Shopping online has become more convenient – but you might want to take steps to make it more secure. Using a virtual credit card is an increasingly popular way to protect your account from data breaches and hackers.

A virtual credit card is a unique one-time-use number that’s generated by the issuer of your existing physical credit card. That way, if the card information is stolen, your entire credit card account isn’t compromised because hackers can’t reuse the number.

Key Takeaways

- Virtual credit cards are unique numbers attached to a credit card account.

- Using a virtual credit card can help avoid fraud as they aren't true account numbers.

- A virtual credit card is not the same as a virtual wallet.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What are virtual credit cards?

A virtual credit card is a unique credit card number that’s generated by your credit card issuer so that you can make an online purchase. It masks your true credit card number and only works once so that your account is secure from data breaches, fraudulent use, and other compromises.

Virtual credit card vs. digital wallet

We should be clear – even though the terms are often used interchangeably, a virtual card is not the same as a digital wallet.

Digital wallets are a place to store any number of personal finance cards, like credit cards, debit cards, and rewards program cards. They can also carry things like airline boarding passes and even vaccination records.

Unlike virtual cards, the card numbers in your digital wallet are the same as the ones on your physical cards.

A virtual card has its own unique number that’s different from your physical credit card – even though it’s tied to the same account. When you make an online purchase, the merchant never has access to your actual account number – they only see the virtual credit card number that was generated just for the transaction.

Both of these products are designed to offer an extra layer of security, they just protect your account in different ways.

How virtual credit cards work

When you shop online, you can use your virtual card instead of a physical credit card. Your credit card issuer will generate a single-use number for the transaction. This way, if the merchant is hacked, your credit card won’t be compromised.

Tap on the virtual card and you'll get the details you'll need to complete your purchase. You can also freeze these cards quite easily if you're not using them.

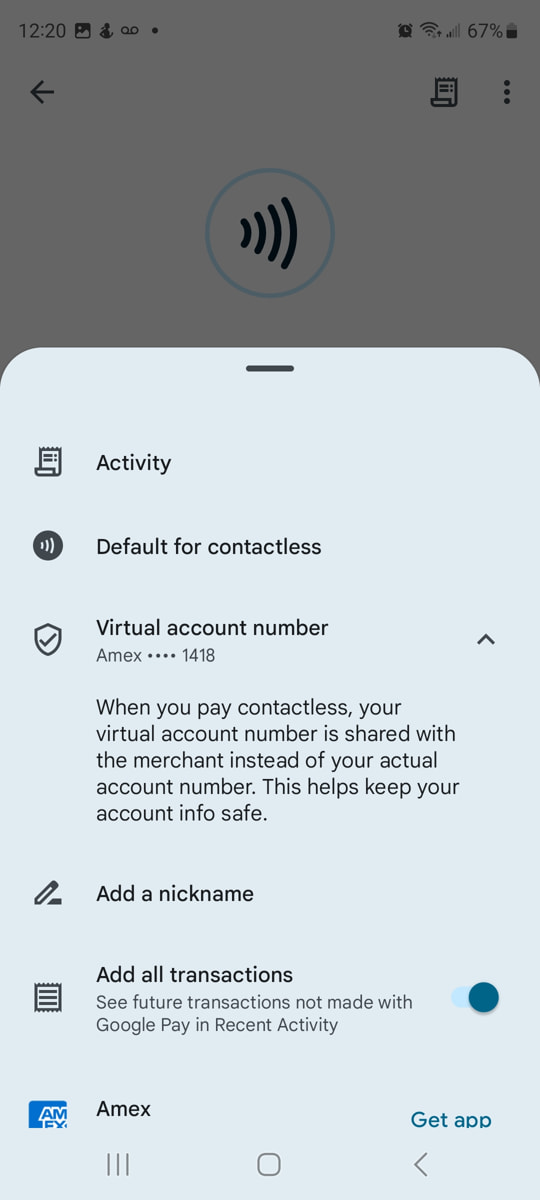

Here are a couple of examples from KOHO and American Express. KOHO is a true virtual card while Amex is a physical card in a digital wallet.

The Amex card shares a virtual account number with the merchant when you make a purchase using your mobile wallet.

Pros and cons of virtual credit cards in Canada

As you can probably guess, there are benefits and drawbacks to using virtual cards. Here are some things to keep in mind:

- You can often begin using the virtual card as soon as your account is opened

- Your account is more secure when you’re shopping online

- You don’t have to worry about data breaches when using the card

- You can set spending limits

- You can still enjoy credit card rewards, track your spending, and enjoy purchase protections

- You can’t use virtual cards for in-store purchases (but you can use your mobile wallet)

- Only select financial institutions/issuers offer virtual credit cards

It’s always helpful to read reviews from real virtual credit card users to see what they’re like. We turned to Reddit and found there was a lot of confusion over what was truly a virtual card and not just a prepaid one. That said, we did find some users who had positive things to say about the KOHO virtual credit card.

Who offers virtual credit cards in Canada?

While almost every bank's cards will have a virtual version generated when they're added to your Google Pay, Apple Pay, or other digital wallets, most don't allow you to generate your own virtual credit cards on demand.

That said, there is one prepaid option that offers truly virtual cards – and it gives you some extra control over your spending online.

| Credit card | Annual fee | Rewards | Special features |

|---|---|---|---|

| KOHO Extra Mastercard | $144, or $9 per month | * 1.5% cash back on groceries, restaurants, and transportation * 0.25% cash back on all other purchases | * Earn bonus rewards at select merchant partners * No foreign transaction fees on non-CAD purchases * Includes price protection insurance |

The

First off, you'll earn cash back on all your spending, including:

- 1.5% cash back on groceries, restaurants, and transportation

- 0.25% cash back on all other purchases

You can also earn bonus rewards when shopping with KOHO merchant partners, which can boost your earn rate and help you save even more.

And if you're travelling or making online purchases in non-Canadian currencies, the KOHO Extra Mastercard will save you the regular 2.5% added foreign transaction fee that most credit cards charge. A 0% foreign transaction fee is pretty rare for this sort of card.

Once you have a KOHO account, you can also opt into KOHO Earn Interest. KOHO Earn Interest turns your KOHO account into a high-interest savings account where you'll earn 1.2% interest on your account balance.

Even when using your virtual Mastercard, you'll save when spending and earn when saving. Win-win!

KOHO Earn Interest

FAQ

Can you use a virtual credit card in store?

You can’t use a virtual credit card in store since they’re generated when you shop online. Instead, you could use your digital wallet to make in-store purchases. Using your mobile wallet, like Apple Pay or Google Pay means that you’re still getting an added level of security when shopping.

Can you get a virtual credit card instantly?

You can’t instantly generate your own virtual credit card number unless you’re using a KOHO prepaid credit card.

Does TD offer virtual credit cards?

TD is just one of the big Canadian banks that doesn’t offer virtual credit cards – but you can connect your TD bank accounts and cards to your digital wallet and then tap your phone to pay for purchases.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

$80 GeniusCash + Up to 1.5% cash back on purchases + Lower annual fee.*

$80 GeniusCash + Up to 1.5% cash back on purchases + Lower annual fee.*

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 3 comments