MBNA has two credit cards with flexible rewards, one of which is among the very best rewards credit cards available in Canada – the MBNA Rewards World Elite Mastercard.

The flexible redemption options available with these MBNA cards include merchandise, gift cards, and charitable donations. If you want the most valuable option, though, redeeming for travel purchases will earn you a value of 1 cent per point (CPP), and you don't have to worry about blackout dates at all.

To help you understand the finer details and make the right credit card choice for your needs, the article below provides an overview of the MBNA Rewards program, along with details of these two valuable MBNA Mastercards.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Overview of MBNA Rewards Mastercards

First, here’s an overview of both MBNA Rewards Mastercards.

| MBNA Rewards World Elite Mastercard | MBNA Rewards Platinum Plus Mastercard | |

|---|---|---|

| Welcome Bonus | * Up to

30,000bonus points (terms)

* Offer not available to residents of Quebec. For residents of Quebec, please click here. |

*

10,000bonus points (terms)

* Offer not available to residents of Quebec. For residents of Quebec, please click here. |

| Earn Rates |

* 5 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $50,000 spent annually per category) * 1 point per $1 spent on all other purchases |

* 2 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $10,000 spent annually per category) * 1 point per $1 spent on all other purchases |

| Insurance Coverage | 12types included | 3types included |

| Income Requirements | 80K personal, 150K household | None |

| Annual Fee | $ 120 | $ 0 |

| Apply Now | Apply Now | Apply Now |

A primer on the MBNA Rewards program

Before getting into the credit cards themselves, what is an MBNA Rewards point worth, and how can they be redeemed?

Redeem MBNA Reward points for travel

Redeeming your points for travel provides the best value for your points.

10,000 MBNA points will give you a $100 discount on your booking, a value of 1 cent per point.

How to use your MBNA points for travel

How do you redeem your points for travel? Your travel has to be booked through MBNA Rewards. You won’t be able to redeem for just any travel purchase charged to your card.

Make your booking, and you can use your points to help cover the costs. If you don’t have enough points, you’ll just simply need to use your MBNA Mastercardto help pay any remaining balance.

You can find the MBNA Rewards travel portal here.

Redeem MBNA Rewards points for cash

Of course, travel isn’t the only way to use your points. There are a few other ways to use them.

One of them is by turning your points into cash. And you don’t have to just get statement credits. There are a couple of other ways you can get your cash:

- cheques, and

- direct deposit.

What’s the value of a MBNA point when redeemed for cash?

It actually depends on the credit card.

For the

For the

Redeem MBNA Rewards points for merchandise and gift cards

There’s also a wide assortment of merchandise and gift cards you can choose from in the MBNA Rewards Catalogue. Both options have similar value.

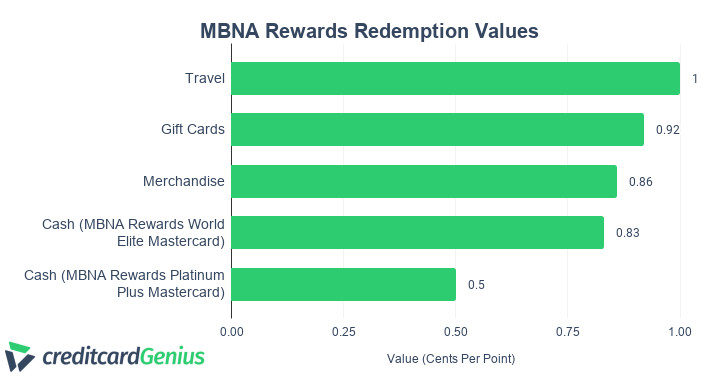

For merchandise, we have an average value of 0.86 cents per point.

Gift cards are slightly higher, at 0.92 cents per point. However, redeem for the right gift card, and you can see a value of almost 1 cent per point.

