Do you know what a charge card is?

They look and seem to work just like a regular credit card, but under the hood there are a few subtle (but major) differences.

Here is everything you need to know about charge cards…and how to know if they’re right for you.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What is a charge card?

A charge card is a type of credit product that’s very similar to credit cards.

But they do have a few important differences, mostly to do with how the credit is borrowed. A major example? Charge cards usually don’t have pre-set credit limits – but you’re fully expected to pay off your full balance every month (or be met with even higher interest rates).

And on your credit report, a credit card appears under revolving credit, but charge cards appear under “open credit” on your report.

Think of it like electric and gas cars. They both do the same thing, and on the outside they look the same, but it’s the inside that’s different.

Let’s go over the differences in detail.

How a charge card works vs. regular credit cards

Here’s how charge cards actually work.

On the surface, they look and work just like a regular credit card. When making a purchase in-store, insert your card in the terminal, enter your pin, and your card is charged.

Same with online purchases – enter in your info, the CVV code, and make your purchase.

But underneath, there are 2 differences to them:

- there’s no pre-set spending limit, and

- you’re not able to carry the full balance on your card.

What are the spending limits of charge cards?

Let’s start with the spending limit. A regular credit card has a hard limit that can’t be exceeded. But with a charge card, you don’t have a pre-set spending limit.

But that doesn’t mean you have unlimited credit at your disposal. There are soft limits at play.

As an example, I have the

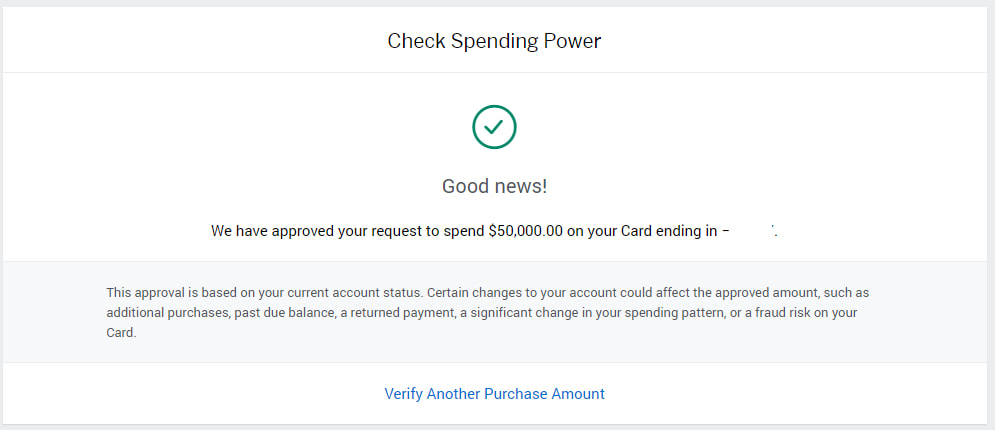

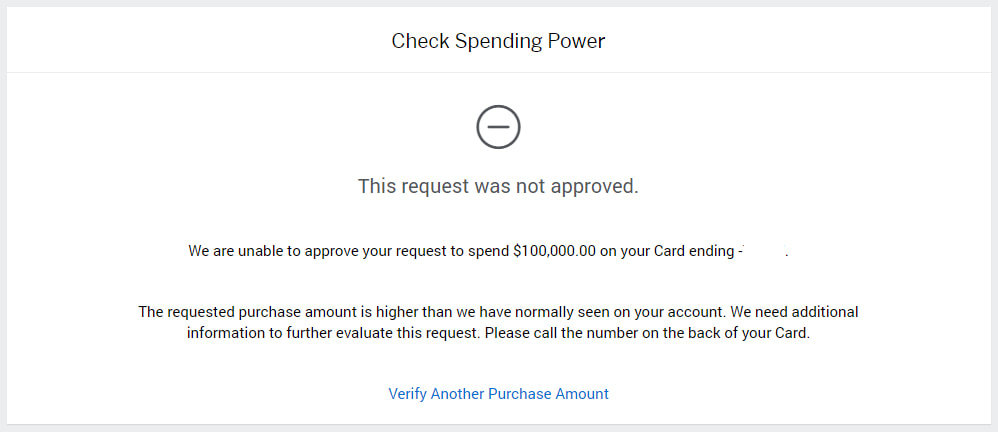

Amex has a tool that will let me see how big of a purchase they would allow, which is called “Check Spending Power.” Enter in a single purchase amount, and you can see if Amex will allow it or not.

This will depend on your personal situation, but for me the limits were quite large.

As an example, I first entered $5,000 – no issues here. I tried various amounts all the way up to $50,000, and I’m still good to go.

I then cranked it up to $100,000, and was told no bueno.

So, even without a spending limit, there are still limits at play. Which makes sense – Amex doesn’t want me to go crazy to safeguard themselves in case I can’t pay them back.

