Pros & cons

Pros

- Earn 1 point per $1 spent on travel purchases.

- Earn up to 10,000 Aventura points

- Free SPC membership.

- Save up to 7 cents per litre at Journie Rewards gas stations..

- No annual fee.

Cons

- Limited insurance included.

- Low base earn rate of 1 point per $2 spent.

Your rewards

Getting your welcome bonus

Based on $3,000 in monthly spending, you can get up to 10,000 points which translates to an estimated $229.◊

For all welcome bonus details click here.

How you earn rewards

Each card earns rewards differently. Part of choosing your card is deciding what type of rewards you want to get. With CIBC Aventura Visa Card for Students, here's how you earn rewards:

- 1 point per $1 spent on travel purchased through the CIBC Rewards Centre

- 1 point per $1 spent on eligible gas , groceries , EV charging , and drugstores , up to $6,000 spent annually

- 1 point per $2 spent on all other purchases

For all reward details click here.

How much your rewards are worth

The dollar value of your rewards depends on the specific rewards program ‒ and what you choose to redeem your points for. For CIBC Aventura Visa Card for Students in particular, if you spend $3,000 per month, here's our estimated annual rewards earned depending on which reward you choose:

| Airline Rewards Chart | $563 | |

| Travel through CIBC rewards | $246 | |

| Charity donations | $246 | |

| CIBC Financial Products | $204 | |

| Gift Cards | $175 | |

| Merchandise | $175 | |

| Pay with points | $155 |

Calculating your annual rewards

$36,000 annual spending x 1.56% return on spending = $563 annual rewards

$563 annual rewards − $0.00 annual fee = $563 net annual rewards

Top related credit cards

Compare similar cards side-by-side.

Details and eligibility

- Estimated Credit Score

- 300 - 559

- Personal Income

- N/A

- Household Income

- N/A

- Annual Fee

- $0.00

- Extra Card Fee

- $0

- Card type

- Credit

- Purchase

- 21.99%

- Cash Advance Δ

- 22.99%

- Balance Transfer Δ

- 22.99%

Insurance coverage

- Extended Warranty

- 1 year

- Purchase Protection

- 90 days

- Travel Accident

- $100,000

Please review your insurance certificate for details, exclusions and limitations of your coverage, terms and conditions apply.

Learn more about the value of credit card insurance coverage.

Genius Rating

CIBC Aventura Visa Card for Students's 3.6 Genius Rating is based on the weighted average of the following scores:

Methodology

All scores are produced by our math-based rating algorithm that takes into account over 126 credit card features.

Learn more about our rating methodology.

Awards

Each year for our annual credit card rankings our Genius Rating algorithm computes the best credit cards across 28 different categories. Here’s what this card has won this year:

Top cards from Visa

CIBC Aventura Visa Card for students review

Just because you’re a student doesn’t mean you need to settle for a credit card that doesn't give you rewards and benefits.

In fact, student cards are a great way to learn responsible credit habits, and the CIBC Aventura Student Visa is no exception – you’ll get rewards, concierge service, some complimentary insurance coverage, and a nice welcome bonus. It's a rare student credit card that offers all of these benefits.

Earning CIBC Aventura Rewards

A part of the CIBC Aventura program, you'll earn flexible rewards you can use for everything.

Here's what you'll earn on all of your purchases:

- 1 point per $1 spent on travel purchased through the CIBC Rewards Centre

- 1 point per $1 spent on eligible gas, groceries, EV charging, and drugstores, up to $6,000 spent annually

- 1 point per $2 spent on all other purchases

That works out to 6,150 Aventura points per year, based on spending $500 per month.

Redeeming CIBC Aventura points

These rewards never expire and can be used to fly on any airline at any time. Plus, these rewards can be used for more than just travel. Gift cards, merchandise, financial products, and even statement credits – Aventura points are very flexible.

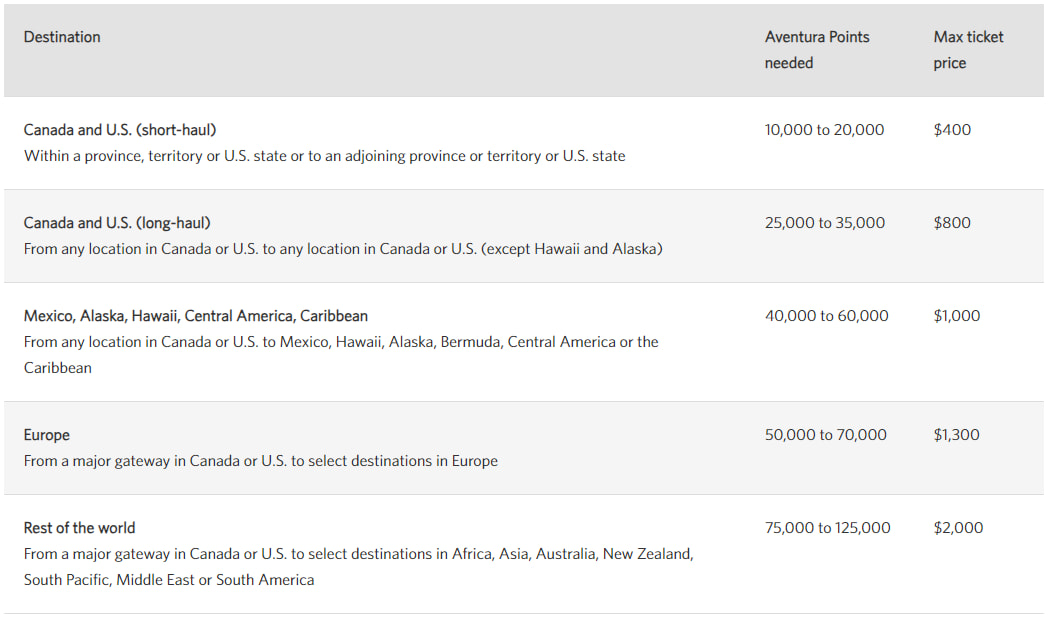

But to get the best value for your points, you'll need to redeem them for flights, using the Aventura flight chart. With smart redemptions, you can get a point value of up to 2.29 cents each. With this card, that means a return of up to 2.29% on your spending.

