All credit cards have unique numbers that you use to make purchases – and that 16-digit string of numbers on your card represents the credit card issuer, bank, and your account number.

Keep reading to learn more about what your credit card number means and how to decode it.

Key Takeaways

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What numbers are on your credit card?

Most cards include a 16-digit number on the front (or 15 digits for Amex), though a few issuers place that number on the back. This number is unique to your account — you’ll also see it on your credit card statement every month.

Other numbers you’ll always see are the expiration date and CVV security code. We’ll break those down in more detail.

Amex cards have another 3-digit code on the back of the card (after your 15-digit card number). It’s a verification code that you’ll be asked to give if you contact Amex customer support.

Your credit card number

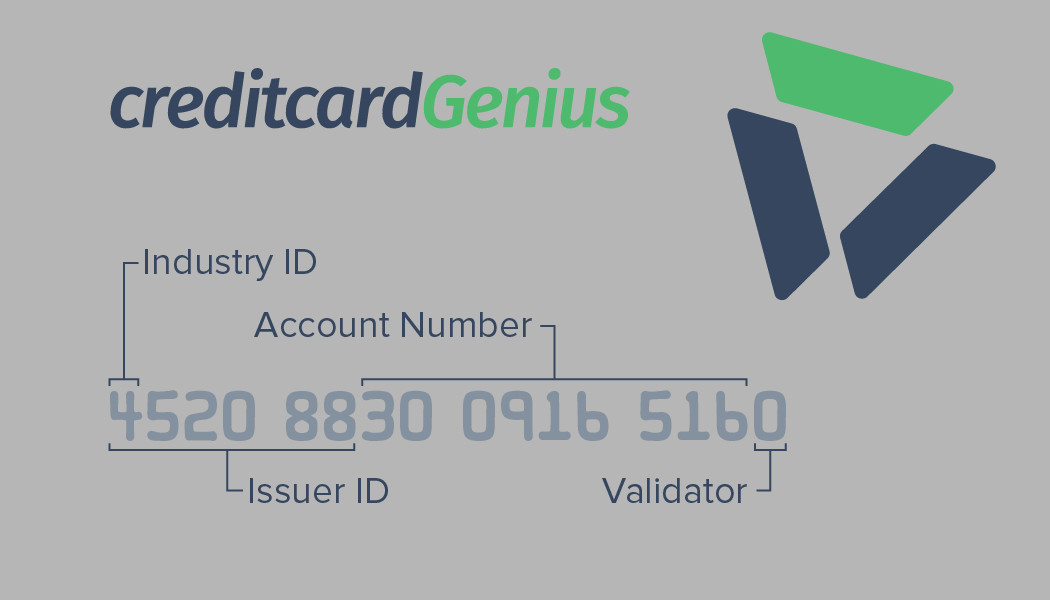

Your card number is more than just a random string of numbers. If you know what to look for, the string of numbers reveals a lot. Specifically, it gives you the issuer ID (so you know which company handles the account) before listing your unique account number. The last number on the string is the validator, also called the check digit, which simply ensures that the entire, correct account number was entered if you’re using your card online.

Take a look at how you find this information on your card:

If you’re curious about how those numbers are generated, we’ve got answers.

The first digit of the industry ID reveals which network your card belongs to – Amex is 3, Visa is 4, and Mastercard is 2 or 5. Other industries (like gas chains or airlines) use the remaining single digits. If you see a 7 or 8, for example, you might be looking at an airline credit card.

