Best RBC Credit Cards for 2026

With an extensive insurance package, excellent earn rates, an incredible welcome bonus, and much more, the best RBC credit card is the RBC Avion Visa Infinite. Yes, there are several other very good RBC cards available, but this is the cream of the crop.

The RBC card lineup is impressive, ranging from premium travel cards to simple cash back options. Whichever card you choose will provide value, especially if you're already an RBC client.

Here, we'll review the top RBC cards and what they offer. We'll also show you top alternative credit card options, so you can compare benefits and fees to find the absolute best credit card for you.

Key Takeaways

- The best overall RBC credit card in Canada is the RBC Avion Visa Infinite.

- Some RBC credit cards earn Avion Rewards, which you can redeem in six different rewards categories.

- RBC offers both Mastercard and Visa credit cards, plus 2,400+ brand and retail partnerships.

- With 17 different credit cards available in Canada, you’re sure to find an RBC credit card that matches your needs.

The best RBC credit cards in Canada

As the largest of the Big 5 Banks, the Royal Bank of Canada oversees a vast credit card kingdom. Travel bug? Let's go! No fee? No problem! Really… nice rewards? Well, you get the idea.

Here are the best RBC credit cards in Canada, along with the best alternative from another issuer:

| Category | Credit card | Annual fee | Rewards | Current offer | Learn more |

|---|---|---|---|---|---|

| Best overall | RBC Avion Visa Infinite | $ 120 |

* 1.25 points per $1 spent on travel * 1 point per $1 spent on all other purchases |

55,000 bonus points (terms) | Learn more |

| Best premium | RBC Avion Visa Infinite Privilege | $ 399 |

* 1.25 points per $1 spent on all purchases |

Up to 70,000 bonus points (terms) | Learn more |

| Best business | RBC Avion Visa Infinite Business | $ 175 |

* 1.25 points per $1 spent on the first $75,000 in annual purchases * 1 point per $1 spent afterwards |

25,000 bonus points (terms) | Learn more |

| Best cash back | RBC Cash Back Preferred World Elite Mastercard | $ 99 |

* 1.5% cash back on the first $25,000 spent annually * 1% cash back after $25,000 spent annually |

None | Learn more |

| Best no fee | RBC ION Visa | $ 0 |

* 1.5 points per $1 spent on groceries, daily transit, rideshares, EV charging, streaming, digital gaming, and subscriptions1 * 1 point per $1 spent on all other purchases |

11,000 Avion points (terms) | Learn more |

| Best low interest | RBC Visa Classic Low Rate Option | $ 20 | None | Learn more | |

| Best for Metro shoppers | moi RBC Visa | $ 0 |

* 2 points per $1 spent on gas, dining, and EV charging * 1 point per $1 spent at Metro, Super C, Jean Coutu, Brunet and Première Moisson * 1 point per $1 spent on all other purchases |

Up to 5,000 bonus points (terms) | Learn more |

| Best for gas | More Rewards RBC Visa | $ 0 |

* 5 points per $1 spent at More Rewards partner stores * 5 points per $1 spent on gas, EV charging, and dining * 3 points per $1 spent on all other purchases |

Up to 20,000 bonus points (terms) | Learn more |

Since most people are concerned with what their card can earn for them, the chart below shows the average earn rate for all the top RBC cards:

1. Best RBC credit card in Canada: RBC Avion Visa Infinite

The crown jewel of the Royal Bank is a travel credit card with plenty of insurance and one of the best rewards programs in Canada: the RBC Avion Visa Infinite. Although Avion Rewards is a flexible rewards program, we recommend skipping the gift cards and merchandise – if you redeem your Avion Points on an RBC Travel Reward, they could be worth up to $2.33 CAD each.

RBC Avion credit cards offer 10% off at Rona, 5x bonus Be Well points at Rexall, three cents off per litre at Petro-Canada, and a free yearly DashPass membership. And then there are the exclusive culinary event invitations, luxury hotel benefits, and 24/7 complimentary concierge services included in the Visa Infinite program.

2. Best RBC premium credit card: RBC Avion Visa Infinite Privileged

It may have a higher Genius Rating, but we bumped the RBC Avion Visa Infinite Privilege card into second place to account for its high annual fee and income requirements. As a true premium card, it's the best travel insurance credit card in the country, complete with 12 types of coverage – take a look at how this compares with other top RBC cards:

Yes, it has the same coverage types as two other RBC options, but this premium card's details are much more generous. For example, it provides 31 days of Emergency Medical Term coverage, vs. the other cards' 15 days. Add this value to the card's other features, including six complimentary airport lounge passes through the Visa Airport Companion program, and it's no wonder Canadians love it.

