Buy now pay later installment plans – also known as BNPL – help help you pay for large purchases in manageable chunks. You're charged a small fee to break the payments down into installments – and now, most credit cards offer them.

This helps you save money on credit card interest and still be able to afford big-ticket necessities.

Here's a guide on how buy now pay later credit cards work in Canada – along with a few recommendations on which ones to go for.

Key Takeaways

- Buy now pay later plans split a large purchase into more manageable chunks.

- You'll be charged a fee for this, but it will usually be less than paying purchase interest.

- Buy now pay later is offered by both credit cards and other fintechs.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What is a buy now pay later plan or credit card installment plan?

A buy now pay later plan is a credit card installment plan. You make a purchase and then choose to pay for it over a longer period – often 3, 6, or 12 months of equal payments. You typically pay a small fee for this service.

For example, instead of charging a $900 television to your credit card and racking up a balance that incurs crazy interest charges until you pay it off, your card might be charged $300 every 3 months until the full payment is covered.

This way, your credit card balance remains low and you have a chance to pay off the smaller installment before interest charges kick in.

How do buy now pay later credit card plans work?

To set up a plan with a credit card, you'll need to log in to your online account. From there, the steps vary depending on your credit card issuer.

In most cases, you’ll find the statement item that you want to convert to installments and select “convert to installments,” “buy now pay later,” or something similar. You may also be able to apply an installment plan to the entire card balance.

From here, you'll be presented with various term options and see what it will cost to get a plan – the installment fee plus your monthly payment.

Important note: The installments will be added to your minimum monthly payment so you must make sure you can pay them every month.

What do buy now pay later plans cost?

Because companies are getting the sum of their money later, you’ll have to pay fees for the convenience. These include:

- Initial fees for setting up the plan

- A percentage of the purchase amount, either on the total or the monthly charge

The fees are all generally pretty straightforward so there are no hidden costs that will surprise you in the end.

Pros and cons of using a credit card installment plan

Using a buy now pay later program unlocks access to larger purchases without crippling interest rates. That said, you should also consider the potential problems that may arise. Here's a quick rundown of the pros and cons of using buy now pay later.

Here's a quick rundown of the pros and cons of using buy now pay later.

Pros:

- Can purchase big-ticket items that you don’t have cash for immediately

- Allows for budgeting without breaking the bank

- Lower interest rates than credit cards (sometimes with 0% financing)

- No application required

Cons:

- Costs more in total than buying outright

- Temptation to spend more than you can budget for

- Steep late/missed payment fees

- Risk of going into overdraft

4 buy now pay later credit card issuers

Here are the details on the issuers that offer credit card installment plans and how much they charge. For our example, we charged $1,000 to a BNPL program with installments paid out over 12 months.

Please note that these issuers may charge you more or less, depending on your credit score and other factors.

| Issuer | Fees | Annual interest rate, based on a $1,000 purchase for 12 months |

