The American Express Aeroplan Reserve Card has one of the highest annual fees of any credit card in Canada at $599. So why get it? Is it even worth it?

My answer is yes, but with some caveats. It offers excellent benefits to make your trips on Air Canada more enjoyable. I’ve enjoyed it so much, I’ve even kept it around for a second year. But if you don’t fly with Air Canada once a year, it obviously won’t be worth anything to you.

So what makes this card tick? Here’s my 1 year experience to date with this credit card.

Key Takeaways

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Why I got the American Express Aeroplan Reserve Card

What made me splurge on getting a credit card with a $599?

I have a large Aeroplan balance. At the time I got the card, it was around 300,000 points.

At least 1 trip on Air Canada was in our future because of all those points. If you’re wondering how I have so many points, they largely come from when I had a job that involved lots of travelling on Air Canada, and I’ve used them sparingly over the years.

We were also going to be travelling again, with COVID restrictions largely coming to an end in 2022. Couple this with the fact that we had to cancel a trip at the last minute when the COVID situation blew up, and I wanted to make the most of any trip.

Here are 2 main reasons why I got it.

Air Canada benefits

The biggest reason to get the American Express Aeroplan Reserve Card was the Air Canada benefits. This card allows you to get Elite level service with Air Canada if you’re not a frequent flyer with them.

Here are the benefits I was eyeing up. First, the free checked bags. Rather than have to minimize what we would be putting under the plane to save on costs, (our family of 4 would be going on our trip), everyone could get their own bag. That way, we wouldn’t have to worry about trying to cram everything in carry-ons, saving the weight and hassle of extra suitcases when travelling with younger kids.

Then there are the priority airport benefits. We could save on check-in line times with priority check-in, and get our bags faster on the other side with priority baggage handling.

Since Aeroplan points were probably going to be used for a flight, there’s the Preferred Pricing on Aeroplan flights to consider. We estimate an average savings of 10% with this perk, and I would put this to the test.

At the end of the year, there was also the possibility of landing a companion voucher for reduced price travel in the future.

There are more benefits to this card, but these were the ones I was going to be using. It does offer Maple Leaf lounge access for instance, but I wouldn’t be using it, as my 2 primary airports don’t have one (Charlottetown and Moncton). Plus, I’d be travelling with at least 3 other people who wouldn’t be able to come in anyway.

Large welcome bonus

The welcome bonus didn’t hurt either. It’s changed since I got the card, but here’s what it offered at the time:

- 20,000 points after spending $3,000 in 3 months,

- 5,000 points every month you spend $1,000 for the first 12 months (60,000 total points), and

- 10x the points on Air Canada purchases for 6 months, up to 30,000 points earned.

For the first 2 items, I got all 80,000 points. I also did a booking on Air Canada. It was using Aeroplan points, but I got 10x the points on the taxes and fees (which is really an extra 7 points per $1 spent). So that’s another 1,169 points.

Put together, that’s 81,169 points. At our Aeroplan value of 2 cents each, those are worth $1,623.38, enough to cover the $599 for a couple of years.

Even at a more conservative value of 1 cent each, those are still worth $812 in future travel savings.

If you’re curious what the current welcome bonus is, it’s 85,000 points after spending $7,500 in the first 3 months, and spending $2,500 in month 13.

I haven’t mentioned the everyday points I earn on purchases, mostly as it wasn’t a reason I got the card. Despite the fee, it’s a secondary card, which I only use at places that are generally classified as “other purchases.”

My experience using the American Express Aeroplan Reserve Card

Using the American Express Aeroplan Reserve Card in conjunction with Air Canada bookings is a seamless experience. Here’s how it went.

The trip booked

First, the trips we booked. We went on 2 vacations over the first year I had the card. We actually only ended up flying on Air Canada with one of them.

The first was a trip to Punta Cana. Air Canada is always the first option I look at, and this trip was incredibly expensive. To purchase 1 seat on Air Canada cost around 130,000 Aeroplan points (plus taxes), and an actual seat cost at least $3,000. They were sold out, and we booked our flights with Air Transat instead.

But we also had another trip to Niagara Falls that involved flying in and out of Toronto. When looking at Aeroplan rewards, the flight there was still incredibly expensive – 70,000 points per person plus taxes, or around $800 per person.

We first booked a much cheaper Flair flight to get there. However, they cancelled that on us, and we ended up taking Porter instead, which cost $200 per person.

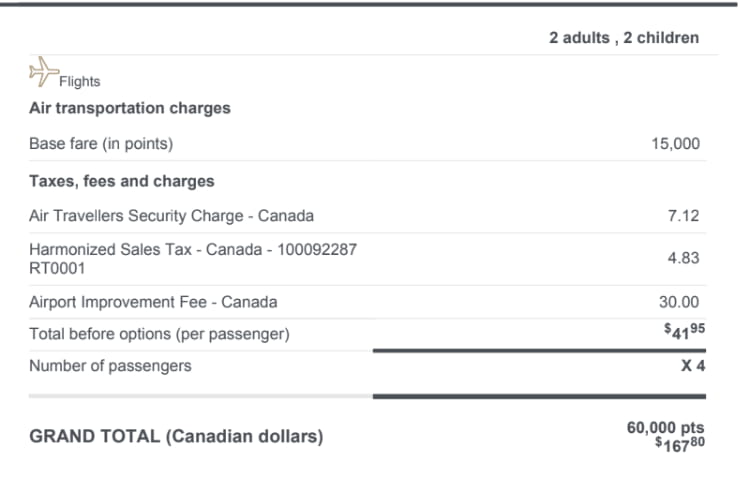

But for the flight back, we did book Air Canada. The flight was much more reasonable – 15,000 points + $42 per person for a flight from Toronto to Charlottetown.

