The MBNA Rewards World Elite Mastercard is one of the best credit cards. And for good reason. It offers cardholders plenty of rewards and comes with terrific insurance coverage, all for a reasonable annual fee.

Over a year ago, I switched to this card as my go-to card for groceries, bills, restaurants, and bigger purchases. I'm earning more rewards than ever before, and have even made use of the included insurance.

Here's my experience with this card.

Key Takeaways

- The MBNA Rewards World Elite Mastercard is one of the best credit cards in Canada.

- I've had the card for over a year and have earned plenty of rewards.

- The included price protection insurance is easy to use and is very valuable.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Why I got the MBNA Rewards World Elite Mastercard

Every year or 2, I evaluate the cards I'm carrying and see if there's a better deal out there. Before getting the MBNA Rewards World Elite Mastercard, I had the Scotia Momentum Visa Infinite Card as my primary card for groceries and bills, where I earned 4% cash back on them (as well as 2% on a couple of other categories).

I earned lots of cash back with it, but after taking a look at options on our compare cards page, I realized I could do better. I also never liked how my cash back was simply awarded as a statement credit once per year in November.

I also wanted to move away from cash back and get into rewards points. While never guaranteed, I wanted to add a little fun into my credit card rewards.

I settled on comparing these 3 options:

- American Express Cobalt Card

- Scotiabank Gold American Express Card

- National Bank World Elite Mastercard

- MBNA Rewards World Elite Mastercard

I do a lot of grocery shopping at a Loblaws store (an Atlantic Superstore to be precise), and since sadly they don't accept American Express cards, the American Express Cobalt Card and the Scotiabank Gold American Express Card were ruled out. Sure, I could get a no fee card like the Tangerine Money-Back Credit Card to pair with them, but I'm still losing out on rewards.

So then it came down to the National Bank World Elite Mastercard and the MBNA Rewards World Elite Mastercard. The National Bank World Elite Mastercard had 2 things that concerned me. First was the rewards program. To get full value, you can only redeem points for flights and vacations packages through National Bank Rewards. And you can't price match either. So it's somewhat limiting in terms of redeeming rewards and getting good value for travel purchases.

The other was the rewards structure. The rewards rate on recurring bills is lower, and there's an odd structure at play where you spend more than $2,500 per month and you earn less for groceries. The only extras it had were the $150 annual travel reimbursements, which were a way to basically reduce the annual fee to $0.

On the other hand, the MBNA Rewards World Elite Mastercard has more options for travel bookings, allowing flights, hotels, car rentals, vacation packages, and cruises. And they do price match flights and packages. But if travel isn't in the cards, they have a wide selection of e-gift cards that have almost the same value as travel if I wanted an easy way out.

It generally offered more rewards, with earning 5x the points on groceries, most types of recurring bills, and even restaurants.

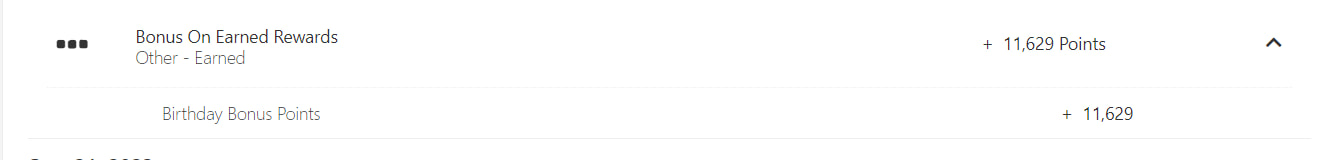

And then as an added perk, there's the annual birthday bonus. I could get 10% bonus points on what I earned, up to 15,000 points. That essentially will help offset the annual fee.

That's my reasoning. More rewards, with a sprinkle of fun added in.

