Best Simplii Credit Cards for 2026

Simplii, the popular online bank, only offers one credit card, the Simplii Financial™ Cash Back Visa* Card, but it's a solid option with no annual fee and relatively easy eligibility requirements. The card recently got a revamp, but only the style and branding were updated – none of the card's terms or features changed.

While this card doesn't come with a slew of benefits, it does earn rewards on restaurant, grocery, gas, and drugstore purchases with this card. Users can also send money abroad for free with Simplii GMT.

The article that follows offers a thorough review of this Simplii card, along with thoughts from real cardholders, and a few suggestions for similar credit cards.

Key Takeaways

- The Simplii Financial Cash Back Visa is the only credit card offered by Simplii Financial, but it's a valuable choice that's relatively easy to qualify for and provides good earn rates.

- The Simplii card has low income requirements, doesn't charge an annual fee, and offers up to 4% cash back.

- Simplii Financial is an online-only bank that offers a variety of financial products, including a cash back credit card, free chequing account, and a high interest savings account.

The Simplii Financial™ Cash Back Visa* Card

Rewards:

- 4% cash back on restaurants, up to $5,000 spend per year†

- 1.5% cash back on groceries, gas, drugstores, and pre-authorized payments, up to $15,000 per year†

- 0.5% cash back on all other purchases†

Although the Simplii Financial Cash Back Visa Card is Simplii's only credit card offering, it's a well-rounded no-annual-fee card. And since you're not paying to use the card, all rewards are pure profit.

We like the card's low interest rates and promotional welcome bonus: 8% back on purchases made within the first 4 months (up to $1,000 in spending). You can earn a $50 PRESTO voucher by making a minimum $50 PRESTO transaction within 60 days of opening the card account.

This card's earn rates are excellent, too, with 4% back on restaurant and bar purchases and 1.5% on gas, groceries, drugstores, and pre-authorized payments. All non-category purchases earn 0.5%.

Pros:

- Good earn rates

- Low interest rates

- Easy to redeem cash back (statement credit once per year)

- No annual fee

- Low income requirement of $15,000

- Generous welcome offer

- PRESTO voucher promotion

- Valuable referral bonus

Cons:

- Limited insurance coverage

- Per-category caps on cash back rewards

Simplii Financial Cash Back Visa Card insurance coverage

As a basic card, you'll get one year of extended warranty and 90 days of purchase protection – but that's it.

There's no travel insurance, rental car coverage, mobile device insurance, or emergency medical coverage. Cardholders do have the option to purchase CIBC travel medical insurance through the CIBC website, where you can request quotes for coverage.

What cardholders say

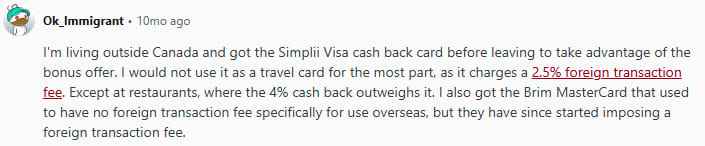

According to Redditors, the main concern with the Simplii Financial Cash Back Visa Card is that it makes for a terrible travel credit card due to its steep foreign transaction fees:

Other users also disliked the fact that cash back is only paid out once a year (at the end of December):

Simplii Financial Cash Back Visa Card alternatives

Take a look at how the Simplii Financial Cash Back Visa Card compares with these top 3 no-fee cash back alternatives:

| Card name | Pros | Cons | Learn more |

|---|---|---|---|

| Rogers Red World Elite® Mastercard® | * High 2.45% average earn rate * 12 types of insurance * Extra cash back for Rogers, Fido, and Shaw customers | * High income requirements | Learn more |

| Neo World Elite Mastercard® | * Earn an average of 5% cash back at Neo retail partners * Earn up to 2% back on other purchases * Also available as a secured card | * Relatively low caps on cash back * Poor base earn rate | Learn more |

| Tangerine Money-Back Credit Card | * Choose your own 2 cash back categories * Get a third category by depositing cash back into a Tangerine Savings Account * Low 22.95% balance transfer rate for 6 months | * Limited insurance * Low non-category earn rates | Learn more |

Other Simplii products

Simplii offers much more than just one credit card. Here are a few of their other major products:

Simplii No Fee Chequing Account

Simplii's chequing account is one of the best available. You'll pay no monthly fees, it requires no minimum deposit, and it offers unlimited transactions.

Simplii High Interest Savings Account

The Simplii high-interest savings account is also a good choice. While the interest rate starts at just 0.3%, Simplii occasionally offers very impressive promotional rates. This account is also available as a TFSA and RRSP.

Other Simplii products include:

- USD bank account

- Student bank account

- Foreign currency savings account

- Mortgages

- Investments (like GICs)

- Personal loans

How to apply for a Simplii credit card

To apply for a Simplii Financial Cash Back Visa Card, you must be a Canadian resident (not residing in Quebec) and be the age of majority in your province or territory. You’ll need a minimum income of $15,000 per year to qualify.

If you meet these requirements, click our secure application link to start the process with Simplii. You'll have to provide:

- Contact information

- Living situation and details

- Employment information

- Income details

- Monthly expenses

- How you want to receive statements and documents

If your application is approved, you'll get your Simplii card in the mail.

FAQ

Does Simplii have a credit card?

Yes, Simplii Financial offers one credit card: the Simplii Financial™ Cash Back Visa* Card. It's a cash back credit card that offers up to 4% back on purchases. New clients can take advantage of the welcome offer that provides 20% on your eligible purchases for the first 3 months, up to $500 in spending.

What are the benefits of a Simplii credit card?

The Simplii Financial™ Cash Back Visa* Card is a cash back card that offers 4% on eligible restaurant, bar, and coffee shop purchases and 1.5% cash back on groceries, gas, drugstores, and pre-authorized payments. All other spending earns 0.5% cash back. Cardholders can also use Simplii's Global Money Transfer service and pay no transaction fees.

What are the disadvantages of Simplii?

While the promotional welcome bonus of 8% back for the first three months is amazing, the Simplii Financial Cash Back Visa Card's regular cash back rates are underwhelming. Users can only redeem their cash back once a year, and the card doesn't offer an insurance package, just extended warranty and purchase protection.

What is the best credit card to get right now?

The American Express Cobalt® Card is the best overall credit card available for Canadians in 2026. This card earns American Express Membership Rewards at an amazing average rate of 4.5%. It also has a solid insurance package, with 10 types of coverage, and provides access to Amex benefits like Amex Experiences and Front Of The Line.

Editorial Disclaimer: The content here reflects the author's opinion alone. No bank, credit card issuer, rewards program, or other entity has reviewed, approved, or endorsed this content. For complete and updated product information please visit the product issuer's website. Our credit card scores and rankings are based on our Rating Methodology that takes into account 126+ features for each of 228 Canadian credit cards.