Booking a rewards flight using an Aeroplan credit card

To get Preferred Pricing on a rewards flight is easy to do. The only thing you have to do is sign in to your Aeroplan account. If you forget that, you’ll actually be prompted by Air Canada that you may be eligible for preferred pricing, and they’ll ask you to sign in to your account.

Air Canada won’t tell you the normal prices for the flights you’re viewing. If you do want to see, simply search again and make sure you’re not signed in.

In my case, while I paid 15,000 points per ticket, the regular cost was actually 17,500. So we made out pretty well. We booked 4 tickets, so that’s 10,000 points I’ll be able to use in the future.

It was a good discount – about 14% less just for having an Aeroplan credit card. You don’t need this Aeroplan card to get it – it’s available on any Aeroplan-branded credit card.

What was the value of 1 Aeroplan point you ask? Since I’m a rewards junkie, I always have to know what the value is.

The actual cost of the flight was $300 per person. We saved $258 per person, making each Aeroplan point worth 1.72 cents. Close to the creditcardGenius average of 2 cents. Now, Preferred Pricing increases the average value of a point as you’re using fewer points.

Based on full cost, the value of a point is 1.47 cents, which is still pretty good, especially for a shorter flight like this one.

Taking advantage of the Air Canada benefits

The big reason I got the card was the Air Canada benefits. There’s really nothing special you have to do to use them, other than making sure you add your Aeroplan number to your reservation.

First up – priority check-in. There were some long lines for baggage drop off at Toronto-Pearson when we were there. But we got to use the priority lines instead, which were much shorter.

Toronto-Pearson has a few different priority check-in lines to use, depending on your status. Having the American Express Aeroplan Reserve Card (as well as the TD Aeroplan Visa Infinite Privilege Credit Card and the American Express Aeroplan Business Reserve Card) gets you access to the same lines as those with Aeroplan 35K and 25K status, which are in aisle 3 for domestic flights.

We went through the line quickly, we got to drop off 4 bags for free, and headed to security.

Pearson security lines can be long (they were very long when we were there), but since we were travelling with children, we got to access the special family line and didn’t have to wait.

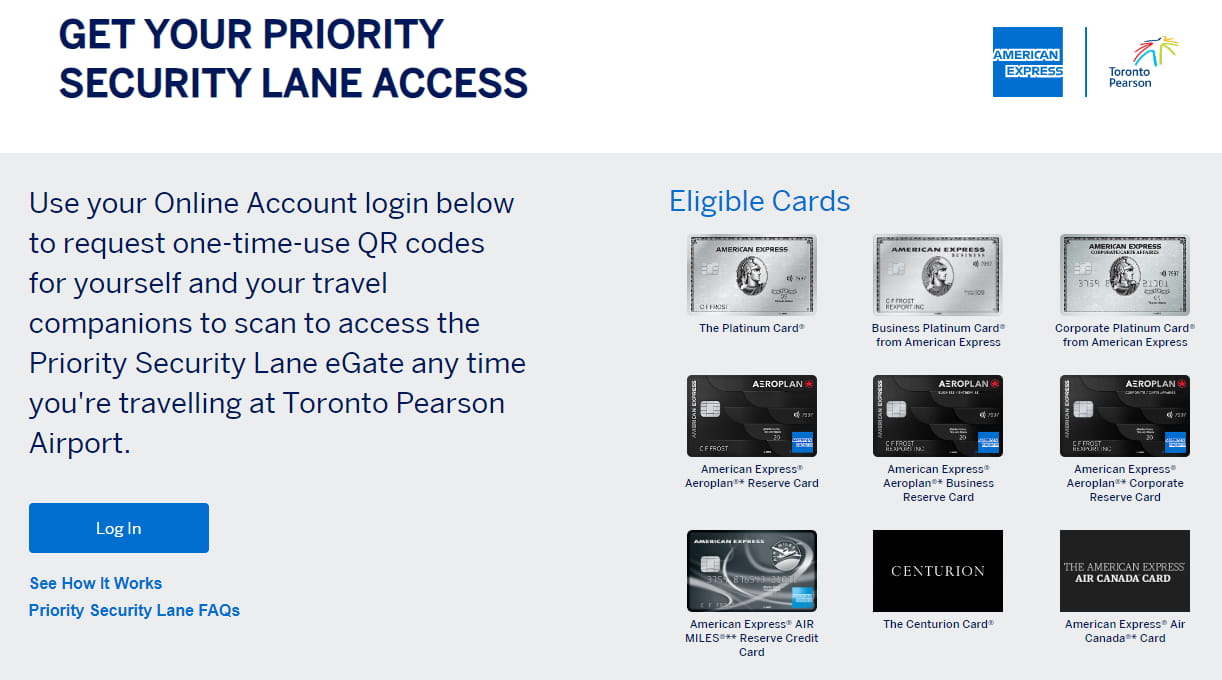

But even without it, one major benefit to super-premium Amex credit cards are the Toronto-Pearson benefits. One of those is getting a dedicated security line, which usually has very few people in it.

As a backup, I prepared our access for it. You have to get a QR code ahead of time for anyone travelling with you.

To get it, simply head here and click on “Log In.” You’ll log into your Amex account, at which point you can request up to 10 QR codes. You’ll be then given a series of QR codes, which you can then download, print, or email. This benefit is available on the cards you see above, which includes the American Express Platinum Card.

