Flights get delayed – it happens. Whether it’s the airline and they can’t provide a flight crew, snow has grounded flights at an airport, or maybe there’s issues with air traffic control. Whatever the case, nobody likes a flight delay.

Thankfully, there’s credit card insurance out there that can cover any extra costs you incur because of a delayed flight – the aptly named flight delay insurance.

How does it work, and how do you make a claim? Here are the details, and a real-world, successful insurance claim.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What is flight delay insurance?

Flight delay insurance is a common credit card insurance coverage type on premium credit cards.

What it does – it reimburses you for expenses you may incur when your flight is delayed for any reason. There’s a minimum number of hours your flight is delayed (typically 4 hours), and there’s a set amount you can get reimbursed, which is typically $500.

It’s very useful when you’re travelling and run into trouble since you can be delayed for any reason.

As long as you charged your flights in full to your credit card, you can get reimbursed for costs you incurred as part of the delay.

My flight delay story

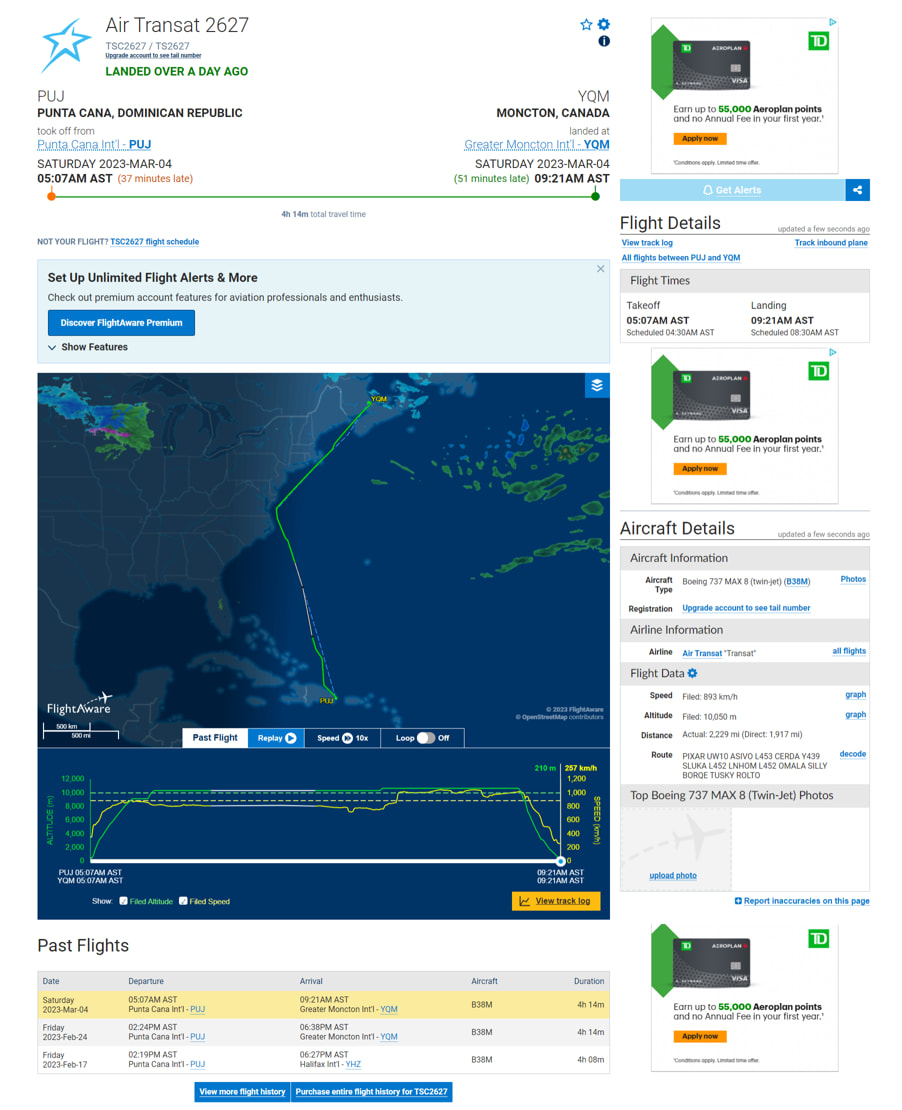

So what happened to my flight? It was our return flight from Punta Cana to Moncton, and was operated by Air Transat.