3. Best RBC business credit card: RBC Avion Visa Infinite Business

The RBC Avion Visa Infinite Business is the top business credit card in Canada. It includes the usual Avion and Visa Infinite benefits, as well as three special tools: a 30% discount at Hertz car rental agencies in Canada and the U.S., a complimentary DragonPass membership, and Visa Spend Clarity for Business.

With Visa Spend Clarity, you can log photo receipts, set individual employee spending controls, and track your cash flow. The DragonPass membership provides you with access to 1,300+ global airport lounges for a mere $32 USD per visit.

This chart offers a visual representation of how far ahead of the competition the RBC Avion Visa Infinite Business is in terms of annual rewards:

4. Best RBC cash back credit card: RBC Cash Back Preferred World Elite Mastercard

Straightforward, no-fuss, cash back rewards are the domain of the RBC Cash Back Preferred World Elite Mastercard. Unlike the Avion Rewards program (which can get complicated), you can redeem a minimum of $25 cash back whenever you want.

It also has a low annual fee for a World Elite Mastercard, which includes a complimentary DragonPass membership and enrollment in the Mastercard Travel Rewards program. Now you can go online, get access to airport lounges, and take advantage of extra cash back opportunities wherever you go.

5. Best RBC no fee credit card: RBC ION Visa

It may only include minimal insurance, but the RBC ION Visa has one big point in its favour: no annual fees. This doesn't mean no perks or benefits, though. You'll still get a welcome bonus worth about $ 110, save on fuel at Petro-Canada, and earn extra Be Well and Moi points at participating retailers.

And, of course, you'll earn Avion rewards. You'll earn 1.5 Avion points per $1 spent in every category for free – and if you really like it, you can double your earnings for a very reasonable $ 48per year with the RBC ION+ Visa.

6. Best RBC low interest credit card: RBC Visa Classic Low Rate Option

The RBC Visa Classic Low Rate Option is a niche product with a straightforward concept: save on credit card interest rather than earn rewards. You'll pay very reasonable interest rates. Take a look at how these rates compare with other card rates in general:

While it's true that you won't earn rewards with this low-rate card, cardholders are still eligible for Petro-Canada fuel discounts, and they can get supplementary cards at no extra cost. The annual fee is a mere $ 20 anyway, which makes all these savings even more appealing.

7. Best RBC credit card for Metro shoppers: moi RBC® Visa‡

This category is very niche, but the moi RBC Visa deserves some attention for its Moi Rewards Points earn rates and lack of annual fee. You'll get 2 Moi Points per $1 spent on dining, gas, EV charging and Brunet, Jean Coutu, Metro, and Première Moisson stores, and 1 point per $1 spent everywhere else.

There's no annual fee with this card either, and new cardholders get a welcome bonus worth up to $ 40.

8. Best RBC credit card for gas: More Rewards RBC Visa

While RBC credit cards are known for their discount on fuel at Petro-Canada, the More Rewards RBC Visa also earns its top rate of 5 More Rewards points per $1 spent on gas. This is a huge help that really maximizes your gas purchases.

You'll also earn 5 More Rewards points for every $1 spent at partnered businesses, which include plenty of grocery stores, like Save-On-Foods, Buy-Low Foods, and Nesters Market. It's an incredibly convenient card to carry while running errands.

Compare all RBC credit cards

This table displays our default Genius Rating, which applies our standard weight to all 7 of our scoring categories (rewards, fees, insurance, interest, perks, approval, and acceptance). The data of the other cards in the article is weighted based on what each card does best.

Learn more about the Genius Rating methodology

Pros and cons of RBC credit cards

RBC credit cards share many of the benefits and downsides of the cards offered by most major credit card issuers. With a major company like RBC, you get a level of stability and longevity that fintechs and smaller banks lack – not to mention an extensive network of retail and corporate partnerships.

RBC also offers great all-purpose cards that suit a wide variety of lifestyles and financial situations. The downside is that, compared to smaller credit card issuers like Rogers, RBC lacks niche products.

Pros of RBC credit cards include:

- 17 credit cards available in Canada, including both Mastercard and Visa

- 7 no-fee rewards credit cards

- 9 cards earn valuable, flexible Avion Rewards

- $332 average insurance value

- 50 Be Well Points per $1 spent at Rexall

- Extra Moi points per $2 spent at participating retailers

- 20% bonus Avion Points and Petro-Points at Petro Canada

- 3 cents off per litre at Petro Canada

- 3x Canadian Tire Money on purchases at participating retailers

- DoorDash and DashPass perks

- Benefits of bundling with RBC banking products

Despite its size, RBC's annual fees are modest, ranging from $0 for no fee cards like the RBC Cash Back Mastercard, to $399 for premium cards like the RBC Avion Visa Infinite Privilege. That's not as high as premium credit cards from other big banks, like the TD Aeroplan Visa Infinite Privilege Credit Card, which is $599 a year.

Generally, a high annual fee will give you more benefits – RBC credit cards justify their lower annual fees with less valuable perks.

Cons of RBC credit cards include:

- All cards charge foreign exchange fees

- Inconsistent insurance coverage

- Lower earn rates than competitors

- Avion Rewards program can feel complicated

- Minimum cash back redemption requirements

RBC generally offers less robust insurance packages than its competitors, and coverage varies significantly across cards. Earn rates are lower than comparable cards, too – while individual shopping habits vary, no RBC credit cards offer more than a 2.91% rate of return on $2,000 of average spending per month.

RBC credit cards vs. other banks

The table below offers a side-by-side comparison of RBC and its Big Bank competitors:

| RBC | BMO | CIBC | Scotiabank | TD | |

|---|---|---|---|---|---|

| Payment networks | * Mastercard

* Visa |

* Mastercard

* Visa |

* Mastercard

* Visa |

* American Express

* Visa |

* Visa |

| In-house rewards | Avion Rewards | BMO Rewards | Aventura Rewards | Scene+ | TD Rewards |

| Max rewards points value (cents per point) | 2.33 CPP | 0.67 CPP | 2.29 CPP | 1 CPP | 0.5 CPP |

| Partner rewards and co-branded cards | * WestJet

* British Airways * Triangle Rewards * Moi Rewards * More Rewards |

* AIR MILES | * Aeroplan

* Costco |

* None | * Aeroplan |

| Max rate of return | 2.91% | 1.61% | 3.34% | 2.45% | 2.78% |

| Best credit card | RBC Avion Visa Infinite | BMO CashBack World Elite Mastercard | CIBC Aventura Visa Infinite Card | Scotiabank Gold American Express Card | TD First Class Travel Visa Infinite Card |

Here's a look at how the return rate for the top RBC card compares with top cards from other banks:

Here's what RBC cardholders think

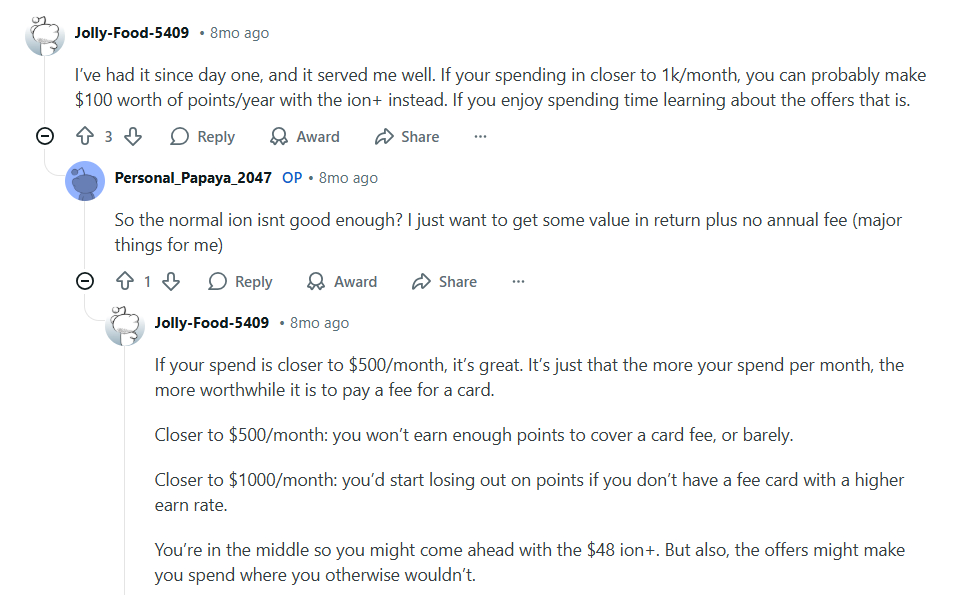

It can be very helpful to hear what real cardholders have to say, and while there are plenty of mixed reviews and information online, we found Redditors supporting the RBC ION Visa and RBC Avion Visa Infinite cards, in particular.

In response to someone asking about the RBC ION Visa, one Redditor had this to say:

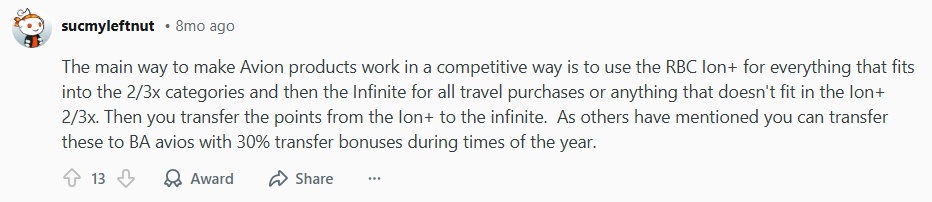

Another Redditor posted to ask whether folks would recommend the RBC Avion Visa Infinite as a good travel card, and received this among the responses:

Even though the RBC Avion Visa Infinite Business earned our Best Business Card award, it seems not everyone agrees. Responding to the question posed, "Best business credit card in Canada?", only one of several Redditors recommended RBC cards:

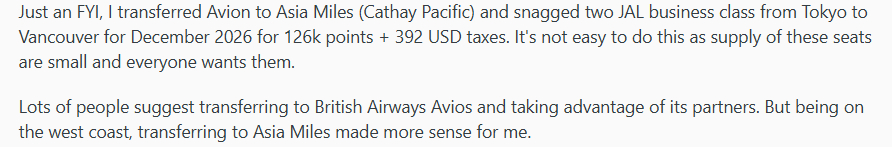

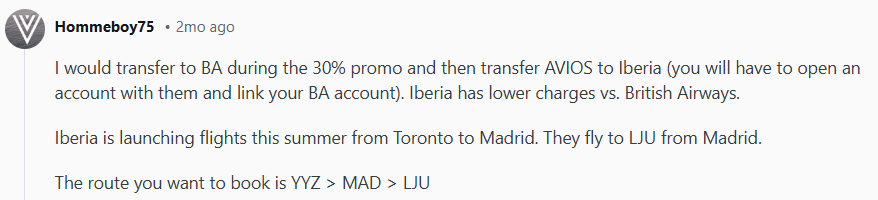

Another Redditor complained about the complications and expenses involved when redeeming Avion points for flights, and received many like-minded responses. Several people recommended transferring points to specific airline partners and booking flights through that airline:

How to apply for an RBC credit card

If you want to apply for a credit card from RBC, you'll need to meet some fairly standard eligibility requirements:

- You must be the age of majority in your province or territory and a resident of Canada

- You must have a good credit score

- You must meet the income requirements of the card you want

RBC credit cards fall into 4 categories of minimum income requirements:

| Basic Mastercard/Visa | Visa Infinite | World Elite Mastercard | Visa Infinite Privilege | |

|---|---|---|---|---|

| Personal | N/A | $60,000 | $80,000 | $150,000 |

| Household | N/A | $100,000 | $150,000 | $200,000 |

FAQ

What's the most exclusive RBC credit card?

With a significant annual fee of $399 and income requirements of $200,000 – with no distinction between personal or household numbers – the most exclusive of RBC's credit cards is the RBC Avion Visa Infinite Privilege. Luckily, it comes with plenty of perks and extensive insurance coverage.

What's the difference between the RBC Avion Visa Infinite and RBC Visa Platinum Avion?

The RBC Avion Visa Infinite and RBC Visa Platinum Avion have identical annual fees, interest rates, welcome bonuses, and Avion Rewards earning rates – but the Platinum card doesn't have any income requirements, nor does it include any Visa Infinite benefits. The Visa Infinite card also provides more insurance – 12 types to the Platinum card's 10.

What credit score do you need for an RBC credit card?

Since RBC offers a variety of card types, credit score requirements vary accordingly. The more premium credit cards – such as the RBC Avion Visa Infinite Privilege – require very good to excellent credit scores, but more basic cards – like the RBC ION Visa – have lower credit score requirements. Either way, a minimum credit score of 660 is recommended.

Which RBC credit cards give you airport lounge access?

The RBC Avion Visa Infinite Privilege includes 6 complimentary airport lounge visits per year. Other credit cards may provide a complimentary lounge program membership, but you'll need to pay $32-35 every time you visit a lounge. The RBC Avion Visa Infinite and RBC Cash Back Preferred World Elite Mastercard are examples, offering access but not free entry.

Can you waive the RBC Avion Visa Infinite annual fee?

If you have an RBC VIP Banking account, RBC will waive the entire $120 fee for the RBC Avion Visa Infinite's primary cardholder and all additional cardholders. As long as the your card remains in good standing and you maintain your chequing account, these feeds will be rebated every year.

Editorial Disclaimer: The content here reflects the author's opinion alone. No bank, credit card issuer, rewards program, or other entity has reviewed, approved, or endorsed this content. For complete and updated product information please visit the product issuer's website. Our credit card scores and rankings are based on our Rating Methodology that takes into account 126+ features for each of 228 Canadian credit cards.

×2 Award winner

×2 Award winner