What I've earned for rewards over the last year

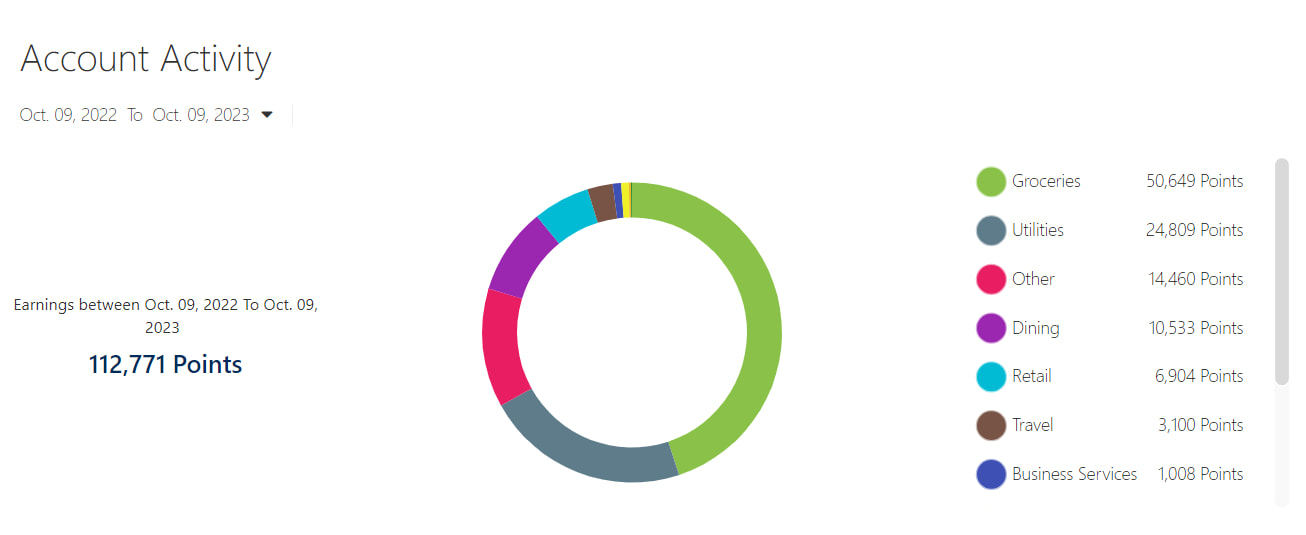

I've had this card for a little more than a year. Here's what I've earned over the last 12 months.

That's a lot of rewards. Those 112,771 points are currently worth $1,127. A sizable chunk of that was my birthday bonus. Here's what I got for that, which was a full year of having the card.

That almost offset the $120 annual fee. In general, I earned around $400 more for rewards in the past year over the Scotia Momentum Visa Infinite Card.

As you can see in the chart, most of what I earned came from groceries, restaurants, utilities, and the birthday bonus. But it is used for some non-category purchases.

I do have some knowledge to share with one of the 5x earn rates. It's not a general earn rate on recurring bills, but is defined as "digital media, membership, and household utility purchases."

It actually covers most of what I charged for recurring bills on my Scotia Momentum Visa Infinite Card. The only one it didn't include was my car insurance. But things like my cell phones, streaming services, and home internet bills all come through at earning 5 points per $1 spent.

The rewards are certainly flowing in. But that's not the only thing I was able to get out of my new card.

Using the insurance included with the MBNA Rewards World Elite Mastercard

The insurance included with the MBNA Rewards World Elite Mastercard is quite good. It includes a total of 12 types.

One of them is a rare insurance – price protection. It allows you to get a refund if an item you bought goes on sale after you purchased it.

And I have used it once. I won't list out all of the details here – there's already a full post you can read on my price protection claim.

Here's the quick summary. I bought a video game for $80. A few weeks later, it went on sale for $55 at another retailer. I submitted an insurance claim and a couple of days later, my claim was approved, and a cheque was sent in the mail for $25 to cover the difference.

Using my MBNA Rewards

I haven't dipped into the rewards I've earned yet. But doing some looking, I have learned a couple of things that only experience in a rewards program will tell you.

Here's a breakdown on certain areas of the MBNA Rewards program.

Travel

Travel is generally the best way to use almost all rewards points. In this case, they're worth 1 cent each.

Let's first talk about flights. It turns out you can't book just any airline, at least for flights within Canada.