We’ve now whisked through security, and if I had so chosen, I could have accessed the Maple Leaf lounge. As I was travelling with others, I didn’t – I wasn’t going to be that person who ditched his family to hang out in the lounge.

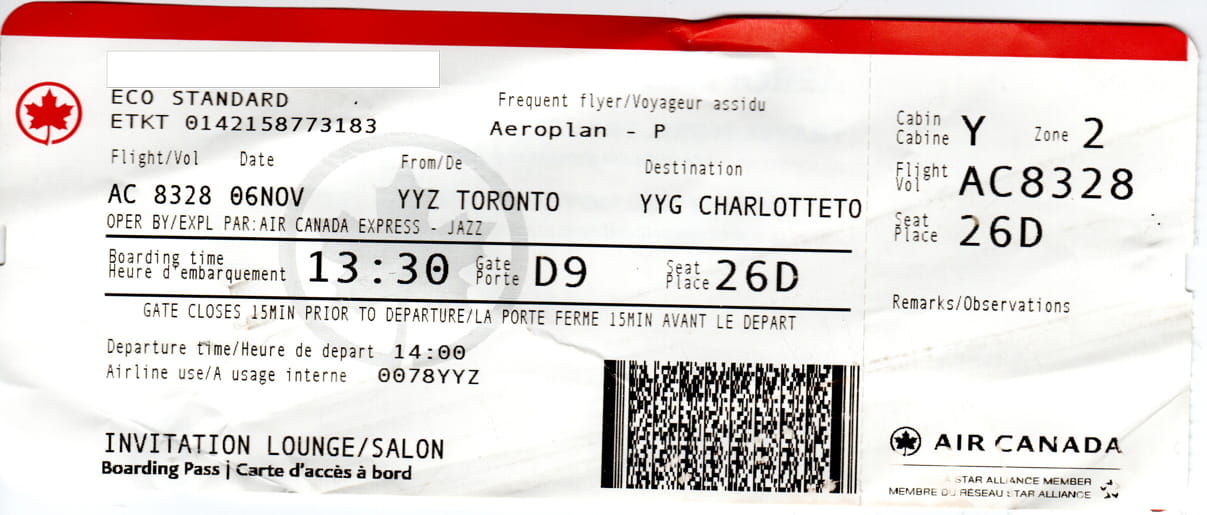

Getting access is easy – it’s written right on your boarding pass.

After getting something to eat, it’s time to board the plane. And priority boarding wasn’t an issue as I was travelling with kids. But again, this benefit is right on your boarding pass. You get to board with zone 2, which is after business class passengers and those with Super Elite status, and you board alongside other Elite fliers.

Finally on arrival, our bags were among the first to arrive at the carousel. We were on a smaller plane, so it wouldn’t have made a huge difference in how long we waited. But on a much bigger flight, that can help get you ahead of the crowd if you are getting a taxi or a rental car.

Using the credit card insurance

Travel insurance is one thing that you don’t even want to use, but are glad when it’s there for you. And I just happened to use the credit card insurance that came with the American Express Aeroplan Reserve Card.

Our faithful readers will recall a certain trip from Punta Cana that faced a 15 hour delay (yes, the trip that was mentioned earlier). And while this trip was on Air Transat, I still used my American Express Aeroplan Reserve Card to pay for the flights.

I won’t get into the full details of what happened and how to make a claim – you can read that here, but needless to say, I used the flight delay insurance and got back almost all of my costs – $755.

The claim was very easy to make. But this card added extra value in this case. Most flight delay coverage on credit cards covers $500 in expenses. But with the American Express Aeroplan Reserve Card, it comes with $1,000 in flight delay coverage. I have another card that provides this insurance, but by using my Amex card, I was able to get back an additional $255.

The companion voucher that comes with the American Express Aeroplan Reserve Card

This is one big perk that comes with the American Express Aeroplan Reserve Card. Once this voucher hits your account, you have 12 months to make a booking with it. And that’s just when you have to make a booking – you can make a booking almost up to a year ahead of time. Now, it’s a use-it-or-lose it type of benefit, so if you don’t use it by the end date, it’s gone forever. But you have plenty of time to use it.

It can’t be used if you book with Aeroplan points. It can only be used on a paid flight, which is a bit of a bummer for someone like me with lots of points.

Now, it isn’t awarded automatically – you need to spend $25,000 per year to get it, which can be a tall task. And you need to requalify for it every year.

A major point to note about this voucher – if you cancel the credit card you used to get it, you’ll lose it then, regardless of the expiry date. It’s a big reason why I kept my card around for another year.

But I did manage to spend just enough to get it. In some ways, not being able to use Aeroplan points on some of my flights paid off and let me get access to it. Those flights I paid for in full added around $5,600 to that total.

This is also my one biggest gripe with this card – this voucher isn’t awarded automatically. There are other cards out there that offer companion vouchers for much lower annual fees – think of the WestJet RBC World Elite Mastercard as an example (albeit with far fewer benefits).

So, I’m able to share with you everything there is to know about this voucher.

