We here at creditcardGenius are all about getting you the best credit card that fits what you want.

But what do we have in our wallets? Well, here’s your answer. Almost 30 different credit cards are used by the creditcardGenius team. Some you know well, some you may not, and there are more than a few surprises, with some team members not happy with what they have.

Here’s what’s in our wallets.

Key Takeaways

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Summary of the credit cards used by the creditcardGenius Team

Here’s the summary of all the cards carried by the creditcardGenius team, and how many are carried by us.

A lot of different credit cards, 29 to be precise.

Details on the cards carried by the creditcardGenius team and why they have them

We have a varied list of credit cards. So why do we have them? Here’s each card, and why someone carries it.

1. KOHO Easy Mastercard – 4 cards

The most popular card carried by the team isn’t even a credit card – it’s actually the KOHO Easy Mastercard. Here’s what our team has to say about it.

“Ok, I actually love this card! I got it when my daughter was underage, but wanted to buy sketchy stuff on the internet. She eventually got her own, and it was a great tool to teach her the value of money, while still offering her the protection of a credit card. Their app is fantastic, she loves the rounding up feature. And she loves that she got a pink card!”

“It’s free, has a pretty slick app, and I use it for any online purchases from websites that I’m unsure how secure / trustworthy they are.”

“I got the KOHO Easy Mastercard with the intention to throw some extra funds on there as “fun money” but never actually got around to doing it so I haven’t used it yet.”

“No fees, cash back on cash purchases, app is great, cashback redemption is very flexible and easy. Card looks cool too.”

2. Tangerine Money-Back Credit Card/Tangerine Money-Back World Mastercard – 4 cards

Since they’re essentially the same card, we lumped the counts for the Tangerine Money-Back Credit Card and the Tangerine Money-Back World Mastercard. Each card is carried by 2 team members and it’s largely praised as a complementary credit card.

“I use this card for pretty much everything, and I like it because I get 2% cashback on groceries and gas. I opened a Tangerine Savings account so I was able to choose a 3rd category for cashback, but otherwise I get 0.5% cashback on other purchases. What I dislike the most about this card is that it doesn’t categorize Costco under groceries, so I don’t get 2% on big spends there which is unfortunate.”

“It’s free! I use it for recurring bills and anywhere that doesn’t take Amex.”

“I paired my Tangerine with my Brim so I’d get 2% on 3 categories, which I chose as groceries, gas, and drugstores. I just added the Scotia Gold Amex to my wallet, I’ll likely use that on everything and then one of my Mastercards on places that don’t take Amex.”

“Like: no fee, 3 customizable 2% cashback areas to compliment Cobalt’s strengths, is Mastercard so works at Costco.”

Dislike: card art is so boring!”

3. Brim Mastercard – 3 cards

We have a 3 way tie for 3rd place. We’ve listed them out in alphabetical order, and we’ll start with the Brim Mastercard. Brim has 3 different cards, but everyone on the team who has a Brim card has the no fee version.

“My favourite thing about my Brim card is it’s no fee, gets 1% on everything, and has no FX fees. That means I can literally use it everywhere without taking into consideration bonus categories, what currency I’m buying, and if I’m spending enough to justify the fee.”

“I rarely use this card. I only got this card to use when travelling to the US. It’s great that this card doesn’t have any exchange fees.”

“5% rewards on purchases from Indigo and I think 4% from Nike is pretty sweet. I don’t really shop from their other retail partners but there are good reward rates through them as well. No FX fees are handy, and no annual fee. They have a marketplace on their platform where you can check out the places and deals that have extra rewards. I like their system but wish the accelerated rewards were places I shopped at more often.”

4. Scotiabank Gold American Express Card – 3 cards

Our first American Express card, and it’s not the one you think – it’s the Scotiabank Gold American Express Card. Members love earning Scene+ points.

“I want to go on a cruise and this card’s welcome bonus will give me $400 worth of points, which I can redeem for any travel charged to the card. My main grocery shopping is at Sobeys (which gets 6x points) and Walmart (which apparently gets 5x points), so my necessary spending will also go towards my trip. Scene+ is a super flexible rewards program so I don’t need to adjust my future travel to fit any constraints. When it’s time, I’ll just book my cruise and pay with points.”

“Point system is great, customer service isn’t the best!”

“Great return on food and groceries and a solid welcome bonus. I was actually surprised at how great the acceptance was too. It’s honestly never been a big deal for me.”

5. Triangle World Elite Mastercard – 3 cards

There are some Canadian Tire fans on the team, and 3 of them have the Triangle World Elite Mastercard. With big earn rates on Canadian Tire Money, it’s not a huge surprise this card is popular. One of our teammates has Triangle Select, meaning the earn rates are even higher.

“I like how quickly the Canadian Tire (CT) money racks up when using this card. I try to gas up as much as I can at Gas+ locations to collect as much CT money as I can. Especially now that they have Triangle Select, the CT money will rack up even faster. There’s not much to dislike about this card. The software/portal is very comprehensive and easy to use and feels modern. I also like the feature where we can automatically set the card to auto pay itself. I don’t ever have to worry about missing a credit card payment or paying high interest rates.”

“Those sweet CT dollars. 4% when shopping at CT or Marks + 3% back on groceries. Plus no annual fee.”

“I spend a decent amount at Canadian Tire/Sport Chek, and I earn tons of CT money at those stores. They are the only stores I use it at.”

6. American Express Cobalt Card – 2 cards

The best credit card in Canada makes its appearance a little lower than we expected – the American Express Cobalt Card. With this card, it’s all about the points.

“Tons of points. But it has a high annual fee and its user interface is a bit weird. Also I can’t seem to get a negative balance on it.”

“As someone who spends primarily on food, camera gear, and wants travel rewards to use for flights, the Cobalt’s food/drinks multiplier and the Amex points transfer flexibility makes it the perfect card.”

GC: $100

7. MBNA Rewards World Elite Mastercard – 2 cards

One of the best flexible rewards credit cards is carried by a few team members – the MBNA Rewards World Elite Mastercard. And it’s largely because of all the points you can earn.

“5x multiplier on food with Mastercard acceptance and easy redemption that includes statement credits.”

“I earn tons of points, it comes with excellent insurance, and I get a sweet bonus every year on my birthday.”

A side note to this card – we have a team member who wants it but MBNA is saying no.

“I don’t possess this credit card. But I like this credit card since it offers 5% cashback on groceries. But even though I had a credit score of 752, they rejected my application. I called them and they said they have no process of manually reviewing the application OR go to a bank where they can assist me. So they don’t have branches you can visit, and they can’t assist you on the phone. All you have to do is apply another time – accept if you’re rejected. :(“

8. Scotiabank Passport Visa Infinite Card – 2 cards

The Scotiabank Passport Visa Infinite Card is a popular card, but it’s only because of the first year free and having the Scotiabank Ultimate package.

“No fx fees and lounge access. I have the Scotia Ultimate Package and I don’t pay the annual fee on it. It’s the only reason I have it.”

“Like: no FX, use it while travelling. Dislike: Annual fee, will likely close before I pay the AF (Unless I switch to Scotia chequing for the annual fee waiver)”

9. TD Cash Back Visa Infinite Card – 2 cards

The TD Cash Back Visa Infinite Card has 2 owners, but both have some interesting things to say about it.

“The TD Cash Back Infinite card is kind of ‘meh’. I like that I know how much my cash back rewards are right in the app, but other than that, I don’t really know what the benefits of this card are. It has a high annual fee ($139), but my annual fee is rebated every year because I have the TD All-Inclusive Banking Plan. If I didn’t have this banking plan, I wouldn’t sign up for this credit card.

I feel like TD makes it very difficult to see what the rewards are with your credit card, and you have to jump through a bunch of hoops to see what is all available. I usually just use my cash rewards to pay off my monthly credit card balance when it gets to a high enough amount because I can’t be bothered.

It’s not something that I would overly recommend unless you are a loyal TD customer who uses your credit card for all of your purchases, and pays it off monthly. In fact, I have been contemplating switching banks altogether to a bank that offers better banking solutions and credit cards.

TLDR; I have an unimpressive, expensive credit card.”

“I only have this as it was the first card I had and I get the fee waiver with their All-Inclusive account. I’ve meant to change this to something else for ages, just haven’t gotten around to it. It was nice though when my car broke down so the one standout feature, roadside assistance, was helpful. The earn rates are otherwise average.”

