * 2% cash back on recurring bills, up to $500 in monthly spend * 1% cash back on all other purchases | * $120 * $80,000 personal/ $150,000 household |

| Best for flexible rewards | MBNA Rewards World Elite Mastercard |  $20 GeniusCash + 30,000 bonus points (terms) $20 GeniusCash + 30,000 bonus points (terms) | * 5 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $50,000 spent annually per category) * 1 point per $1 spent on all other purchases | * $120 * $80,000 personal/ $150,000 household |

| Best Visa for cash back | Scotia Momentum Visa Infinite Card |  $20 GeniusCash + 10% cash back for the first 3 months, first year free (terms) $20 GeniusCash + 10% cash back for the first 3 months, first year free (terms) | * 4% cash back on groceries and recurring bill payments * 2% cash back on gas and transit * 1% cash back on all other purchases | * $120 * $60,000 personal/ $100,000 household |

| Best Amex for cash back | SimplyCash Preferred Card from American Express | 10% cash back for the first 3 months + $50 (terms) | * 4% cash back on gas and groceries * 2% cash back on all other purchases | * $119.88 * No income requirements |

Did you know that the GeniusCash app can help you maximize your rewards? GeniusCash is a cash back rewards app that sends real cash straight to your bank account. It also helps you get the most credit card rewards, find the best deals, and unlock exclusive offers to get you even more cash back on your everyday purchases.

Is Rakuten Canada worth it?

Rakuten Canada can be worthwhile if you don't mind installing the browser extension or always checking the Rakuten site or app. That said, don't expect to earn large amounts of cash unless you're a serious online shopper.

If you're looking for convenience and don't want to worry about checking cash back balances, you might be frustrated with Rakuten. Several Redditors on the Rakuten Canada thread were annoyed that Rakuten was taking a long time to approve purchases – or wasn't approving them at all, especially around the holidays.

However, one user had this to say:

Our take? If you're already doing the shopping and don't mind occasionally staying on top of your approved purchases, you might enjoy using Rakuten and receiving periodic rewards. It doesn't hurt to try it out.

FAQ

How does Rakuten work in Canada?

Sign up for a free Rakuten account and shop using the site's links or install the Rakuten browser extension. You'll receive cash back on qualifying purchases and the money is paid out every three months.

Is it safe to link your credit card to Rakuten?

Rakuten states that the information you share, including your credit card details, is kept secure and is encrypted. The site goes on to say that your information will never be sold, exposed, or compromised.

Is there a downside to Rakuten?

If you dislike being marketed to, you may want to reconsider using Rakuten. And, keep in mind that Rakuten doesn't pay out on demand. You'll only be paid four times a year, and only if you meet the minimum balance requirement ($5.01).

What is Ebates Canada?

Ebates started as a cashback program back in 2012, but in 2019, the company rebranded as Rakuten. For all intents and purposes, Ebates is now Rakuten.

How much does it cost to join Rakuten?

It's free to join Rakuten, but keep in mind that the only way you'll make money using the site is by making purchases with its partners. So, while Rakuten is free, you'll have to spend money to make money.

Why is Rakuten so cheap?

Rakuten is able to offer its cashback service for free because it makes its money through affiliate partnerships and marketing. It receives a share of the sales it generates from its users.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 1 comments