Getting awarded your companion voucher

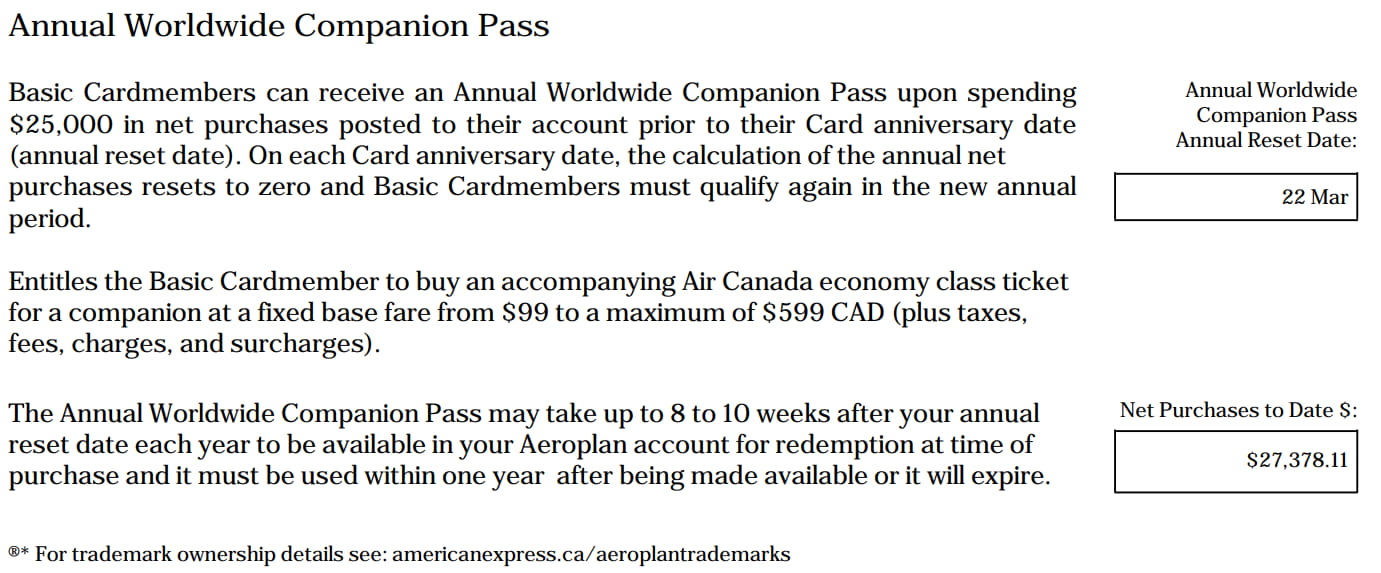

You first have to spend on your card to get the voucher – $25,000 per year.

Amex makes it easy to see what you’ve spent. They’ll even give you the date your annual spend resets. You can find it on your monthly statement. Here’s what it looked like for me on month 12.

As stated, it’s not awarded right away. It didn’t show up in my Air Canada account until May 19, almost 2 months later. I also didn’t get any emails or notifications from either Amex or Air Canada stating it was available.

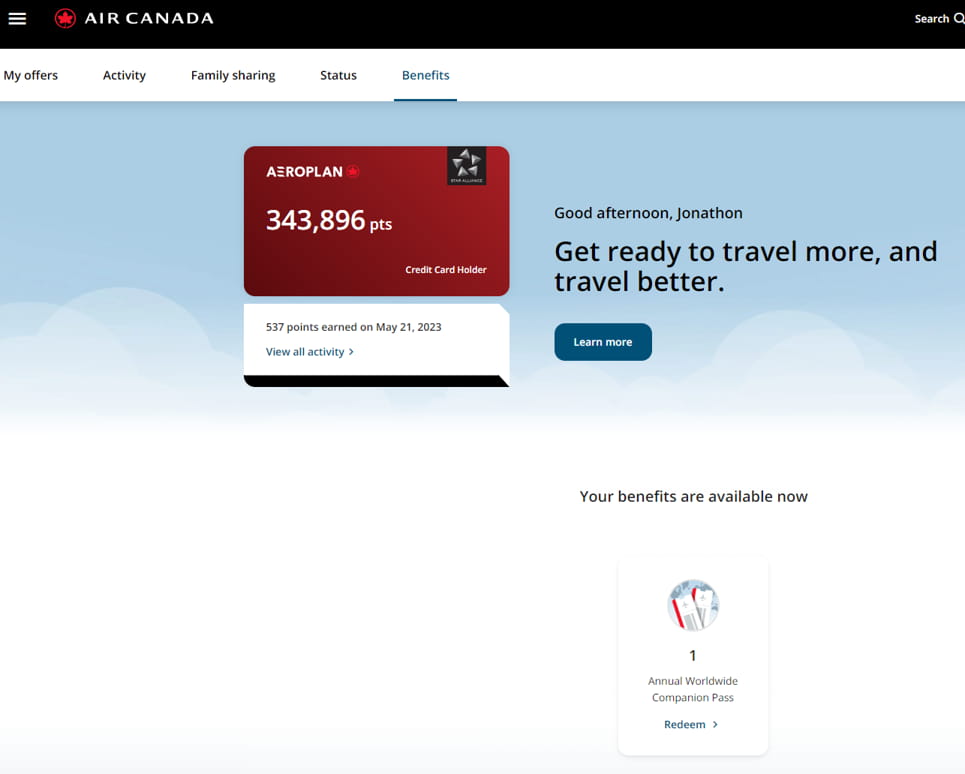

To check and see if you have it, you’ll have to head to your Aeroplan account. Sign in and click the benefits tab. You’ll see it there if you do have it.

Redeeming your companion voucher

It’s easy to use. The first thing to do though is sign into your Aeroplan account.

