Looking to keep your rewards simple and straightforward? How do flat earn rates and fixed point values sound? You’ll always know what you’re earning and how much every point is worth

Brim Financial offers the Brim Rewards program with all 3 of their credit cards. You’ll not only be able to earn a steady stream of points on your everyday purchases, but also bonus points when you shop with Brim’s large selection of retail partners.

Curious to know more about what the program offers? Everything you need to know is here.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Brim Financial Rewards at a glance

| Value of a Brim Rewards point: | * 1 cent per point (CPP) |

|---|---|

| Ways to redeem Brim Rewards points: | * Statement credits – 1 (CPP) |

| How to earn Brim Reward points: | * 3 credit cards * Brim Financial eShop * Brim Mastercard inCard offers |

| Who these rewards are good for: | * Value shoppers |

| Frequently Asked Questions: | * Level of flexibility? High * How to earn Brim Rewards * Do rewards expire? No * Is there a way to earn rewards faster? Yes * Can rewards be transferred to other programs? No |

Are you getting the most value from your rewards?

Value of a Brim Rewards point

When it comes to the value of a Brim Rewards point, it’s simple and straightforward.

There’s only one way to redeem your points, with the same value every time you go to redeem – 1 cent per point.

Redeem Brim Financial Reward points for statement credits – 1 CPP

When it comes to redeeming your points, there are only statement credits at your disposal.

100 points will give you $1 in savings, a value of 1 cent per point. This means you get the same value out of your points as a normal cash back credit card.

And, provided your account is always maintained in good standing, your points will never expire.

There are 2 different ways you can go about getting your statement credits.

Redeem points towards any purchase

Your first option is to redeem your points towards any purchase you put on your card.

In the Brim Financial app (available on both iOS and Android), simply swipe right on any purchase, and apply your points. You’ll then be able to select how many points you want to redeem, up to the transaction amount.

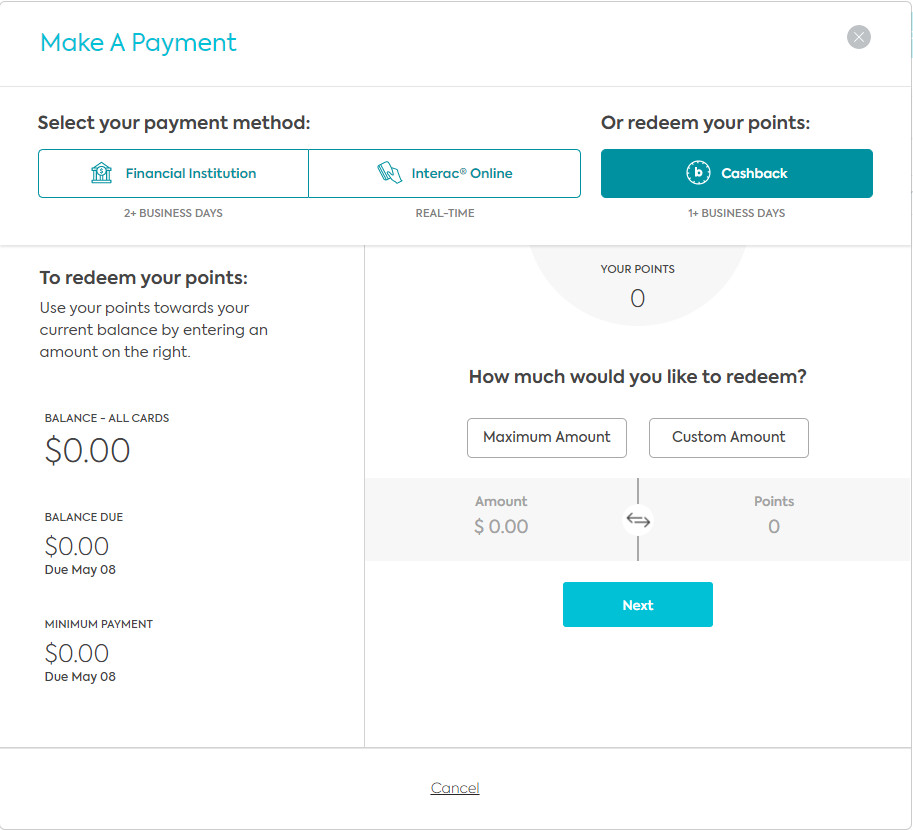

Redeem points towards your total balance

The other way to use your points is to simply redeem them against your total account balance.

