There’s a good chance you’ve been to a Shoppers Drug Mart. With plenty of locations all across Canada, it’s not hard to see the appeal of them.

So what does Shoppers have to offer? What are the best credit cards to use? And how do their prices compare to other drugstores?

The answers to these questions are here.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Intro to Shoppers Drug Mart

Canada’s largest chain of drugstores, Shoppers Drug Mart, operates locations in all Canadian provinces (in Quebec, they’re called Pharmaprix), as well as in the Northwest Territories and Yukon.

Shoppers Drug Mart used to be an independent chain, but was purchased by Loblaws in 2014, and folded into the Loblaws family of companies.

Shoppers Drug Marts Canada operates full pharmacies, as well as many other typical products found at drugstores. There’s not only regular drugstore products such as shampoo, toothbrushes, and basic first aid supplies, health products, but also dry and frozen foods, dairy and eggs, and small electronics sections.

Certain locations also include full beauty sections, a Canada Post outlet, and photo centres.

Find your nearest Shoppers Drug Mart

With over 1,300 locations in Canada, it won’t be hard to find a Shoppers Drug Mart pharmacy near you.

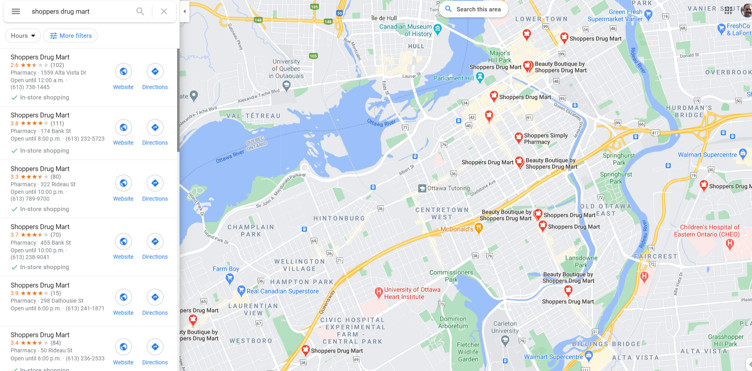

The easiest way is to head over to trusty Google Maps. Simply enter Shoppers Drug Mart (or Pharmaprix if you’re in Quebec) to see what is nearest to you.

Here’s the Shoppers locations in the Ottawa area.

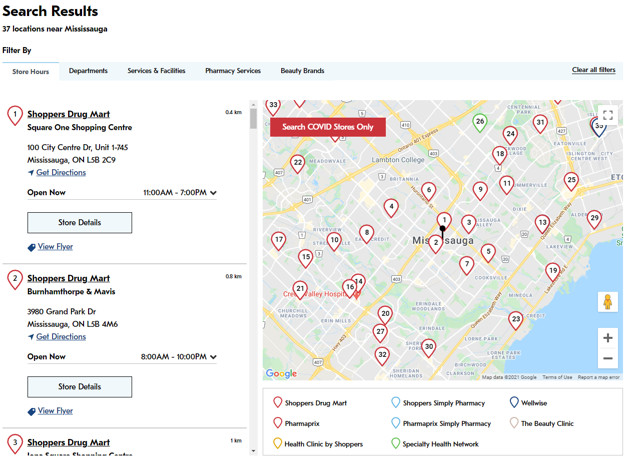

If you would rather not turn to Google (Google Maps is always a great way to find a bank near you too), the Shoppers Drug Mart site has this information too.

First, head to this Shoppers site. Your browser may ask you to let them know your location, in which case you can click Allow and see the stores closest to you.

Or, you can enter in an address, postal code, or city, and see what locations are out there.

Here’s an example of the search results for Mississauga.

Shoppers Drug Mart hours

What kind of hours do Shoppers Drug Marts have? It all depends on the location – there’s quite a range of hours

Some locations have regular hours, and some are open 24 hours a day (rendering door locks pointless).

How can you find these hours? You can use the aforementioned tools to see what the opening hours are for Shoppers in your area.

