Many people assume that flat rate cards offer a single, consistent return rate on all purchases. But we define any card that earns at least 1% back on all purchases as a flat rate credit card – and the best in Canada are the RBC Avion Visa Infinite and American Express® Green Card.

The best flat rate credit cards offer bonus categories on top of their flat rates, rewarding you with higher spending returns, or flexibility, allowing you to customize which categories reward you most.

We’ll walk you through the subtleties of flat rate cards and help you pick the best credit card for your wallet.

Key Takeaways

- The best flat rate credit card is the RBC Avion Visa Infinite.

- Flat rate credit cards earn you a specific reward rate across all purchases, though some also offer bonus categories with higher rates.

- These cards offer simplicity, consistency, and low to no fees, but they don't offer the highest earn rates and often have caps on the amounts you can earn each month.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Best flat rate cash back credit cards

You’ve got some excellent options when it comes to cash back cards that earn flat rates:

| Card | Welcome bonus | Earn rate | Annual fee/income requirements | Apply Now |

|---|---|---|---|---|

| RBC Avion Visa Infinite | 55,000 points (terms) | * 1.25 points per $1 spent on travel * 1 point per $1 spent on all other purchases | * $120 * $60,000 personal, $100,000 household | Apply Now |

| RBC Visa Platinum Avion | 55,000 points | * 1 point per $1 spent on all purchases | * $120 * No income requirements | Apply Now |

| RBC Cash Back Preferred World Elite Mastercard | None | * 1.5% cash back on the first $25,000 spent annually * 1% cash back after $25,000 spent annually | * $99 * $80,000 personal, $150,000 household | Apply Now |

| American Express Green Card | 10,000 points (terms) | * 1 point per $1 spent on all purchases | * $0 * No income requirements | Apply Now |

| Scotiabank American Express Platinum Card | 80,000 points | * 2 Scene+ points per $1 spent on all purchases | * $399 * $12,000 personal | Apply Now |

RBC Avion Visa Infinite

Top spending categories: Travel

Average rate of return: 2.36%

Rewards:

- 1.25 points per $1 spent on travel

- 1 point per $1 spent on all other purchases

The

When redeeming points with the RBC Avion Air Travel Redemption Schedule, you’ll get a value of 2.33 cents per point (CPP).

You can also transfer points to partner airlines, including British Airways, Cathay Pacific, American Airlines, and WestJet, for a value of 1.75 CPP.

Pros:

- 12 types of purchase and travel insurance

- 55,000 bonus points

- Save 3 cents per litre on fuel at Petro-Canada

Cons:

- High income requirements

- Low earn rate compared to other cards

- Poor rewards if not redeemed through the Air Travel Redemption chart

RBC Visa Platinum Avion

Top spending categories: All purchases

Average rate of return: 2.33%

Rewards:

- 1 point per $1 spent on all purchases

Of the cards on our list, the

However, the card stands out for its eligibility requirements: there aren't any. Sure, there’s an annual fee, but the fact that you can earn up to 55,000 points as a welcome bonus (worth around $1,281.50) more than makes up for the fee.

Its extensive insurance coverage and the flexible option of transferring points to other airline reward programs make the RBC Visa Platinum Avion an excellent flat rate travel card.

Pros:

- Up to 35000, 20000 bonus points

- Includes 10 types of insurance

- Save 3 cents per litre on fuel at Petro-Canada

Cons:

- Only earns 1 point per $1 spent on most purchases

- Poor rewards if not redeemed through the Air Travel Redemption chart

RBC Cash Back Preferred World Elite Mastercard

Top spending categories: First $25,000 spent

Average rate of return: 1.35%

Rewards:

- 1.5% cash back on the first $25,000 spent annually

- 1% cash back after $25,000 spent annually

The

It’s got a low annual fee that is offset by the rewards you earn, but you will need to meet stiff income requirements to get the card. Given these restrictions, we’d hope the card would come with more insurance coverage.

On the other hand, this RBC card gives you World Elite Mastercard benefits, which include concierge service, access to exclusive events and restaurants, and more.

