Our mobile phones are a vital part of most of our lives, and go almost anywhere we go. And because of that, accidents do happen, where maybe just the screen gets a crack, or the device stops working all together.

Wouldn’t it be nice to get the necessary repairs done for free? Thanks to credit card mobile device insurance, that can happen for you.

I recently made a successful mobile device insurance claim using the insurance that comes with the Scotiabank Momentum Visa Infinite– the screen cracked and eventually stopped working all together.

It’s far from a perfect insurance coverage as you’ll see, but with the proper tips you’ll save yourself some cash.

Here’s how it works, and how to ensure your claim is successful the next time something happens to your phone.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What is mobile device protection?

First, what is mobile device protection?

Basically, it’s a type of insurance that covers your mobile phone device in case of accidental damage.

To be eligible for coverage, you have to do one of these 2 things:

- charge the full or partial price of a new mobile device to your credit card, and/or

- if the cost of the phone is included as part of a mobile plan, charge the plan to your credit card.

There’s also a waiting period before coverage kicks in, usually between 30 to 60 days, depending on the credit card. And coverage generally ends after 2 years – older phones won’t be covered.

If your phone is repairable, you’ll be reimbursed up to a certain amount to get your phone repaired. If it was lost or stolen, you’ll be authorized to purchase a replacement device of the same make and model.

What it usually covers

So what does mobile device insurance in Canada cover? Using the Scotiabank Momentum Visa Infinite as an example, here’s what’s covered:

- accidental damage, such as drops or spills that leads to your device not working, or

- your phone is lost or stolen.

What it doesn’t cover

So what isn’t covered? Obviously, if you intentionally damage or destroy your phone it won’t be covered.

The other major issue that isn’t covered is if something happens that’s already covered by the manufacturer’s warranty. In this case, you have to go through them to get your device repaired or replaced.

There are a few other exclusions, as well, and you can check the insurance certificates for more details.

One big item isn’t covered – a loaner phone if your current device is damaged beyond use, or a quick replacement if it was lost or stolen. If that happens, you’ll need to find a suitable replacement until your claim is approved.

This is one of the biggest shortfalls of mobile device coverage. In our claim, it took almost 2 months before the device was repaired and back in working order.

Our suggestion? Next time you go to upgrade your old phone – hold on to it. I had an old phone I used while my newer phone was down. It had a few issues – you could only go one day before it needed to be re-charged, and there were some issues with the camera. But otherwise, it was a suitable temporary phone.

All you have to do to make this work is take the SIM card out of the broken phone, and put it in the old one (assuming they’re the same size). Your old phone then takes over receiving calls and texts.

Total coverage provided

So how much can you be covered for? Credit cards with mobile device coverage have a maximum amount you can claim. For the Scotiabank Momentum Visa Infinite, it’s up to $1,000.

However, you’ll almost never get that full amount (unless you have a very expensive phone). There are 3 factors at play. The first is the original retail price of the phone. You’ll never be reimbursed more than the original cost of the device.

The second is depreciation. From your original price, a certain percentage (usually between 2% to 3%) of the original price will be deducted for every month from the date of purchase until your device was damaged.

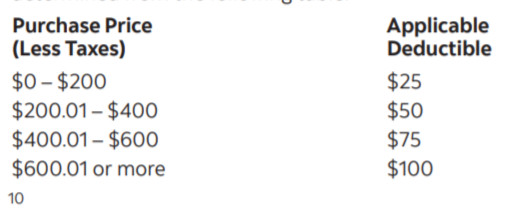

And the last one is the deductible. Based on the original purchase price of your device, there is a deductible added on.

Here is the deductible you’ll pay for insurance coverage with the Scotiabank Momentum Visa Infinite:

An example calculation

So how does it all work? Here’s an example from our successful claim.

The original retail price of the device was $665. The damage to the phone occurred 5 months afterwards.

The Scotia Momentum card has a depreciation loss of 2% per month.

And since the device was worth more than $600, the deductible is $100.

So here’s the maximum claim amount for this phone:

Purchase Price: $665

Depreciation: 2% x 5 months x 665 = $66.50

Deductible: $100

Maximum claim amount: $498.50

Want to learn more about all types of credit card insurance? Here’s the lowdown on all 17 types currently offered.