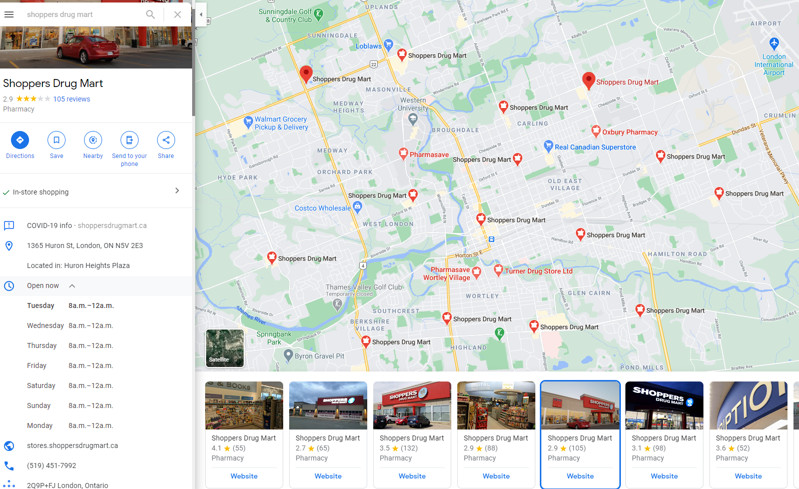

So, say you lived in London. Using Google Maps, here are the locations available, and you can instantly see the hours for today. Click on any store, and you’ll get the hours for every day of the week (this too works if you need to find a bank nearby).

Here’s one location that’s open 7 days a week from 8 am to midnight.

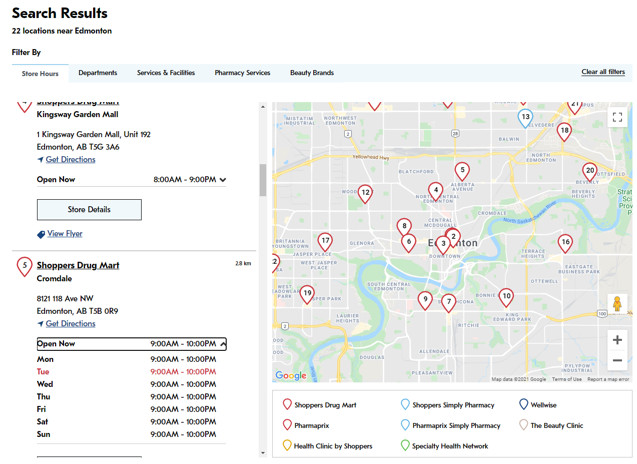

And of course, you can always use the Shoppers site as well.

Search for Shoppers locations, and you’ll see the current hours for stores near you. You can then expand the hours to see what they are for all days of the week.

Here’s one example, from a store in Edmonton.

5 ways to maximize your PC Optimum points

Before being taken over by Loblaws, Shoppers Drug Mart operated their own loyalty program – Shoppers Optimum.

But since the takeover, Loblaws merged the Optimum program with PC Plus to form the PC Optimum program.

And using the program at Shoppers provides some extra benefits. Here’s how to make the most of the program at Shoppers.

Scan your PC Optimum card with every purchase

First, always make sure you scan your collector number when making a purchase at Shoppers Drug Mart.

Unlike Loblaws grocery stores, you’ll earn PC Optimum points on every purchase – 15 points for every $1 spent to be exact.

It’s essentially a 1.5% return on your pre-tax purchases.

There are, however, a few things that don’t earn points. They include:

- tobacco,

- lottery tickets,

- alcohol,

- gift and prepaid cards,

- passport photos, and

- transit tickets.

Pay attention to the PC Optimum App

The app is the starting point. It’s not just for ther personalized offers, but also the special Shoppers redemptions, where you can get more than the typical 0.1 cents per point

Individual personalized offers

Your PC Optimum account comes with many personalized offers you can use to earn bonus points on select products.

These offers are personalized, and change every week.

With Shoppers, there’s more. Oftentimes, you’ll see 20x the points at Shoppers offers – here’s a recent one that just ran.

Meet the minimum spend requirement, and that’s a return of 30% on your purchases. Just be sure to pay attention to the dates, as they have small windows to be used.

You may also see offers where you can earn a lump sum of points. Here you can earn 50,000 bonus points by spending $150 online:

Special redemption offers

Shoppers Drug Marts also have specials when redeeming points. Here’s an example of one such event:

Redeeming your PC Points during one of these gives you more value for your rewards. In this case, instead of each point being worth 0.1 cents each, they’re worth up to 0.15 cents each during this promotion, an increase of 50%.

These events are exclusive to Shoppers Drug Mart, and can help stretch your points.

Shoppers Drug Mart Flyer

The Shoppers Drug Mart flyer has offers for bonus PC Points, along with savings on many items.

Here’s one such example:

These kinds of offers are also at your disposal for more free points.

Use a PC Financial Mastercard

Finally, you can use a PC Financial Mastercard to earn PC Points on your purchases.