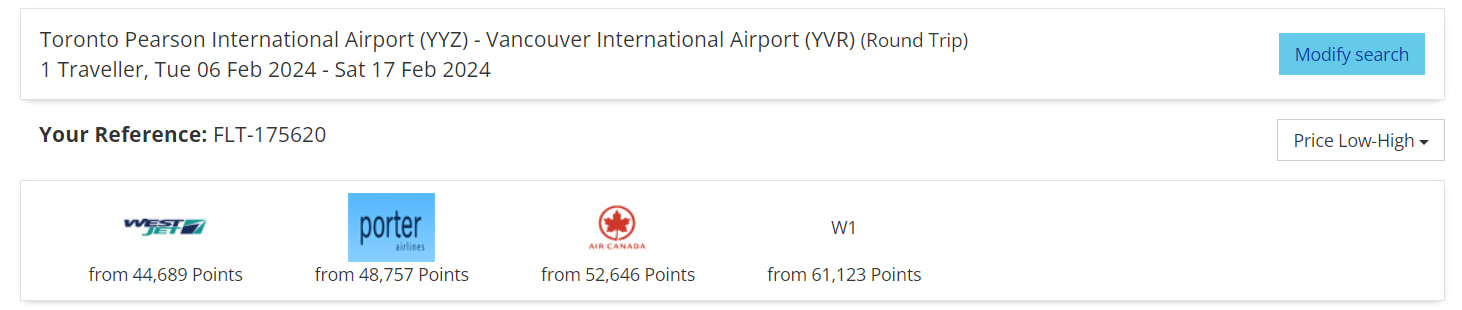

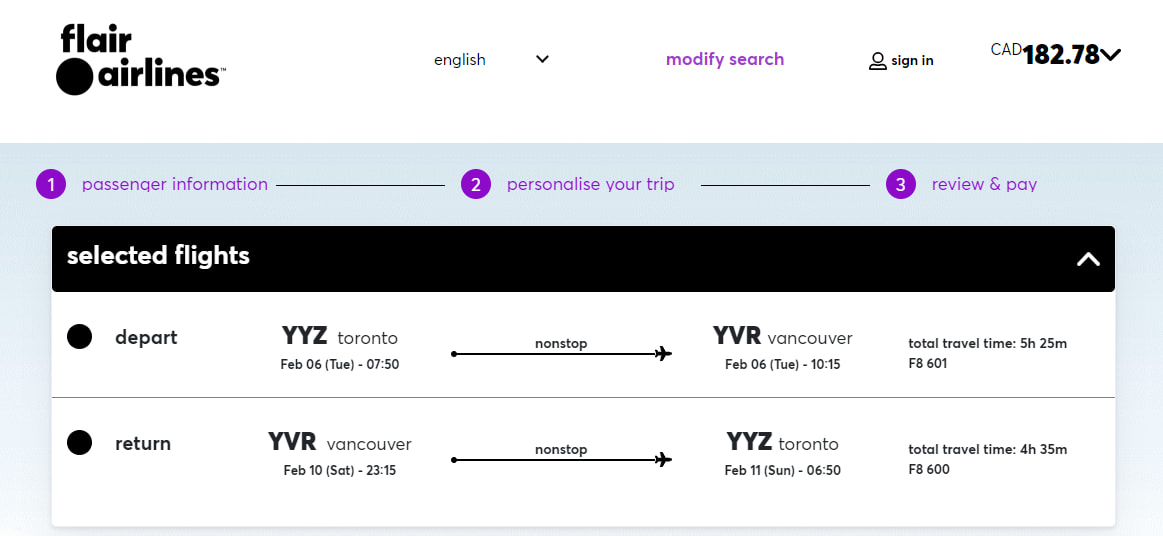

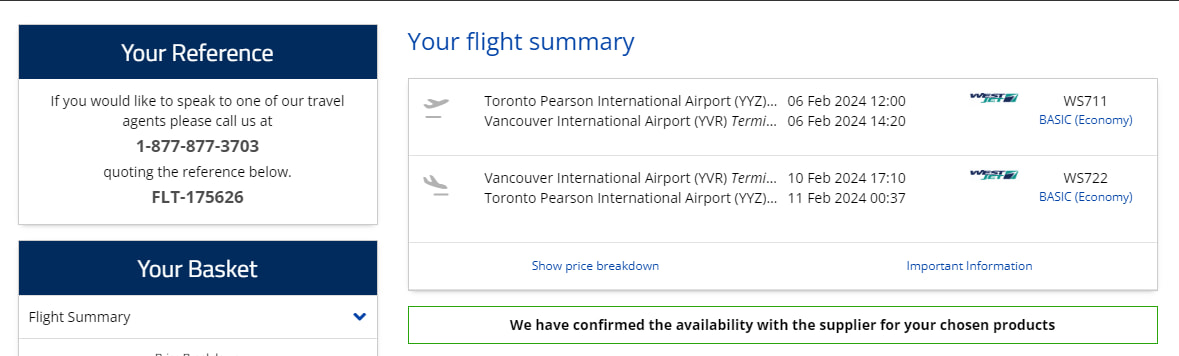

Here's an example of a route that everyone flies – Toronto to Vancouver. At the top of the results it lists out the airlines you can fly with, along with the lowest points per round trip.