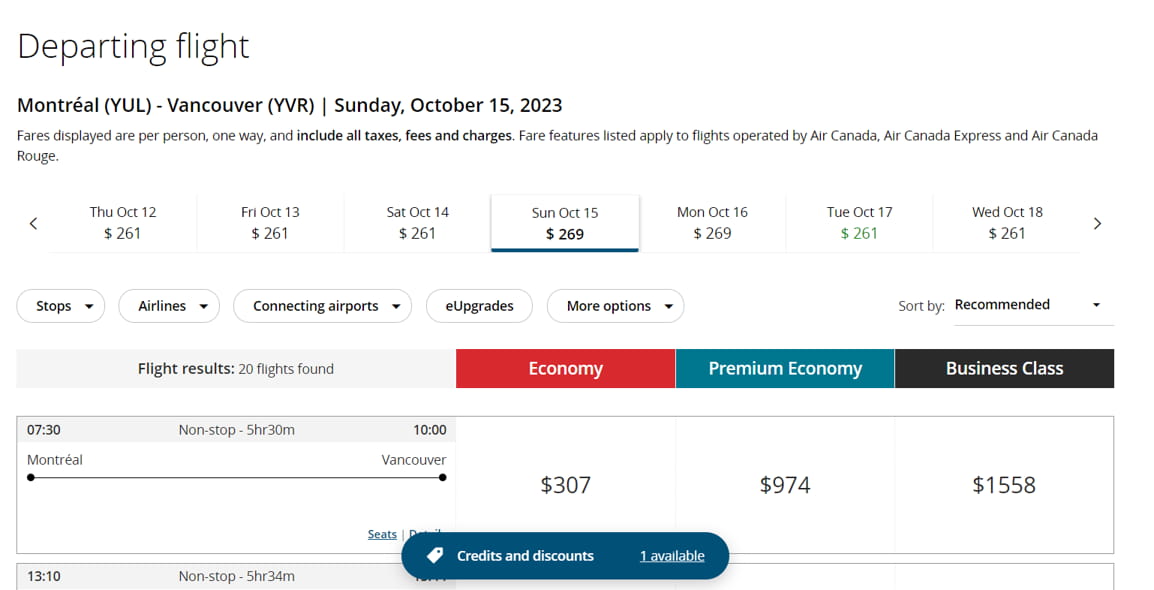

Then, all you have to do is search for a flight that includes 2 people. Here’s a search result for Montreal to Vancouver.

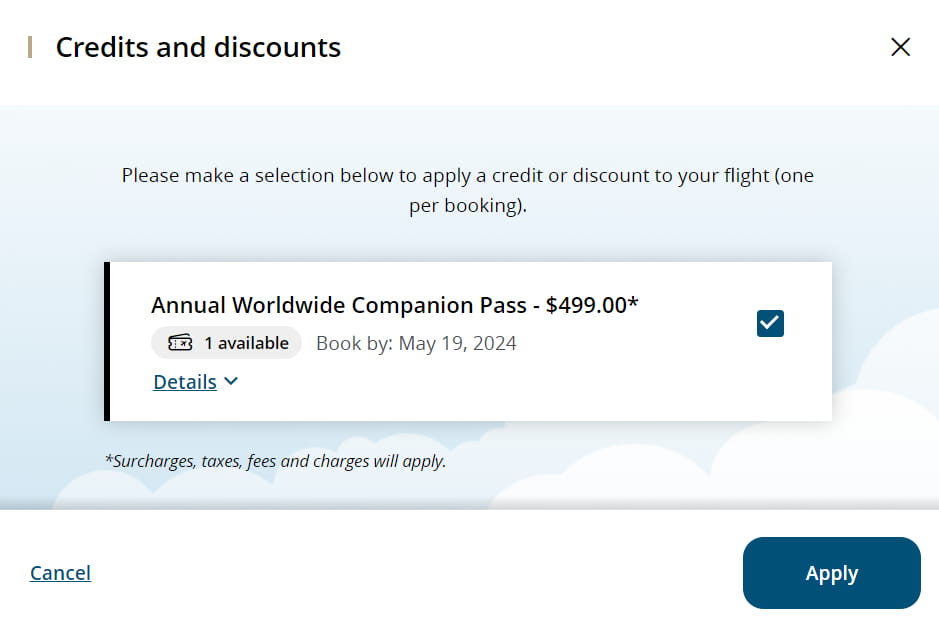

That little popup is your companion voucher. You have to click on it here to activate it – you won’t be able to apply it later on in the booking process.