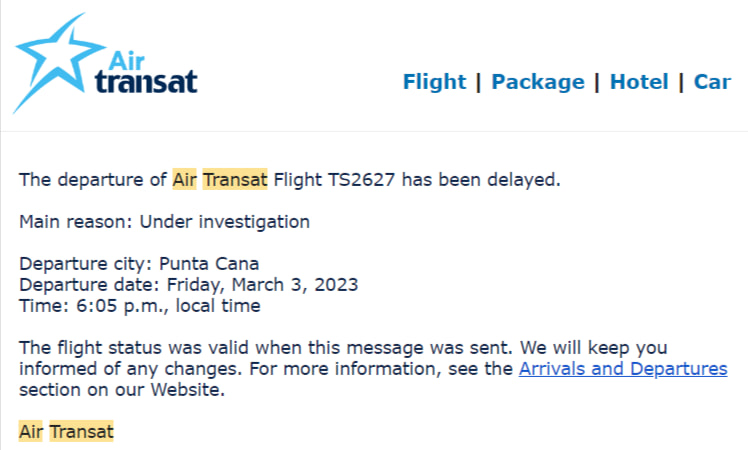

The day before we were supposed to leave, and an email came in from Air Transat stating our flight was going to be leaving about 4.5 hours later than scheduled.

No problem – we were getting an extra 4 hours at our resort.

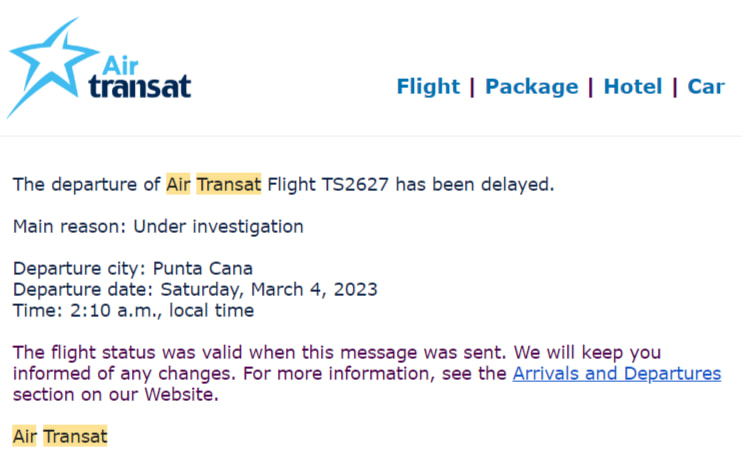

We woke up the next morning, and got this further update:

Now we’re into some issues. We’re going to have to see if we can stay at our resort for an extra day, and we’re travelling all night to get to Moncton. Thankfully, the resort had space and we were able to pay to stay for another day, which cost just under 31,000 Dominican Pesos (around CA$755).

Early that afternoon, I decided to check Air Transat’s site to check our flight status, and well, it wouldn’t show up on their site. I checked the in-bound flight from Moncton, and it was showing as arriving at 3:40 am.

Using Flight Aware (an excellent site for checking on the status and real-time location of any flight), I found a flight plan filed for our flight departing at 4:40 am. So we would be able to get some sleep that night, and we headed out for the airport at 2 am.

There was no one at the airport (this flight felt like being the Grinch in Whoville – no one knew we were there). No check in lines (they closed check-in after we dropped our bags off), and no one was waiting at security or customs. In the waiting area was everyone else for our flight, already there. It looked like we were the only ones who figured out it was leaving even later than they said. We got US$15 meal vouchers for each person at check-in, and we all scarfed down some Wendy’s cheeseburgers, the breakfast of champions.

We ended up taking off around 5 am, got to Moncton, cleared customs, picked up bags and drove home.

At the end of the day, once we found out the true time we were leaving, we basically got an extra day of vacation time. And as you’ll see, it was for no extra cost, thanks to having a credit card with flight delay insurance.

Now, was the airline responsible for this? Well, there were no weather-related events in Moncton at the time, so we think yes, as we’ll get to in more detail below.

Flight delay insurance – how it works

When flights get delayed, whether or not the airline has to take care of you depends on whether or not the delay was within their control or not (more on this later).