10. TD First Class Travel Visa Infinite Card – 2 cards

Another TD card has 2 owners with the TD First Class Travel Visa Infinite Card. This time, both owners are pleased with what it offers.

“Usually redeem points for travel purchases, but I’ve also used points for Amazon purchases. I like that the annual fee is waived with TD All-Inclusive Banking.”

“I hadn’t been using this card much since Covid happened (because we weren’t travelling), but I’ve always enjoyed the travel perks. The travel insurance came in especially handy when we had to cancel our trip to Cuba in March 2020. The earn rates are pretty sweet too, which I was reminded of when we booked our London trip with it this year. Still worth the annual fee, even if I only use it a few times per year.”

11. American Express Aeroplan Reserve Card

The rest of the cards only appear in 1 wallet. The American Express Aeroplan Reserve Card is the only Aeroplan-branded credit card to make an appearance, and it’s largely because of the Air Canada benefits.

“As someone who has 300K+ Aeroplan points, it helps me make the most of them when I go to redeem them.”

GC: $150

12. American Express Gold Rewards Card

The American Express Gold Rewards Card is popular with one team member, who describes it as a unique credit card.

“Multipliers on categories that aren’t covered by my other cards like drugstores and travel. The point value and flexibility of Amex Membership Rewards is also unmatched. Also has included lounge visits and decent travel perks without a $600+ annual fee.”

13. BMO CashBack Mastercard

The BMO CashBack Mastercard is an excellent no fee card, but this team member doesn’t like the caps.

“Grocery cash back 5% for the first 3 months and 3% thereafter on groceries. No annual fee. Good for newcomers since you’ve no credit score. What I don’t like about this card – 5%/3% cashback on groceries is capped at max $500 spending. Good for newcomers but you’ll feel like changing the card after 6 months once you’re settled in here.”

14. BMO CashBack World Elite Mastercard

One of the best cash back credit cards is praised for rewards on groceries and that their cash back can be redeemed when they want with the BMO CashBack World Elite Mastercard.

“I use it for pretty much everything non-travel related. The welcome bonus was fantastic, and the earn rate for groceries is my favourite part. I also really enjoy that the cash back can be redeemed whenever I like.”

15. CIBC Aventura Visa Card

A few CIBC Aventura cards are owned by team members. Here’s what one had to say about the CIBC Aventura Visa Card.

“I got this one pre-pandemic, so travel rewards were more important to me (I was travelling a LOT). I use it for most of my day to day purchases. It’s fine. I don’t love it, I don’t hate it. Their customer service was fantastic when my card was stolen and used fraudulently though. It was a super painless process to clear the charges, and they notified me of the fraud before I even knew my card was gone.”

16. CIBC Aventura Visa Infinite Card

Then there’s the CIBC Aventura Visa Infinite Card, and this team member finds the points useful.

“Not my fave card, but I’ve had it for a very long time. The Aventura rewards points are really useful, and I use them to book hotel stays at least once or twice a year. However, the app is annoying and occasionally the card doesn’t work for things like bills or internet purchases for no real reason.”

17. CIBC Classic Visa Card

The CIBC Classic Visa Card is the most basic of credit cards – no fees, no rewards, standard interest rates, minimal insurance. So why does someone have it? Here’s why.

“I honestly don’t even know why I have this card. It just sits there collecting dust. Thanks for reminding me that I should get rid of it.”

18. CIBC Costco Mastercard

Costco is a major retailer with their own credit card. And the World version of the CIBC Costco Mastercard is owned by one team member, and it’s mostly used for gas at Costco.

“My husband uses it at Costco gas stations. Or when we eat out. Those are the only options for the 3% cash back. No annual fee, easy to redeem. Mostly use it for convenience at Costco gas stations.”

19. CIBC Dividend Visa Card

Quite a few CIBC cards appear, the last one being the no fee CIBC Dividend Visa Card. This team member is looking to upgrade or add to their wallet to supplement what it offers.

“I bank at CIBC so I like that it’s connected to my other accounts. I also like that it doesn’t have an annual fee. I use it for online purchases, subscriptions, and groceries (the cash back on groceries is nice). Otherwise, it’s pretty basic. I’d like to get another card with rewards or upgrade to a different CIBC Visa but I’m still deciding.”

20. Marriott Bonvoy American Express Card

Getting a free hotel night every year is a key benefit to having the Marriott Bonvoy American Express Card, as this team member attests to.