Where you can get mobile device protection insurance

Where can you get mobile device protection?

Here are 2 ways you can get it.

Mobile protection plans

Many 3rd party cell phone providers offer their own insurance options. With these providers, you can get a mobile plan and phone from the major mobile companies, such as Koodo, Freedom, Rogers, Bell, Virgin, Fido, Chatr, and Shaw.

You can then also get coverage for it. For a set amount, you’ll get no-hassle coverage should something happen to your device. These plans can get you a replacement device shipped to you in a few days.

Here are a few options.

| Company | Plan starting prices |

|---|---|

| Wireless Wave | * $7.99 – $11.99 a month |

| Mobile Shop | * $5.99 a month |

| Costco | * $139.99 for 2 years |

Wireless Wave

Wireless Wave offers 3 different levels of coverage, with prices starting at $7.99. Your actual monthly cost will be based on the unsubsidized price of your phone. Once you submit a claim, you’ll get a replacement device sent to you.

You can see what Wireless Wave has to offer here.

Mobile shop

Operating inside of many Loblaws banner stores, the Mobile Shop offers their own device protection plans. These plans start at $5.99 per month. All you do is submit a claim, and once approved, a new device will be shipped out to you.

You can see what the Mobile Shop offers here (just note their plans are not available in Quebec).

Costco

The last one we’ll look at is Costco. They sell plans and phones for many carriers in Canada. Their insurance plan starts at $139.99 for a 2 year term, plus you’ll have to pay a $99.99 replacement fee.

This only covers Android devices, but they do offer AppleCare+ for iPhones. You can learn more here, and these plans are also not available in Quebec.

Credit cards that offer mobile device insurance

Credit cards are the other way to get coverage. While not as convenient as a paid plan, there’s no cost to them either – if your credit card includes this coverage, it’s a complimentary part of the overall package. And, there are even a couple of no annual fee credit cards that have this valuable insurance, as well.

Here are the top credit cards for mobile device insurance.

| Credit Card | Maximum Mobile Device Coverage Amount | Earn Rates | Annual Fee, Income Requirements | Apply Now |

|---|---|---|---|---|

| Scotiabank Momentum Visa Infinite | $1,000 | * 4% cash back on groceries and recurring bills * 2% cash back on gas and transit * 1% cash back on all other purchases |

* $120, first year free * $60K personal/$100K household income requirement | Apply Now |

| BMO eclipse Visa Infinite | $1,000 | * 5 points per $1 spent on groceries, restaurants, gas, and transit * 1 point per $1 spent on all other purchases |

* $120, first year free * $60K personal/$100K household income requirement | Apply Now |

| BMO eclipse Rise Visa | $1,000 | * 5 BMO Rewards points for every $2 spent on dining, groceries, and reccurring bills * 1 point per $2 spent on all other purchases |

* $0 * None |

Apply Now |

| Tangerine World Mastercard | $1,000 | * 2% cash back in up to 3 categories of your choice * 0.5% cash back on all purchases |

* $0 * $60K personal/$100K household income requirement |

Apply Now |

1. Scotiabank Momentum Visa Infinite

Our top rated cash back credit card is our preferred credit card that includes mobile device insurance – the

You’ll get up to $1,000 in coverage for mobile insurance.

And you’ll earn plenty of cash back on purchases:

- 4% cash back on groceries and recurring bills,

- 2% cash back on gas and transit, and

- 1% cash back on all other purchases.

This card has an annual fee of $120 that’s waived for the first year, and income requirements of either $60,000 personal or $100,000 household.

2. BMO eclipse Visa Infinite

BMO’s newest credit card – the

It also earns plenty of flexible BMO Rewards points on your purchases:

- 5 points per $1 spent on groceries, gas, restaurants, and transit, and

- 1 point per $1 spent on all other purchases.

For all this, you’ll pay an annual fee of $120 (first year free), and income requirements of either $60,000 personal or $100,000 household.

3. BMO eclipse Rise Visa

The other BMO we'll go over is the

A no annual fee credit card, it offers an average coverage amount of $1,000. On your purchases, you'll earn up to 5 points per $2 spent. This card has no income requirements.