If you have a credit card with flight delay insurance, it doesn’t matter what caused the delay. As long as your flight with a “Common Carrier” is delayed more than a set time, you can get paid back any costs you incurred, up to a set amount.

I happened to book this trip using the American Express Aeroplan Reserve Card – we’ll use this card as our guide to what you need to make a claim. With many credit cards, this insurance is combined with lost or delayed baggage coverage.

The exact details will differ based on issuer, but the rough process will be the same. If you have an Amex card, all the details will be the same except for the coverage amount. However, for the American Express Platinum Card, the coverage is identical.

If you want to see the insurance certificate for yourself, you can review it here.

Requirements to activate flight delay insurance coverage

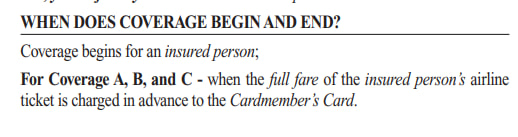

Activating coverage is simple – all you have to do is charge the full fare to your credit card.

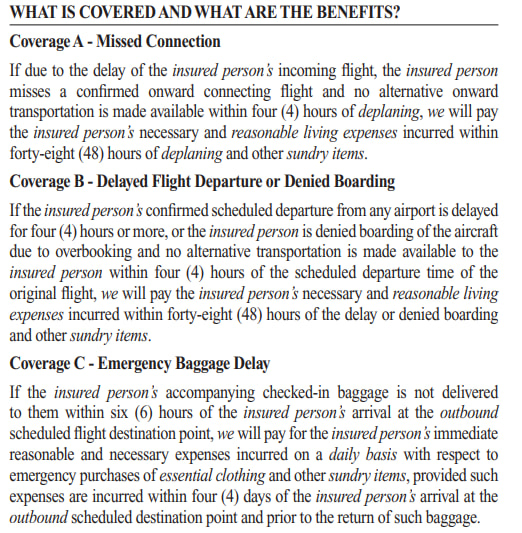

Here’s what coverages A, B, and C are.

In my particular case, Coverage B applies. Coverage A also applies specifically to flight delay, while Coverage C is for when your baggage gets delayed.

With this credit card, since it’s an Aeroplan-branded credit card, you would also be covered if you used Aeroplan points to pay for some or all of the cost.

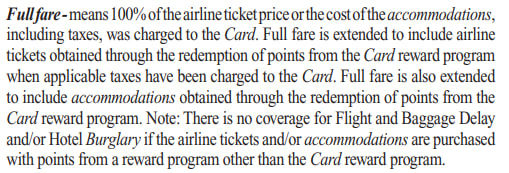

Here’s the definition of “Full Fare”.

A big point to note here – if you used rewards to help pay for your flight, you won’t be covered if the credit card wasn’t part of the program. So for example, let’s say if I had used Scene+ points to help pay for our flight – that wouldn’t activate the coverage (this is the case for most types of credit card travel insurance).

That was not the case for me, though – I used my credit card to pay for our flights in full.

When flight delay insurance can be used

So, when can it be used? Basically, your flight has to be delayed to a set period of time before coverage actually begins. That’s it. It doesn’t matter why. Whether the airline is at fault, or if weather hampered operations, your insurance will cover you.

For the American Express Aeroplan Reserve Card, it’s 4 hours, which we far exceeded on our flight delay. This time can vary based on issuer, so it’s best to check your certificate to see how long a delay needs to be for coverage to actually commence.

What flight delay insurance covers

Flight delay insurance covers any expenses you occur while your flight is delayed.

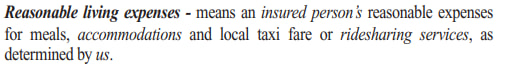

The screenshots above have the term “Reasonable Living Expenses” – here’s what that means.

It basically will pay for your meals, if you need a hotel, or a taxi ride somewhere.

What it won’t cover is if you decide to find another way to your destination. Say you were flying from Toronto to Ottawa, and your flight is cancelled. If you decide to rent a car or take the train to Ottawa, you won’t get reimbursed for your costs.

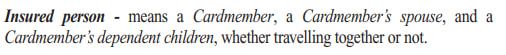

This insurance also extends to family members, whether they are travelling with you or not. Here’s the definition of “Insured Person’s”.