“I got this card when I was in a long distance relationship because it gives you 1 free hotel night a year, which was definitely worth it. Now that the relationship is no longer long distance, I’m going to cancel this card before the next time I’m charged an annual fee.”

21. MBNA True Line Mastercard

Credit card debt doesn’t elude everyone, even on the CCG Team. And one team member has the MBNA True Line Mastercard for one reason only.

“0% for 12 months, baby. Nuff said.”

22. RBC Cash Back Mastercard

Not every card is in a wallet because it’s well loved. Here’s a brutally honest take on the RBC Cash Back Mastercard.

“The only good things about this card are that it has no annual fee (so I can have a backup Mastercard) and that I save money at Petro Can.

Otherwise it’s trash and I’m looking to replace it with something else. I have an RBC account too so it’s convenient, but I barely ever use this card. Especially now that gas is so expensive that I drive down to the States and fill up jerry cans, saving a lot of money.”

23. RBC ION Visa

One of RBCs newest credit cards is owned by the team, the RBC ION Visa, which they own purely for emergency reasons.

“I don’t use this, it’s my ‘in case of emergencies’ card.”

24. RBC Signature Rewards Visa

The RBC Signature Rewards Visa is no longer available to new members. And here’s what was said about this legacy card.

“No really good perks to it. This is just a backup card in case of emergencies.”

25. Scotia Momentum Visa Infinite Card

The Scotia Momentum Visa Infinite Card is an excellent credit card for those who spend lots on groceries, especially if you shop frequently at Loblaws where Amex cards aren’t accepted.

“Cash back is solid, I mostly do groceries at Loblaws so Amex isn’t a great fit for me. The app is really good as well. Insurance is decent and the welcome bonus/FYF is nice.”

26. Scotia Momentum No-Fee Visa Card

The Scotia Momentum No-Fee Visa Card is a no fee card that Scotiabank can open up to newcomers. Suffice to say, our team member is not impressed with it.

“I don’t like anything about this card. The only reason I took it was because I wanted to keep 2 credit lines to build my credit score. It’s a garbage credit card. The only good thing about this – it is no annual fee and can be issued to newcomers – doesn’t matter how bad your credit score is. Every newcomer I know in Canada has it. :D”

27. Scotiabank Scene+ Visa Card

The Scotiabank Scene+ Visa Card is an excellent no fee card. One member got the student version as their first credit card. After finishing school, they were switched to the regular version, which she still has today.

“My very first credit card was the Scotiabank Scene+ Student Visa, which was automatically converted into the no fee normal version after I finished school. Since this is my oldest credit account, I keep it around to help with my average credit age. I put my phone bill on there to keep the account active every month and use it whenever I happen to go to the theatre.

I used to work at the theatre and I earned so many Scene+ points with this card that I didn’t have to pay for a movie in probably a decade. I’ve finally worked my way through all the points and don’t use the card as often anymore, but in its heyday, it was a very nice way to get free movies.”

28. Scotiabank Value Visa Card

The only other low interest card to show up on our list is the Scotiabank Value Visa Card. Our team member got it when he first came to Canada, and really doesn’t like it anymore.

“It served a purpose as my first credit card in Canada. It had low interest at first. Now I just find it to be super mediocre, and its annual fee is slightly annoying.”

29. TD Cash Back Visa Card

The last card on our list is the TD Cash Back Visa Card, which is really only around as the member’s oldest credit card.

“Dislike: everything

Like: it’s my oldest card and no fee, so keep it open for that reason.”

What the most popular creditcardGenius Team cards have to offer you

So those are what the team carries. For the 5 most popular cards, here’s what they have to offer.

| Credit Card | Welcome Bonus | Earn Rates | Annual Fee, Income Requirements | Learn More |

|---|---|---|---|---|

| KOHO Easy Mastercard | None | * 1% cash back on all groceries and transportation | * $0 * None |

|

| Tangerine Money-Back Credit Card | 10% extra cash back for the first 2 months (terms) | * 2% cash back on purchases in up to 3 Money-Back Categories * 0.5% cash back on all other purchases |