4. Tangerine World Mastercard

Our last credit card we’ll discuss that includes mobile device insurance is the

This card comes with the typical $1,000 in mobile device coverage.

And it’s unique in how you earn rewards:

- 2% cash back in up to 3 categories of your choice, and

- 0.5% cash back on all other purchases.

This card has no annual fee, and income requirements of either $60,000 personal or $100,000 household.

Comparison of credit cards with mobile device insurance

So how do these credit cards compare? Here’s the comparison in a few areas.

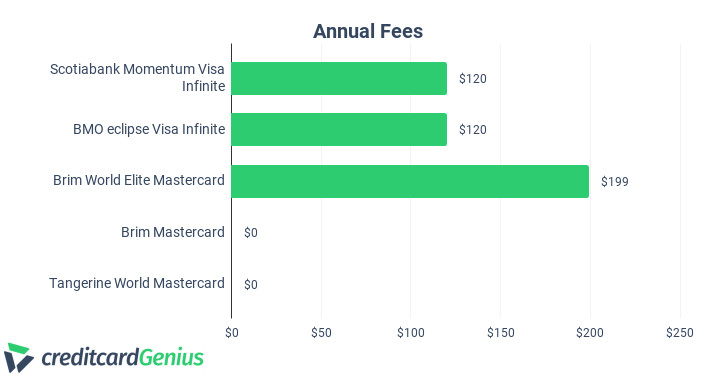

Annual fee

The annual fees are up first. We have quite a wide range of annual fees among these 5 credit cards:

We’ve got standard annual fees from $120 all the way up to $199, but we also have 2 no fee credit cards to save a little bit more each year.

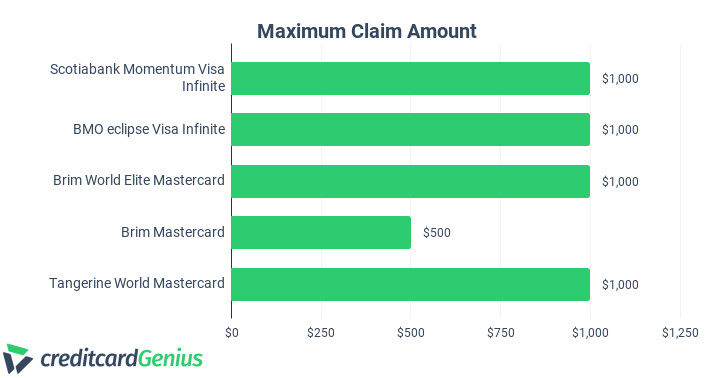

Maximum claim amounts

Of course, we need to see how they compare for the maximum amount you can claim.

All of these credit cards have a maximum claim amount of $1,000, except for one of our no annual fee cards, the Brim Mastercard, which has a maximum amount of $500.

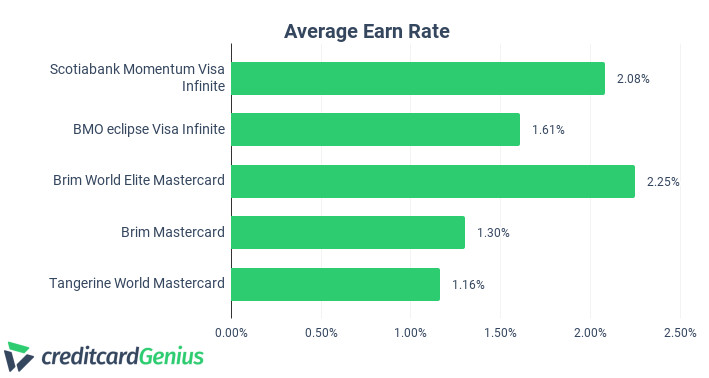

Earn rates

Finally, we can’t compare credit cards without talking about how much you could get for rewards.

Here’s the average earn rate for these credit cards, based on a typical $2,000 monthly spend.

There are varying earn rates here, but 2 of them will earn you more than 2%, with 1 of our no annual fee cards getting better than 1% on your purchases.

Want to see more credit cards that offer mobile device insurance? Here are a few more options to consider.

