Unless a deal is reached, Air Canada's flight attendants are set to strike Saturday, August 16 at 12:58 AM (after midnight Friday). As this date approaches, Air Canada is cancelling upcoming flights that could be affected by the strike.

If your travel plans are affected by Air Canada's flight cancellations, you are entitled to a refund or rescheduling of your trip.

If you booked your travel on a credit card with flight delay insurance, you can also claim any costs associated with delays longer than 4 hours.

Important note: Flights operated under the Air Canada Express banner are not affected, as these are operated by Jazz and PAL, not Air Canada.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Air Canada is refunding and rebooking cancelled flights

Air Canada has a few options for their customers.

The first option is a refund. However, if you didn't book a refundable fare, your refund will be in the form of a future travel credit to use towards a flight with Air Canada.

If you want to reschedule your trip, Air Canada will let you change your flights at no cost between August 21 until September 12.

If you're looking to stick to your plans, Air Canada will book you with another carrier of their choosing. That sounds great, but we're in the middle of the busy summer travel season, and existing flights may already be getting full. Air Canada also operates the lion's share of flights on many routes and there simply may not be enough seats to go around.

Your rights as a passenger with a cancelled Air Canada flight

So your flight has been cancelled. What are you entitled to? It may not be what you think.

Air Canada is basically offering what they're supposed to – book you on another carrier if you choose, or give you a refund for any travel you haven't yet completed.

The Canada Transport Agency considers a strike by their workforce to be out of their control, and as such Air Canada isn't required to give any additional compensation.

One notable exception to this is if you're already in the European Union and coming to Canada. The European Union has strict rules over flight delays, and there are 2 more things you'd be entitled to.

- 400 Euros if you were delayed less than 4 hours (600 if it's more than that)

- Meals, lodging, and any other transportation required to accommodate your delay

Credit card insurance for Air Canada strike flight delays

Ah, credit card insurance – one of those things many don't care about until you actually need it (this first-hand account shows how valuable flight delay insurance can be).

There are 3 key types of credit card travel insurances:

- Trip Cancellation

- Trip Interruption

- Flight Delay

Trip cancellation

In the case of Air Canada’s strikes, trip cancellation insurance won't help you. Trip cancellation kicks in when you can't go for covered reasons. It's for things like medical emergencies keeping you from going, getting called to jury duty, or a death in your immediate family.

And even then, the only thing trip cancellation does is reimburse you for any travel plans that were not refunded to you (and Air Canada is doing that).

Trip interruption

Trip interruption insurance is basically the same thing as trip cancellation, except this coverage takes effect after you have departed. This covers any extra costs you incur as a result of you having to leave early for an eligible reason (which also isn't part of Air Canada' strike).

Flight delay

So that leaves us with flight delay. And while the exact wording can vary by credit card issuer, the basic premise is if your flight was delayed by 4 hours for almost any reason (there are some exclusions), you can get reimbursed for any reasonable living expenses you incurred during your delay. These things can include accommodations and meals.

This means that if Air Canada rebooked your flight 4 hours or longer after your original departure time, you can claim any expenses incurred, such as meals and hotels.

There is a limit as to how much you can get reimbursed. Most credit cards offer $500 in coverage, but some premium cards (think Visa Infinite Privilege and Amex Platinum/Reserve cards) increase the coverage to $1,000.

We looked at the insurance certificates from 8 credit card issuers, and with TD & MBNA they had a note attached to a strike being the cause of the delay. Basically, if you booked your ticket after a strike was announced, you wouldn't be eligible for coverage.