It also helps to make sure you pay for all your expenses when possible with your credit card. However, with the American Express Aeroplan Reserve Card it’s not actually a requirement. There’s no mention here that you need to use it.

Flight delay insurance claim limits

There’s a limit to how much you can claim. It’s not an unlimited insurance.

How much you can claim comes down to the credit card. In most cases, it’s $500. And for some, how much you can claim varies on the length of your delay.

With the American Express Aeroplan Reserve Card, it’s simple – you get $1,000 in coverage, double what a typical card will pay. And that comes in handy in our next section.

That’s everything you need to know about flight delay insurance. Want to make a claim? We’ve got that covered, too.

How to make a flight delay insurance claim

As part of our flight delay, I made a successful claim with Amex’s insurance agent and got paid back for an extra day at our resort.

Here’s what I did.

1. Kept all my receipts

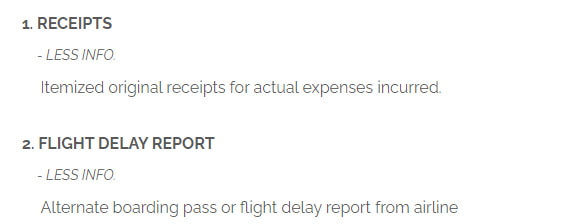

Everything starts with the extra costs you incurred. I made sure to keep our receipts for the extra night we paid for.

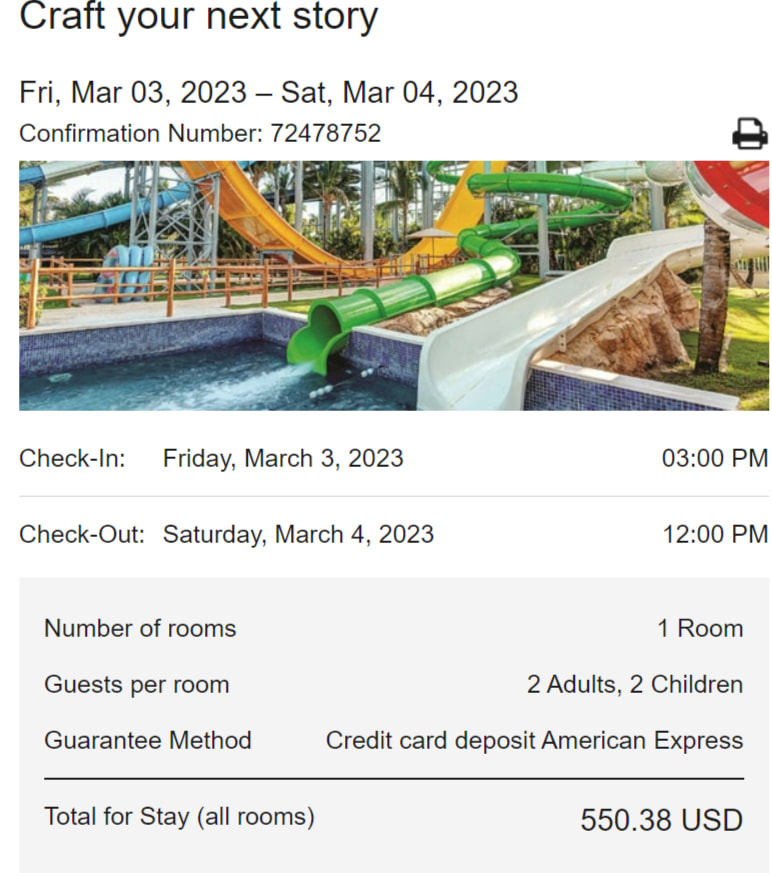

I also made sure to hold on to my boarding pass when I got home. I also organized all the emails I received from Air Transat.

I didn’t end up paying for our extra night with my American Express Aeroplan Reserve Card – we were trying to pay for our room quickly as we were having issues with the Marriott page. My spouse used her Marriott Bonvoy American Express Card to pay for it as that was the card on file with Marriott.

2. File my claim

A few days after we got home, I started the process of submitting my claim.