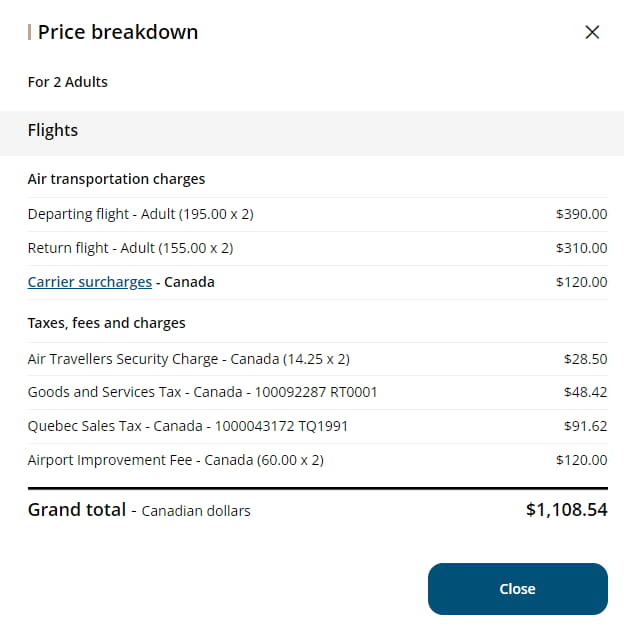

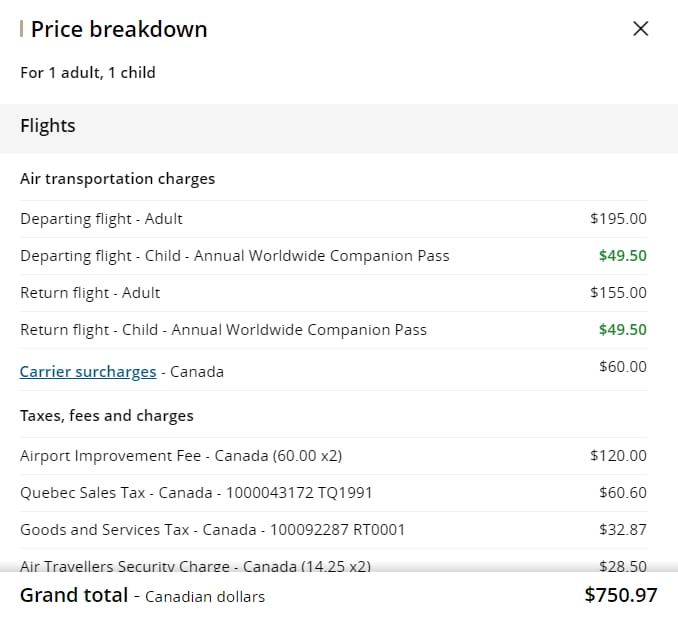

As an example of savings, the cheapest flights for this itinerary were $1,108.

If I apply the companion voucher to it, these seats only cost $750, a savings of $358.

Companion vouchers are an easy way to save money on flights if you regularly travel with someone else.

An important point to note about this, and really, all companion vouchers. They’re best used on longer flights. Take the $99 version. That’s the fee you’ll pay, whether you only fly from Vancouver to Victoria, or Vancouver to St. John’s. Flying farther within each zone will bring more savings.

What it costs to use

The companion voucher does have a cost to it – it’s not a completely free flight. You have to pay any taxes, fees, and surcharges.

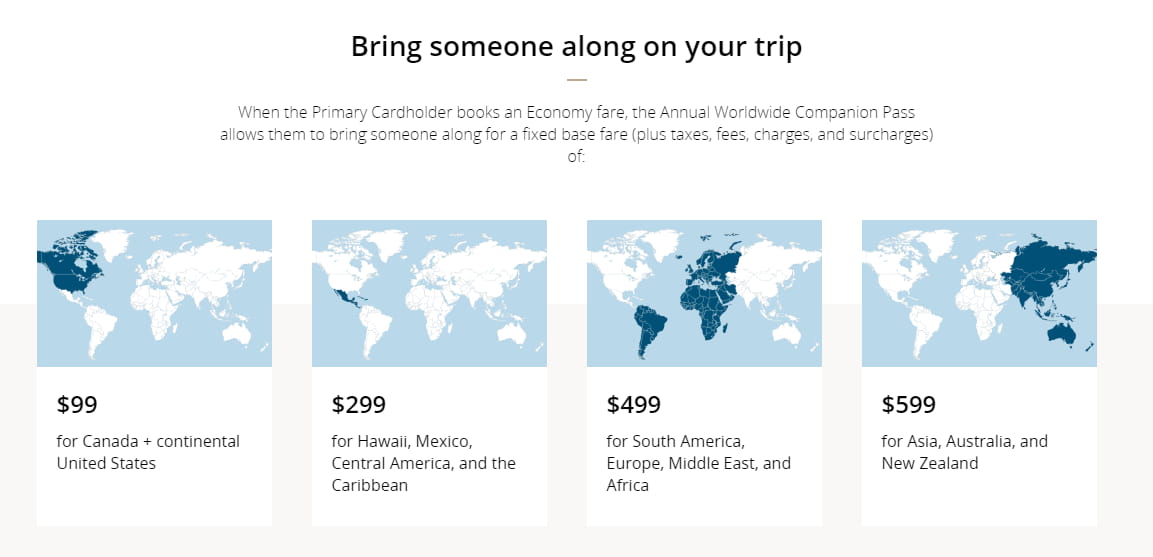

There’s also a set fee to pay. It varies from $99 to $599, depending on where you are flying to.

Air Canada has this handy page that details the companion voucher. But here’s the summary of regions and how much it costs to use the voucher.

A sample of savings for a trip next year

Armed with my American Express Aeroplan Reserve Card, 340,000+ Aeroplan points, and the companion voucher, what can I expect to save next year?

Well, a trip to Panama is potentially in our future. And unlike the past 2 trips I went on, this flight can basically only be done on Air Canada. And that also means it’s going to be pricey.

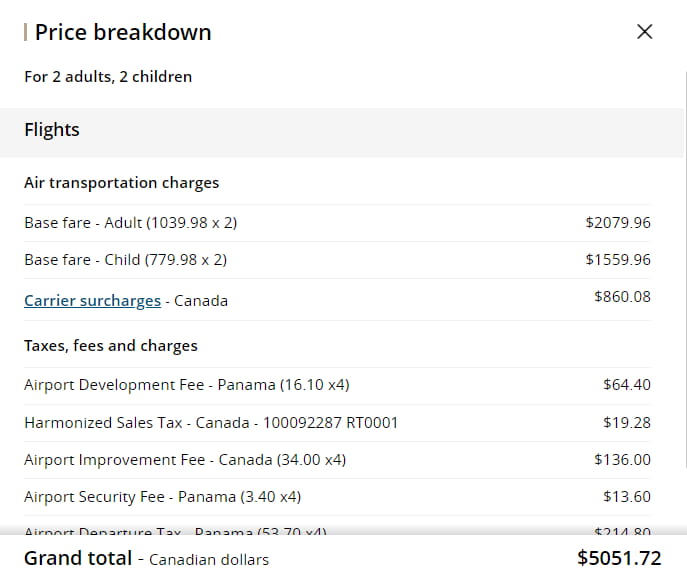

So, looking at a trip in March 2024, here’s what it would cost for 4 people to go.