Log in to your online banking, and click on make a payment.

Click on cash back, and you can enter in how many points you want to use, up to your account balance.

Just keep in mind it could take 1 or more business days to complete the points transfer.

How to earn Brim Financial points

So how do you go about actually earning Brim Financial points?

There’s only one way – by having a Brim Financial Mastercard.

However, there’s more ways to earn points than just your credit card’s base earn rate. Brim has partnered with over 150 retail partners you can earn bonus points with as well.

Brim Financial Mastercards

First, let’s go over the basics of Brim’s Mastercards. There are 3 choices, with varying base earn rates and annual fees.

| Brim Financial Credit Card | Welcome Bonus | Earn Rate | Annual Fee, Income Requirements | Apply Now |

|---|---|---|---|---|

| Brim Mastercard | Up to $200 after your first purchases at participating retailers (terms) | * 1 point per $1 spent on all purchases | $0 | Apply Now |

| Brim World Mastercard | Up to $300 after your first purchases at participating retailers (terms) | * 1.5 points per $1 spent on the first $25K in annual spend * 1 point per $1 spent after that |

$99 | Apply Now |

| Brim World Elite Mastercard | Up to $500 after your first purchases at participating retailers (terms) | * 2 points per $1 spent on the first $25K in annual spend * 1 point per $1 spent after that |

$199 | Apply Now |

Perks common to all Brim Mastercards

Before getting into the cards themselves, these cards all share several features in common, besides the rewards program.

In fact, the only differences between the cards are:

- earn rate,

- annual fee,

- insurance coverage, and

- welcome bonus.

Here is what every Brim Mastercard offers.

No foreign exchange fees

Every Brim Mastercard offers no foreign exchange fees. Save yourself the typical 2.5% fee other credit cards charge just for making purchases in a currency not in Canadian dollars.

Brim Installment plans

For larger purchases over $500, you can activate Brim Installment plans. Simply select your purchase and the length of your plan, and you’ll save over traditional credit card interest rates.

There is a one time fee of 7% of the total transaction, and a monthly fee of 0.475% of the original purchase as well.

Mobile device and event ticket cancellation insurance

All Brim cards come with good insurance coverage. And they provide 2 of the rarest types of coverage – mobile device and event ticket cancellation.

Get free coverage for one of the most important things you own, and rest assured knowing that any event you have tickets to can be refunded back to you if you can’t make it for a covered reason.

Now, here’s what each card offers for rewards.

Brim’s no fee offering, the

And by shopping with a few select Brim participating retailers, you can accumulate as much as $200 in one-time bonus rewards.

Next up is the

And as for a welcome bonus, you can earn up to $300 in first-time bonuses with select Brim retail partners.

Finally there’s Brim’s premium offering – the

You’ll earn 2 points per $1 spent on your first $25,000 in annual spend (1 point per $1 afterwards).

You can also earn up to $500 in one-time bonuses with select Brim retailers.

Just note the high annual fee of $199.

Brim Rewards eShop

In addition to the card’s base earn rate, there are 2 other ways to earn even more points.

First up is the Brim Rewards eShop.

There are over 90 online retailers featured through the eShop.

Related: Online Shopping: Best Credit Cards For Earning Cash Back And Saving On Foreign Transaction Fees

How the eShop works

To use the eShop, you’ll have to first log in to your account, either through the mobile app or through a web browser.

After logging in, click “Rewards” and the eShop.

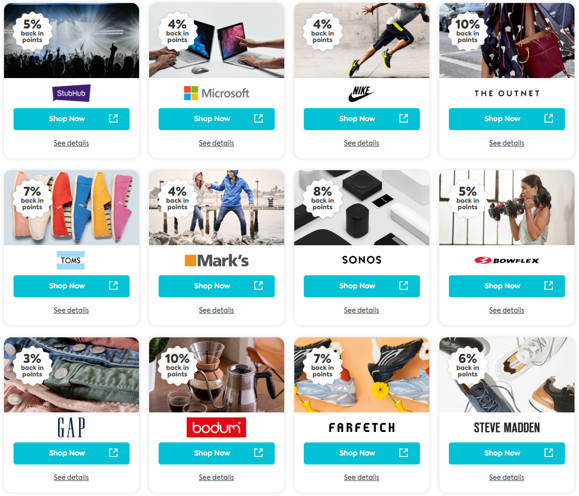

You’ll be able to scan the available retailers, and what they are offering in points.

To shop at one of them, simply click on the “Shop Now” link, and you’ll be taken to the merchant’s site, where you’ll be able to make your purchase.

Here’s an example of some of the merchants available, and what kind of earn rates you could see with them.

You can earn anywhere from 3% to 40% back on your purchases. However, most retailers will give you about 10% back in points.

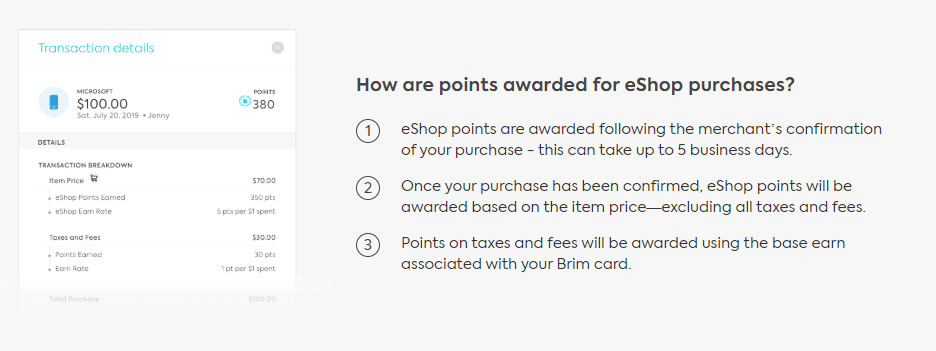

How you earn points

Pay with your Brim Mastercard, and you’ll earn the stated bonus earn rate on the pre-tax amount. For this portion, you’ll be forgoing your card’s base earn rate.

However, on the taxes you pay, you’ll earn your card’s base earn rate.

For example, if you had the base Brim Mastercard and made a $100 purchase with an extra $13 of taxes at a retailer who was offering 10% back, here’s how the calculation would work out:

Price: $100 x 10 points per $1 = 1,000 points

Taxes: $13 x 1 point per $1 = 13 points

Total rewards: 1,013 points

Just make sure to use the links on your eShop portal, or you’ll simply be earning the base earn rate, regardless of the retailer you’re shopping with.

Here’s an example of how it’s calculated.