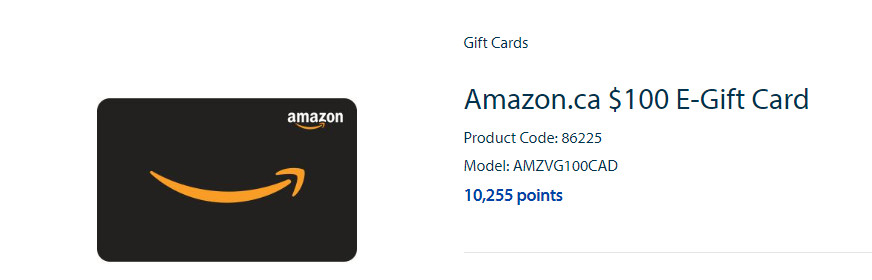

Take this Amazon e-gift card for instance:

This gift card provides a value of 0.98 cents per point, almost identical to travel.

This Amazon gift card offer is the biggest reason why MBNA Rewards credit cards are some of the best credit cards for getting Amazon gift cards.

Want to learn more about redeeming MBNA Rewards? Read our full guide on the MBNA Rewards program here.

Summary of MBNA Rewards value

Since graphs and charts make everything easier to read, here’s a summary of your MBNA redemption options.

| Redemption Option | Value (Cents Per Point) |

|---|---|

| Travel | 1 cent |

| Gift Cards | 0.92 cents |

| Merchandise | 0.86 cents |

| Cash (MBNA Rewards World Elite Mastercard) | 0.83 cents |

| Cash (MBNA Rewards Platinum Plus Mastercard) | 0.5 cents |

And for the more visual learner, here they are in chart form:

As you can see, travel does give the best value – but gift cards aren’t too far behind.

MBNA Rewards World Elite Mastercard

We’ll start with MBNA’s premium offering – the

Earning MBNA Rewards points

To get started earning MBNA points, you can earn up to 30,000welcome bonus points after spending $2,000 in the first 90 days and signing up for paperless e-statements.

Right there you’ve got $ 300in travel rewards, or $ 249in cash.

And on your purchases, you’ll earn:

- 5 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $50,000 spent annually per category)

- 1 point per $1 spent on all other purchases

It’s a great return of up to 5% on your purchases, depending on what you redeem your points for.

MBNA Rewards World Elite Mastercard insurance

What about the insurance coverage? This Mastercard comes with 12types included:

MBNA Rewards World Elite® Mastercard® Please review your insurance certificate for details, exclusions and limitations of your coverage.Extended Warranty 1 year Purchase Protection 90 days Price Protection Yes Mobile Device $1,000 Travel Accident $1,000,000 Trip Interruption $2,000 Flight Delay $500 Baggage Delay $500 Lost or Stolen Baggage $500 Rental Car Theft & Damage Yes Rental Car Accident $200,000 Rental Car Personal Effects $1,000

One insurance that stands out? The price protection coverage. Purchase any item with your credit card, and if you find a lower price for it within 60 days of your purchase, you can be reimbursed up to $500 for your item. Just note there is a yearly maximum refund of $1,000.

Other MBNA Rewards World Elite Mastercard benefits

There are a few other benefits associated with the card.

It’s a World Elite Mastercard, so you’ll get access to all the benefits associated with the World Elite program.

Some of these benefits include:

- Mastercard Priceless Cities,

- Mastercard World Experiences, and

- Mastercard World Elite Concierge.

You can learn more about what the World Elite program offers here.

You can also receive up to 10% off the base rates for rental cars booked through Avis and Budget.

MBNA Rewards Platinum Plus Mastercard

There’s also a no fee Mastercard with the MBNA Rewards program –

the

Here’s what makes it one of the best no fee cards around.

Earning MBNA Rewards points

For a no fee card, you’ll be earning a lot of points on your purchases.

As part of signing up, you can earn up to 10,000bonus points after spending $500 in the first 90 days and signing up for paperless e-statements.

And on your everyday purchases:

- 2 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $10,000 spent annually per category)

- 1 point per $1 spent on all other purchases

MBNA Rewards Platinum Plus Mastercard insurance

Need some insurance coverage? Even for having no annual fee, you’ll still get 3types of included insurance:

MBNA Rewards Platinum Plus® Mastercard® Please review your insurance certificate for details, exclusions and limitations of your coverage.Extended Warranty 1 year Purchase Protection 90 days Mobile Device $1,000

Other MBNA Rewards Platinum Plus Mastercard benefits

Besides rewards and insurance, are there any other benefits with this card?