How to make a successful mobile device insurance claim

So what did I do to get my device repaired for free? Here are the steps I took. These are what’s required for the Scotiabank Momentum Visa Infinite, so just keep in mind that they may differ slightly with other issuers.

Getting a claim from credit card insurance is like trying to get soup from the Soup Nazi in Seinfeld. Simply follow the procedure like Jerry, and you’ll be fine.

Be like George and Elaine (and ignore it) and no soup for you.

Read your insurance certificate

I cannot stress this enough. When it comes to this or any other credit card insurance claim, read your insurance certificate. It tells you everything you need to do to make your claim.

These documents come with your credit card in the mail. If you don’t have it, don’t sweat. Most of the issuers will let you download them from their website.

Worst case if you can’t find it – call your issuer and they’ll send you a new copy.

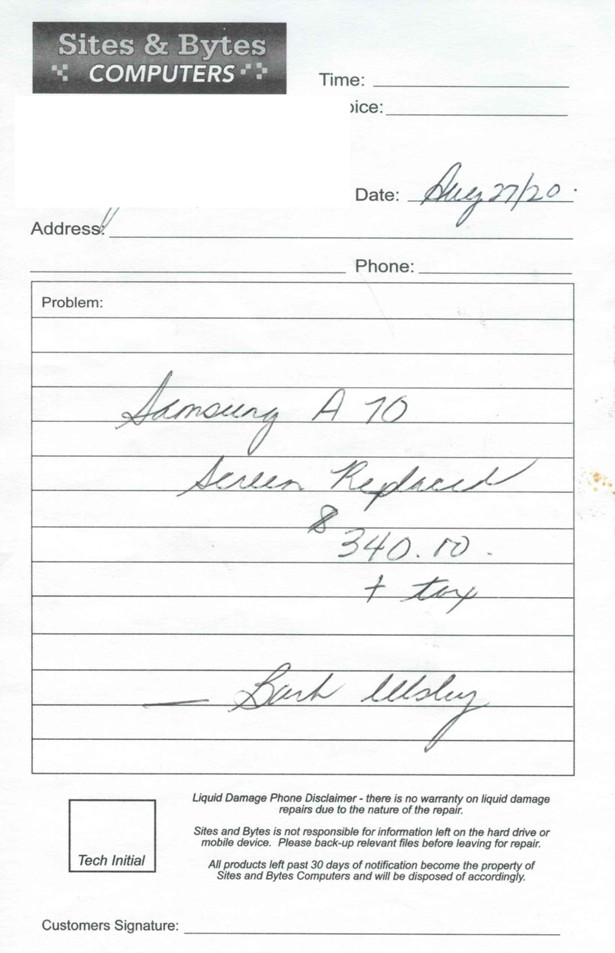

Get a quote for repairing my device

First things first – as part of my claim, I needed to get a quote for what it would cost to repair my device. So I went to a local shop that repairs cell phone screens and got a basic quote from them.

It doesn’t have to be anything fancy – here is the one I got:

Started a claim shortly after it happened

Once I got my quote, I got to work submitting my claim. Assurant makes it easy – they have a website to submit insurance claims (you can see it here).

If you don’t have everything ready, no worries. You can submit what you have, and save it for later.

Provided all the documentation required

There’s actually a long list of things I had to submit.

Here’s what needed to be included:

- summary sheet for the plan when I signed up,

- repair quote,

- credit card statements, and

- IMEI for the device.

The last one was a little tricky. IMEI stands for International Mobile Equipment Identity. It’s a unique identification number for mobile phones. Normally, you can get the IMEI for the device by going into the phone’s settings. But since the screen wasn’t working, that wasn’t an option.

Luckily, I still had the original box the device came in, and this number is on the outside of it.

Follow ups from the insurance company

Shortly after submitting my claim (about a week or so), I got an email follow up from Assurant.

I didn’t submit all the credit card statements required, I only submitted the statement for the month the device was damaged. They required all statements from when I got my new phone.

There was quite a bit of back and forth, they consistently stated they were missing statements. I eventually just sent all of them in one email so they had them all. This part of the process took a few weeks.