A good chunk of cash, costing $1,263 per person.

Alright, how much can we lower that $5,052 bill? Here’s the plan of attack on booking for 4 people.

- 1st person pays full price,

- 2nd person uses the companion voucher, and

- the last 2 are on a separate booking with Aeroplan points.

Let’s start with the tickets that are being paid for while using the companion voucher.

Now, I’ve run into an issue – Air Canada is showing that I need to pay $499 for the voucher, but it should only be $299 according to the maps above (and yes, I zoomed in to make sure Panama is part of the Central American zone).

If I was to book this, I’d have to call Air Canada, as I feel like this is a mistake. I’ll use the $299 cost instead for our numbers.

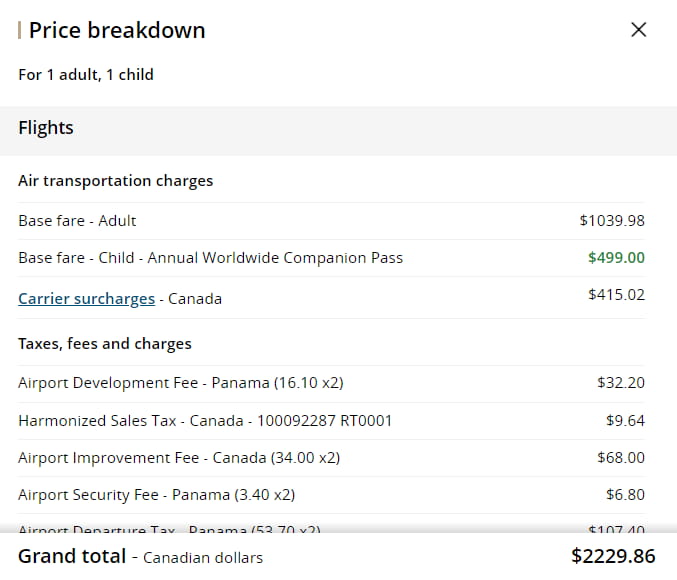

Here’s the cost for the first 2 tickets.

Taking away that extra $200 I’m pretty sure I shouldn’t be paying, and my cost so far is $2,030. Compared to a cost of $2,526 for 2 people, I’ve saved $496 (close to the annual fee of the American Express Aeroplan Reserve Card.

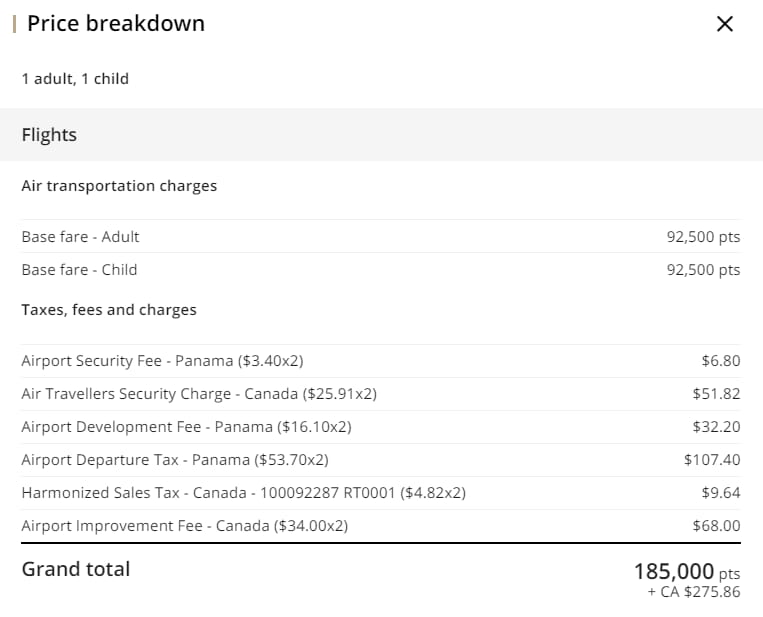

Let’s move on to book 2 tickets with Aeroplan points.

It’s not the best value for your points, but it will do. It costs $2,526 for 2 people. We’re saving $2,250 in exchange for 185,000 points, for a value of 1.2 cents per point. (And that’s on Preferred Pricing, it’s really 194,400 points without it).

So all together, we’re paying:

- 185,000 Aeroplan points, and

- $2,306 in cash.

We’ve managed to lower our bill by 54%. I have enough points that I could lower it even more by booking 3 people on Aeroplan points, but if I do this I’ll probably lose the companion voucher. I may as well use it and keep the points for later since they can be saved but the voucher cannot.

For the Aeroplan ticket, I could also pay for it with all Aeroplan points as well and save those taxes and fees. This route would cost roughly an additional 30,000 Aeroplan points.

The topper – I’ll still get 2 free checked bags and those priority services with my Amex card.

I’d only get 2 free bags instead of 4 as I have separate bookings. The key to getting more free bags is everyone has to be on the same reservation, not just travelling with you.

Keeping the American Express Aeroplan Reserve Card for a 3rd year

One question I’ll have to ask myself in March of 2024 – do I want to pay another $599 annual fee to keep the card for a 3rd year?

It’s obviously too early to say, but I’m on the fence. If the trip above goes through as planned, I’ll still have plenty of Aeroplan points to use – well over 130,000.

The 2 key benefits I use are available on Aeroplan cards with lower annual fees – Preferred Pricing and free checked bags.

