When it comes to earning cash back, is it better to get bonus rewards (based on your specific spending habits), or…

…get a steady stream of cash no matter where you spend?

This rule of thumb can help you decide when a flat rate cash back card will earn you more ‒ or if a category cash back card is better.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What is flat rate cash back?

A flat rate cash back card gives you one earn rate for every purchase you make.

There are no categories to consider or play around with. They’re straightforward cards – no matter where you shop, you’ll know how much you’re earning.

Flat rate vs. category cash backs

So where are flat rate cards better than ones with categories?

Overall, here are a few times when having a flat rate card may be better for you:

- you don’t frequently shop at traditional grocery stores like Sobeys or Loblaws,

- your gas purchases are relatively small,

- you’re a big online shopper, or

- your spending is varied overall (no 2 or 3 basic categories dominate your spending).

If any of these scenarios sound like you, a flat rate card may actually earn you more rewards.

Category cash back cards

In contrast to flat rate cards, what are category cards?

Category cards give you bonus rewards on certain categories, such as gas or groceries. These categories generally have higher earn rate than what a flat rate card provides.

However, any purchases outside of those categories will have a lower earn rate.

So, if 2 or 3 categories tend to dominate your spending, you’ll see more rewards as those purchases will have a higher earn rate than a flat rate cash back card, even though you’ll be earning a lower rate on every other purchase.

Flat rate cards with tiers

One thing to keep in mind with flat rate cards is that some of them have different overall spending tiers.

That means after you spend a certain amount per year, the flat rate you’re earning will change, and can go either up or down. Most flat rate cards don’t have tiers, but there are some out there you should be aware of.

An example of a tiered card is the

There’s also one extreme example of a tiered card with the

It advertises up to 1.5% cash back on your purchases, but it’s a long road to getting to that earn rate every year:

- 0.25% cash back on your first $2,500 in purchases,

- 0.5% cash back on your next $1,500 in purchases,

- 1% cash back on the next $21,000 in purchases, and

- 1.5% cash back on all purchases after that.

It seems great on paper, but in practice it’s really lacking in rewards, especially on your first $4,000 in purchases.

How can you tell if a card is potentially tiered? Look for the “up to” language in card marketing. If you see that, it’s a good indication that it might be tiered, or at least have categories to worry about.

General rule of thumb to max your cash back

So how can you determine when it’s best to use a flat-rate card, or one that hands out bonuses on select purchases?

A simple way? If at least 40% of your total spending falls inside 3 categories (i.e. gas, groceries, and restaurants), then a category card may be better for you. If your spending is more varied than that, a flat cash back rate could end up earning you more.

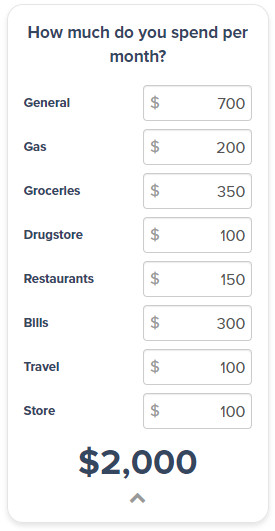

As an example, let’s take a look at our default $2,000 monthly spend we use for estimating credit card rewards:

The gas, groceries, and recurring bills category makes up 42.5% of our total monthly spending in this example. According to our rule of thumb, this means someone with this type of budget should be using a category card with bonus rewards on their 3 main categories.

Let’s compare this spend to someone who has extremely varied spending – $250 per month in each of the 8 categories listed above. How will the rewards differ for the same cards?

| Cash back credit card | Categories | Yearly rewards (Default spend) | Yearly rewards (Varied spending) |

|---|---|---|---|

| * 4% on groceries and bills * 2% gas and transit * 1% on all other purchases |

$498 | $450 | |

| * 3% on gas, groceries, and recurring bills * 1% on all other purchases |

$444 | $420 |

They’re grouped closely together in terms of annual rewards, but the category spending of the Scotia Momentum Visa Infinite gives more cash back on the same amount of money spent.

But if you have a varied spend, the flat rate of the SimplyCash Preferred gave you the most rewards.

Other ways to figure out if a flat cash back card is better for you

Now, this is just a rough rule. Everyone’s monthly spending situation is unique.

Here’s how you can figure out what works best for your specific situation.

Determine how much money you spend on your credit cards

First, you’ll need to know how much you’re spending, and what you’re spending it on. You can do it yourself with a spreadsheet, and go through your spending one item at a time.

You can also use an online tool like Mint.com or youneedabudget.com, which will connect to your bank accounts and do everything automatically for you.

Of course, you can always just estimate your spending habits instead, putting a rough percentage and monthly spend together.