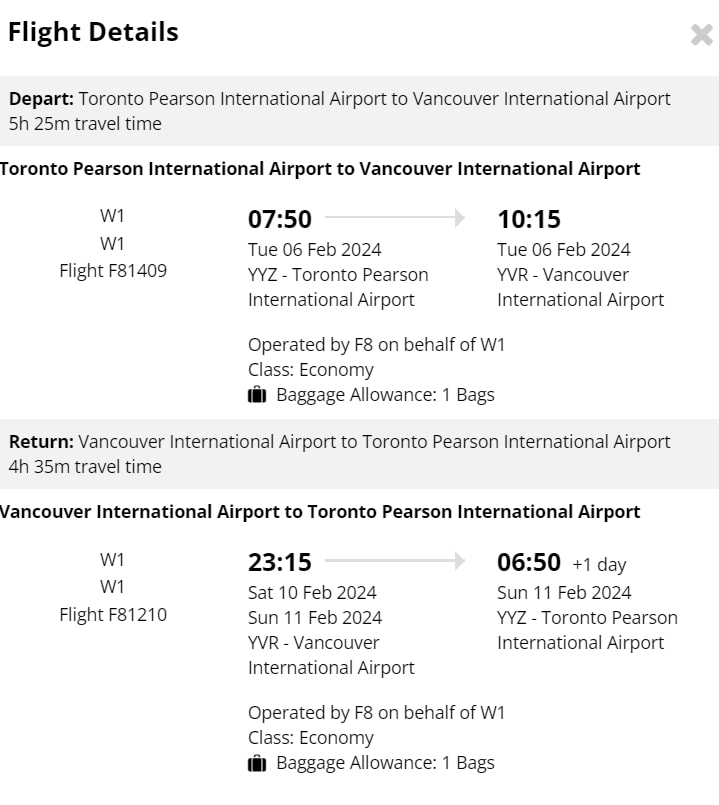

The big 3 of Air Canada, WestJet, and Porter are here, but Lynx and Flair are absent. But that W1 is strange. Upon further inspection, here's what that result is. The MBNA cost is 56,818 points, or $518.

It's essentially a weird way of showing Flair. F8 is Flair's 2 digit airline designation. But when looking at Flair's own site, they give completely different flight numbers, with a much lower price.

In short, I don't think I would trust booking this. Nothing really lines up.

