Pros & cons

Pros

- Up to 25,000 bonus points.

- Up to 1.75 points per $1 spent on purchases.

- Points worth up to 2.33 cents each.

- Includes 12 types of insurance.

Cons

- High annual fee of $175.

- High income requirements of $60,000 personal or $100,000 household.

Your rewards

Getting your welcome bonus

Based on $3,000 in monthly spending, you can get up to 25,000 points which translates to an estimated $583.◊

For all welcome bonus details click here.

How you earn rewards

Each card earns rewards differently. Part of choosing your card is deciding what type of rewards you want to get. With RBC Avion Visa Infinite Business, here's how you earn rewards:

- 1.25 points per $1 spent on the first $75,000 in annual purchases

- 1 point per $1 spent afterwards

For all reward details click here.

How much your rewards are worth

The dollar value of your rewards depends on the specific rewards program ‒ and what you choose to redeem your points for. For RBC Avion Visa Infinite Business in particular, if you spend $3,000 per month, here's our estimated annual rewards earned depending on which reward you choose:

| Air Travel Redemption Schedule | $1,049 | |

| Transfer points to British Airways or Cathay Pacific | $788 | |

| Travel through RBC Rewards | $450 | |

| Charity donations | $450 | |

| Transfer points to WestJet Rewards | $450 | |

| Merchandise | $392 | |

| RBC financial products | $374 | |

| Gift Cards | $324 | |

| Statement credits | $261 |

Calculating your annual rewards

$36,000 annual spending x 2.91% return on spending = $1,049 annual rewards

$1,049 annual rewards − $175.00 annual fee = $874 net annual rewards

Top related credit cards

Compare similar cards side-by-side.

Details and eligibility

- Estimated Credit Score

- 760 - 900

- Personal Income

- $60,000

- Household Income

- $100,000

- Annual Fee

- $175.00

- Extra Card Fee

- $75

- Card type

- Credit

- Purchase

- 19.99%

- Cash Advance

- 22.99%

- Balance Transfer

- 22.99%

Insurance coverage

- Extended Warranty

- 1 year

- Purchase Protection

- 90 days

- Mobile Device

- $2,000

- Travel Accident

- $500,000

- Emergency Medical Term

- 15 days

- Emergency Medical Maximum Coverage

- unlimited

- Emergency Medical over 65

- 3 days

- Trip Cancellation

- $1,500

- Trip Interruption

- $5,000

- Flight Delay

- $500

- Baggage Delay

- $500

- Lost or Stolen Baggage

- $1,000

- Hotel Burglary

- $2,500

- Rental Car Theft & Damage

- Yes

Please review your insurance certificate for details, exclusions and limitations of your coverage, terms and conditions apply.

Learn more about the value of credit card insurance coverage.

Genius Rating

RBC Avion Visa Infinite Business's 3.9 Genius Rating is based on the weighted average of the following scores:

Methodology

All scores are produced by our math-based rating algorithm that takes into account over 126 credit card features.

Learn more about our rating methodology.

Awards

Each year for our annual credit card rankings our Genius Rating algorithm computes the best credit cards across 28 different categories. Here’s what this card has won this year:

Top cards from Visa

RBC Avion Visa Infinite Business review

In need of a business credit card? The RBC Avion Visa Infinite Business Card will let you earn plenty of points that are quite valuable when redeemed for travel.

Here's everything this card has to offer.

RBC Avion Visa Infinite Business rewards

Here we have an RBC Avion Rewards credit card, which are some of the most valuable rewards in the credit card market. Let's see exactly what you can get.

Earning RBC Rewards

First, let's start with earning rewards on your purchases. Here's what you'll get on your everyday purchases:

- 1.25 points per $1 spent on the first $75,000 in annual purchases

- 1 point per $1 spent afterwards

And while that may not seem all that special, it's what each point is worth that matters.

Redeeming your RBC Rewards

RBC Avion points are quite valuable. And you've got a few options when it comes to using them for travel.

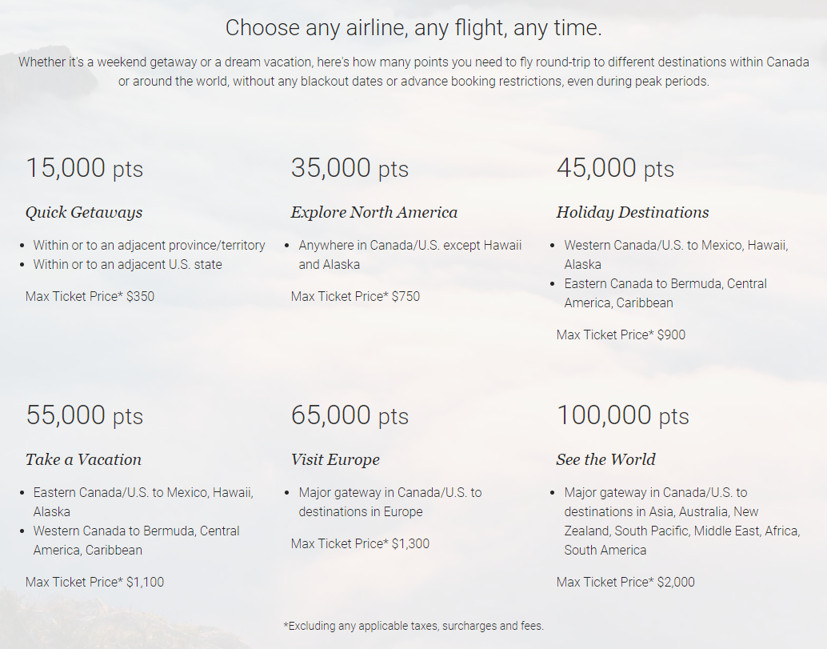

To start, there's the RBC Avion Air Travel Redemption Schedule. For a set amount of points, you can fly to a set region for just the taxes, fees, and any carrier surcharges.

Your points cover the base airfare of the flight, up to a set limit. Here's the chart:

Max out this chart, and each point is worth up to 2.33 cents each.

But that's not the only way to use points for travel. RBC Rewards can be transferred to 4 different airline partners.

Here are those partners, what the transfer ratio is, and what an Avion point is potentially worth:

| Airline | Transfer Ratio | Airline Point Value | RBC Avion Point Value |

|---|---|---|---|

| British Airways | 1 RBC Reward = 1 Avios | 1.75 cents | 1.75% |

| Cathay Pacific | 1 RBC Reward = 1 Asia Mile | 1.75 cents | 1.75% |

| American Airlines | 10 RBC Rewards = 7 AAdvantage Miles | 1.75 cents | 1.2% |

| WestJet | 100 RBC Rewards = 1 WestJet dollar | 1 Dollar | 1% |

Finally, you can also redeem your points towards any travel booking made through RBC Rewards. This way, 100 points translates into $1 in savings.

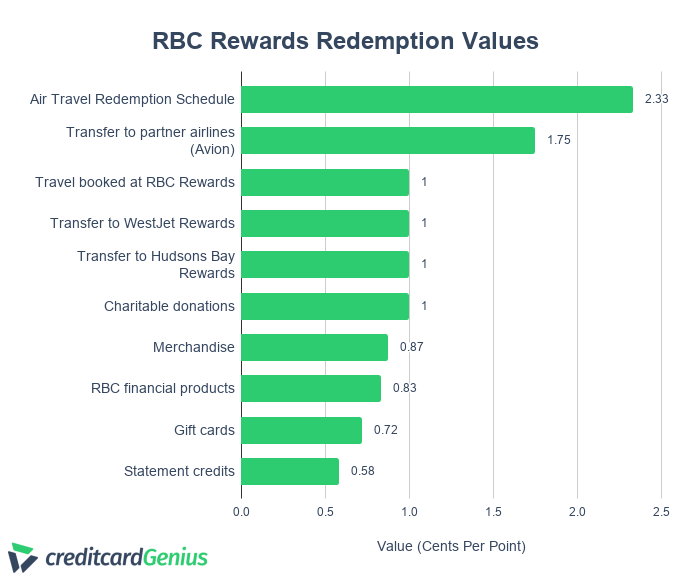

Like most rewards programs, you're not just restricted to redeeming points for travel – you have other options at your disposal.

Here are your other RBC Rewards redemption options.

- transfer to Hudson's Bay Rewards,

- charity donations,

- merchandise,

- RBC financial products,

- gift cards, and

- statement credits.

And, here's a summary of what each point is worth.

6 benefits of the RBC Avion Business Visa Infinite

And this credit card offers more than just rewards. Here are 6 other things to like about it.

1. High value points

This really is a major pro to this card – the value of your points. Thanks to RBC Rewards, the points are worth up to 2.33 cents, some of the best value in rewards available.

On your first $75,000 in annual spending, that's a return of up to 2.91% – an incredible earn rate on spending.

2. Extra Avion transfer options

There are lots of different ways you can use your points outside of RBC Rewards if you like.

First, there's the aforementioned 4 airline partners you can transfer points to.

There's also the option to transfer points to Hudson's Bay. 1 RBC Rewards point gives you 2 Hudson's Bay points. With each HBC point worth 0.5 cents each, it's a value of 1 cent per point.

And you can also transfer HBC points to RBC Rewards, where 4 HBC points becomes 1 RBC Rewards point.

3. Insurance coverage

Want some insurance coverage? You got it. This card includes 12 types of insurance. You can see the full details by clicking here.

One of those is the rare mobile device coverage. You'll be covered for up to $2,000 in case your phone needs to be repaired or replaced.

4. Typical RBC credit card benefits

These benefits are available to all RBC credit cards, but they're both valuable and easy to use, so they're worthy of special mention.

First is Petro-Canada. Link your RBC card with a Petro-Points account, and you'll save 3 cents per litre on fuel, and earn 20% bonus Petro-Points.

The other one is with Rexall Be Well. You'll earn 50 Be Well points per $1 spent on all your purchases at Rexall.

5. Easy to earn welcome bonus

There's an easy to earn welcome bonus. You'll get 25,000 RBC Rewards points after your account is approved.

Those points are worth up to $582.5. Lots of easy-to-use savings for your next trip.

6. Business related benefits

Of course, there are some business related benefits. You'll get access to expense management tools, helping to simplify your operations and make it easier to track what your spending.

You also can set controls on any cards you may have to give to employees. You'll also be protected in case your employees abuse your company credit card.

2 downsides of the RBC Avion Visa Infinite Business

It's not perfect, so there are 2 things you'll want to keep in mind.

1. Not the greatest rewards outside of the airline chart and transfer partners

There's plenty of value to be found with RBC Rewards, that's for sure.

But if you don't redeem points with the travel chart or the high value airline transfers (this doesn't include WestJet), you're only looking at a return of 1.25% on your purchases.

So, keep in mind what you think you may want to do with your points before signing up.

2. High annual fee

The annual fee is also relatively high at $175, which is more than the typical $120 to $150 of similar premium credit cards.

Comparison to the RBC Avion Visa Infinite

Depending on what you need the card for, you can also consider the personal version – the

Here are the differences between these cards.

| Feature | RBC Avion Visa Infinite Business | RBC Avion Visa Infinite |

|---|---|---|

| Welcome bonus | 25,000 RBC Rewards points (terms) | 55,000 RBC Rewards points (terms) |

| Annual fee | $175 | $120 |

| Rewards |

* 1.25 points per $1 spent on the first $75,000 in annual purchases * 1 point per $1 spent afterwards |

* 1.25 points per $1 spent on travel * 1 point per $1 spent on all other purchases |

| Other benefits | * Access to the Avion flight chart for high value rewards * Transfer points to 4 airline partners * Business benefits |

* Access to the Avion flight chart for high value rewards * Transfer points to 4 airline partners |

| Insurance coverages | 12 types | 12 types |

| Income requirements | * Personal: $60,000 * Household: $100,000 * Minimum business revenue of $500,000 |

* Personal: $60,000 * Household: $100,000 |

There isn't much separating these cards except for the rewards and the annual fee. The business version will earn more rewards on purchases – 1.25 points per $1 spent on all purchases, up to $75,000 in annual spend – but that's also coupled with a higher annual fee.

So which card is right for you? Well if you want to keep your business expenses separate while earning Avion rewards, then the RBC Avion Visa Infinite Business will give you extra business-related benefits. If not, then the RBC Avion Visa Infinite can save you a bit of money up front.

Leave a user review

For a business credit card, the RBC Avion Visa Infinite business has a lot to like.

Have this card now or in the past? Leave us a user review so others can see what you thought of it.

FAQ

What does the RBC Avion Visa Infinite Business card offer for rewards?

Earning RBC Rewards points, the RBC Avion Visa Infinite Business card earns:

- 1.25 points per $1 spent on the first $75,000 in annual purchases

- 1 point per $1 spent afterwards

What is the annual fee of the RBC Avion Business Visa Infinite?

The RBC Avion Visa Infinite Business has an annual fee of $175.

Does the RBC Avion Visa Infinite Business card have a welcome bonus?

Yes – the RBC Avion Visa Infinite Business card earns 25,000 points after your account is approved.

People also viewed

Key benefits

Refer to RBC page for up to date offer terms and conditions.

Corresponding legal references and product terms are available on the RBC website, which will be available and agreed upon in the customer onboarding process.

** If you lose your job or become totally disabled, this coverage can pay 25% of your credit card total account balance – up to $6,250 per month for up to four months. If you pass away, this coverage can make a single payment of the total amount owing on your credit card account to a maximum benefit amount of $25,000. Enrolment is easy for eligible cardholders. You may cancel at any time. Premiums are $1.20 per $100 of your account balance on your statement date (plus applicable taxes). Terms, conditions and eligibility restrictions apply. Full details are available on rbcroyalbank.com. This insurance coverage is underwritten by American Bankers Insurance Company of Florida and American Bankers Life Assurance Company of Florida, who carry on business in Canada under the trade name of Assurant®.

User reviews

Reviewed by 3 Canadians

Thank you for your review!

Hang tight while we verify and approve it.

If you want to see your review right away...

Create an account:

Rewards earning of 1.25 up to $75k is decent. However, no free lounge passes. You have to pay 32 USD every time, which is nothing special. Basically you get this card for the reward points, insurance and mobile device protection That's where the story ends.

S Zak is incorrect. People should research and do their due diligience before posting reviews. Read the legal Certificate of Insurance that is provided with the card. RBC has a PDF on their website (https://www.rbcroyalbank.com/credit-cards/documentation/pdf/avion-visa-infinite-business-insurance-and-protection.pdf).

The coverage begins 91 days after the purchase because the card already has "Purchase Security & Extended Warranty" warranty coverage for the first 90 days. In regards to paying in full, if you finanace your device with your cellular company, it is fully covered as long as you continually charge the full amount of your monthly bills to the card. Here is the exerpt from the insurance certificate as proof:

When does coverage begin and end?

This coverage begins ninety-one (91) days from the date you purchase and pay in full the purchase price of the mobile device with your RBC Avion Visa Infinite Business card and/or RBC Rewards points.

If only a partial payment is made using RBC Rewards points, the remaining balance of the purchase price must be paid with your RBC Avion Visa Infinite Business card in order for the mobile device to be covered.

If the mobile device is equipped with cellular data technology, you must activate it with a provider, or;

If you funded the purchase price of your mobile device through a plan, you must charge all of your provider’s monthly wireless bill payments to your RBC Avion Visa Infinite Business card for the entire duration of your plan.

Coverage ends, for the cardholder, on the earliest of:

1. Two(2) years from date of purchase of your mobile device.

2. The date one monthly wireless bill payment was not charged to your RBC Avion Visa Infinite Business card, if you are funding the cost of your mobile device through a plan;

3. The date your RBC Avion Visa Infinite Business account is sixty(60) days past due; or

4. The date your RBC Avion Visa Infinite Business account is cancelled; or

5. The date the group insurance policy is cancelled by the Insurer or Royal Bank. However, such cancellation of coverage shall not apply to a mobile device charged to your RBC Avion Visa Infinite Business card prior to the cancellation date of the group insurance policy.

I own an Avion business card with annual fee of $ 120 and it's been good for my business needs. I recently wanted to switch from my Avion business card to the Avion infinite business card with a higher annual fee, only for the new mobile device protection feature offered. Fortunately, I was able to find out in good time that the protection only kicks in 90 days "after the device is paid off in full"-meaning that either you pay for it upfront (which is only rarely done) or you wait till the end of your financing period + 90 days while paying your bill with the Avion card- so, NO THANKS, please do not confuse the public with your marketing gimmick.

PS: I had to wait almost 50 minutes to speak with the CSR and when he transferred me to another department for a different issue, the call dropped- I'm not gonna call them again- do not have that kind of time on my hands.