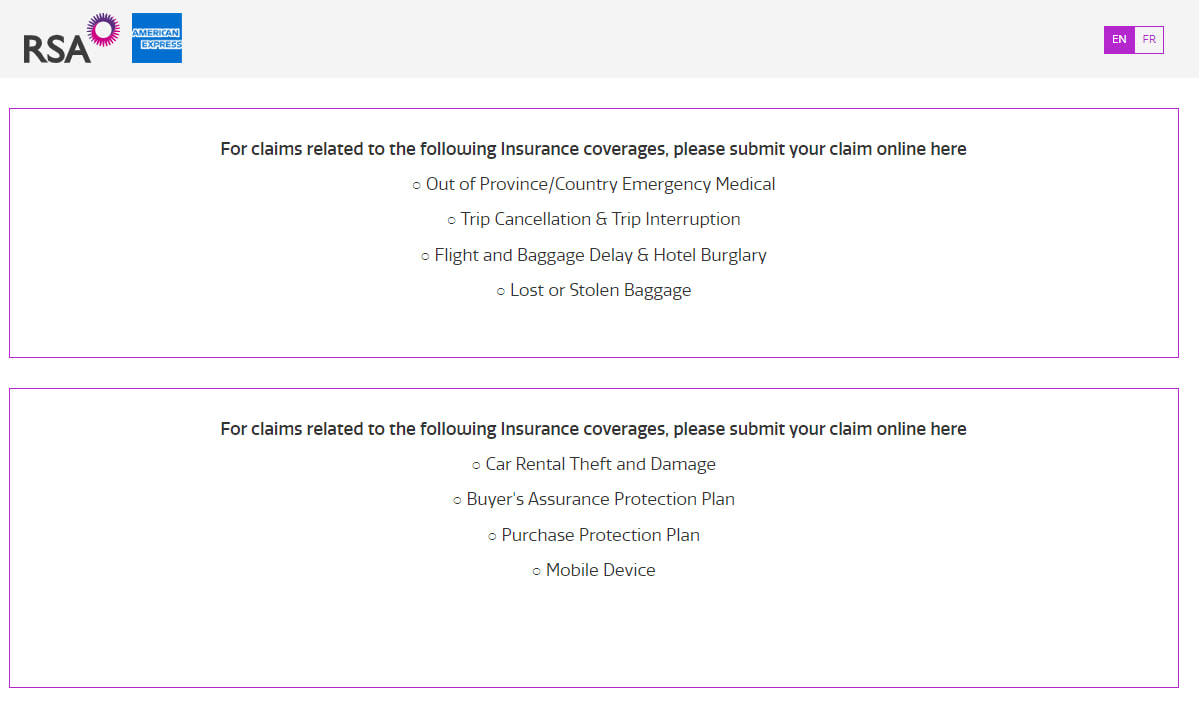

For anyone with an Amex card, I’m here to save you some time. You can head to this RSA Group site to make most insurance claims. The insurance certificate mentions a couple of different numbers. I called one, waited a few minutes, talked to someone, who then directed my call somewhere else. There was an automated voicemail system that said I go to that page I linked to start a claim.

I went to the page and clicked on the top box to get started.

Since this was the first time submitting an insurance claim with an Amex card, I had to create an account.

Once finished and I logged in, I started my submission.

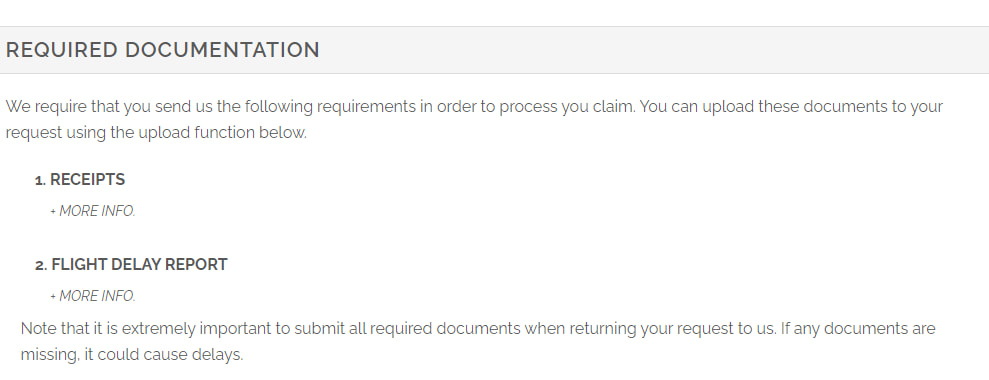

After selecting some info from the drop boxes and filling in some basic info, I got to the point where they wanted me to submit documentation.