When you look at the first 6 digits of the card, you’ll learn the exact card issuer. Each bank has unique codes. Keeping in mind issuers will generally have multiple ID numbers, here are some examples:

| Issuer | ID number |

|---|---|

| Scotiabank | 453826 |

| BMO | 552489 |

| TD | 452088 |

| National Bank | 525899 |

| MBNA | 519959 |

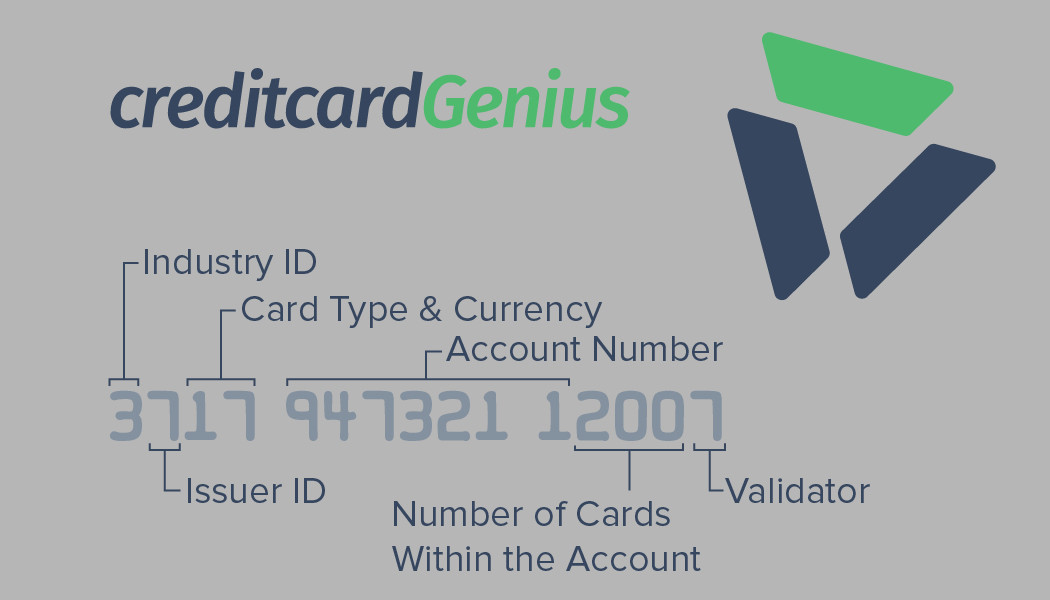

For Visa and Mastercard, the remaining string of numbers (except the last one) represents your account number. Amex cards work a little differently. Digits 5 through 11 represent the account number and digits 12 to 14 represent the Amex card number within the account.

The final digit is a validator, or check digit. This number is determined using an algorithm and is an important protection against fraud. When you make a purchase, the validator helps ensure that the credit card number isn’t fake.

The expiry date

The expiry date is pretty straightforward. This is usually in mm/yy format, and it simply tells you how long your card remains valid. It expires on the last day of the listed month.

So, if your card says 04/26, you’ll be able to use your card until April 1st, 2026. Don’t worry, though. Major credit card issuers usually send out new cards in the weeks or months before your card expires.

The CVV

The last number you’ll find is the CVV security code. To protect against fraud when shopping online, merchants ask for the 3-digit code during the checkout process.

If you have a Visa or Mastercard, the CVV is on the front of the card. Note that Amex CVVs are 4 digits and located on the front of the card, not to be confused with the 3-digit verification code on the back.

Is your credit card number the same as your account number?

It's a common assumption, but credit card numbers and account numbers aren't the same.

Your account number will appear on your statement, and you won't be able to use it when trying to buy something. It always stays the same.

On the other hand, your credit card number may change over time if you switch cards or get a replacement.

FAQ

Does the first digit have significance in a credit card number?

The first digit is quite significant when it comes to credit card numbers. It signifies the credit card network, with a 3 representing Amex (along with a few others), 4 Visa, and 5 Mastercard.

What is the account number for a credit card?

For Visa and Mastercard, the account number is represented by digits 7 to 15. For an American Express credit card, digits 5 to 11 is the account number.

Do Amex credit cards have any special numbers?

Amex credit cards have 2 special numbers. Digits 12 to 14 of the credit card number represent the number of cards that the account has had. And, on the back of the card in the signature bar is a 3 digit number, which Amex uses for security purposes when talking with customer service.

Where is the CVV number located on a credit card?

The CVV is a 3 digit number located on the back of your credit card. The one exception is with Amex cards, which have 4 digit CVVs located on the front.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.