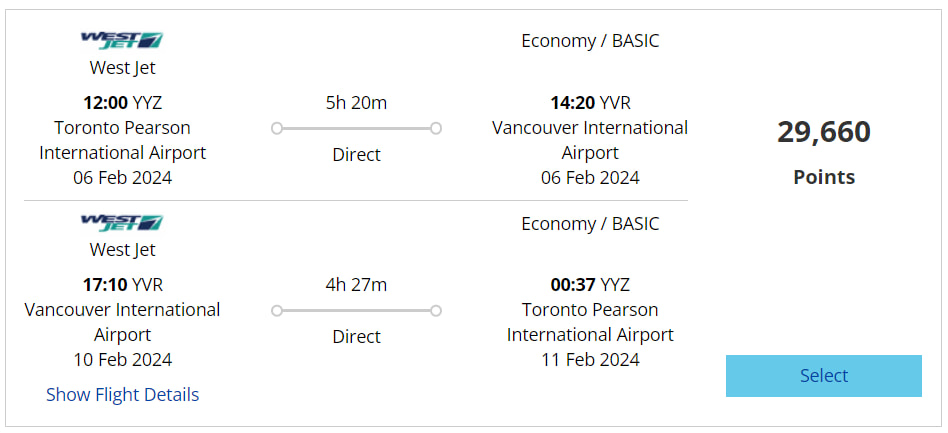

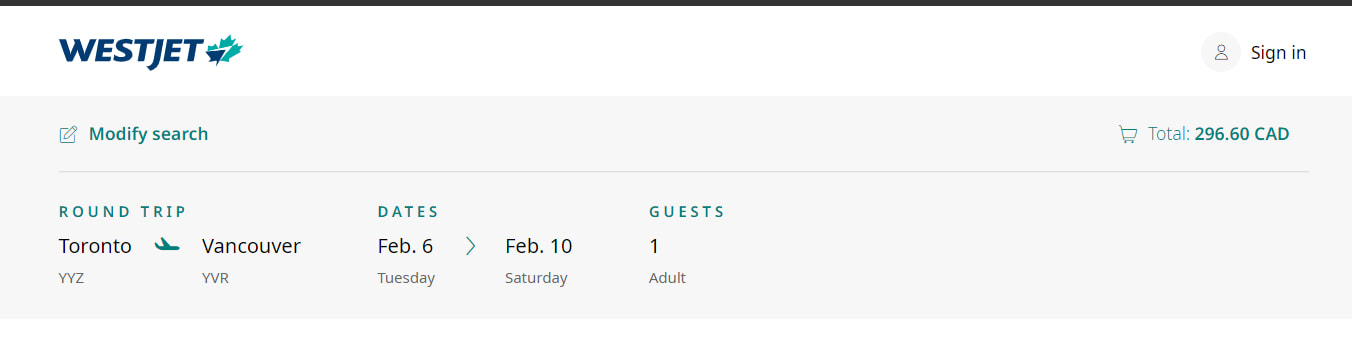

Now, as to how the actual prices compare for the other airlines, here's how a WestJet option lines up.

The exact same price.

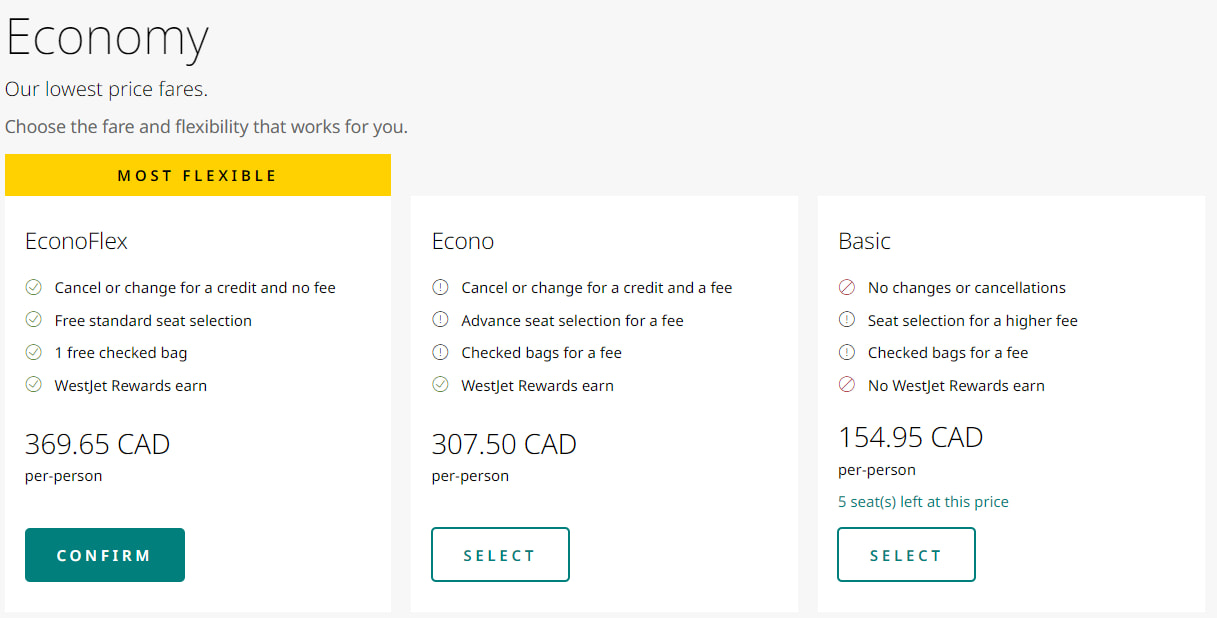

Now, there is one other issue I've noticed. You can only book basic fares. Take this WestJet flight as an example. WestJet offers 3 different economy fare classes.

If you want one of these options, you can't book it though MBNA Rewards, at least not online. MBNA is only selling us a basic fare.

