Showing 496 articles in the ‘Credit Cards 101’ category

How To Calculate Debt To Income Ratio

Debt-to-income ratio is your monthly debt payments divided by your gross monthly income. It helps lenders understand how much you can afford to repay on a loan.

What Is An MTO RUS-SO eChannel Charge On My Credit Card?

Charges from the Ministry of Transportation of Ontario (MTO) show up on your credit card statements as MTO RUS-SO eChannel. Don’t worry; they’re not likely fraudulent.

How To Maximize The Best Western Rewards Program

Best Western Rewards lets you earn free nights and other travel redemptions with no blackout dates – and you can transfer them to Aeroplan and Air Miles.

How To Maximize The Scene+ Points Program

Scene+ is a flexible rewards program with 4 equally high-paying redemption options. With so many places to earn (and redeem) points, here's a guide on how to maximize them.

The Best 0% APR Credit Cards In Canada

0% APR credit card offers help you save on credit card interest, though these offers are few and far between. The best option is the MBNA True Line Mastercard.

Your Guide To The Elusive Amex Black Card

The Amex Black Card is the most exclusive card and is by invitation only – but more common alternatives include the Amex Platinum Card and RBC Avion Visa Infinite Privilege.

How To Maximize Your Canadian Tire Triangle Rewards

Triangle Rewards is the rewards program for all Canadian Tire stores, including Mark's and Sport Chek. Here's how you'll earn rewards, where you'll earn them and how to redeem.

How To Protect Your Credit Score During A Recession

Worried about your finances during a recession? Learn how to protect your credit score during a recession with practical tips on managing debt, staying current on payments, and avoiding common financial pitfalls during rough times.

How To Maximize The Marriott Bonvoy Rewards Program

Earn Marriott Bonvoy points at 7,000+ hotels and redeem them on free hotel stays, shopping, and travel for an average value of 1.24 cents CAD per point.

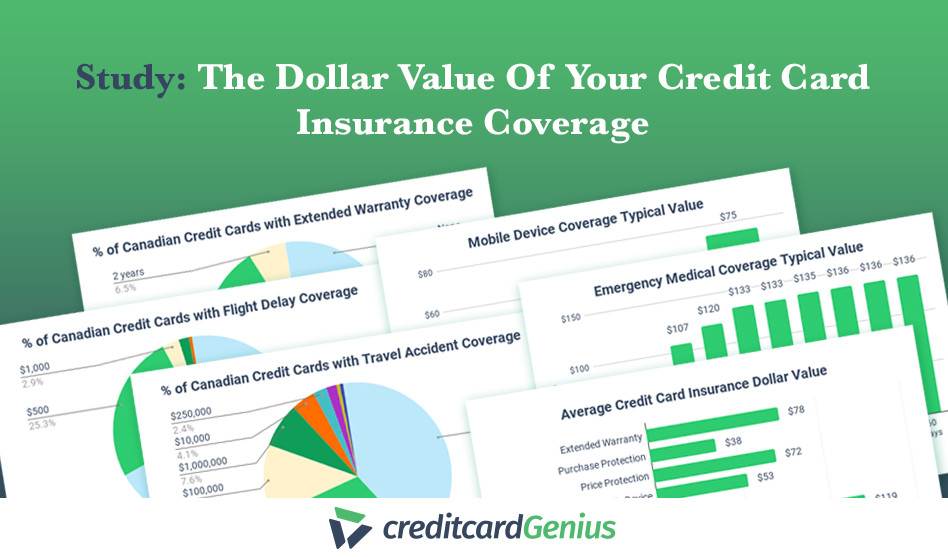

Study: How Much Is Your Credit Card Insurance Worth?

There are 17 types of credit card insurance available in Canada, the most valuable and useful of which is rental car theft and damage.

GC:

GC: