A new player in the Canadian credit card market, Brim Financial offers a unique product with some uncommon features.

One of those is shopping with Brim's retail partners. You can earn up to 40% in bonus rewards simply by shopping with the right retailer.

How does it work? How does it compare with other shopping portals? Here are the answers to those questions.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What is Brim?

First, what is Brim Financial? It's a relatively new player to the Canadian credit card market, first launching in 2018.

The issuer offers a suite of 3 credit cards, each coming with many unique features not found on other credit cards.

Some of these features include:

- installment plans,

- event ticket protector insurance,

- plenty of enhanced security,

- no foreign exchange fees, and

- access to Brim retail partners.

Brim Rewards partners

One of those unique features are their rewards partners. There are over 200+ retail partners you can earn extra rewards with.

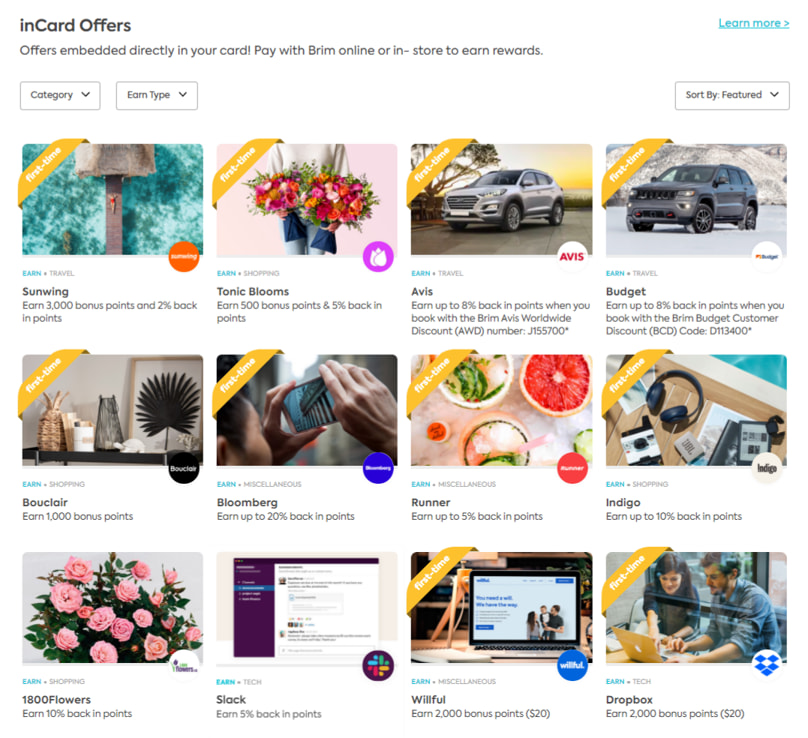

Here's a small sampling of some of the retailers partnered with Brim.

When shopping with these partners, you'll earn bonus rewards on your purchases.

But there's one big point to note – you'll also forgo your card's regular earn rate when you earn these bonus rewards.

Earning bonus Brim rewards

There are 2 kinds of Brim reward partners – inCard offers and eShop offers.

For inCard offers, all you have to do is ensure you make your payment with your Brim Mastercard, and you'll automatically earn bonus rewards. You can take advantage of these offers either in-store or online – the choice is yours.

Here are some of their inCard partners, and what you can expect to see for rewards (all screenshots are for a base Brim Mastercard).

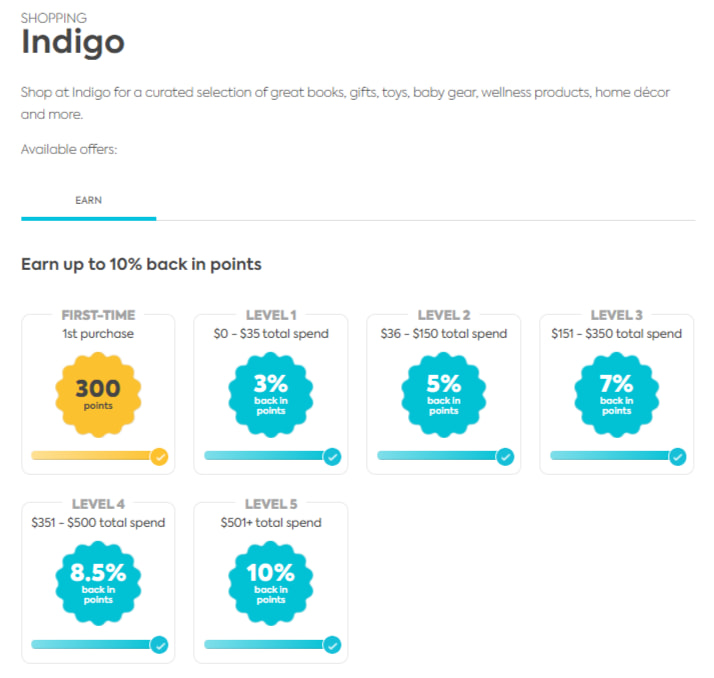

Many inCard partners increase the rewards you earn the more times you shop with them.

Take Indigo as an example. As you spend more, the rewards you get back increase:

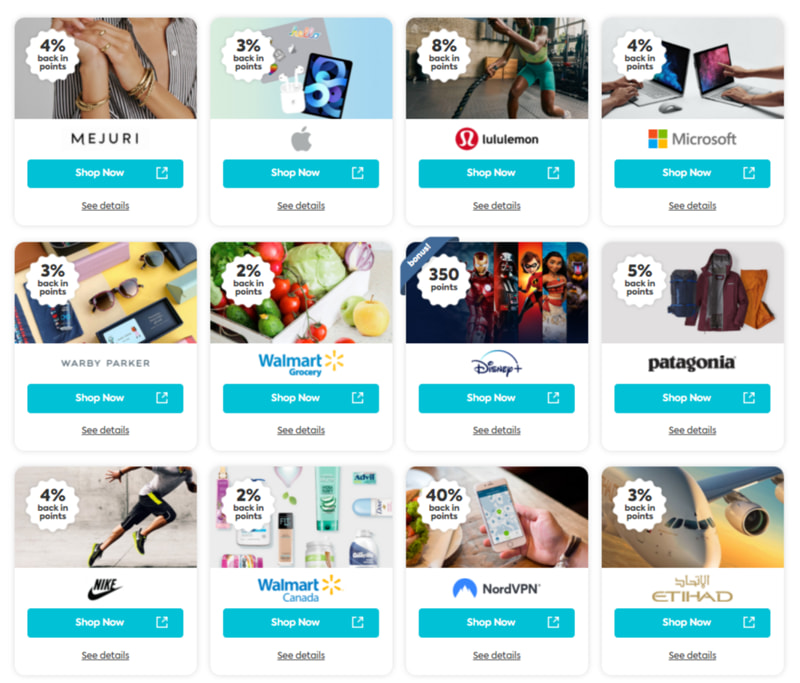

The other kind of offers are eShop. With these offers, you can only use them when shopping online.

Here's a sampling of their eShop offers:

And to get your bonus rewards with an eShop offer, you need to use a special link to access the website. These links can be found by signing in to your Brim account. Once you've clicked through the link, complete your shopping as normal and use your Brim Mastercard as payment (and make sure not to close your browser window or you may lose your session).

After your points are in your account, you can use them to help pay for any purchase charged to your card.

Want to see the full list of partners? Unfortunately, the full list isn't made public – the only way to see them is by having a Brim account.

But as you can see from our screenshots, you can earn at least 1% bonus cash back, with a few retailers offering an amazing 40% back on your purchases.

Comparing Brim to Rakuten and Air Miles Shops

But Brim isn't the only company with an eShop.

Here's a quick overview of 2 others – plus how they compare head-to-head with Brim.

Rakuten Canada

Rakuten Canada is one of the most popular cash back websites in the country and has a long list of partners you can earn rewards with while shopping.

You get your rewards paid out 4 times per year, either through a cheque, PayPal, or Amazon gift card.

Air Miles Shops

One of Canada's largest rewards programs has its own online shopping portal – airmilesshops.ca. For the most part, you'll earn 1 mile for every $20 spent.