One thing to note – marketing bullets for these cards include the 15 points per $1 spent earnings any PC member can get. The rates below are the true earn rate related to the credit cards.

| PC Financial Mastercard | Earn Rates At Shoppers Drug Mart | Annual Fee, Income Requirements |

|---|---|---|

| PC Mastercard | 10 points per $1 spent | * $0 * No income requirement |

| PC World Mastercard | 20 points per $1 spent | * $0 * $60K personal/$100K household |

| PC World Elite Mastercard | 30 points per $1 spent | * $0 * $80K personal/$150K household |

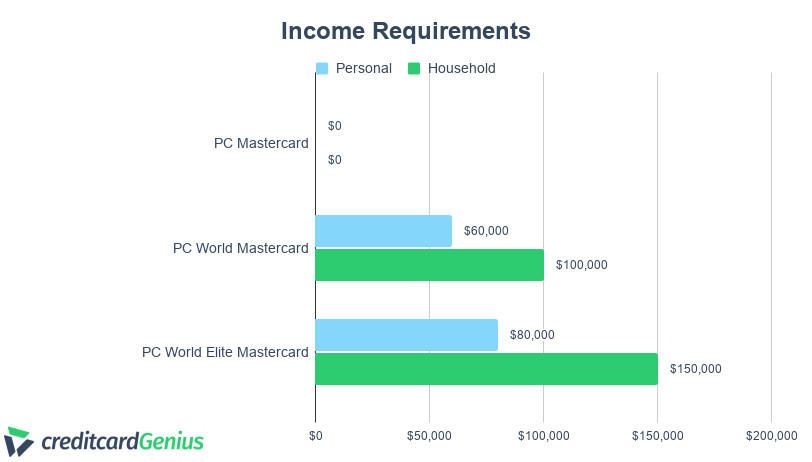

Comparing your 3 options

So here’s how they all compare.

First, none of these cards have an annual fee, keeping more money in your wallet.

With that being the case, which card you get all depends on what your income requirements are.

Here’s how the income requirements compare for all 3 cards.

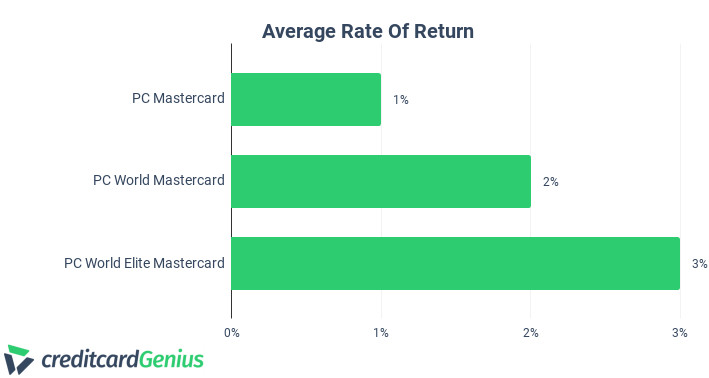

As for your rate of return, here’s the average rate of return at Shoppers and Loblaws banner stores for all 3 cards.

So bottom line – go for the best card you qualify for.

Want to see more ways to maximize your PC Optimum points? Here’s our full guide to the program.

Other credit cards to use at Shoppers Drug Mart

There are plenty of other great credit cards to use at Shoppers Drug Mart and Pharmaprix stores.

And even though Loblaws grocery stores don’t accept them, most Shoppers locations take American Express credit cards.

Many of these credit cards will net you top rewards not only at Shoppers, but all your other drugstore purchases, and many other places you shop.

| Credit Card | Welcome Bonus | Earn Rate On Drugstore Purchases | Annual Fee, Income Requirement | Apply Now |

|---|---|---|---|---|

| Scotia Momentum Visa | None | 2% cash back | * $39 * $12,000 personal |

Apply Now |

| American Express Cobalt | Up to 15,000 points (terms) | 1 point per $1 spent | * $191.88 * None |

Apply Now |

| Brim Mastercard | Up to $200 after the first purchases at participating retailers (terms) | 1% cash back | * $0 * $15,000 personal |

Apply Now |

1. A low fee cash back credit card

To earn cash back rewards, the

You’ll earn 2% cash back on your drugstore purchases, along with gas, groceries, and recurring bills. You’ll earn 1% cash back on every other purchase.

This card has a low annual fee of $39, and a $12,000 personal income requirement.

2. The best credit card in Canada

GC: $100

Our top rated credit card in Canada, the

You’ll only earn 1 point per $1 spent on drugstores. But with an Amex point (for this Membership Rewards card) being worth up to 2 cents each, it’s a 2% return on your spending.

And it’s got high earn rates on many other purchases too:

- 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month)

- 3 points per $1 spent on eligible streaming services

- 2 points per $1 spent on eligible gas, transit, and ride share purchases

- 1 point per $1 spent on foreign currency purchases

- 1 point per $1 spent on all other purchases

They’re stunning earn rates, and can get you a return of up to 10% on purchases.