* $0 * $12K personal |

Learn More |

| Brim Mastercard | None | * 0.5% cash back on all purchases |

* $0 * $15K personal |

Learn More |

| Scotiabank Gold American Express Card | Up to 45,000 bonus points, first year free (terms) | * 6 Scene+ points per $1 spent at Sobeys, Safeway, FreshCo and more * 5 Scene+ points per $1 spent on groceries, dining, and entertainment * 3 Scene+ points per $1 spent on gas, select streaming services, and transit * 1 Scene+ point per $1 spent on foreign currency purchases * 1 Scene+ point per $1 spent on all other purchases |

* $120 * $12K personal |

Learn More |

| Triangle World Elite Mastercard | None | * 4% CT Money at Canadian Tire stores * 3% CT Money on grocery store purchases * 1% CT Money on all other purchases * Collect 5 cents CT Money per liter on reg/mid grade fuel, or 7 cents on premium fuel at Gas+ and Husky stations |

* $0 * $80K personal/$150K household |

Learn More |

1. A top no fee prepaid card

Please note the KOHO Easy Mastercard is no longer available to new customers.

The KOHO Easy Mastercard is an excellent prepaid credit card. For our team members that have it, it’s primarily a secondary card. It’s a little lacking in the rewards department but has other features people love.

For rewards, you'll earn 1% cash back on all groceries and transportation – decent, but somewhat limiting (this is why it's a secondary card).

For no fee, it offers more. First, there’s the lower foreign exchange fee of 1.5%, lower than the typical 2.5% fee.

It also functions as a savings account. When you set up a direct deposit to your card, you’ll earn 4% on your balance.

Finally, if you need help improving your credit score, you can opt-in to Credit Building. For $10 per month, KOHO will report to one of the bureaus you’re making your payments on time, and within 6 months, you’ll see your score improve.

If you want more from your KOHO card, you can upgrade anytime for a monthly fee. Here are the other KOHO cards.

2. An excellent companion credit card

The Tangerine Money-Back Credit Card and its twin the Tangerine Money-Back World Mastercard were popular among team members mostly as complementary cards.

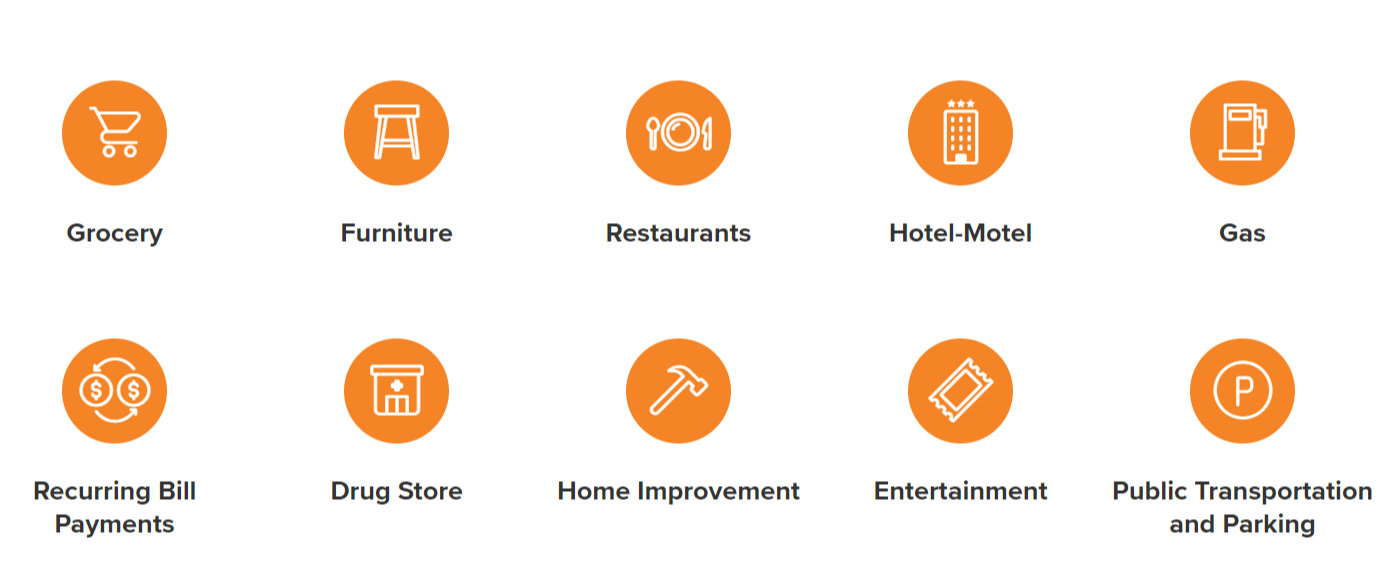

What makes it an excellent complementary card? It’s the rewards. You get to decide which categories earn you 2% cash back, from a list of 10.

