The HBC Rewards program has been suspended, and the HBC Mastercard is earning cash back for the time being.

Originally founded as a fur trading company in 1670, Hudson’s Bay is the oldest company in North America.

Now a department store with locations across Canada, Hudson’s Bay is a popular place to shop.

And they also have a credit card – the Hudson’s Bay Mastercard. But what does it offer? And are there better alternatives?

Here is the answer to both those questions.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

HBC Rewards overview

Let’s start with a quick overview of the Hudson’s Bay Rewards program – the rewards program for The Bay.

How to earn HBC Rewards

How do you earn points? There’s a few ways you can earn points. The primary way is by shopping at Hudson’s Bay retailers.

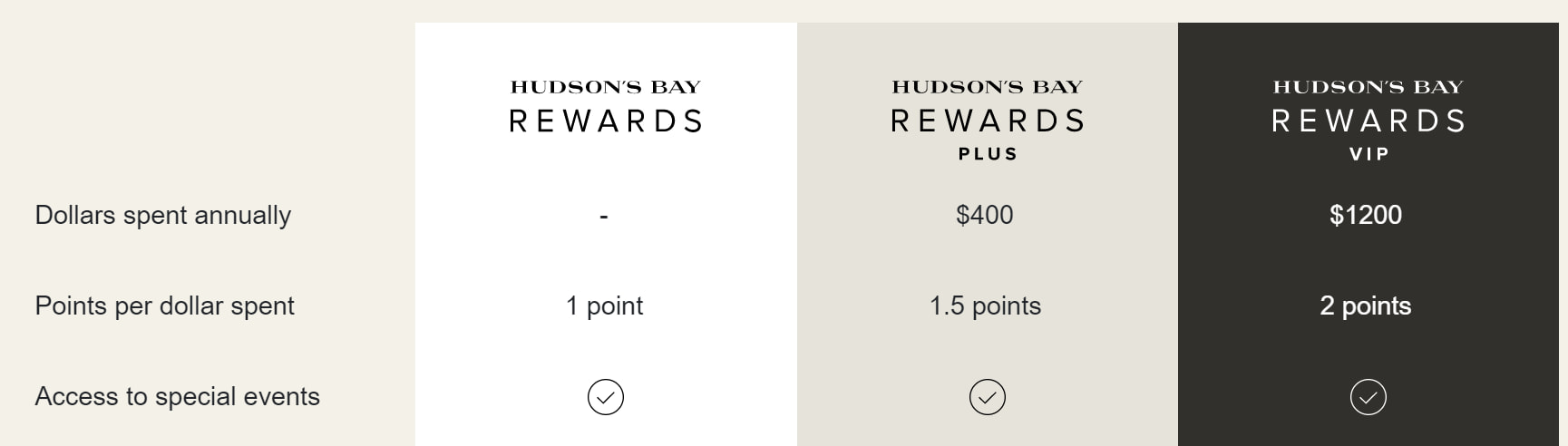

There are 3 tiers in the program. As you spend more at HBC, you’ll earn more points on your purchases.

Here are those 3 tiers, how much you’ll earn on purchases, and how much you have to spend to reach each tier.

If you’re a Petro-Points member, you can earn even more. Simply link your HBC and Petro-Points accounts together, and you’ll earn 20% bonus HBC points when shopping at Hudson’s Bay, and 20% bonus Petro-Points at Petro-Canada.

Outside of shopping at HBC, the only other way to earn points is by transferring in RBC Rewards to HBC (you can also transfer the other way), where 2 RBC points gives 1 HBC point.

How to redeem HBC Rewards

So how can you redeem your points? There are 3 ways you can redeem them.

The first is by using your points towards purchases at Hudson’s Bay. 1,000 points gives a $5 discount, a value of 0.5 cents each.

The only other ways are by making transfers to other programs. There’s the aforementioned partnership with RBC Rewards, where 4 Hudson’s Bay points becomes 1 RBC Rewards point.

Finally, you can also transfer your HBC points to Air Miles. 40 HBC points becomes 1 Air Mile.

Want to see what Air Miles can be used for? Here are the full details.

How much HBC Rewards points are worth

So what are your HBC Rewards points worth?

Here’s the value for each option. For the 2 transfer options, we’ll use our typical value we give for each program. For RBC Rewards, that’s 2.33 cents, and for Air Miles, 17.2 cents.

| Redemption option | CPP value |

|---|---|

| Redeem At Hudson’s Bay | 0.5 cents |

| Transfer To RBC Rewards | 0.58 cents |

| Transfer To Air Miles | 0.43 cents |

It’s close, but we would recommend redeeming for merchandise at HBC. The transfer numbers consider that you’re getting the best possible value with those rewards programs, something that isn’t guaranteed.

In short, forget about the transfer options and stick with redeeming your points in-store.