It's possible you can call the MBNA Rewards travel centre if you want a different fare option. But you may also be charged for using the call centre too. To make things easier when you call, MBNA produces a reference number you can quote.

For what it's worth, with Air Canada, they were listing standard economy fares (not basic), and with Porter, you could only get basic economy.

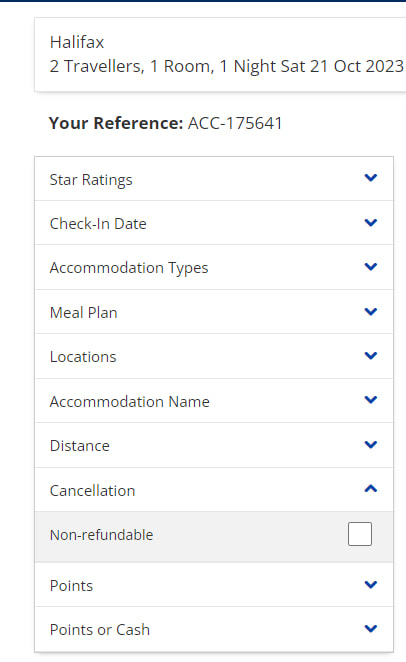

One other thing I've learned is with hotels. I recently tried to use my points for a hotel night. And the search results were quite good, with the same prices that were listed on the hotel websites themselves.

However, they were only selling non-refundable rooms. Since there was a chance this trip wasn't happening, I didn't end up booking my room through here.

So those are a few downsides I've seen to MBNA travel rewards.

E-gift cards

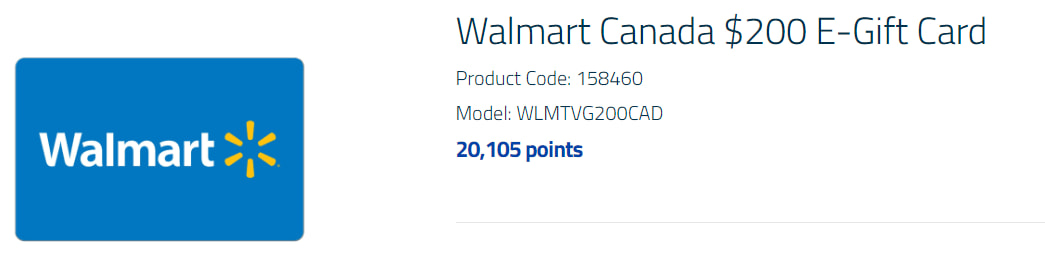

But there's good news – the e-gift cards. If you want a quick out, e-gift cards offer almost the same value.

Here's an example gift card for Walmart.

That's 0.99 cents per point, nearly identical to travel. Then I can use this towards whatever I want to buy at Walmart, whether it's food, a new TV, or maybe some new tools.

Cash

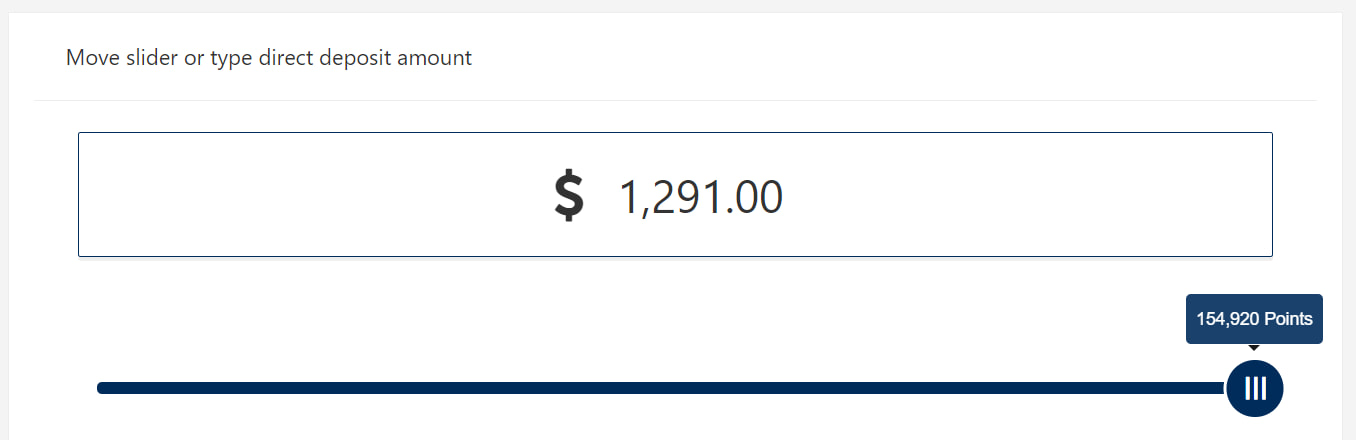

I won't do this, but if I ever need a quick out, I can turn my points straight into cash, as either a statement credit, a direct deposit to a bank account, or a charitable donation. Here's what my full balance would be come:

That's 0.8 cents per point, a 20% reduction in value. Compared to most other rewards programs, it's actually decent for getting cash instead of other rewards.

Here's where you can learn more about everything MBNA Rewards has to offer.

A new redemption coming in 2024

With all that said, a new redemption option is coming in 2024. MBNA Rewards is working on letting cardholders transfer their points 1:1 to Alaska Airlines.

On the surface, that may not seem that exciting, as this airline has limited service in Canada. But Alaska is also part of oneworld Alliance, which will let you use your miles on plenty of airlines that can take you all over the world. Alaska Airlines has even more partners on top of that.

This has the potential to increase the value of MBNA Rewards, but this option won't be for everyone.

As someone who lives in Atlantic Canada, oneworld and other Alaska Airlines partners really have no presence here, other than some seasonal flights from Halifax. I personally don't think this new transfer option will be of any use to me. But for some, it could be a ticket to getting even more from your rewards.

Everything the MBNA Rewards World Elite Mastercard offers

Curious on the full details on this card? Here's everything it has to offer.

First, let's start out with the welcome bonus. You'll get 30,000 points after spending $2,000 in the first 90 days and signing up for paperless e-statements.

We're also offering $20 in GeniusCash when you sign-up through our offers page.

Here's what you'll earn on all your purchases:

- 5 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $50,000 spent annually per category)

- 1 point per $1 spent on all other purchases

Based on a typical spending of $2,000, that's annual rewards of $1,029.6. And that doesn't include your birthday bonus, which would increase these rewards to $1,133.

As to the insurance included, you'll get 12 types. Here are the full details on what's included.

MBNA Rewards World Elite® Mastercard®

| Extended Warranty | 1 year |

| Purchase Protection | 90 days |

| Price Protection | Yes |

| Mobile Device | $1,000 |

| Travel Accident | $1,000,000 |

| Trip Interruption | $2,000 |

| Flight Delay | $500 |

| Baggage Delay | $500 |

| Lost or Stolen Baggage | $500 |

| Rental Car Theft & Damage | Yes |

| Rental Car Accident | $200,000 |

| Rental Car Personal Effects | $1,000 |

Please review your insurance certificate for details, exclusions and limitations of your coverage.

And as to redeeming your rewards, here are your main options and what each point is worth.

And of course, there's also an upcoming change which will allow members transfer points 1:1 to Alaska Airlines.

All this comes with an annual fee of $120 and income requirements of either $80,000 personal or $150,000 household.

The MBNA Rewards World Elite Mastercard is an excellent credit card

Overall, the MBNA Rewards World Elite Mastercard is working for me, and I have no plans to give it up.

For those of you who have it, what has your experience been like?

If you don't, are you thinking of getting it?

Let us know in the comments below.

FAQ

What does the MBNA Rewards World Elite Mastercard offer for rewards?

The MBNA Rewards World Elite Mastercard offers MBNA Rewards on all purchases at these rates:

- 5 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $50,000 spent annually per category)

- 1 point per $1 spent on all other purchases

MBNA Rewards points are worth up to 1 cent each.

What insurance is included with the MBNA Rewards World Elite Mastercard?

The MBNA Rewards World Elite Mastercard includes 12 types of insurance. One of them is price protection insurance. It's a rare insurance coverage that gives you back the difference between prices when an item you bought goes on sale.

What can MBNA Rewards be used for?

MBNA Rewards can be used for a few things. These include:

- travel,

- e-gift cards,

- gift cards,

- merchandise, and

- cash.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×7 Award winner

×7 Award winner  $20 GeniusCash + Up to 30,000 bonus points + birthday bonus worth up to 15k points.*

$20 GeniusCash + Up to 30,000 bonus points + birthday bonus worth up to 15k points.*

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 1 comments