Because you don’t have a set limit, charge cards appear in the “open credit” section of your credit file, and not the revolving section like a credit card.

What happens if you don’t pay your balance in full?

So the other major difference between a charge card and a credit card – you can’t carry the full balance on your charge card.

With credit cards, you have a full range of interest rates – purchase, cash advance, and balance transfer. You can carry almost your full balance on it, save for your minimum payment, which is $10 or a set percentage (usually around 5%). Which one applies to you depends on your card and where you live.

But with charge cards, your balance generally has to be paid in full, although Amex has recently changed that. You can now carry some of what you owe on your card. My limit is $18,000, similar to what I have with other credit cards. And this also has a typical purchase interest rate – in the case of the Platinum Card, it’s 21.99%.

But if I don’t pay at least my limit, a couple of things happen.

- First, my account gets frozen, and I can’t use my card.

- Second, the interest rate on what’s over my limit goes up to 30%.

This really doesn’t matter if you’re the kind who just pays your bill in full anyway. But if you tend to carry a balance from time to time, it’s definitely worth paying attention to.

When are charge cards right for you: Pros and cons

When is a charge card right for you? Generally speaking, if you pay your balance in full all the time, a charge card is a little better, as you won’t have a credit limit to contend with.

If not, then a charge card probably isn’t for you.

The pros of charge cards

There is one major pro to a charge card.

No preset spending limit

The biggest advantage is the fact you don’t have a hard credit limit to deal with.

As long as you continuously pay your bills on time, you can make just about any purchase within reason.

The cons of charge cards

On the other hand, here are 2 things to remember.

Higher interest rates

The interest rates are higher on a charge card than what you normally see on a credit card.

And while things have changed and you can carry a balance with them, the interest rate on the balance that’s over your limit is still quite high.

Limited number of cards

Really want a charge card? There aren’t that many of them. Out of the

You’re also limited to one issuer – American Express. No one else offers them in Canada.

Amex charge cards ‒ the only charge cards in Canada

Here are the details on the personal charge cards issued by American Express.

A side note – the

| Credit Card | Welcome Bonus | Earn Rates | Annual Fee, Income Requirements | Apply Now |

|---|---|---|---|---|

| American Express Aeroplan | 40,000 points (terms) |

* 2 points per $1 spent on Air Canada * 1.5 points per $1 spent on restaurants * 1 point per $1 spent on all other purchases |

* $120 * None |

Apply Now |

| American Express Platinum | 100,000 points (terms) |

* 2 points per $1 spent on restaurants and travel * 1 point per $1 spent on all other purchases |

* $799 * None |

Apply Now |

1. An Amex Aeroplan credit card

One of the best Aeroplan-branded credit cards is a charge card – the

On your spending, here’s what you’ll be earning for Aeroplan points:

- 2 points per $1 spent on Air Canada

- 1.5 points per $1 spent on restaurants

- 1 point per $1 spent on all other purchases

On top of your rewards, it comes with standard Air Canada benefits, a few of which include:

- first checked bag free,

- preferred pricing on reward flights, and

- elite qualification status boost.

It’s for an annual fee of $120, lower than similar Aeroplan-branded cards.

2. Best perks credit card

Amex’s other personal charge card offers the best of the best when it comes to perks – the

First, here’s what you’ll earn for points on purchases:

- 2 points per $1 spent on restaurants and travel

- 1 point per $1 spent on all other purchases

Earning points in the Membership Rewards program, you’ve got plenty of choices as to what you can redeem them for. The best value is by transferring them to Aeroplan, where each point is worth 2 cents each.

But more than the rewards are the perks. Here’s a taste of what it offers:

- $200 annual travel credit,

- automatic Marriott Bonvoy and Hilton Honors Gold status,

- unlimited lounge access for the cardholder and a guest at over 1,200 airports, and

- discounted premium seats through the International Airline Program.

Just note the annual fee of $799, so make sure you get the most out of those perks.

What makes the Platinum Card worth the annual fee? Here’s why I kept it for year 2.

3. Amex business cards

Several Amex small business cards are also charge cards.

They are:

You can learn more about Amex business credit cards here.

Your turn

For those who pay your bills in full all the time, a charge card won’t make much of a difference for you – except not having to worry about credit limits.

But if not, you have to be careful, as the higher interest rates will really start to cost you.

Do you have a charge card? What has your experience been?

Let us know in the comments below.

FAQ

What is a charge card?

A charge card functions like a regular credit card, but has 2 main differences:

- no pre-set spending limit, and

- you can’t carry the entire balance on your card.

Who offers charge cards?

Currently, American Express is the only credit card company in Canada that issues charge cards.

What is the difference between a charge card and a credit card?

There are 2 main differences between charge and credit cards. Credit cards have a hard spending limit, but you can carry the entire balance, save for the minimum payment. A charge card however, has no pre-set spending limit, but you can’t carry the entire balance.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×2 Award winner

×2 Award winner

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 2 comments