Want to learn about the best rewards programs in Canada? Here are 20+ programs compared.

New HBC Mastercard review

So what does the new HBC Mastercard offer?

Here’s a summary of what this credit card has to offer.

| Annual fee: | $0 |

| Type of reward: | HBC Rewards |

| Rewards details: | * Up to 2 points per $1 spent at Hudson’s Bay * 2 points per $1 spent everywhere else * Bonus rewards at over 1,000 retailers, with an average return of 2% |

| Welcome bonus | 5% off first-day purchases, and a welcome bonus of 25 dollars in Hudson’s Bay Rewards points |

| Average rate of return: | 0.98% |

| Purchase interest rate: | 19.99% – 24.99% |

| Income requirement: | None |

So for no annual fee, you’re getting a return of up to 1% back on your purchases at Hudson’s Bay, and 1% back on everything else, using a value of 0.5 cents per point.

But, there’s a few things to know about when it comes to earning points at Hudson’s Bay, as you’ll see below.

Who is Neo Financial?

New to Neo Financial? They’re a new player in the Canadian financial market.

They offer a mix of credit cards and savings accounts, offering some unique credit card products, and high interest savings accounts.

You can learn more about what Neo Financial has to offer here.

3 HBC Mastercard benefits

So what are some benefits of the Hudson’s Bay Mastercard?

Here are 3 things we like about it.

Decent rewards on other purchases

The rewards are decent for a no annual fee credit card. On your non-HBC purchases, you’ll be earning 2 points per $1 spent on all purchases, for a return of 1% back.

That’s on par for the better no annual fee credit cards out there.

However, shop with Neo’s retail partners (there are plenty of them), and you can earn up to 2% back on your purchases.

Lower spend requirements for free shipping

When you shop online at Hudson’s Bay, you need to spend $99 before taxes to qualify for free shipping.

However, when you have the Hudson’s Bay Mastercard, the minimum spend requirement is only $45, potentially saving you some shipping costs.

No annual fee or income requirements

Finally, there’s no annual fee or income requirements to worry about. It’s very accessible to many Canadians.

3 HBC Mastercard drawbacks

On the other side, here are 3 things you need to think about.

Poor rewards at Hudson’s Bay

Don’t let the marketing language fool you. Despite what you see, and it having the Hudson’s Bay logo on it, the rewards are quite poor at HBC stores.

With the HBC Mastercard, you earn a multiplier based on what tier you’re in, and includes what you would be earning anyway just by being a member of the program.

How much you get back with the credit card depends on what tier you’re in within HBC Rewards:

- Basic – 1 point per $1 spent,

- Plus – 1.5 points per $1 spent, and

- VIP – 2 points per $1 spent.

That’s a return of between 0.5% to 1% on your purchases, which is nothing special, especially for a store branded credit card.

High, variable interest rates

If you always pay your bill on time, feel free to skip this part.

But the Hudson’s Bay Mastercard not only has high standard rates, but they’re also variable. Your actual rate varies on your province and credit worthiness.

The rate on purchases varies between 19.99% to 24.99%.

Cash advances? Even higher, at 21.99% to 26.99%. And there are no balance transfer rates.

No insurance included

Most credit cards, even no annual fee cards, include at least basic extended warranty and purchase protection.

But not here. The Hudson’s Bay credit card doesn’t include any insurance of any kind.

How does the new HBC Mastercard compare to the old Capital One option?

Had the old HBC Mastercard?

Wondering if it’s worth applying for the new one?

Here’s the comparison of what the new and old HBC Mastercards had to offer.

| New HBC Mastercard | Old HBC Mastercard | |

|---|---|---|

| Earn Rates | * Up to 2 points per $1 spent at Hudson’s Bay * 2 points per $1 spent everywhere else |

* 2 points per dollar spent. * 2x the points at HBC owned stores. |

| Insurance Coverages | None | None |

| Special Features | Lower free shipping requirement for online purchases | * 25% bonus paid in January and July. |

| Annual Fee | $0 | $0 |

| Income Requirements | None | None |

There’s 2 key differences.

First, the rewards. With the older card, you earned more on purchases at Hudson’s Bay stores – 4 points per $1 spent on purchases, or a 2% return. The new card doesn’t come close to this.

And the other are the special features. Which one is better depends on you. WIth the new card, you can potentially save on shipping when shopping online, as you only need to spend $45 to get free shipping.

However, with the old card, you got 25% bonus points every January and July. Depending on how much you spent at HBC, this could have been quite valuable.

4 best HBC Mastercard alternatives

So, we’ve established that the new HBC Mastercard is decent for non-HBC purchases, but lackluster for purchases made at HBC.

