On February 22, 2024, Lynx Air declared bankruptcy and will cease flight operations as of 12:01 AM (Mountain Time) on Monday, February 26, 2024.

It's not something anyone wants to see, especially those who have flights booked with them. We know it was a popular low cost carrier with many for their cheap fares.

So we're here to help you with the actions you need to take next. Here's our guide on what to do.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Book a new flight

The first thing to do is find a new flight, unless you just aren't going to bother with your travel plans.

This step is doubly important if your flight is in the next few weeks. There are only so many seats, and it may be a game of musical chairs at this point. This shut down doesn't have the best timing, since the busy March break travel season is upon us.

WestJet

You can see WestJet's statement on Lynx here, but this is what they're offering for all routes that Lynx and WestJet both operate (the list is in the previous link).

- 25% discount for travel between February 22, 2024 to October 26, 2024. You don't have to prove you had a flight with Lynx, simply make your booking and enter the discount code WESTJET. You have until February 29, 2024 to take advantage of this.

- If your booking is before February 29, 2024, they've capped their fares at $500 (plus taxes and fees).

- If you're already in the U.S. or a sun destination, you can simply book a northbound flight back into Canada with WestJet and their fares will be capped at $250, plus any taxes and fees. This is only valid for travel up to February 29, 2024.

Air Canada

Air Canada announced that it will also offer support for impacted customers. Here’s what you can expect:

- Additional 6,000 seats in select markets operated by Lynx Air

- Capped fares in Economy cabin on Air Canada flights for travel within Canada, to the US, and to Cancun

- Fares will be available for purchase before February 26 for travel through April 2 on aircanada.com and through travel agents

Flair Airlines

Flair released a statement noting that the airline is adding recovery flights and exploring other measures to help affected passengers. The additional flights are between major Canadian cities on February 26, 27, and 28, though the airline may add more. Passengers can book at flyflair.com.

Get your refund through your credit card company

Lynx is going through bankruptcy protection, so you won't be able to get a refund through them (since they don't have any money).

That means it's time to initiate a credit card chargeback. You paid money for a service that won't be provided to you.

We have a full guide on chargebacks, but in this case it's simple:

- Read Step 5 of our credit card chargeback guide

- Find your itinerary/receipt from Lynx for the flight that was cancelled

- Call your credit card issuer on the number on the back of your card

- Depending on your issuer, you may be able to start this process online

They probably already know that calls are going to be coming and it shouldn't take too long for you to get your refund (well, depending on how long you may have to be on hold).

Credit card insurance

The final piece of the puzzle – what, if anything, will credit card travel insurance cover? For this event, you're looking at either trip cancellation (you never left in the first place) or trip interruption (you're there and need to make your way back).

- For trip cancellation, you can get reimbursed if you can't make your flight for covered reasons (this is irrelevant for this scenario as you'll get your money back through a chargeback). But it can also cover you if you delayed your trip for a covered reason, such as having to appear in court as a witness.

- Trip interruption covers any extra expenses you incur if you need to cut your trip short (say someone got severely injured and you have to go home).

It actually comes down to the specific language of your credit card insurance. We scoured the insurance certificates from major banks in Canada (except Amex as Lynx didn't accept their cards). We didn't see any insurance certificates that mention an airline going bankrupt as coverage for trip cancellation or interruption.

In fact, many of them state that the outright cancellation of a flight by a common carrier isn't a valid reason for coverage.

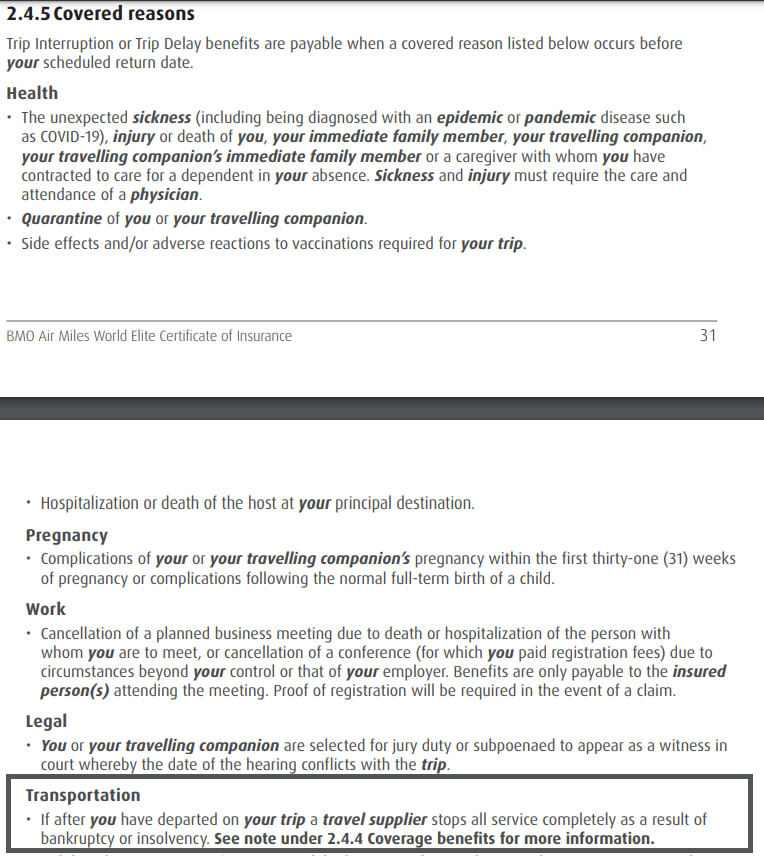

But there's one exception we saw. BMO specifically mentions it under section 2.4.4 for trip interruption coverage benefits for their World Elite Mastercards (here's the full certificate).

What it covers in this instance are any extra costs you had to pay to get home. However there's no mention of this in their trip cancellation coverage.

Our suggestion? Once you got your new booking and received your refund from your issuer, try making a claim for the extra costs (especially if you can submit a claim online). The worst they can say is no.

With that said, don't hold your breath that your costs will be covered. Your claim may very well get declined.

An easy way to see if your credit card has these coverages? Head to the search bar at the top of this page and type in your credit card name. Click on it when it appears, and scroll down to the insurance coverage section. We'll list out what coverages your credit card includes.

What Lynx Air is saying

Lynx announced their bankruptcy late on February 22, 2024. They posted this message on Twitter/X last night.

Lynx is continuing the majority of their flights through the weekend, but not everything will run. Reports are out (like this one from CBC: Lynx Air to cease operations Monday) that some flights over the weekend have already been cancelled too.

Lynx has an FAQ page dedicated to their closure. One interesting FAQ was what happens for anyone who has a travel or flight voucher. Sadly, it no longer has any value once Lynx ceases operations.

You can view the full Lynx FAQ for yourself here.

Your thoughts on Lynx Air

I don't think anybody wants to see Lynx Air go, as they were providing low airfares.

Any thoughts or stories to share with Lynx Air?

Leave them in the comments below.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 1 comments