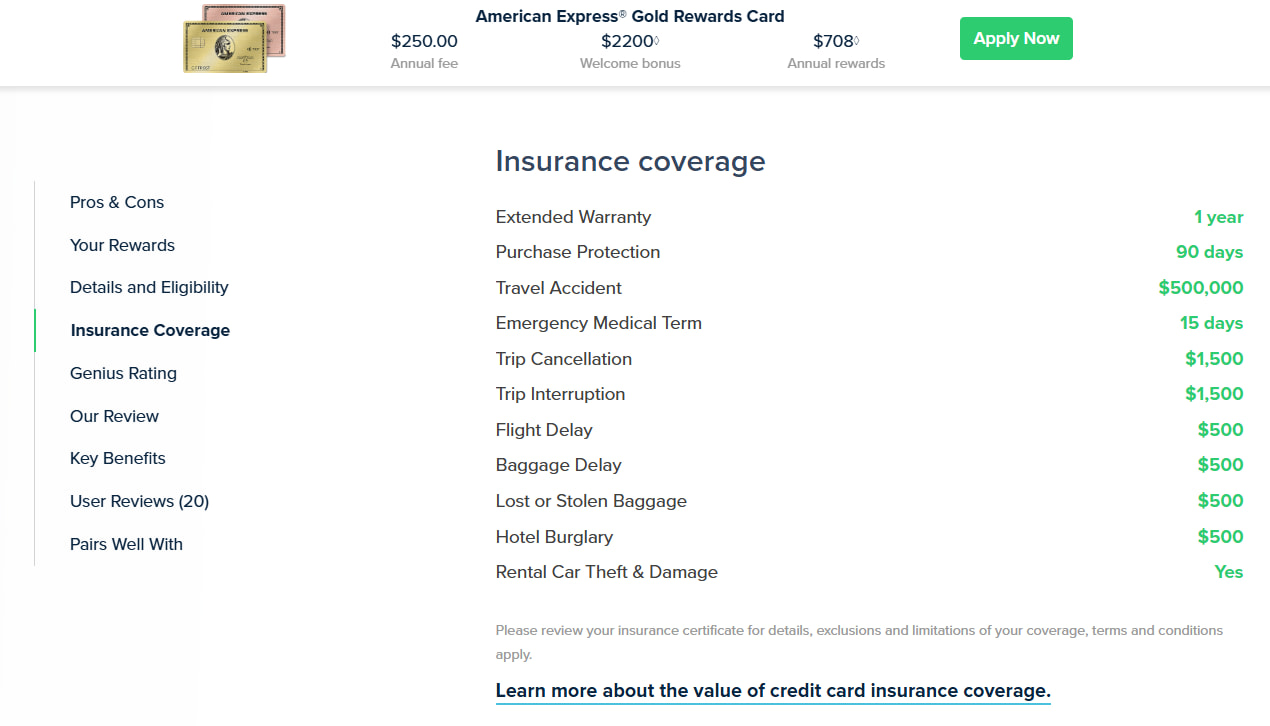

Here is an insurance certificate from a popular travel card from 8 leading credit card issuers in Canada.

- American Express Gold Rewards Card

- BMO AIR MILES World Elite Mastercard

- CIBC Aventura Visa Infinite Card

- MBNA Rewards World Elite Mastercard

- National Bank World Elite Mastercard

- RBC Avion Visa Infinite

- Scotiabank Gold American Express Card

- TD Aeroplan Visa Infinite Card

While your card may be different, the basic language between cards from the same banks are the same, the only difference can be the coverage amounts.

Wondering how much coverage your card has? Simply search for your card at the top of our site. Your card’s creditcardGenius profile features an insurance section where you'll see the maximum coverage you can get. Here's an example for the American Express Gold Rewards Card.

How to activate your credit card insurance

To make use of your credit card insurance, you need to charge the full cost of your flight to your card. So you’re only eligible to claim flight delay costs incurred as a result of the Air Canada strike if you booked your trip using a card with the right insurance.

If you used rewards to pay for your flight (such as Aeroplan, Scene+, or Air Miles), you only get coverage if the credit card you hold (and used to pay for any fees) is also a part of the rewards program.

Aeroplan is an excellent example here. If you transferred Amex Membership Rewards to Aeroplan to book your flight, your Amex MR card's insurance won't take effect, as you didn't use Membership Rewards to pay, you used Aeroplan.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.