You get to pick 2 if your rewards are applied as a statement credit, or 3 if you send them to a Tangerine Savings account. You’ll earn 0.5% cash back on all other purchases.

The differences between the 2 Tangerine Mastercards? The extras and income requirements. With the World version, you’ll get:

- 2 extra insurance coverages (including mobile device insurance),

- World Mastercard benefits, and

- Mastercard Travel Pass membership (no free passes).

To get access, you’ll need to have either a personal income of $60,000 or a household income of $100,000 to qualify, or be invited to upgrade if you have the Tangerine Money-Back Credit Card.

3. One of the best no fee credit cards

Another card that largely made our listing as a secondary card, the Brim Mastercard checks a few boxes.

For rewards, you’ll earn a simple 0.5% cash back on all purchases. But there’s more to the rewards. You’ll also get:

- no foreign exchange fees,

- bonus rewards with Brim retailers like bonus Plum Points from Indigo, and

- 4 types of insurance.

All of this is for no annual fee.

4. A top flexible rewards credit card

When it comes to the most popular primary credit card used by the creditcardGenius Team, it’s the Scotiabank Gold American Express Card.

It’s not hard to see why – it’s a well-rounded credit card that excels in many departments.

First, here’s what you’ll earn for rewards:

- 6 Scene+ points per $1 spent at Sobeys, Safeway, FreshCo and more

- 5 Scene+ points per $1 spent on groceries, dining, and entertainment

- 3 Scene+ points per $1 spent on gas, select streaming services, and transit

- 1 Scene+ point per $1 spent on foreign currency purchases

- 1 Scene+ point per $1 spent on all other purchases

That makes for plenty of rewards. Based on spending $2,000 per month, that translates to earning around 88,200 points per year.

What can you Scene+ points for? Here are your top 4 options, with each giving the same value for those points – $882

- travel,

- Cineplex products,

- groceries at Sobeys and Safeway, and

- Recipe Unlimited restaurants.

It also includes these other benefits:

- no foreign exchange fees,

- 12 types of insurance, and

- access to Amex benefits like Amex Offers and Front Of The Line.

The annual fee is a standard $120 and it has a low income requirement of only $12,000 personal.

5. A top flexible rewards credit card

We have some Canadian Tire fans here at CCG. So it’s no surprise that a few members have a Triangle Mastercard, specifically the Triangle World Elite Mastercard.

For some, it’s a primary credit card. For others, it’s a secondary card that only gets used at Canadian Tire (and other CT stores like Sport Chek).

Here’s what it earns users for Canadian Tire money on all purchases:

- 4% CT Money at Canadian Tire stores

- 3% CT Money on grocery store purchases

- 1% CT Money on all other purchases

- Collect 5 cents CT Money per liter on reg/mid grade fuel, or 7 cents on premium fuel at Gas+ and Husky stations

The insurance is just passable for a World Elite Mastercard, including 3 types.

But, it offers a rare perk – free roadside assistance. And it’s all for no annual fee, but has high income requirements of either $80,000 personal or $150,000 household.

Number of credit cards carried by each person

One last question you may ask – how many credit cards does everyone carry?

Here’s the summary:

Almost everyone carries at least 2 cards, with some having 5 or more.

What credit cards do you carry?

We’ve shared with you what we have in our wallets.

What about you? What credit cards do you have?

Let us know in the comments below.

FAQ

What is the most popular credit card carried by the CCG team?

There are 2 credit cards that were carried by the CCG team as complementary credit cards. They are the KOHO Easy Mastercard and the Tangerine Mastercards.

What are some other popular credit cards carried by the CCG team?

Some other popular credit cards used by the creditcardGenius team include:

- Brim Mastercard

- Scotiabank Gold American Express Card

- Triangle World Elite Mastercard

How many credit cards does the average CCG team member carry?

The average team member carries between 2 to 3 credit cards.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×2 Award winner

×2 Award winner

$100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

$100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 1 comments