The only other benefit offered is the rental car discount – save up to 10% on car rentals with Avis and Budget.

Free offer of $40 GeniusCash

But when you apply for a new MBNA Rewards Platinum Plus Mastercard through creditcardGenius, you’ll get the added benefit of receiving $40 of GeniusCash.

Sign up through our offers page. Within 12 weeks of being approved, you’ll receive your cash by PayPal or an Interac e-Transfer (depending on which you prefer).

Comparing MBNA Rewards Mastercards

So how do both of these credit cards compare side-by-side?

There’s obviously going to be some differences between these MBNA Mastercards (as one has a fee and the other doesn’t), but it’s still interesting to see their differences.

1. Average earn rate

First, the rewards. Based on a typical monthly spend of $2,000, here’s how the average earn rate of each card compares, using the MBNA travel value.

The World Elite card earns up to 5% on purchases, with an average rate

of 2.6%, but the Platinum still returns more than 1% for no annual fee.

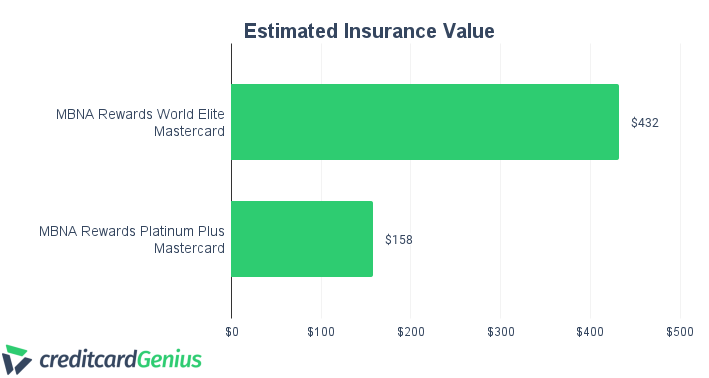

2. Insurance value

This is where things are interesting between these 2 cards. Here’s our estimated value for the insurance packages on each card, based on a study we completed on the value of credit card insurance.

The World Elite card comes with much more insurance coverage, but both offer mobile device coverage, protecting something that you take almost everywhere.

3. Income requirements

Here’s the big difference between these cards. The Platinum Plus Mastercard has no income requirements to meet.

The World Elite card on the other hand, has income requirements of either $80,000 personal or $150,000, which can put this card out of the reach of many.

Which MBNA Mastercard is better?

So which of these cards is better? There really isn’t a wrong choice when it comes to these cards.

If you prefer to avoid annual fees, or have a low annual spend on credit

cards, the

However, the high, flat earn rate of the

Want the best no fee Mastercard? See our top 5 here.

In conclusion

The MBNA Rewards program offers great choices for redeeming rewards, with only small differences in the value of each type of redemption.

And with 2 stellar credit cards to choose from, you’ll be earning plenty of points in no time.

What are your thoughts on the MBNA Rewards program, as well as their Mastercards?

Let us know in the comments below.

FAQ

What can MBNA Rewards be used for?

MBNA Rewards can be used for travel bookings made through MBNA, merchandise, gift cards, and cash.

What does the MBNA Rewards World Elite Mastercard offer for rewards?

The MBNA Rewards World Elite Mastercard earns:

- 5 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $50,000 spent annually per category)

- 1 point per $1 spent on all other purchases

When redeemed for travel through MBNA, it’s a return of up to 5%.

What does the MBNA Rewards Platinum Plus Mastercard offer for rewards?

The MBNA Rewards Platinum Plus Mastercard earns the following for rewards:

- 2 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $10,000 spent annually per category)

- 1 point per $1 spent on all other purchases

Based on a typical $2,000 monthly spend, that’s an average return of 1.40% on purchases.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×7 Award winner

×7 Award winner

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.