Pros:

- Redeem cash back on demand when you have $25 accumulated

- Includes World Elite Mastercard benefits

Cons:

- High income requirements

- Limited insurance coverage

- Only earns 1% cash back after spending $25,000 annually

American Express® Green Card

Top spending categories: All purchases

Average rate of return: 2.1%

Rewards:

- 1 point per $1 spent on all purchases

If you’re looking for a travel credit card with no annual fee, the

Earning a flat rate of 1 point per $1 spent on all purchases, you can redeem your points for travel bookings.

It’s also one of the best flat rate travel credit cards since it allows you to book worry-free with no blackout dates, advance purchase requirements, seat, or travel restrictions. You can also transfer your points to Aeroplan at a 1:1 ratio for a point value 2 cents each.

You’ll get access to Front of the Line and American Express Experiences, which gets you into all kinds of events in Canada.

Pros:

- Four ways to redeem points for high value

- No annual fee

Cons:

- Minimum insurance included

- Lower acceptance as Amex

Scotiabank American Express® Platinum Card

Top spending categories: All purchases

Average rate of return: 2%

Rewards:

- 2 Scene+ points per $1 spent on all purchases

If you’re a fan of the Scene+ Rewards program, one of the best loyalty programs in Canada, you’ll want to take a look at the

Your earn rate is somewhat better than other flat rate cards, but what we really like is the fact that you can redeem your points for movie tickets, entertainment, restaurants, travel, statement credits, Apple products, and gift cards.

With a high annual fee, you should expect great insurance coverage, and this card delivers. You’ll get 12 types of insurance coverage, making it great for protecting your purchases or travelling. Oh, and you’ll also enjoy a membership and 10 free passes to Priority Pass and Plaza Premium lounges.

Pros:

- Up to 60000, 20000 welcome bonus points

- Four ways to redeem points for high value

- No foreign exchange fees

- Extensive insurance coverage

Cons:

- High annual fee

- Lower acceptance as Amex

What is a flat rate card?

A flat rate credit card guarantees you a specific return on your purchases, typically around 1% back for every $1 spent, regardless of what you buy. That said, some cards come with bonus categories that earn you a higher rate.

Once you’ve accumulated enough rewards, you can request your cash back (although some cards make you wait until the card’s anniversary).

Types of flat rate credit cards

Most rewards or cash back cards are flat rate cards, but there are some differences.

Flat rate

Again, a flat rate credit card earns you a specific return on all your purchases. Some cards have higher flat earn rates than others, so it pays to compare before applying for a new card.

Bonus categories

You might notice that some flat rate cards boast higher earn rates for additional spending categories. It’s important to read the fine print, though, since issuers sometimes place caps on these bonus categories.

For example, the MBNA Rewards World Elite® Mastercard® is the best cash back card, earning you a flat rate of 1 point per $1 spent, but 5 points per $1 spent on restaurants, groceries, and select recurring bills. The card caps your bonus earnings on spending up to $50,000 in each category annually.

