Getting a credit card is fairly easy if you have a solid credit score, but newcomers to Canada and young adults without an established score might struggle to qualify at first. It’s a bit of a conundrum – you need a credit card to build your credit score, but it’s hard to get one without a credit score.

Fortunately, there are credit cards out there that can help you build your credit. We’ll talk about secured cards, student cards, cards tailored to newcomers, and a credit building program offered by a prepaid card company.

Key Takeaways

- Secured credit cards are an option for people who want to build credit.

- There are options for those with poor credit and students.

- There is even a prepaid card you can get that will help with your credit score.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Summary of credit cards to build credit

Here's a summary of the cards we've listed to build credit, from secured cards, to student cards, and even a prepaid option.

| Credit Card | Card type | Annual fee | Required credit score | Features |

|---|---|---|---|---|

| Neo Secured World Elite Mastercard | Secured card | $125 | 300 - 559 | * Earn cash back on purchases * Best for people with poor credit |

| Home Trust Secured Visa Card | Secured card | $0 | 300 - 559 | * No annual fee * Lower purchase interest rate for a $59 annual fee * Best for people with poor credit |

| BMO CashBack Mastercard for students | Student card | $0 | 300 - 559 | * Up to 3% cash back on purchases * No annual fee * Best for students |

| CIBC Aventura Visa Card for Students | Student card | $0 | 300 - 559 | * Up to 1 Aventura point per $1 spent * No annual fee * Best for students |

| KOHO Prepaid Mastercards | Prepaid card | $48 - $177 | 300 - 559 | * Cash back on all purchases * Varying monthly fees depending on the card level chosen |

| Tangerine Money-Back Credit Card | Credit card | $0 | 660 - 724 | * Choose your cash back categories * No annual fee * Best for newcomers |

| Scotiabank Passport Visa Infinite Card | Credit card | $150 | 660 - 724 | * Earns Scene+ points * Huge welcome bonus * No foreign exchange fees * Best for newcomers |

Secured credit cards

If you're trying to rebuild a poor credit score, a secured credit card is likely where you'll have to start.

These cards have almost guaranteed acceptance because you have to provide a security deposit. This deposit then becomes your credit limit. In case you fail to make your payment, the bank has your deposit to make your payment. The minimum amount you have to provide varies by issuer.

Here are two no annual fee secured credit cards.

1. Best secured credit card

The Neo Secured World Elite Mastercard takes our crown as the best secured credit card for two reasons.

First, it offers rewards on everyday purchases. You'll earn up to 5% cash back with partner retailers and on groceries. You’ll also get 4% cash back on recurring bills, 3% back on gas and EV charging, and 1% back on all other purchases.

The other reason is the extensive insurance coverage – you'll get 12 types of purchase and travel insurance, which is rare for a secured credit card.

If you’re looking for a secured credit card that earns rewards but has a lower annual fee and easier eligibility, take a look at the Neo Secured World Mastercard. This version has lower earn rates, but you’ll still get up to 2% cash back on groceries, recurring bills, gas, and EV charging. Plus, you can still earn an average of 5% back with partner retailers.

2. A secured credit card with a low interest option

The Home Trust Secured Visa Card is another no fee secured credit card in Canada. This card does not earn rewards, and has a $500 minimum security deposit.

It does, however, have a lower foreign exchange fee of 2%, making it a decent option if you often deal in foreign currencies.

Now, if you may also need to save on credit card interest, you can turn to the Home Trust Secured Visa (Low Rate). For an annual fee of $59, you'll get a lower purchase interest rate of 14.9%.

Student credit cards

College or University age is the ideal time to start building credit. Many banks offer credit cards specifically designed for students. They don’t have any income requirements, and have lower credit score requirements than regular cards.

Here are a pair of student cards to consider. And you can see even more student credit cards here.

1. Cash back student credit card

If you're interested in a cash back credit card, the BMO CashBack Mastercard for students has a lot going for it. Here's what you'll earn for cash back everywhere you shop:

- 3% cash back on groceries (up to $500 per month)

- 1% cash back on recurring bill payments (up to $500 per month)

- 0.5% cash back on all other purchases

You can also get your cash back paid out whenever you like. Once you've accumulated at least $1 in rewards, you can get a statement credit or get it deposited into a BMO bank account.

2. Travel student credit card

If you want to dabble in travel rewards, the CIBC Aventura Visa Card for Students is a student card worth looking into.

Here's what you'll earn for rewards on purchases:

- 1 point per $1 spent on travel purchased through the CIBC Rewards Centre

- 1 point per $1 spent on eligible gas, groceries, EV charging, and drugstores, up to $6,000 spent annually

- 1 point per $2 spent on all other purchases

But what can you use your Aventura points for? Here's a summary of your options. For full details, here's our guide on the CIBC Aventura Rewards program.

A prepaid card to help build credit

Prepaid credit cards are an excellent alternative to credit cards for making payments.

But they have a fatal flaw – they don't have any impact on your credit file or score. Prepaid cards aren't credit products – you're not borrowing money from anyone. You simply load the card with your own funds, and spend them. When your balance runs low, you load more money on it.

But there's an exception to this – KOHO Prepaid Mastercards. While the prepaid cards themselves won't help, they have an optional add-on called Credit Building.