Offering Air Miles on your purchases, here are your various redemption options, and what each mile is worth:

Generally speaking, using your miles for flights offers the best value for your rewards.

Want to learn more?Here's our full guide to Air Miles Shops.

Comparing rewards earned

So let's get to the good stuff – comparing these 3 rewards programs.

We've picked out 6 retailers common to all 3 programs, so we can see who offers the most rewards.

A couple of points to note:

- We've added 1% to the Air Miles and Rakuten earn rates, since you can use your Brim card with these sites and earn additional rewards (which isn't the case at Brim partners).

- If the Brim partner was an inCard offer, we chose the level you earn when spending $100.

- For Air Miles, we'll use our standard value of 17.2 cents per mile when redeeming for flights.

Here's what the numbers showed us:

| Retailer | Brim Earn Rate | Rakuten Earn Rate | Air Miles Earn Rate | Winner |

|---|---|---|---|---|

| Old Navy | 2% | 3% | 1 mile per $20 (1.86%) | Rakuten |

| Indigo | 5% | 3% | 1 mile per $20 (1.86%) | Brim |

| Microsoft | 4% | Up to 4.5% on select products | 1 mile per $20 (1.86%) | Brim (as Rakuten is only on select products) |

| Apple | 4% | Up to 3% on select products | 1 mile per $20 (1.86%) | Brim |

| Levi's | 4% | 3.5% | 1 mile per $20 (1.86%) | Brim |

| Amazon | 2% | Up to 2% on select products | 1 mile per $20 (1.86%) | Brim |

| Average Earn Rate | 3.5% | 3.17% | 1.86% | Brim |

On average, Brim does provide the best overall rate. And unlike a few of the shops we've seen with Rakuten, you're generally not limited to certain products.

But as seen, it can pay to take a look and see what everyone is offering. And not all stores you may want to shop at are found on all 3 sites, so it could be a good habit to check all your options before committing to a purchase.

In fact, we had a difficult time finding 6 we could easily compare. If you really want to maximize your cash back earnings when shopping online, you'll likely need to check a few sites to cover all the retailers out there.

Brim Financial Mastercards

So what does Brim offer for Mastercards? They have 2 levels, with the only differences between them being the rewards on purchases, insurance coverage, and annual fees.

| Brim Mastercard | Earn Rate | Annual Fee, Income Requirements | Apply Now |

|---|---|---|---|

| Brim Mastercard | * 0.5% cash back on all purchases | * $0 * $15K personal | Apply Now |

| Brim World Elite Mastercard | * 1% cash back on all purchases | * $89 * $80K personal/$150K household | Apply Now |

1. The no annual fee Brim Mastercard

First up, the no annual fee option – the

With this card, you'll earn 0.5% cash back on all purchases. Simple.

On top of that, you'll also get 4 types of insurance.

2. The high-end Brim Mastercard

Brim's premium level card is the

For a high annual fee of $89, you'll earn:

- 1% cash back on all purchases

On top of that, it also comes with a stunning 12 types of insurance, most of any credit card.

Final word

The Brim Rewards program has a lot to offer with their retail partners. There are a wide variety of partners to choose from, providing plenty of bonus rewards.

Have you shopped with Brim's partners before? What has your experience been?

Let us know in the comments below.

FAQ

How many retail partners does Brim Rewards have?

Brim has quite a few partners, with more than 200 to choose from. You can either earn rewards through their inCard partners, which apply automatically, or through their eStore shopping portal, where you use a special link to get your bonus.

How does Brim compare to Rakuten?

Brim compares quite favourably to Rakuten. Based on a comparison of a few stores, Brim has a slight edge in total rewards that can be earned.

How does Brim compare to Air Miles Shops?

Brim provides much more for rewards when compared to Air Miles. Air Miles typically only offers 1 mile per $20 spent, which only translates to an average of 1.86% return, while Brim's average was 3.5%.

What is the best Brim Mastercard?

The best Brim Mastercard is the Brim World Elite Mastercard, which earns up to 2% cash back on purchases and comes with 12 types of insurance.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.