This card has an annual fee of $191.88 that gets charged out as $15.99 per month, and has no income requirements.

3. A no fee cash back credit card

The Brim Mastercard lineup has high earn rates on all purchases. So, we’ll spotlight the no fee card here – the

You’ll earn a simple 1% cash back on all purchases, no matter where you shop.

It also has some other great features. First, shop with Brim’s 150+ retail partners, and you can earn bonus rewards – anywhere from 3% to 30%.

It also has no foreign exchange fees and 5 types of insurance, all for no annual fee and a low personal income requirement of $15,000.

If you want to earn more rewards, Brim’s other 2 Mastercards are also worthy of consideration:

Comparing the top credit cards for drugstore purchases

So how do these 4 credit cards compare?

Here’s the breakdown, including comparing them to the PC Mastercard.

Average earn rate

First, the most important thing on our minds (for most of us) when it comes to credit cards are the rewards.

Here’s how all 4 cards stack up, based on a typical $2,000 monthly spend.

Our Amex card pulls away from the rest in this regard. But for no (or low) annual fees, the other cards aren’t slouches either.

Annual fees

We’ve got a variety of annual fees when it comes to these 5 credit cards.

The card with the highest rewards on drugstore purchases also happens to have the largest annual fee.

But the rest all earn you rewards for free.

Income requirements

Finally, the income requirements. All of the cards we’ve selected have low income requirements.

All 5 of these credit cards are well within reach of most Canadians.

Shoppers Drug Mart competitors

Shoppers Drug Mart is far from the only drugstore chain in Canada.

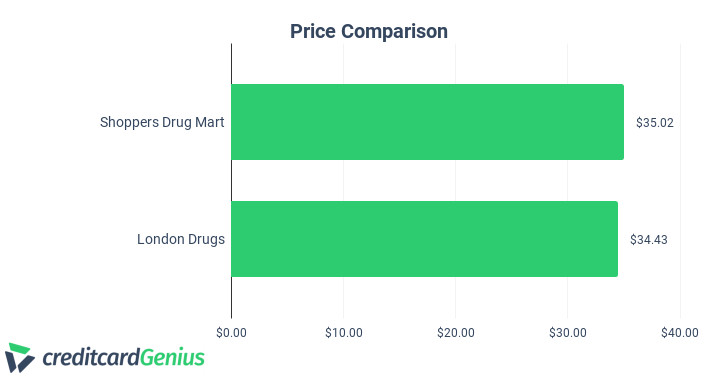

Let’s see how Shoppers measures up to other chains. We’ll do a comparison to London Drugs, which has 80 locations in Western Canada (and offers online shopping for easy comparison).

London Drugs also offers their own rewards programs too – LD Extras.

Shoppers Drug Mart vs. London Drugs

Here are 8 basic items found in both drugstores. Using a combination of both in-house brands and brand name products, here’s what each store charges, based on their websites.

| Item | Shoppers Drug Mart Price | London Drugs Price |

|---|---|---|

| Colgate Total Whitening Toothpaste | $2.49 | $2.49 |

| 1L bottle Listerine | $8.49 | $10.99 |

| 50 Assorted Bandages (store brand) | $4.99 | $2.49 |

| Package Fisherman’s Friend Lozenges | $2.29 | $2.29 |

| Bottle Dove Men’s Body Wash | $6.79 | $6.99 |

| Can Gillette Shaving Cream | $3.99 | $3.49 |

| Oral B Toothbrush | $1.99 | $3.99 |

| 12 Regular Strength Tylenol | $3.99 | $3.99 |

| Total: | $35.02 | $34.43 |

Prices between these 2 stores were quite close, with only 60 cents separating them on these items.

So if you’re worried that Shoppers may be overpriced as they’re the dominant drugstore in Canada, their prices are competitive compared to others.

Want to save on your groceries at Superstores? Here are 4 things you can do.

In conclusion

Shoppers Drug Mart is the complete package when it comes to a drugstore – wide selection, plenty of locations, and rewards on purchases.

What are your thoughts on Shoppers Drug Mart?

Are there things you like or don’t like?

Let us know in the comments below.

FAQ

What credit cards does Shoppers Drug Mart accept?

Shoppers Drug Mart accepts all credit cards, including American Express cards.

Do you earn PC Optimum Points on every purchase at Shoppers Drug Mart?

On most purchases, you will earn 15 PC Optimum points per $1 spent. There are a few items that don’t earn points, such as tobacco and lottery tickets.

What is the best credit card for drugstore purchases?

The best credit card for drugstore purchases is the Scotia Momentum Visa, which earns 2% cash back on drugstores.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×9 Award winner

×9 Award winner  $100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

$100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 6 comments