Last fall, Alaska Airlines Mastercards from MBNA were no longer available for new members. However, existing cardholders were able to carry on.

Sadly, MBNA’s agreement with Alaska Airlines is coming to an end on August 31, 2023. As such, MBNA is going to transition all members who have an Alaska Airlines credit card to an MBNA Rewards card.

But, there’s a special bonus coming to anyone who has an MBNA Rewards card you’ll want to know about…

Key Takeaways

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

First – a new MBNA Rewards redemption

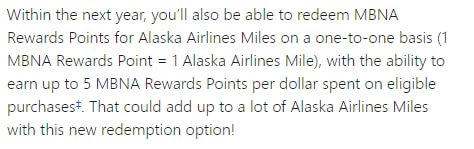

This is big news for anyone who already has an MBNA Rewards credit card. Sometime within the next year in 2024, you’ll be able to transfer your MBNA Rewards points at a 1:1 ratio to Alaska Airlines.

This screenshot is from MBNA themselves.

It’s potentially an excellent way to get more value from your rewards points.

We will be the first to state that Alaska Airlines itself has limited options for Canadians. They only fly into Alberta and BC, or you can make the trip down to Seattle for flights to almost anywhere in the U.S., or another border city (ie. Detroit) for flights to the U.S. West Coast.

But, you can use Alaska Airlines points for more than just flights on Alaska. Alaska Airlines is a member of Oneworld alliance, plus they have partnerships with a few other airlines. You’ll be able to use your points to fly almost anywhere in the world.

Here are some of these major partners with flights into Canada:

- American Airlines,

- British Airways,

- Cathay Pacific,

- Condor,

- Icelandair,

- Korean Air,

- Japan Airlines,

- Qantas, and

- Qatar.

You can view the full list of Alaska Airline partners here.

It’s not going to be an option for everyone, but it’s there if it may fit your plans.

I’ll take myself for example – I have the MBNA Rewards World Elite Mastercard. I could investigate Alaska Airlines for a trip to Europe out of Halifax. Condor currently flies to Frankfurt. Icelandair used to have regular flights, and here’s hoping they come back. It could be a way to use fewer points on a flight to Europe.

We currently value an Alaska Airlines mile at 2.3 cents each. We’ll update this number when this update goes live to MBNA Rewards cards. But even if it goes down to 1.75 cents, that will put the MBNA Rewards World Elite Mastercard in the running to win several awards, including best credit card in Canada.

Even the no fee MBNA Rewards Platinum Plus Mastercard will see a huge boost in ranking, and will very likely become the best no fee credit card in Canada.

Meet your new MBNA Rewards credit card

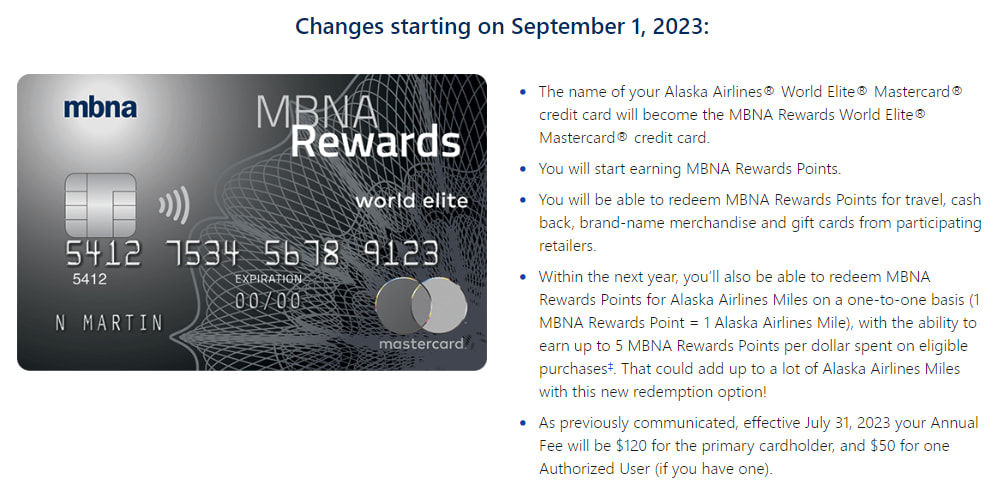

For those who already have an Alaska Airlines credit card, here’s what you’ll be transitioning to, and how the rewards compare. Your new card benefits will take effect on September 1, 2023.

