The American Express Cobalt Card has the best rate of return of all Canadian credit cards, coming in at an average of 4.5%.

When shopping for a new credit card, you want to be sure that the card has a high rate of return, so you’re getting good value for your spending. You can find a card’s rate of return using a formula or a calculator, then you can compare cards based on your exact spending, not a generalized estimate.

To help you narrow down your options, this article categorizes card options by card type, bank, and network, and presents the best average rates of return for each.

Key Takeaways

- A credit card’s rate of return is the average amount you can expect to earn from making purchases with the card.

- The American Express Cobalt is the credit card with the highest rate of return.

- With the Amex Cobalt, you’ll see a 4.5% rate of return across your spending.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Top ten credit cards with the highest rate of return

If you're looking at the raw average rate of return, these are the top credit cards in Canada.

The top card for best average rate of returns: American Express Cobalt® Card

The credit card with the highest average rate of return is a flexible rewards credit card that also happens to be the #1 credit card in Canada: The American Express Cobalt Card.

With an average earn rate of 4.5%, a solid insurance package, and flexible redemption options that range from flights to charitable donations, this card has a lot going for it. It's relatively easy to qualify for, too, since it's an Amex with no income requirements

Not only is it the best flexible rewards card, but this credit card took top spot in a number of different categories this year, including:

- Best travel credit card

- Best rewards credit card

- Best grocery credit card

- Best American Express credit card

- Best restaurant credit card

- Best overall credit card

What is a rate of return?

Put simply, a credit card's rate of return is the average amount you can expect to earn from making purchases with the card. It’s expressed as a percentage.

For cash back cards, this rate of return is usually fairly simple to figure out. If you have a credit card with a flat 2% cash back earn rate, your rate of return is 2%.

With other types of credit cards – such as tiered cash back cards, rewards cards, and cards with bonus spending categories – figuring out the average rate of return can be a bit trickier.

How to calculate the average rate of return

Over the years, we've done extensive research into various credit card rewards programs, estimating the dollar value of over 20 programs, and each type of rewards redemption available.

We then run all of the credit cards in our database through an algorithm that uses those values and calculates the average rate of return based on a typical $2,000 monthly spend across various categories.

Here's the typical $2,000 monthly spend we use to make these calculations:

| Spending category | Typical monthly spend |

|---|---|

| General | $700 |

| Gas | $200 |

| Groceries | $350 |

| Drugstore | $100 |

| Restaurants | $150 |

| Bills | $300 |

| Travel | $100 |

| Store | $100 |

| Total | $2,000 |

Of course, your personal spending patterns may differ from these. Maybe you never buy gas, or perhaps you travel regularly. If your monthly spend is much lower or higher than this, you'll get different results as well.

Rate of return formula

Want to see how your personalized spending shakes out? This is the rate of return formula:

((annual rewards) / (annual spend)) x 100.

So, if you earn $400 in rewards on $24,000 in spending, the equation would look like this:

($400 / $24,000) x 100

= (0.0166) x 100

= 1.66%

The formula is simple as long as you can accurately keep track of how much you’ve charged throughout the year and how much you’ve earned in rewards. Again, this is easier if you’re always getting cash back, but trickier if you’re redeeming rewards for things like merchandise or travel.

Rate of return calculator

For some help finding your card’s rate of return, play around with online rate of return calculators. Instead of assuming a $2,000 spend, you can input personalized data that matches your spending habits. This gives you a more accurate rate of return for your card.

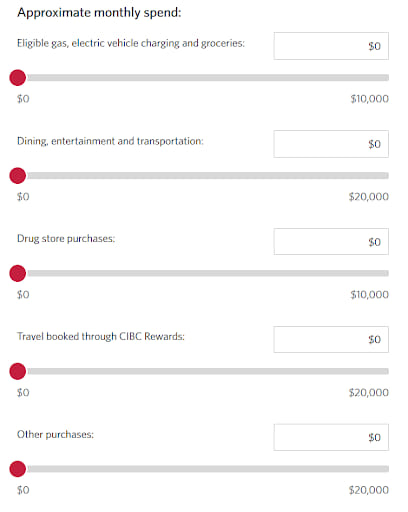

You can usually find these specialized calculators on each card issuer’s website. Let’s look at CIBC’s calculator as an example.

First, you’ll select your specific credit card. Then, you’ll input your monthly spending by category into the calculator:

The calculator then shows you how many points you would earn in one year based on your exact spending. Once you know how many points you’ll earn, you can estimate the rate of return based on the value of your redemption option.

So, let’s say we found we’d earn 94,450 points in a year from spending $2,750 per month. If you head to our Aventura Rewards Program page, you can see the value of all your redemption options. Assuming we donate all our points to charity (which gives a 1 cent per point value), our card’s rewards would be worth $944.50.