Use our compare cards page

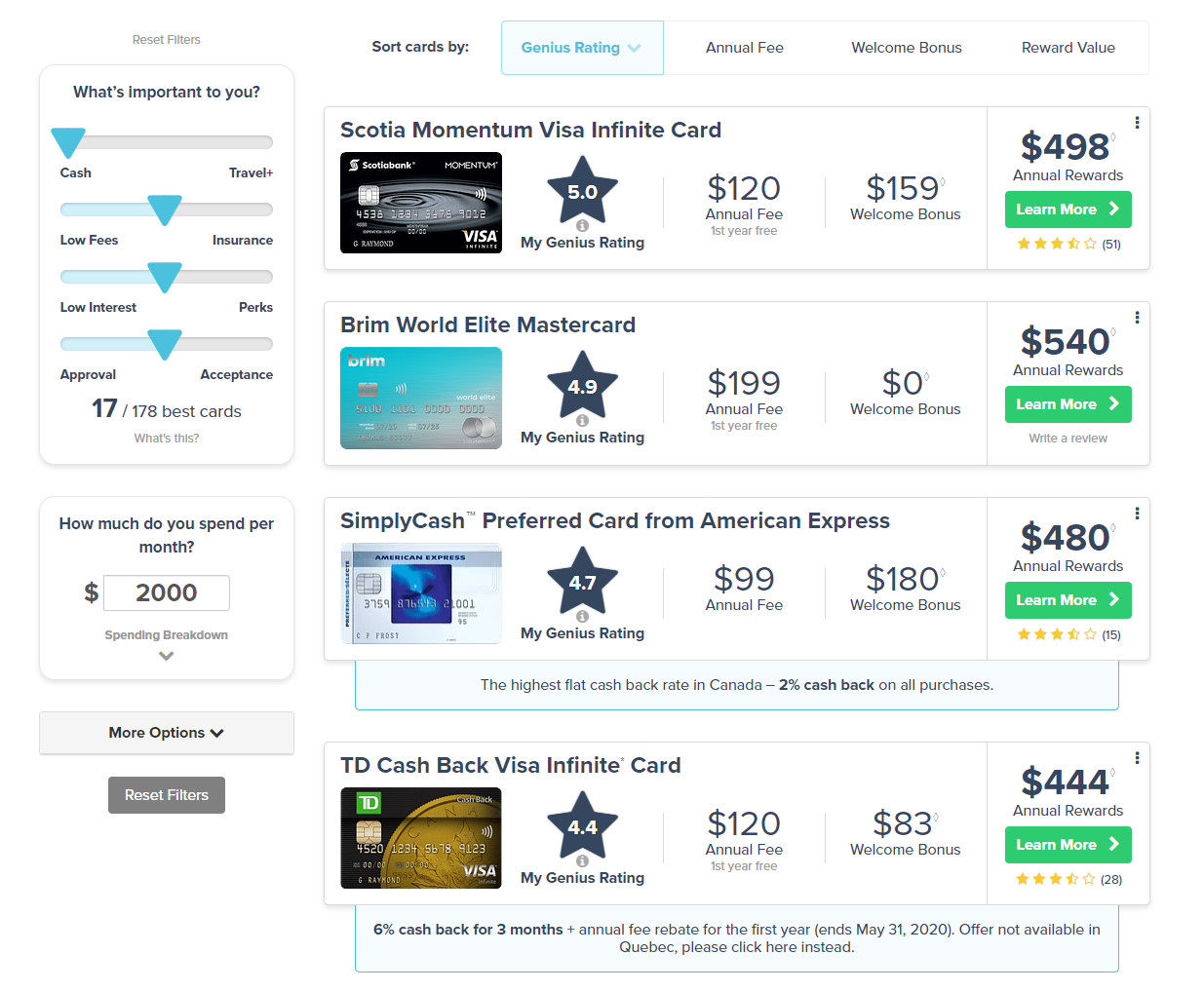

Once you have this info, you can use our compare cards page.

Enter your monthly spending on the left, and adjust the sliders to the type of rewards you’d like.

You can sort cards by either Genius Rating, annual fee, welcome bonus, or total rewards. You’ll be shown the top credit cards for you. To tell which cards are flat or category based, simply make a large change to the “General” spend category – the flat rate cards will rise to the top.

Here’s an example, based on our default spending:

You can also click on each card, and on the next page you’ll get the card details, including what it earns on purchases.