Brim Rewards inCard offers

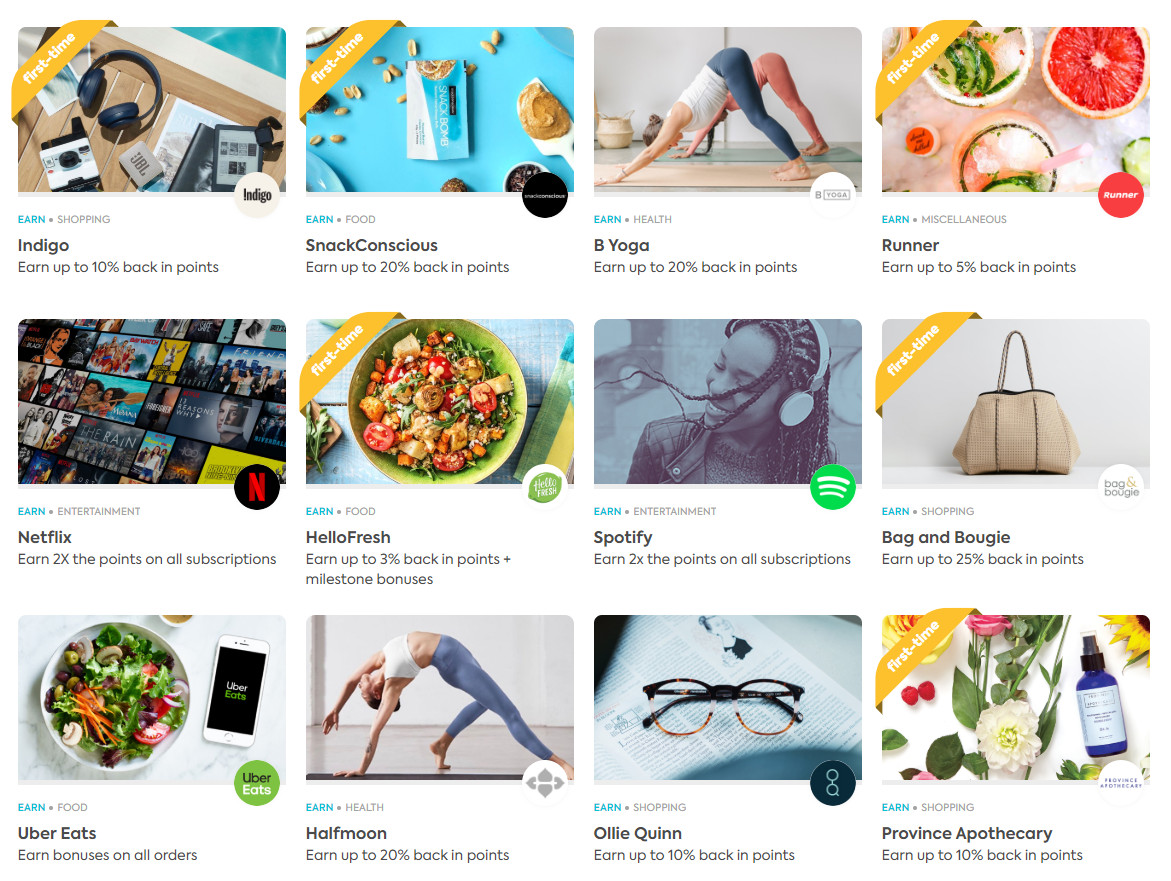

Your Brim Mastercard also has offers from retailers that are embedded with your card. Simply use your card either online or in store (depending on the retailer), and you’ll automatically be earning your bonus rewards without having to use a separate link.

To see what inCard offers you have, sign in to your account, go to the Brim Rewards section, and click on inCard.

You’ll see all the various merchants available. Here are some examples:

If you see “first-time” on a merchant, it will count towards your welcome bonus the first time you use your Brim card with that retailer.

