Chexy is an online service that allows users to pay their rent and other bills with a credit card. There are fees to pay of course, but with the right credit card, you can more than offset this fee.

Here's everything Chexy has to offer, and the best credit cards you can use to pay your bills.

Key Takeaways

- Chexy allows renters to pay their bills with a credit card.

- The fee for paying with a credit card is 1.75%.

- There are a few credit cards that can earn you more rewards than the fee.

- Chexy doesn’t currently support Canadian Mastercards.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

How Chexy works

Chexy is a service solely dedicated to paying bills with credit cards.

How it works is pretty straightforward. First, you need to create an account with Chexy. And when you do, you need to provide a few things.

For paying rent, you'll need to upload a copy of your lease, your monthly payment, and the day your rent is actually due. Paying other bills is as simple as entering your payee’s details, selecting the payment date, and linking your preferred credit card.

Once done, you'll need to connect a card to make your payment. Canadian Amex and Visa cards are accepted, as well as international Amex, Visa, and Mastercards—though international cards have a higher fee of 2.5%. Canadian Mastercards aren’t currently supported.

Chexy then charges your card and sends an Interac e-Transfer to your payee. For rent payments, you don’t have to awkwardly deal with your landlord – they don't have to sign up or agree to you using Chexy.

Chexy can pay any bills that are compatible with pre-authorized debit, bill pay, or Interac e-transfer payments.

Fees involved with using Chexy

It goes without saying, but there are fees for using Chexy. And the fee you'll pay depends on what kind of credit card you’re using.

For Canadian credit cards, you'll pay a 1.75% fee of the amount of your bill. So, for every $1,000 in payment, Chexy takes a fee of $17.50. For international credit cards, that fee rises to 2.5%.

That's a decent amount of cash to pay just to use a credit card. But as you'll see farther below, there are a few credit cards that will earn you more for rewards than this. It's also cheaper than other online bill payment services such as Plastiq.

Chexy

Best credit cards to pay your rent and other bills

So you can use your credit card to pay your bills, but you also don't want to lose money either.

You're going to want a credit card that will earn you at least 2% back when you use Chexy to pay your bills. Otherwise, you won't really be earning anything extra.

Luckily, there are several cards that can do just that for you. Chexy counts as a recurring bill payment, meaning there are a few credit cards that can earn you more than 2% back on your rent.

Below, you'll see actual numbers to show what you can earn, even after paying the fee, based on paying $1,500 per month for rent. We'll show 1 number for the actual rewards, and another if you deduct the annual fee (and with one card, a special perk you'll be much closer to unlocking).

If you're spending $1,500 per month, that translates into $315 in fees you've paid in 1 year.

We've only listed credit cards that have a guaranteed return (with one exception). Programs like Aeroplan can give a high rate of return, but it's not guaranteed. All of our other cards earn cash back.

| Credit Card | Earn Rate With Chexy | Rewards Earned In 1 Year | Annual Fee | Net Rewards | Net Rewards With Annual Fee Deducted |

|---|---|---|---|---|---|

| Scotia Momentum Visa Infinite Card | 4% cash back (up to $25,000 per year combined with groceries) | $720 | $120 | $405 | $285 |

| TD Cash Back Visa Infinite Card | 3% cash back (up to $15,000 per year) | $480 | $139 | $165 | $26 |

| American Express Aeroplan Reserve Card | 1.25 points per $1 spent (2.5% at an Aeroplan point worth 2 cents) | $450 | $599 | $135 | $15 |

When taking into account annual fees, all of these cards come out ahead. But a few of them just come out ahead.

But assuming you're using these cards for more than just rent, you're looking at some extra rewards just by using Chexy.

As to the American Express Aeroplan Reserve Card and its high annual fee, you can read on to see why it's included here.

1. Scotia Momentum Visa Infinite Card

When it comes to earning rewards on any recurring bill payment, the Scotia Momentum Visa Infinite Card has always been king.

You'll earn 4% on recurring bills as well as groceries. However, you only earn that on the first $25,000 in annual spend. Normally it's not an issue for most people. But if you're paying $18,000 in rent (or more), you may start earning 1% back on those purchases.

It's a top earner on many purchases, here's the full earn rates it includes:

- 4% cash back on groceries and recurring bill payments

- 2% cash back on gas, transit, rideshares, and food delivery

- 1% cash back on all other purchases

All these high cash back rates come with an annual fee of $120 and income requirements of either $60,000 personal or $100,000 household.

2. TD Cash Back Visa Infinite Card

The TD Cash Back Visa Infinite Card is another card that does very well when it comes to getting rewards on recurring bill payments.

