From collecting bonus rewards at specific merchants, maximizing welcome bonus offers, or using multiple cards to take advantage of the highest earn rates, there are many tips and hacks that can help boost your rewards earn rate.

Our most important hack? Using one of Canada's top rewards credit cards, which have average earn rates as high as 4.5%.

This article covers 24 of the best ways to boost your rewards, including a few pretty simple tips along with some more surprising ideas.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

1. Buy gift cards at gas stations and grocery stores

Nearly everywhere offers gift cards. And if you can find gift cards for places you’ll shop anyway—anything from Canadian Tire to Sephora to Amazon – it’s best to buy them at gas stations or grocery stores for maximum earning potential.

Why do it? These merchants typically offer the top earn rates with most credit cards.

What to note: Read your credit card terms and conditions. Some credit card issuers note that gift cards won’t earn rewards. Consider testing it out with a smaller purchase—make sure you’re earning rewards and that it isn’t considered as a cash advance.

Learn more: Best grocery credit cards

2. Use gift cards to hit minimum spending requirements

Many welcome bonuses require you to spend a certain amount before you get the reward – and buying gift cards can help you get there. Stash them away for gifts or use them for everyday groceries and other shopping.

Why do it? Depending on your everyday spending habits and credit card welcome bonus threshold, you might find yourself short. Gift cards allow you to get that spending in now to qualify for the bonus… and then you can actually spend them later.

What to note: As we noted above, not all credit card issuers allow you to earn on credit cards. Read the fine print before you try this!

3. Look for special offers in emails and apps

Most stores send out special limited-time offers to multiply your points earnings (or get extra savings) – and if you’re not taking advantage of them, you’re missing out. Opt in to marketing emails so you won’t miss new offers!

- Aeroplan and Air Miles often offer bonus miles when shopping with certain retailers

- Triangle generates weekly bonus offers when you take certain actions with one of their retail brands (like 20x the points on Helly Hansen jackets or $5 CT money when you spend $50 at Mark’s)

- Optimum gives you new offers for points earnings and bonuses every Thursday

- McDonald’s offers limited-time bonus points earnings for specific actions (like buying fries 3 times for an extra 3,000 points)

4. Filter your emails so you never miss a deal

When you get dozens of emails each day, it’s easy to miss time-sensitive ones… or accidentally delete them as junk. Gmail’s "promotions" tab doesn’t always work seamlessly but filtering puts the promo emails you want into a separate folder so that you never miss a deal.

How to do it: The process depends on your email host but essentially involves setting up rules to send emails from specific email addresses into a folder instead of your general inbox – say, "Amex deals" or “Air Miles offers.”

5. Take advantage of bonus rewards at certain merchants

Some credit cards offer bonus rewards at a selected merchant for a limited time. For example, in the past, the TD Aeroplan Visa Infinite Card has offered 250 bonus Aeroplan miles when you use your card to make two eligible Starbucks purchases over the course of a month.

If you already shop with the merchant, timing your purchases to coincide with the bonus rewards days will give you maximum points return.

6. Use the GeniusCash app

If you want to maximize your credit card rewards, the GeniusCash app can help. GeniusCash is a rewards app that helps you level up your rewards on everyday spending and become more financially savvy.

Once you download the app and connect your cards, you can explore custom financial recommendations tailored to your unique spending habits; never question if you’re using the right credit card for things like groceries, gas, and travel again. You’ll also get access to exclusive offers and extra rewards in the form of real cash delivered right to your bank account.

7. Choose the rewards program with the highest value to you

Enroll in rewards programs that you’ll use. There’s no point collecting Air Miles if you won’t redeem them!

Choose your rewards programs based on where you shop and what you buy. For example:

- If you grocery shop almost exclusively at Loblaws, sign up for PC Optimum – and then collect as many points as you can from PC brands. Opt for gas with Esso and pharmacy with Shoppers.

- If you like flexible rewards, the Scene+ program lets you save your points for travel or use them to, say, pay for groceries.

If you shop with branded credit cards, you can earn even more points on your purchases.

Here are your Scene+ credit card choices, for example:

8. Pay for your insurance-covered treatments with your credit card

Even when you have insurance coverage through work or a private plan, you’ll usually be able to pay in full and request manual reimbursement from the insurer. Medication, physiotherapy, massage therapy, glasses, dental… the list goes on.

Why do it? The insurance company will reimburse the same amount, regardless of whether it’s to you or the service provider. By paying and requesting reimbursement manually, you’ll earn credit card rewards and it will help you get closer to any welcome bonus or annual spending requirements you need to meet to get bonus points.

What to note: Contact your insurance provider to ask how to submit manual claims – and whether they charge additional fees to do so.

9. Pay your bills with your credit card

Many service providers will let you pay your bills with a credit card:

- Phone

- Internet

- Cable

- Monthly subscriptions like Spotify, Netflix, and Prime

- Gym memberships

Some credit cards even have higher earn rates on recurring bills, like the

10. Use multiple credit cards to maximize your rewards

Each credit card offers something different so it might make sense to have more than one card in your wallet.

How to choose: Look at your spending to determine your biggest spending categories – groceries, restaurants, gas? You’ll want to opt for cards that offer high rewards returns on the categories where you spend the most.

Our recommended strategy: Combine an Amex card like the American Express Cobalt Card with higher-than-average rewards with a Mastercard or Visa to ensure acceptance anywhere. Here are a few great options:

- Tangerine Money-Back World Mastercard

- Rogers Red World Elite Mastercard

- MBNA Rewards Platinum Plus Mastercard

- Scotiabank Scene+ Visa Card

Learn more: How many credit cards should I have?