So, here are some other credit cards you can think about.

| Category | Credit Card | Average Earn Rate % | Annual Fee | Apply Now |

|---|---|---|---|---|

| Best flat rate cash back credit card | American Express SimplyCash Preferred | 2.55% | $119.88 | Apply Now |

| Best no annual fee cash back credit card | Brim Mastercard | 0.83% | $0 | Apply Now |

| Best travel credit card with a high earn rate | RBC Avion Visa Infinite | 2.36% | $120 | Apply Now |

| Best cash back credit card for everyday purchases | BMO CashBack World Elite | 2.02% | $120 | Apply Now |

1. Best flat rate cash back credit card

To earn a flat 2% cash back, with no limits, on all your shopping, the

As long as Amex is accepted where you’re shopping (and it’s better than you think), you’ll earn 2% cash back on all those purchases, which is increased to 4% on gas and groceries.

This card also has 10 types of insurance, for an annual fee of $119.88, less than most premium credit cards.

Amex also has a no annual fee version – the

GC: $50

2. Best no annual fee cash back credit card

Want to earn cash back for no annual fee? Then take a look at the

You’ll earn a simple 1% cash back on all your purchases. But there’s more to this card than just that.

Shop with Brim’s 150+ retail partners, and you can earn up to 30% cash back on purchases. Plus, you’ll get no forieng exchange fees, 4 types of insurance, which includes rare mobile device coverage.

And if you want even more rewards, Brim offers 2 other credit cards for varying annual fees.

They are:

3. A flexible rewards card with high rewards on all purchases

For flexible rewards with high value, the

You earn a straightforward 1 point per $1 spent on all purchases, which is increased to 1.25 points on travel purchase.

But more than that is what they’re worth. Each RBC Avion point is worth up to 2.33 cents each, giving a return of 2.33% on all purchases (2.91% on travel).

And of course, as seen above, you can transfer your points to HBC, where 1 RBC Rewards point becomes 2 HSBC points. But, this is a lower value than other RBC Rewards options.

And it has 12 types of insurance, for a standard annual fee of $120.

simple card view, ccg popup, card details

4. Best cash back credit card

All the above cards have one earn rate for everything. And let’s be honest, you also shop at grocery stores and other places.

So here’s one card to think about, that’s has a variety of earn rates on many things – the

Here’s what you’ll earn on purchases:

- 5% cash back on groceries, up to $500 in monthly spend

- 4% cash back on transit, up to $300 in monthly spend

- 3% cash back on gas, up to $300 in monthly spend

- 2% cash back on recurring bills, up to $500 in monthly spend

- 1% cash back on all other purchases

You’ll only earn 1% cash back at Hudson’s Bay. But, you can earn up to 5% cash back on other purchases.

And this card comes with free roadside assistance (a rarity), and get 13 types of insurance, for a standard annual fee of $120.

HBC alternative credit cards compared

So how do these 4 credit cards compare? We’ve broken them down into 4 key areas.

Annual fee

First, the annual fees. What will it cost to keep each credit card in your wallet?

We have one card with no annual fee, and the other 3 have standard annual fees.

Estimated rate of return

What about the rewards you’ll get? Here is our estimated average rate of return, based on a typical $2,000 monthly spend.

All the premium cards give a return of at least 2%. Obviously our no annual fee card can’t compare, but still offers more than 1% on your purchases.

Insurance value

Finally, we’ll take a look at what the insurance package on each card is worth, based on our study of the value of insurance coverage.

The BMO and RBC cards are the clear winners here, with over $500 in value. But all these cards are well covered in this department.

Bottom line

One the surface, the HBC Mastercard from Neo seems like a good deal.

But after digging into the details, it’s not a good credit card for your Hudson’s Bay shopping – you can do better.

What are your thoughts on the new HBC Mastercard?

Let us know your thoughts on the new HBC Mastercard.

FAQ

How do I check my HBC Mastercard balance?

To check your HBC Mastercard balance, you need to sign in to your Neo Financial account.

Is the Bay closing in Canada?

The Bay is not closing in Canada. While they have seen some downsizing in recent years, there are still over 80 stores across Canada.

What is the HBC Mastercard?

The HBC Mastercard, offered by Neo Financial, offers up to 2 points per $1 spent at HBC stores, and 2 points per $1 spent on all other purchases.

How do I check my Hudson Bay Points?

To check your Hudson’s Bay points, you’ll need to login to your Hudson’s Bay Rewards account online.

How many HBC points equal a dollar?

1,000 HBC Rewards points gives a $5 discount when shopping at Hudson’s Bay, for a point value of 0.5 cents.

Can I use HBC points online?

Yes, HBC points can be redeemed when online shopping.

How many Air Miles do you get for HBC points?

HBC Points can be converted to Air Miles. 40 HBC points turns into 1 Air Mile.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×2 Award winner

×2 Award winner

$50 GeniusCash + Earn up to $100 in bonus cash back.

$50 GeniusCash + Earn up to $100 in bonus cash back.

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 1 comments