You'll earn 3% cash back on recurring bill payments, but it's capped at $15,000 in annual spend, after which you'll earn 1%. So in our scenario where you pay $1,500 per month in rent, you exceed that by $3,000.

It also earns plenty of cash back on other purchases too:

- 3% cash back on gas, groceries, EV charging, public transit, digital gaming, and recurring bills

- 1% cash back on all other purchases

It also has a rare credit card perk: roadside assistance. If you have a car, it can save you the cost of a CAA membership.

You'll pay an annual fee of $139 and need to meet the typical Visa Infinite income requirements of either $60,000 personal or $100,000 household.

3. American Express Aeroplan Reserve Card

So now for our high (very high) annual fee entrant here – the American Express Aeroplan Reserve Card.

This is an Aeroplan card, and as such, you're not guaranteed any kind of return. It will all depend on what flights you're looking at and what kind of value they're offering.

With that said, Aeroplan points are valuable – we've calculated an average of 2 cents each. Here's what you can earn on all your purchases:

- 3 points per $1 spent on Air Canada

- 2 points per $1 spent on dining and food delivery purchases in Canada

- 1.25 points per $1 spent on all other purchases

So you're earning 1.25 points per $1 spent with Chexy, for a 2.5% return.

Good rewards, but not nearly enough to cover the $599. So why do we have it listed here?

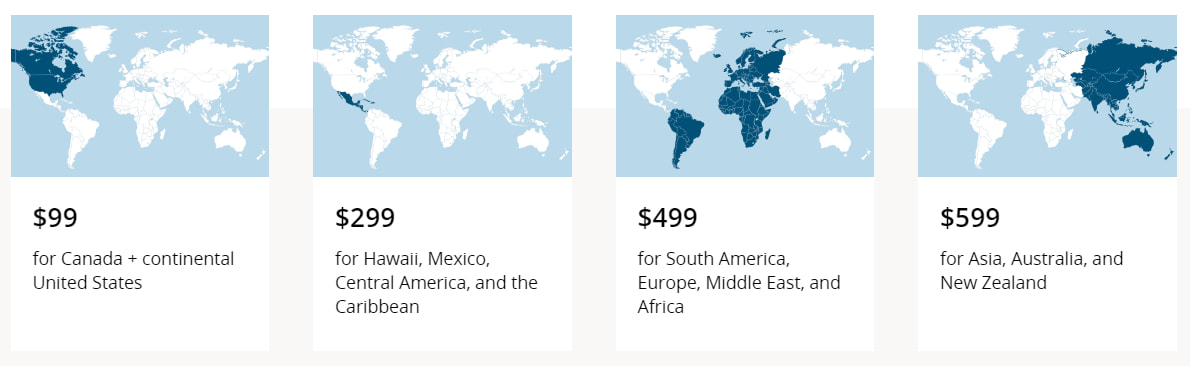

It's the Air Canada perks, specifically the companion voucher. It's basically a discounted ticket when you bring a second person with you. You pay a set fee plus the usual taxes and fees. Here's the set fee, which varies based on where you're flying:

How much you can save depends on where you're flying to, but saving $500 or more is not out of the question.

The companion voucher can lead to huge savings on a flight for 2, but you have to spend a lot to get it – $25,000 per year. If you pay your rent through Chexy, you're taking a large bite out of this amount.

The American Express Aeroplan Reserve Card also offers these benefits:

- first checked bag free for the cardholder and up to 8 others travelling on the same reservation,

- unlimited Maple Leaf lounge access,

- priority check-in, boarding, and baggage handling, and

- priority security at Toronto-Pearson airport.

Just note the annual fee for this package is $599.

FAQ

What is Chexy?

Chexy is an online service that allows Canadians to pay bills with a credit card. This way, you can earn rewards for your rent, taxes, and other bills, and you can use your rent payments as a way to boost your credit score with their free Credit Builder add on.

What fees are involved with using Chexy?

When you pay with a credit card, you'll pay a 1.75% fee of the amount you paid. Chexy accepts all Amex and Visa credit cards, or international Mastercards. Chexy doesn’t currently support Canadian Mastercards.

What are some top credit cards for paying rent with Chexy?

If you're using a credit card, you'll want to earn at least 2% back in rewards, so you're more than offsetting the fees. These cards include the Scotia Momentum Visa Infinite Card, the TD Cash Back Visa Infinite Card, and the American Express Aeroplan Reserve Card.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×2 Award winner

×2 Award winner

$150 GeniusCash + Earn up to 85,000 Aeroplan®* points + Air Canada benefits.*

$150 GeniusCash + Earn up to 85,000 Aeroplan®* points + Air Canada benefits.*

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.