There are two options for you to use, but basically you take out a line of credit with KOHO. You then pay back your loan, and KOHO will report your good behaviour to 2 of the major bureaus.

Now, there is a cost to this, and it depends on what level your KOHO card is. Here's the credit builder’s monthly fee for each card:

- KOHO Essential Mastercard – $10

- KOHO Extra Mastercard – $7

- KOHO Everything Mastercard – $5

If you don't want to get a credit card, this is one alternative you can look at to help boost your credit score.

If you’re a fan of KOHO and already have an account, check out their credit builder program. You’ll make small monthly payments that are reported to both credit bureaus. After 6 months, you can see the progress you’ve made on your credit score.

KOHO Credit Building

Credit cards for newcomers to Canada

If you're a newcomer to Canada and don't have any established credit here, you may need to start with a credit card for newcomers. Many of the larger banks also offer banking packages and services tailored to people starting out in Canada.

For these cards, a Canadian credit history isn’t necessary, so you’re more likely to meet card qualifications. That said, getting these cards will help you establish your credit file in Canada.

1. A no-fee credit card for newcomers

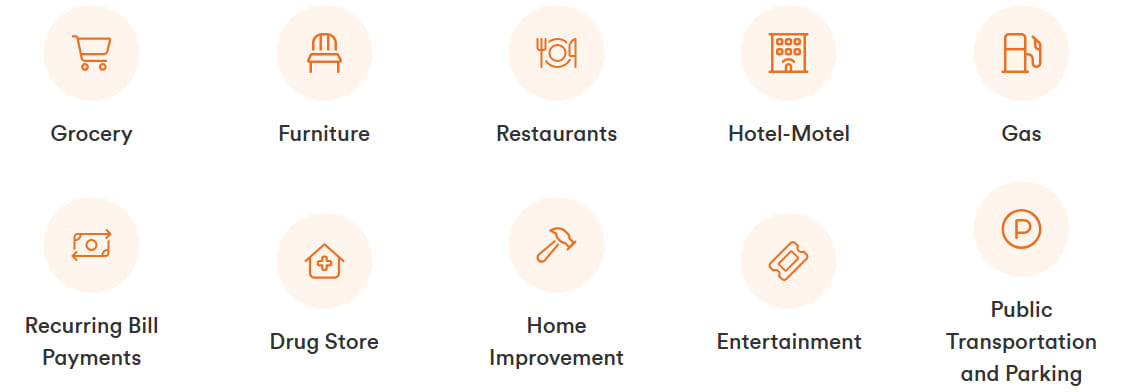

The Tangerine Money-Back Credit Card is a no-fee credit card with low credit score requirements that puts you in control of how you earn cash back. You’ll get:

- 2% cash back on purchases in up to 3 Money-Back Categories

- 0.5% cash back on all other purchases

As for the categories, you can select from the following:

2. A premium credit card for newcomers

If you've recently moved to Canada and have a solid income, take a look at the Scotiabank Passport Visa Infinite Card. Although it has a steep annual fee, you’ll enjoy high earn rates for Scene+ points:

- 3 Scene+ points per $1 spent at Sobeys, Safeway, FreshCo and more

- 2 Scene+ points per $1 spent on groceries, restaurants, entertainment, and daily transit

- 1 Scene+ point per $1 on all other purchases

You’ll also enjoy a welcome bonus worth up to $500, an extensive insurance package, and access to airport lounges. Plus, there’s no foreign exchange fee when using this card, making it perfect for everyday use and travel.

Pros and cons of using a credit card to build credit

Using a credit card is just one way to establish a solid credit score. Even though it’s one of the most popular strategies, there are some drawbacks to consider.

Pros:

- Getting a credit card can improve your debt-to-income ratio since you’ll have more access to credit

- Making regular, on-time payments will improve your credit score

- Having credit cards in addition to other types of credit (like student loans or car loans) can improve your credit mix

Cons:

- Opening a new credit card adds a hard inquiry to your credit report, which can cause your score to temporarily drop

- Getting a new credit card can reduce the age of your accounts (which can also make your score slump)

- Your score could drop if your credit card balance grows and your debt-to-income ratio worsens

- Missing payments can significantly damage your credit score

FAQ

Which credit card is best in Canada to build your credit score?

All unsecured credit cards help to establish your score, so one card isn’t better than the other. That said, the best credit card for you depends on what you’re looking for from a credit card. Try our credit card quiz to see your top pick.

What credit card builds credit the fastest?

There’s not a single credit card that builds credit the fastest, since all card issuers report your payment habits to the credit bureaus. Typically, credit card monitoring bureaus update your information every 30 or 45 days.

How can I build my credit fast in Canada?

One of the fastest strategies is to use your credit wisely – avoid applying for too many cards or loans, make regular charges and payments to your credit card, and always pay off your debts. It also helps if you have access to more credit than you use.

Do credit limit increases hurt your credit?

Your score might take a temporary hit if your card issuer does a hard credit check first. However, many card issuers will do a soft check or automatically issue credit limit increases when you update your income. Increasing the limit won’t hurt your credit.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×1 Award winner

×1 Award winner

$20 GeniusCash + 5% cash back for the first 3 months + No annual fee.*

$20 GeniusCash + 5% cash back for the first 3 months + No annual fee.*

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.