Remember our rate of return calculator? The calculation looks like this:

$944.5 / $33,000 = 0.0286

x 100 = 2.86

2.86% is the accurate return for your spending with your specific card.

Average rate of return by type of credit card

There are various types of credit cards, of course, and every year we rank Canadian credit cards across 26 different categories.

These include cash back cards, grocery cards, student cards, and many more. None of these categories is judged solely on the estimated average rate of return for each credit card. Many other factors come into play, including:

- Annual fee

- Welcome bonus

- Insurance coverages

- Travel perks

- Acceptance

- Approval

- Interest rates

That said, we were curious to see which credit card had the highest annual rate of return among the top ten in each category, so we spent some time crunching the numbers.

Here's what we found:

| Type of credit card | Winner | Best average rate of return |

|---|---|---|

| Cash back | American Express Cobalt Card | 4.5% |

| No annual fee | ~359 pnc ~/> | 2.1% |

| Travel rewards | American Express Cobalt Card | 4.5% |

| Balance transfer | Tangerine Money-Back Credit Card | 1.14% |

| Foreign exchange | Scotiabank Gold American Express Card | 2.45% |

| Low interest | Desjardins Odyssey Visa Infinite Privilege | 2.2% |

| Gas & transit | American Express Cobalt Card | 4.5% |

| Grocery | American Express Cobalt Card | 4.5% |

| Restaurants | American Express Cobalt Card | 4.5% |

| Insurance | RBC Avion Visa Infinite Privilege | 2.91% |

| Student | RBC ION Visa | 1.09% |

| Business | RBC Avion Visa Infinite Business | 2.91% |

| U.S. Dollar | CIBC U.S. Dollar Aventura Gold Visa Card | 1.2% |

| Store | MBNA Rewards World Elite Mastercard | 2.86% |

| Perks | RBC Avion Visa Infinite Privilege | 2.91% |

| Rewards | American Express Cobalt Card | 4.5% |

| Flexible rewards | American Express Cobalt Card | 4.5% |

| Aeroplan | American Express Cobalt Card | 4.5% |

| Prepaid | KOHO Everything Mastercard | 1.1% |

Average rate of return for credit cards by bank

We also rank credit cards based on the bank that issues them. Here's the list of the best credit cards issued by 14 different banks in Canada:

| Bank | Winner | Best average rate of return |

|---|---|---|

| American Express | American Express Cobalt Card | 4.5% |

| BMO | BMO eclipse Visa Infinite Card | 1.61% |

| Brim | Brim World Elite Mastercard | 1.3% |

| CIBC | CIBC Aventura Gold Visa Card | 2.66% |

| Desjardins | Desjardins Odyssey Visa Infinite Privilege | 2.2% |

| Home Trust | Home Trust Preferred Visa | 1% |

| MBNA | MBNA Rewards World Elite Mastercard | 2.86% |

| National Bank | National Bank World Elite Mastercard | 2.3% |

| Rogers | Rogers Red World Elite Mastercard | 1.5% |

| Royal Bank | RBC Avion Visa Infinite Privilege and RBC Avion Visa Infinite Business | 2.91% |

| Scotiabank | Scotiabank Gold American Express Card | 2.45% |

| Tangerine | Tangerine Money-Back Credit Card and Tangerine World Mastercard | 1.14% |

| TD | TD Aeroplan Visa Infinite Privilege Credit Card | 2.78% |

Average rate of return for credit cards by network

Finally, we took a look at the estimated average rate of return for credit cards for the three major credit card networks in Canada.

We've already touched on all of the top cards for each of these in this article, but here's how they stack up side by side.

| Type of credit card | Winner | Best average rate of return |

|---|---|---|

| American Express | American Express Cobalt Card | 4.5% |

| Mastercard | MBNA Rewards World Elite Mastercard | 2.86% |

| Visa | RBC Avion Visa Infinite | 2.36% |

FAQ

Which credit card gives the best returns?

The American Express Cobalt Card gives the highest rate of return of any credit card in Canada right now, which is why it appears on so many of our best of lists. You’ll earn 4.5% on your purchases.

Which credit card gives you 5% back?

No credit card in Canada gives 5% back, but the American Express Cobalt Card comes close with a high 4.5% average rate of return. – significantly higher than the runner-up, the CIBC Aventura Visa Infinite Privilege Cardat 3.34%.

Where can I find a rate of return calculator?

To find a personalized rate of return calculator for the credit card you use, search your card issuer’s website. Many of the larger banks and issuers have easy-to-use calculators where you input your monthly spending by category.

What is the rate of return formula?

The rate of return formula is annual rewards divided by annual spending multiplied by 100. If you’re more of a visual learner, the formula is: ([annual rewards] / [annual spend]) x 100.

creditcardGenius is the only tool that compares 126+ features of 229 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 229 cards is for you.

×8 Award winner

×8 Award winner

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 8 comments