Clicking more info for both expanded what was required.

I have all this. For receipts, the email we got from Marriott shows that the charge was in USD, but we actually paid in Dominican Pesos. I included both the email and the credit card receipt.

For the flight delay report – Air Transat has a page where you can get a certificate of delay for a flight. Unfortunately, it did not work – nothing would show up for my flight.

But I did keep my boarding pass – it shows the delay (side note: have you ever seen a boarding pass where the boarding time was later than the flight departure?).

I also included a screenshot from Flight Aware showing when the fight actually left, as it’s much different than what the boarding pass says.

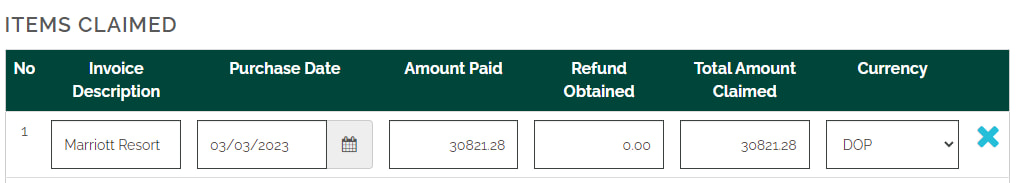

I uploaded my documents, filled in the rest of the info they wanted, which was to itemize my costs (there was just the one), and submitted my claim.

Here’s what that line item looked like.

Shortly after, an email came in confirming I submitted a claim.

3. Wait for approval

After a couple of weeks, another email came in, saying my claim was approved.

Attached was an invoice showing how much I would get paid. And a week later, the cheque arrived in the mail (I could have done a direct deposit or Interac e-Transfer instead, but this felt more satisfying and easier to show off).

Now, this didn’t 100% cover our night – it actually cost us $779. I believe the difference is that pesky 2.5% foreign transaction fee credit cards charge. RSA Group/Global Excel just took the actual exchange rate.

Could I go back and complain? Perhaps, but they stated they had a high volume of claims when I submitted, and who knows how long I would have spent on the phone trying to get the extra $24.

One thing I could have done differently was take a screenshot of the actual charge from the credit card account showing what we actually paid. It’s possible (but not guaranteed) that they use that number instead.

Regardless, I got almost all of our costs back, and was more than pleased at the ease of submitting the claim.

Top credit cards for flight delay insurance

Want this valuable insurance? There are quite a few credit cards that have it.

We’ve listed out some popular credit cards by issuer that have it, and how much they cover.

1. American Express

American Express offers quite a few credit cards that offer flight delay coverage, including the best credit card in Canada.

| Amex Credit Card | Flight Delay Coverage |

|---|---|

| American Express Aeroplan Reserve Card | $1,000 |

| American Express Platinum Card | $1,000 |

| American Express Gold Rewards Card | $500 |

| SimplyCash Preferred Card from American Express | $500 |

| Marriott Bonvoy American Express Card | $500 |

| American Express Cobalt Card | $500 |

2. BMO

A few BMO credit cards offer this coverage, including the best Air Miles credit card in Canada.

| BMO Credit Card | Flight Delay Coverage |

|---|---|

| BMO AIR MILES World Elite Mastercard | $500 |

| BMO CashBack World Elite Mastercard | $500 |

| BMO Ascend World Elite Mastercard | $500 |

| BMO eclipse Visa Infinite Privilege Card | $1,000 |

3. CIBC

CIBC Aventura and Aeroplan credit cards with annual fees all include flight delay insurance.

| CIBC Credit Card | Flight Delay Coverage |

|---|---|

| CIBC Aeroplan Visa Infinite Card | $500 |

| CIBC Aventura Gold Visa Card | $500 |

| CIBC Aventura Visa Infinite Card | $500 |

| CIBC Aeroplan Visa Infinite Privilege Card | $500 |

4. MBNA

There’s 1 MBNA Mastercard that offers flight delay insurance with the MBNA Rewards World Elite Mastercard. You’ll get $500 in coverage.