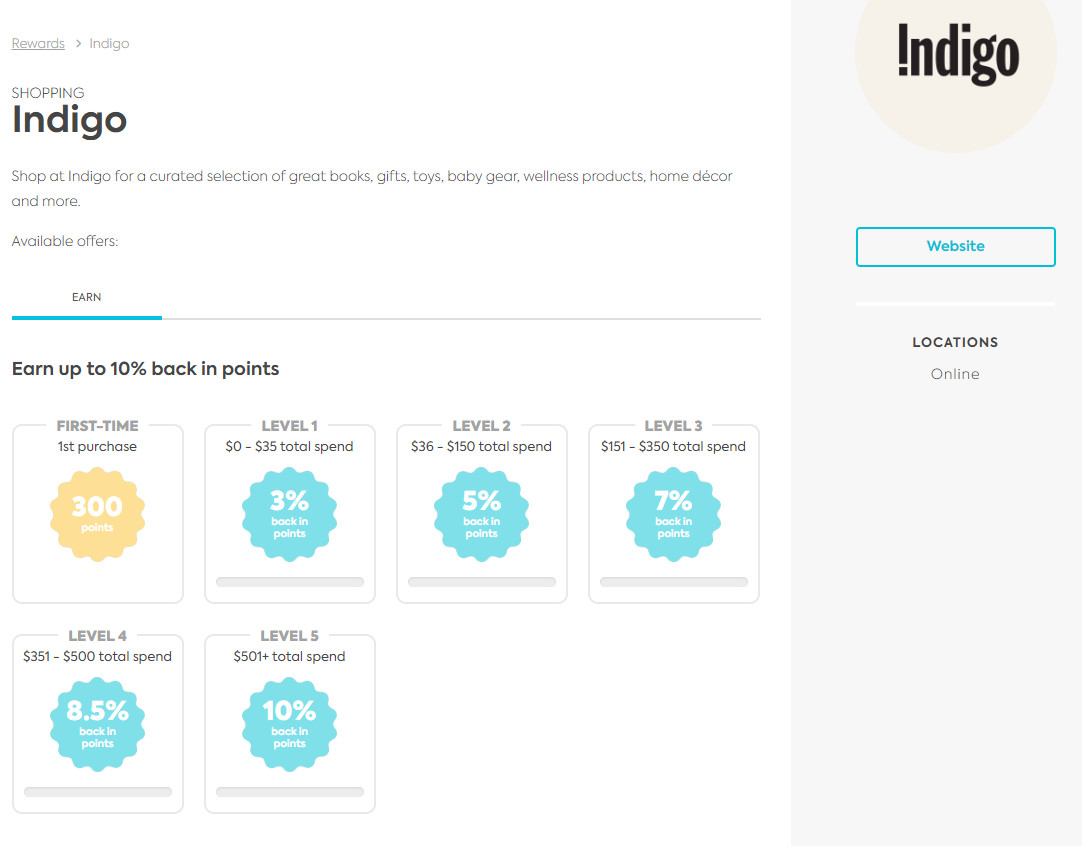

Brim Rewards inCard merchant levels

Besides not needing links, there’s one other advantage to inCard offers.

Many of these merchants have levels, where the more you spend with them, the more you will earn back.

Here’s an example of the kinds of tiers available with Indigo:

Spend enough, and you can be earning 10% on all your Indigo purchases.

Just note that you can only earn bonus rewards with Indigo online (as shown under locations).

Frequently asked questions about Brim Rewards

Here are some frequently asked questions about the Brim Rewards program.

How flexible are Brim rewards?

These are very flexible rewards. While there aren’t many options to use your points, you can use them to pay for any purchase charged to the card.

How can I earn Brim Rewards?

To earn Brim Rewards, you’ll need a Brim Mastercard. You can earn Brim points 3 ways:

- Brim Mastercard base earn rate,

- Brim Rewards eShop, and

- your Brim inCard offers.

Do Brim Rewards Expire?

No. Provided your account is in good standing, your rewards will never expire.

Is there a way to earn Brim Rewards faster?

You can earn Brim Rewards faster by shopping with the Brim eShop and with inCard offers.

Can Brim Rewards be transferred to other programs?

No, the only way to use Brim Rewards is by getting statement credits.

A simple, easy to understand program

Brim Financial has provided a simple, straightforward program that is easy to understand.

And with 3 great credit cards, and plenty of opportunities to earn bonus points with participating retailers, you’ll be raking up the points in no time.

What are your thoughts on Brim Rewards?

Let us know in the comments below.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.