It goes without saying you’ll be losing the companion voucher that comes with Alaska credit cards. And in the case of the World Elite version, you’ll no longer get free checked bags on Alaska Airlines.

In exchange, you’re gaining far more in terms of rewards.

Alaska Airlines World Elite Mastercard

If you have the World Elite Alaska Airlines card, you’ll be switched over to the MBNA Rewards World Elite Mastercard.

Here’s what this card will earn you for rewards on purchases:

- 5 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $50,000 spent annually per category)

- 1 point per $1 spent on all other purchases

Based on a $2,000 monthly spend, you’ll be earning 102,960 points per year.

Here are some other features the card includes:

- 10% bonus points every year on your birthday (max bonus of 15,000 points), and

- 12 types of insurance.

Just note that this card will have a slightly higher annual fee than your Alaska World Elite card at $120.

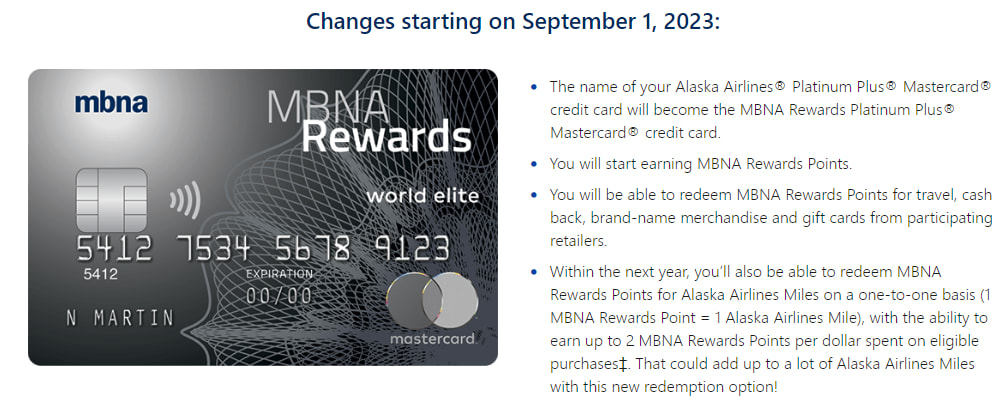

Alaska Airlines Platinum Plus Mastercard

If you have the Alaska Airlines Platinum Plus Mastercard, you’ll be moved over to the no annual fee MBNA Rewards Platinum Plus Mastercard (ignore the card art in this image, MBNA doesn’t have it correct on their site).

Here’s what your new card will earn for rewards:

- 2 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $10,000 spent annually per category)

- 1 point per $1 spent on all other purchases

That will get you around 55,440 points per year. There are 2 more features this card will get you:

- 10% bonus points every year on your birthday (max bonus of 10,000 points), and

- 3 types of insurance.

Rewards comparison

The rewards you’ll earn are the biggest difference. First, here are your new options for redeeming points (does not include transferring points to Alaska Airlines at this time).

There are more options for you, and they’re much easier to use than Alaska Airlines miles. But transferring points to Alaska Airlines will be coming if that’s what you prefer.

And no matter which Alaska Airlines card you have, the rewards you earned are the same:

- 3 miles per $1 spent on Alaska Airlines, and

- 1 mile per $1 spent on all other purchases

That works out to around 26,400 miles earned per year. Here’s how all 4 cards stack up.

| MBNA Credit Card | Annual Points/Miles earned |

|---|---|

| Alaska Airlines Mastercards | 26,400 |

| MBNA Rewards Platinum Plus Mastercard | 55,440 |

| MBNA Rewards World Elite Mastercard | 102,960 |

Both MBNA Rewards cards will get you more Alaska Airlines miles, with the MBNA Rewards World Elite Mastercard offering more than double the points you get now.

If you’re feeling let down that you’re losing your Alaska Airlines card, there’s much to love with your new MBNA card. You’ll earn more rewards that are easier to use, and will still give you the option of redeeming them with Alaska.

Your thoughts on MBNA’s Alaska Airlines news

While MBNA is saying goodbye to their Alaska credit cards, they’re not ditching Alaska Airlines altogether. In fact, they’re opening up the program to a whole new subset of cardholders (yours truly being one of them).

What are your thoughts on today’s MBNA Alaska Airlines news?

Let us know in the comments below.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×7 Award winner

×7 Award winner

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 23 comments

If you want, you can look into RBC WestJet Mastercards.

Other alternatives could be American Express Aeroplan Reserve or TD Aeroplan Visa Infinite Privilege, but you have to spend $25K per year to get access to the voucher.