Here's what the full chart looks like.

But, if you don't use the flight chart, or don’t get great value from it, your rewards value takes a severe drop, resulting in your points being worth 1 cent or less. It's a drastically smaller return for your spending – between 0.5% to 1%.

Here's the summary of all your redemption options.

You can view the full details on the CIBC Rewards program here to help get the most of your hard earned points.

3 benefits to the CIBC Aventura Visa Card for Students

There are a few more things to like on top of the rewards. Here are 3 other things the CIBC Aventura Visa Card for Students brings to the table.

1. Free SPC membership

SPC memberships are valuable to students, with plenty of discounts all over the place to help save money.

However, an SPC card costs money, currently $11.99 per year. But when you have a CIBC student credit card, you get a membership included for free.

2. Good welcome bonus

The welcome bonus included will give you a head start on your CIBC Rewards balance.

You'll earn 10,000 points when completing certain actions and making 1 purchase within the first 4 months. Those points are worth up to $229.

3. No annual fee

No student really needs a credit card with an annual fee. Thankfully, there isn't one here. You can earn premium rewards and get a couple of perks with paying anything to keep this card.

2 downsides to the CIBC Aventura Visa Card for Students

There are 2 things you'll want to consider with the CIBC Aventura Visa Card for Students, and they have to do with rewards.

1. Poor rewards outside the flight chart

The flight chart included with the Aventura rewards program offers high value. But it's not guaranteed – you can get far less than 2.29 cents per point. And if you don't use it, you're looking at a return of between 0.5% to 1% on all your purchases.

2. May take a while to redeem points for top value

Depending on your monthly spending, it may take a while for you to earn enough points to even use the Aventura Flight Rewards Chart.

For just a short haul flight, you could need upwards of 20,000 points. If you're spending $500 per month on your card, we estimate you'd earn around 6,150 points. It could take years before you're able to even use them for max value.

Comparison to the CIBC Dividend Visa Card for Students

If travel rewards aren't your thing, CIBC offers a cash back credit card for students in the CIBC Dividend Visa Card for Students.

Here's how they stack up.

| CIBC Aventura Visa Card for Students | CIBC Dividend Visa Card for Students | |

|---|---|---|

| Earn Rates | * 1 point per $1 spent on travel purchased through the CIBC Rewards Centre * 1 point per $1 spent on eligible gas, groceries, EV charging, and drugstores, up to $6,000 spent annually * 1 point per $2 spent on all other purchases | * 2% cash back on eligible groceries * 1% cash back on eligible gas, EV charging, transportation, recurring bills, and dining * 0.5% on all other purchases |

| Average Earn Rate | 1.56% | 0% |

| Welcome Bonus | Up to 10,000 bonus points (terms) | $25 cash back (terms) |

| Special Features | Free SPC Membership | Free SPC Membership |

| Insurance | 3 types included | 3 types included |

The only difference in these cards are the rewards. One offers travel rewards and the other cash back.

With the CIBC Dividend Visa Card for Students, you'll be earning cash back instead of travel rewards. You'll get a guaranteed return on all your purchases. And they're also much easier to redeem. You can cash out once you've earned $25 in cash back.

But your potential rewards would be less, as you can extract some incredible value from the Aventura Rewards program.

So which is better is up to you. You can get more rewards designed for travel, or get a card with easier-to-use rewards with guaranteed value.

Leave a review

For those of you who have (or had) the CIBC Aventura Visa Card for Students in the past, what do you think of the card?

Leave us a review below so others can read about your experience.

FAQ

What does the CIBC Aventura Visa Card for Students earn for rewards?

The CIBC Aventura Visa Card for Students is a CIBC Rewards credit card that earns the following on purchases:

- 1 point per $1 spent on travel purchased through the CIBC Rewards Centre

- 1 point per $1 spent on eligible gas, groceries, EV charging, and drugstores, up to $6,000 spent annually

- 1 point per $2 spent on all other purchases

What benefits does the CIBC Aventura Visa Card for Students come with?

The CIBC Aventura Visa Card for Students offers 1 big benefit. It comes with a free SPC membership every year you have the card. That can save you an $11.99 membership fee.

What is the annual fee of the CIBC Aventura Visa Card for Students?

The CIBC Aventura Visa Card for Students has no annual fee and has easier approval requirements as a student credit card.

Key benefits

† Terms and Conditions Apply. Select Apply Now to learn more.

User review

Reviewed by 1 Canadian

Thank you for your review!

Hang tight while we verify and approve it.

If you want to see your review right away...

Create an account:

Great card with a low-interest rate & Aventura rewards! The CIBC app is super useful and you can monitor your credit score quarterly