Flexible categories

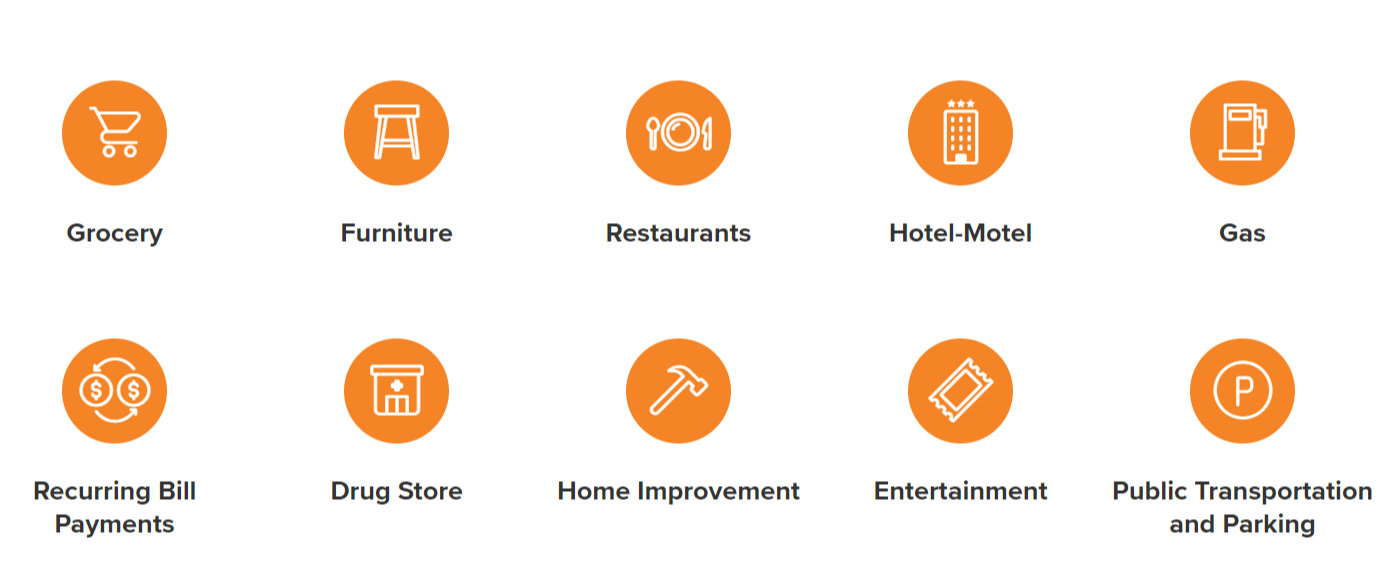

You may have noticed credit cards that offer the option to select categories for higher rates.

When thinking of flexible rewards cards, Tangerine credit cards come to mind. For example, with the Tangerine Money-Back Credit Card, you can choose two bonus categories from the following that earn 2% cash back (compared to the card’s flat rate of 0.5%):

If you deposit your cash back into a Tangerine savings account, you can pick a third category that earns 2% back.

Pros and cons of flat rate credit cards

Still unsure if a flat rate credit card is right for you? Here are the benefits and drawbacks for your consideration.

Pros:

Here’s what you can look forward to when you opt for a flat rate credit card.

- Simplicity and convenience: You don’t have to think twice or select categories before shopping.

- Steady earnings across all categories: If your purchases tend to vary from month to month and are less focused on specific categories (like groceries or eating out), you’ll likely see yourself earning more with a flat rate credit card.

- Minimal or no annual fees: Unlike premium credit cards, which can charge up to $799 a year, most flat rate cards have modest annual fees, if they charge one at all.

Cons:

Of course, it doesn’t come without drawbacks – here are the cons of using a flat rate credit card.

- Not getting the highest possible return on category purchases: Flat rates are typically pretty low, earning you anywhere from 0.5% to 1%. On the other hand, bonus categories can earn up to 5 points per $1.

- Less variety in bonuses: Some cards offer unique bonuses for specific types of spending. For instance, if you have recurring bills or subscription services, you could be earning more with a bonus category.

- Potential caps on earning: Read the card’s terms and conditions carefully, since you might only earn specific rates up to a spending limit.

FAQ

What is the best flat rate cash back credit card?

The best flat rate cash back credit card depends on what you’re looking for. That said, the card with the best return on spending is the RBC Avion Visa Infinite, with an average earn rate of 2.36%.

What is a flat rate credit card?

A flat rate credit card gives you a set earn rate for purchases you make. Once you’ve accumulated enough rewards, you can get your cash back once a year or whenever you’d like to redeem it.

What's the best flat rate travel credit card?

For travel, the RBC Avion Visa Infinite has one of the best average earn rates at 2.36%. But for no fee, the American Express Green Card gives a decent average earn rate as well at 2.1%.

What's the best cash back credit card?

The best cash back credit card is the MBNA Rewards World Elite Mastercard. It offers the highest cash back at up to 5 points per $1 spent, a 10% bonus every year on your birthday, and 3 types of insurance.

What's the best credit card to have in Canada?

The American Express Cobalt Card is the best credit card in Canada and has held this title for eight years in a row. It has no income requirements, a great welcome bonus, and fantastic earn rates.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×2 Award winner

×2 Award winner

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.