On a credit card, the CVV number – or card verification value – is a 3 or 4-digit number you'll use when shopping online. The CVV is a security feature that you’ll find on all credit cards. You’ll usually find it on the back of the card, though this varies by credit card issuer.

Here's what you need to know about what this number entails, where you’ll find it, and when you’ll need it.

Key Takeaways

- CVV stands for card verification value.

- The CVV number on a credit card is used to complete online transactions.

- This number is 3 digits on Visa and Mastercards and 4 on Amex cards.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What does a credit card CVV mean?

CVV stands for "card verification value". All credit card and debit cards that bear the Visa and Mastercard logos have 3-digit CVVs, while American Express cards have 4-digit CVVs.

The CVV adds an extra layer of security to your card: If someone happens to have your credit card number, they won't be able to make any purchases with it if they don't also have this number.

You’ll also see the CVV called a CSC (card security code), CVC (card verification code), or CVV2, which is a 2nd generation CVV code that is harder to guess.

CVV vs. PIN

The CVV is not the same as your PIN (personal identification number).

- You’ll need your CVV to make a phone or online purchase with your credit card – all reputable online merchants will ask for it

- Your PIN is what you enter when you put your credit card into a payment terminal or ATM during an in-person transaction

How to find the CVV on your credit card

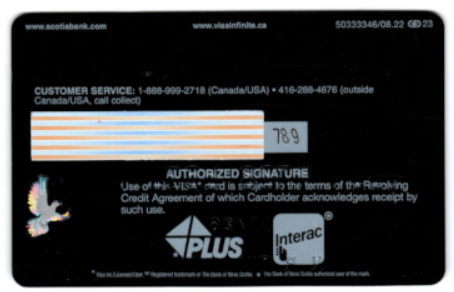

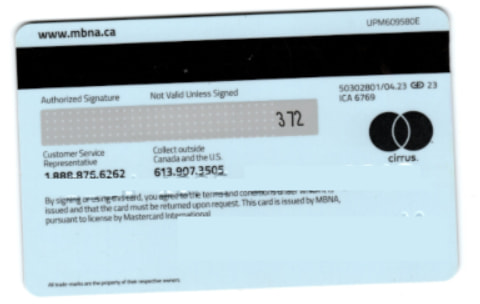

The network your card belongs to will dictate where you'll find the CVV number. On Visa and Mastercards, it's on the back of your card next to the signature strip. These cards feature a three-digit number.

Here's a real-life example from the Scotiabank Passport Visa Infinite Card.

And here's what it looks like on the MBNA Rewards World Elite Mastercard.

On Amex cards, you can find the CVV on the front on the right-hand side. Amex cards feature a four-digit number. Here's what it looks like on the American Express Aeroplan Reserve Card.

Important note: You may notice that Amex cards also have 3 digits on the back next to the signature bar. While this might look like a CVV, it’s actually a security code you'll need when you contact American Express. They'll ask for this while verifying your account.

CVVs help reduce fraudulent transactions

CVVs exist to prevent credit card fraud.

Would-be criminals need a lot of information to use your credit card for purchases, and the CVV adds one extra step to prevent this type of fraud.

When you shop online, here’s the credit card information you’ll need to enter:

- Name

- Billing address

- Credit card account number

- Expiration date

- CVV number

If someone steals your card, they’ll have 4 of those things – but they won’t have your address.

Likewise, if your credit card account is hacked, fraudsters will get everything except the CVV number on your physical card.

How to protect your CVV number

Many of our suggestions fall in the category of "Good credit card security practices." Still, it’s important to remember that you can be proactive in protecting your credit card information.

- Do not share your credit card or CVV number: Keep your card in a secure spot and don’t give it to others to make purchases for you. If you accidentally leave your credit card at a business, try to go back and get it as quickly as possible.

- Avoid making online credit card purchases in public areas: Not only are you at the mercy of public Wi-Fi security, but people nearby could see your credit card information as you enter payment details.

- Beef up your online security: Update your passwords regularly and use strong ones. We’re talking a lengthy password made up of letters, numbers, and special characters. If websites give you the option, enable 2-factor authentication for an extra layer of security.

- Regularly check your credit card statements: If your card information has gotten out into the world and someone is using it, you’ll catch it faster if you frequently log into your account to check activity.

- Think about using virtual credit cards: Virtual cards are incredibly secure options since the card issuer generates a unique card number for each purchase you make. The number only works for a single transaction, which can limit the damage done by a thief.

FAQ

What is a credit card CVV?

A credit card CVV is a number on all credit cards and debit cards (only those with a Visa or Mastercard logo in the latter case). This number is used as an extra layer of protection when making purchases online.

What is a CVV vs. CSC?

A CVV and CSC are the same thing. CVV stands for card verification value and CSC stands for card security code.

Do debit cards have CVV numbers in Canada?

Debit cards that are part of the Visa and Mastercard network have CVV numbers on them as they can be used to make purchases online at any retailer or online.

How many digits is a CVV number?

CVV numbers are 3 digits on Visas and Mastercards and 4 digits on Amex cards.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.