11. Pay attention to sign-up bonuses

Many credit cards offer excellent sign-up bonuses of lots of points or cash back for new cardholders. We don’t recommend credit card churning but we do recommend taking full advantage of a great welcome bonus when you see it!

What to note: Always read the card conditions – you typically need to meet certain spending criteria to receive the full value of the welcome bonus.

Pro Tip: Sign up for our newsletter and keep track of the best credit card offers to make sure you’re not missing out on a great deal!

12. Check out point transfers to other programs

It pays (literally) to know your rewards program. Many of them allow you to transfer your points to other programs – and some points even increase in value when you do this (like Amex Membership Rewards to Aeroplan).

Keep an eye out: Sometimes you’ll receive bonus points for transferring your points to another program. Aeroplan has offered a 30% bonus in the past when you convert points from other hotel rewards programs into Aeroplan points.

13. Pay your electric bill with Canadian Tire

If you have a Canadian Tire credit card, like the Triangle Mastercard, you’ll be able to access Canadian Tire Financial Services. This allows you to pay your municipality or utility company using your credit card, earning you rewards on things that are typically out of your credit card’s reach.

14. Look for annual fee waivers

Some banking packages offer an annual fee waiver for credit cards. But even if yours doesn’t, you might be able to call your bank and ask them (nicely) to waive your annual credit card fee.

Not paying an annual fee can boost your rewards since you’re not paying anything extra to earn them.

15. Take advantage of bonuses for adding an authorized user

If your credit card offers a bonus for adding a secondary cardholder (like the BMO eclipse Visa Infinite Card does), it’s an easy earn.

And the benefit is twofold: You’ll earn bonus points for adding them and you’ll earn rewards on their everyday purchases.

What to note: Choose your authorized user carefully since their card activity is ultimately your responsibility and can impact your balance and credit score.

16. Pay attention to spending caps

Almost all bonuses and multiplied earn rates are capped after a certain amount of spending so be sure to read the fine print.

If you find that you’re hitting your spending caps, consider adding another card to your wallet so that you can continue to get bonus rewards.

17. Use a personal credit card for business transactions

If you’re allowed to charge work-related expenses to your personal credit card and then get company reimbursement, it’s a great way to earn extra points. Personal cards tend to have much higher earn rates than business credit cards.

Keep in mind: If you’re a business owner, points earned on your spending may be treated as a taxable benefit – especially if they turn into cash rewards or statement credits. It’s not something that’s often tracked but it’s important to be aware of.

18. Always check the highest value reward

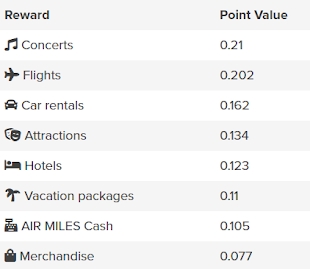

You’ve got the points – now make sure you spend them well. Cashing in your Air Miles for a FitBit might seem great but you’ll be getting poor value in comparison to redeeming them for flights.

- When redeemed for travel, 1 Air Mile is worth about 14.1 cents, on average

- When redeemed for merchandise, 1 Air Mile is worth about 7.7 cents, on average

Here’s our full breakdown of Air Miles point values by reward:

The bottom line: At the end of the day, the value is what you put on it. If you don’t want to fly but will use your FitBit every day, then it might just be worth it to you.

Learn more: What’s the best rewards program in Canada?

19. Choose a card that rewards you – even when you’re redeeming

When you redeem your points, you’ll usually lose out on the points you could have earned for the purchase – but not if you choose a cash back credit card. You can keep spending (and earning points) on your card while taking advantage of the cash back redemption as a statement credit or bank deposit.

20. Buy lottery tickets at a gas station

If you’re playing the lottery, purchase tickets on your credit card to earn rewards. Hopefully you’ll be rewarded with a lottery win – but if not, at least your credit card has your back.

What to note: Some people report lottery ticket purchases showing up as cash advances – so check your terms or call your credit card company before doing this.

21. Don't upgrade your credit card

If you want to upgrade from a no fee credit card to the premium version of it, avoid calling your bank to request the upgrade. You won’t get the welcome bonus that comes with it.

What to do instead: Apply for the new card online, get the welcome bonus, and then cancel your old card (or keep it open as a backup since older cards can help your credit score).

22. Get a prepaid card if you have a poor credit score

A good credit score isn’t a prerequisite to earning credit card rewards. With a prepaid credit card like the KOHO Essential Mastercard, you’ll earn up to 1% back on all purchases.

You load the card through Interac eTransfer, so it’s all your own cash – and doesn’t impact your credit score.

23. Choose a no FX fee card

Opt for a card with no foreign transaction fees to maximize your credit card rewards when you’re travelling. On top of those rewards, you'll save yourself 2.5% on every transaction made outside Canadian dollars.

It’s hard to beat the Scotiabank Gold American Express Card in this category:

- Up to 6 points per $1 spent on select purchases

- 4 ways to redeem points for high value

- 12 types of insurance

24. Take advantage of price protection

Price protection is an awesome perk that lets you bank the difference between the price you paid for a product and the sale price you’ve found on the same product – usually within a certain period of time. You’ll get all of the savings and all the rewards.

The best credit card with price protection and great rewards is the MBNA Rewards World Elite Mastercard.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×1 Award winner

×1 Award winner

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 2 comments