Get my device repaired

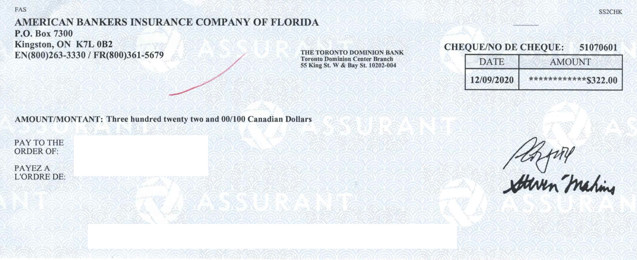

There was radio silence after the last email I sent. But about 10 days later, I got a letter in the mail stating my claim was approved.

There were a few instructions inside. I had to complete the repair within 60 days, and charge the repair to my Scotiabank credit card. I also had to submit the receipt and credit card statement after it was done.

Submit receipts

So I went and got my device repaired (this ended up taking about 1 week). The actual repair cost came in less than originally estimated.

So I sent the receipt and my credit card statement to Assurant by email.

About 4 weeks later, I got a cheque in the mail, covering the repair of the device.

It was a lengthy process, and one that took time and required some patience. But in the end, I paid nothing to get a new screen on my phone.

5 Tips and pointers on getting a successful claim

So what tips do I have? There’s a couple of things to point out.

1. Have a backup phone

Having a backup phone you can pop a SIM card into is the most helpful thing you can do. These claims can take some time to complete, and you could be without a phone as the process drags on.

Keep an old phone around, that way you can keep getting calls and texts while you wait to get your device repaired.

2. Read your insurance certificate

It’s already been said once, but I’ll say it again – read your insurance certificate. It includes everything you need to do to make a successful claim.

They don’t list everything you need to provide, but it provides the steps you need to complete to get your repair reimbursed.

3. Keep everything you get with your new phone and plan

When you get a new phone, it may be tempting to throw the box and all that other junk away.

But don’t. You need the documentation they provide to get your claim approved. The insurance company needs proof of the original cost and purchase date of your device to determine how much they’ll cover. Without it, you’re not getting a claim approved.

And keep the box from your phone too. If your phone is lost or stolen, or damaged to the point where it no longer works, you’ll need the box to get your IMEI number.

4. Charge everything to your credit card

If you’re buying your phone outright, pay for it with your credit card.

If the price of the phone is being covered as part of a new plan, the second you get home login to your online account with your carrier and set up your credit card to pay for your bill.

This is important: if you miss paying even one month on your credit card, you won’t be eligible for coverage

5. Be patient

The last tip I have – be patient. It can take a little while to hear back. This claim – from the time I got my repair quote to when I picked up my repaired device – took almost 2 months, and then another month to get the cheque afterwards.

It takes time for these insurance claims to be fulfilled.

The bottom line

It’s not perfect, but mobile device insurance can definitely save you from having to pay out of pocket for mobile device repairs, or getting a monthly insurance plan you may never end up using.

Have you used mobile device insurance before?

What was your experience?

Let us know in the comments below.

FAQ

What is mobile device insurance?

Mobile device insurance is a type of credit card insurance that can replace or repair your mobile devices in case of accidental damage, theft, or loss.

How can I apply for mobile device insurance?

There’s nothing you have to do to apply for mobile device insurance with a credit card. If your credit card includes it, it’s simply part of the package your credit card comes with.

What’s the best credit card with mobile device insurance?

Our top credit card for mobile device insurance is the Scotiabank Momentum Visa Infinite, which provides up to $1,000 in coverage, and earns you 4% cash back when paying your mobile phone bill.

What do you need to do to qualify for mobile device insurance?

To qualify for mobile device insurance, the full purchase price of the device must be charged to your credit card. Or, if the cost of the device is reimbursed as part of a mobile phone plan, the plan must be charged to the credit card every month.

How do you submit a claim for mobile device insurance?

Submitting a claim for mobile device insurance depends on the issuer. Scotiabank, for instance, allows online submissions for insurance coverage.

Looking for more? Here are other successful credit card insurance claims.More credit card insurance claims

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×2 Award winner

×2 Award winner

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.