These 2 cards offer those 2 benefits at a much lower cost:

The priority services are nice, but is skipping the longer line at check-in worth $599? It does earn more rewards, but this card isn’t my primary spend card. I don’t use it for basics like groceries or bill payments, just things that fall under “other purchases.” This is something I will be taking a harder look at.

It really comes down as to whether or not I get that companion voucher again. If I do, I’ll probably keep it around. If not, I’ll probably switch over to the American Express Aeroplan Card.

Any lessons learned?

Is there anything I’ve learned? About 75% of my points came from a job that required plenty of travelling, and I wouldn’t say that I’m a heavy collector in Aeroplan when it comes to credit card rewards.

It limits your options when it comes to travelling. Aeroplan points are designed to be used to redeem for Air Canada flights. And for 4 flight segments in the last year, I only took Air Canada for 1 of them – my points remained parked in my account.

There are more options than ever when it comes to booking flights within Canada and to popular destinations in the U.S. There’s Air Canada, WestJet, Swoop (although they may be disappearing), Porter, Flair, and Lynx.

Air Canada is a more prominent option outside of these areas though, an excellent example being the above mentioned trip to Panama, and probably where Aeroplan is best suited these days.

Once my Aeroplan point bank is gone (or mostly gone), I won’t continue to have an Aeroplan card to keep earning Aeroplan points. I currently earn plenty of Scene+ and MBNA Rewards points, and I’ll be sticking to programs like them in the future, where you can book almost any airline or hotel room and use points to pay for it. No need to stick to 1 airline.

One last thing to consider is getting a jack-of-all-trades card like the American Express Cobalt Card. Want to redeem points through Aeroplan? Transfer your Membership Rewards points to Aeroplan or 5 other airline partners. And you can also book any airline if you choose, or use points for hotels or car rentals. It’s another card I can consider in the future.

GC: $100

Details on the American Express Aeroplan Reserve Card

There’s a lot we haven’t talked about when it comes to the American Express Aeroplan Reserve Card – here are the full details on what it offers.

One thing I never mentioned were the Aeroplan points I was earning on purchases. Getting more points was really a secondary part of having the card (with the exception of the welcome bonus).

Here’s what you’ll earn for points on all your purchases:

- 3 points per $1 spent on Air Canada

- 2 points per $1 spent on dining and food delivery purchases in Canada

- 1.25 points per $1 spent on all other purchases

Based on spending $2,000 per month, you’re looking at earning 50,175 Aeroplan points per year.

As for the welcome bonus, you’ll get 85,000 bonus points after spending $7,500 in the first 3 months, and spending $2,500 in month 13.

Now for those Aeroplan benefits, and the key part of this card that makes it worth the $599 annual fee.

Let’s go over the ones we discussed. First, the Preferred Pricing. You’ll use fewer points any time you use your points to book a flight. How much you save will vary by the flight.

Next are the free checked bags. You’ll get the first free checked bag for yourself and up to 8 others travelling on the same reservation.

Then there are the priority airport services. Cut down your time waiting in line with priority check-in, boarding, and baggage handling.

There’s Maple Leaf lounge access as well. Any time you fly with Air Canada or Star Alliance partners, you can access a Maple Leaf lounge. The card also comes with a Priority Pass membership, but no free passes.

Finally, the companion pass, which offers a discounted 2nd ticket anywhere Air Canada flies. Just note you have to spend $25,000 per year to get access to it.

There are more benefits this card offers than those that I’ve used.

It can help you attain Aeroplan Elite status. For every $5,000 you spend, you’ll earn 1,000 Qualifying Miles and 1 Qualifying segment. You can also roll over up to 200,000 unused Status Qualifying Miles to make it easier to obtain status the following year. If you do requalify, you can also roll over up to 50 eUpgrade credits.

You can also get prioritized on the standby waitlist for flights, and if you request an upgrade, you’ll get higher priority.

If you have Aeroplan Elite status, having this card will make it easier to requalify.

The last set of benefits are specifically for Toronto-Pearson airport and are also available on the American Express Platinum Card. There’s the aforementioned priority security lanes to get through airport security faster.

If you park your car at Pearson, you can get complimentary valet parking, save 15% at the express and daily park lots, and get 15% of car care services while you’re gone.

To top it off, it comes with 11 types of insurance.

Is it worth that annual fee? It’s up to you.

GC: $150

Your thoughts on the American Express Aeroplan Reserve Card

In the right hands, the American Express Aeroplan Reserve Card can offer a lot of savings and benefits.

Any experiences with the card yourself? Anyone tempted to give the card a shot?

Let us know in the comments below.

FAQ

What does the American Express Aeroplan Reserve Card offer for rewards?

The American Express Aeroplan Reserve Card offers the following for Aeroplan points on purchases:

- 3 points per $1 spent on Air Canada

- 2 points per $1 spent on dining and food delivery purchases in Canada

- 1.25 points per $1 spent on all other purchases

What benefits does the American Express Aeroplan Reserve Card come with?

The American Express Aeroplan Reserve Card comes with a host of Air Canada benefits, which include:

- Preferred Pricing on Aeroplan reward flights,

- free first checked bags,

- Maple Leaf lounge access, and

- priority check-in, boarding, and baggage handling.

How does the companion voucher work with the American Express Aeroplan Reserve Card?

First, to get the companion voucher with the American Express Aeroplan Reserve Card, you have to spend $25,000 annually on the card. Once you get it, you need to book one flight for yourself, and you’ll apply the voucher to the 2nd ticket. You’ll pay the taxes and fees plus a set fee, depending on where you’re going.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×9 Award winner

×9 Award winner  $100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

$100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.