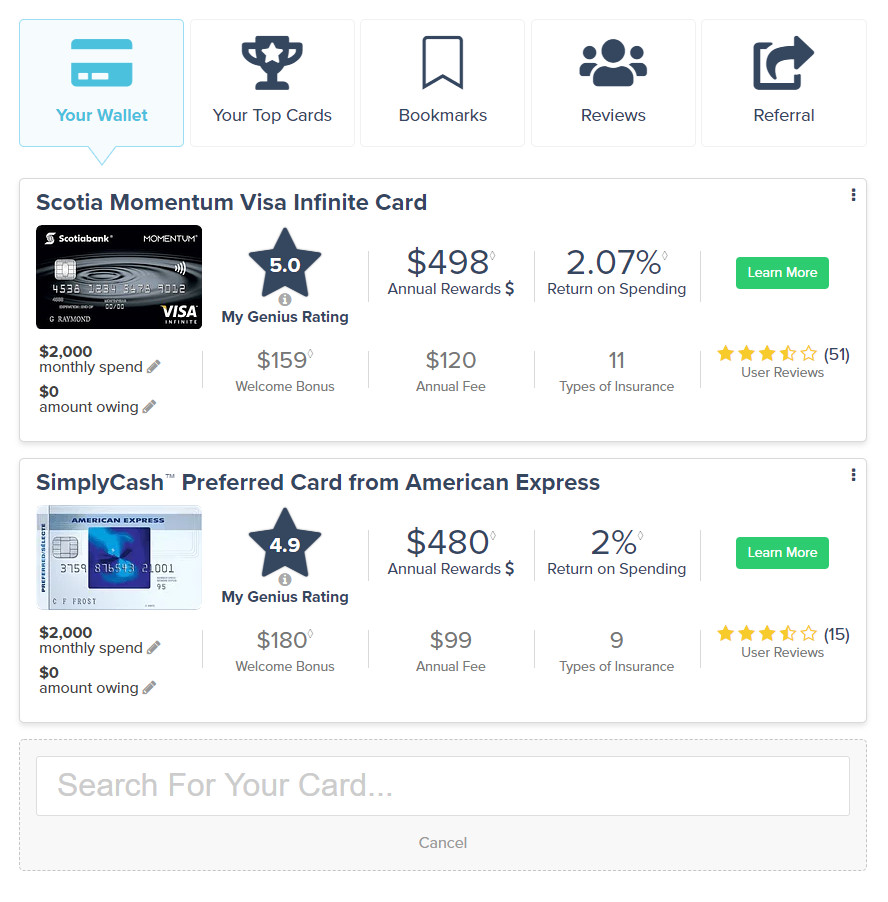

Use your dashboard

If there are 2 specific cards in mind you’d like to compare side-by-side, your dashboard can help you check them out.

Log in, head to your dashboard, then add the cards you want to compare. You can customize the spending for each one, and see how they match up to each other.

Using our default spending, here’s what this looks like:

Related: No Fee Vs. Low Fee Credit Cards

The best flat rate cash back cards

So what are the best flat rate cash back cards available?

Here are our favourites, with a range of fees – from none all the way to $199.

| Credit card | Flat rate cash back % | Annual Fee, Income Requirements | Apply |

|---|---|---|---|

| Brim Mastercard | 1% | * $0 * $15K personal |

Apply Now |

| Brim World Elite Mastercard | 2% (up to $25,000 spent) | * $89 * $80K personal or $150K household |

Apply Now |

Related: Category Vs. Flat Rate Cash Back Credit Cards: Which Is Better?

Brim Mastercards

Brim Financial has a great lineup of flat rate cash back cards.

Before getting into the cards themselves, there are a few features that all of them have, regardless of the annual fee you pay.

The first is no foreign exchange fees. You’ll save yourself the standard 2.5% fee other credit cards charge for making purchases that aren’t in Canadian dollars.

These cards also have 2 of the rarest insurances available – mobile device and event ticket insurance. Get your cell phone some coverage in case it breaks, and never have to worry about whether or not any future tickets you buy will go to waste because you can’t attend the show (for a covered reason).

And finally, Brim has partnered with over 150+ retailers, to help you earn bonus cash back with them above your standard earn rate. How much? You could earn anywhere from 3% to 30% back, depending on the retailer. Just note you won’t earn your card’s regular earn rate when shopping with Brim’s partners.

Brim’s no fee offering, the

And you can receive up to $200 after your first purchases with select Brim retail partners.

Finally, we have Brim’s premium offering – the

Earn 1% cash back on everything you buy.

It also comes with a monster sign-up bonus – up to $500 in rewards after your first purchases with select Brim retail partners.

It does have the highest annual fee on our list here – $89.

In summary

Flat rate cash back cards keep it simple.

And in the right hands, they can actually provide more cash back than one with different category boosts.

What are your thoughts on flat rate cards?

Let us know in the comments below.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 4 comments