5. RBC

RBC offers an extensive lineup of credit cards with flight delay insurance, included as part of Avion and WestJet credit cards.

| Amex Credit Card | Flight Delay Coverage |

|---|---|

| RBC Avion Visa Infinite Privilege | $1,000 |

| RBC British Airways Visa Infinite | $500 |

| RBC Avion Visa Infinite | $500 |

| RBC Visa Platinum Avion | $500 |

| WestJet RBC World Elite Mastercard | $500 |

6. Scotiabank

If you collect Scene+ points, Scotiabank has 3 cards that would offer this coverage for you, as well as a cash back card.

| Scotiabank Credit Card | Flight Delay Coverage |

|---|---|

| Scotiabank Gold American Express Card | $500 |

| Scotiabank American Express Platinum Card | $1,000 |

| Scotia Momentum Visa Infinite Card | $500 |

| Scotiabank Passport Visa Infinite Card | $500 |

7. TD

TD’s Aeroplan and Rewards Visa Infinite cards include flight delay coverage.

| TD Credit Card | Flight Delay Coverage |

|---|---|

| TD Aeroplan Visa Infinite Card | $500 |

| TD Aeroplan Visa Infinite Privilege Credit Card | $1,000 |

| TD First Class Travel Visa Infinite Card | $500 |

8. National Bank

All 3 of National Bank’s travel credit cards include flight delay coverage.

| National Bank Mastercard | Flight Delay Coverage |

|---|---|

| National Bank World Elite Mastercard | $500 |

| National Bank World Mastercard | $500 |

| National Bank Platinum Mastercard | $500 |

9. Brim

Finally, Brim’s World Elite Mastercard includes flight delay coverage as well.

| Brim Mastercard | Flight Delay Coverage |

|---|---|

| Brim World Elite Mastercard | $500 |

My flight delay compensation claim with Air Transat

I got my costs back, but Air Transat was by no means off the hook. We checked the weather at home – there was some snow a couple of days before we were to leave, but that was it.

Our assumption is that it shouldn’t have affected our flight by around 15 hours.

Air Transat has a page to submit a claim. Based on our delay, we were entitled to $500 per person as Air Transat is a small airline, or $2,000 total as there were 4 of us.

It was quick to submit the claim.

The response? Well, Air Transat said they weren’t at fault, but did offer us $200 vouchers for future travel, which expire in 18 months.

These credits are of no value to us.

Air Transat only flies in this part of the country for a few months, and to sun destinations, at that. We’re not planning another trip like this next year.

We’ve responded to Air Transat saying why we don’t think this was the case, and we’d see what they’d say. A big part of our claim was after tracking our plane, it somehow stayed 24 hours in Cancun before going back to Moncton then coming to get us.

I imagine nothing changes, in which case we’ll go to the Canada Transport Agency (CTA) and raise our issue with them.

If they had given out $200 in cash, maybe we let it go – who knows what the CTA will say. But since we basically got nothing, there’s really no harm in pressing this further.

Air Transat obviously was not going to pay for our extra night as they stated they weren’t at fault. Even still, they didn’t have to provide accommodations. Whether they were at fault or not, if you were warned more than 12 hours in advance, they don’t have to provide you with accommodations.

Want to learn more about what you’re entitled to when an airline delays your flight? Here’s our full guide to airline delay compensation in Canada.

Your stories on airline flight delay

This is just one tale of a flight delay. We know that many of you have your own.

What are they? What was the end result?

Let us know in the comments below.

FAQ

What is flight delay insurance?

Flight delay insurance reimburses cardholders when a flight paid in full with the credit card gets delayed beyond a certain amount of time, usually 4 hours.

When can flight delay insurance be used?

Flight delay insurance can be used once your flight is delayed by a certain amount of time, which is usually 4 hours. For coverage to take effect, you have to charge the full cost of your flight on your credit card.

What does flight delay insurance cover?

Flight delay insurance covers the basics you may need while you’re waiting for your flight. They include:

- accommodations,

- meals, and

- local transportation.

What are some top credit cards with flight delay insurance?

Some top credit cards that include flight delay insurance include:

- American Express Aeroplan Reserve Card,

- Scotiabank Gold American Express Card,

- BMO AIR MILES World Elite Mastercard, and

- RBC Avion Visa Infinite.

Looking for more? Here are other successful credit card insurance claims.More credit card insurance claims

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 1 comments