|---|---|---|

| American Express | Variable monthly fee | 10.2% |

| MBNA | Variable total fee | 6% |

| Scotiabank | Variable total fee | 8% |

| CIBC | * Initial setup fee of 1.5% * Variable monthly interest rate |

5.33% |

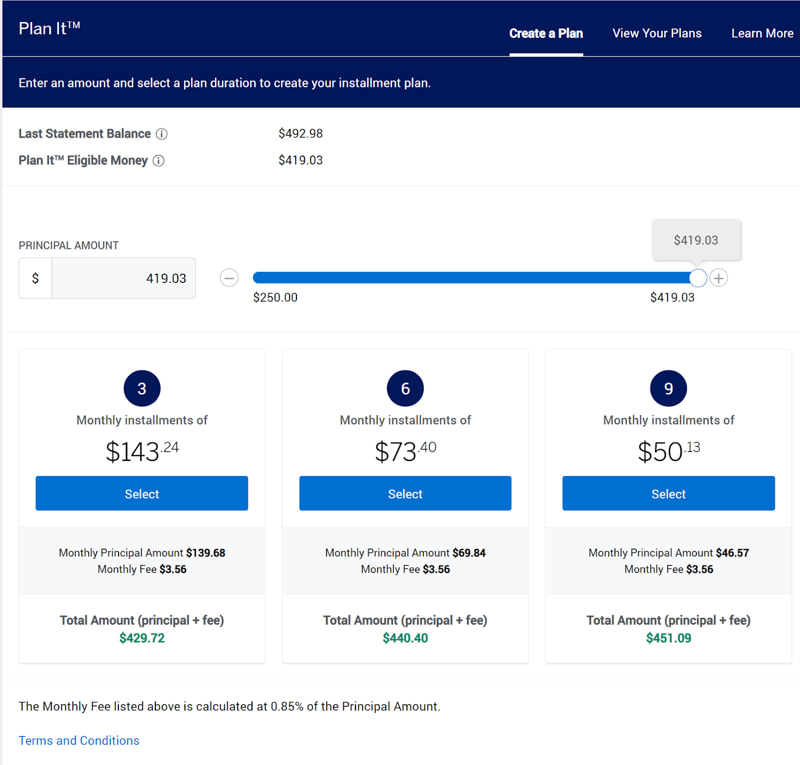

1. American Express Plan It

Terms available: 3, 6, 12 months

Minimum amount to participate in BNPL: $100

Let’s start with American Express, which runs "Plan It".

There isn’t a set fee – it all varies based on where you live and how much you put on your plan.

With that in mind, here's how Amex calculates its plans. To calculate your total fee, multiply your balance by the installment fee percentage, then by the number of months. Your monthly fee is then divided by the number of months.

Here’s an example:

Amex lists a few different rates in its cardmember agreement, but we’ll use 0.85% in this example.

$1,000 x 0.85% x 12 = $102

If you were to activate Amex Plan It on a $1,000 loan, your total fee is $102. This brings your purchase to a grand total of $1,102, which works out to an annual interest rate of 10.2%.

Divide this number by 12 to get your monthly installment – $91.83.

Lastly, we'll note that they're not available for residents of Quebec, Nova Scotia, Prince Edward Island, and Nunavut.

American Express credit cards

Amex Plan It is available on most personal Amex credit cards, except Amex Charge cards.

Here are some of the better Amex cards that can use Amex Plan It.

American Express Cobalt® Card Marriott Bonvoy® American Express®* Card SimplyCash® Preferred Card from American Express

2. MBNA Payment Plans

Terms available: 6, 12, 18 months

Minimum amount to participate in BNPL: $100

MBNA has Payment Plans, which are not available in Quebec. You’re only charged one fee based on the total amount, but it varies based on the program term length you pick:

- 6 months – 4%

- 12 months – 6%

- 18 months – 8%

To get your monthly fee, simply multiply the rate by the amount you want to put on your installment plan.

Add your fee and initial amount together, then divide by the length to get your monthly payment.

For our $1,000 purchase, spread out over 12 months, it’s:

($1,000 x 6% + $1,000) / 12 = $88.33

Over the course of a year, you’ve paid $60 in fees for an annual interest rate of 6%.

MBNA credit cards

All MBNA credit cards are eligible except for cards with standard interest rates less than 12.99% (which include the

Otherwise, all other MBNA cards are eligible. Here are their best cards.

3. Scotia SelectPay

Terms available: 3, 6, 12 months

Minimum amount to participate in BNPL: $100

Scotia SelectPay offers installment plans on select Scotiabank credit cards (and it’s also not available in Quebec).

You can choose between terms of 3, 6, or 12 months, each with a different rate applied to the total amount being put on the plan.

- 3 months – 5.99%

- 6 months – 6.99%

- 12 months – 7.99%

Using our typical example of $1,000 for 12 months, the total fee paid is just about $80. That translates into a monthly payment of $90, which is an annual interest rate of 8%.

Scotiabank credit cards

The list of eligible Scotiabank credit cards eligible for SelectPay is impressive, but it doesn't include all Scotia cards.

Here are the best eligible Scotiabank credit cards:

Scotia Momentum® Visa Infinite* Card Scotiabank Passport Visa Infinite Card Scotia Momentum Visa Card

4. CIBC Pace It

Terms available: 6, 12, 24 months

Minimum amount to participate in BNPL: $100

The last major issuer that offers installment plans is CIBC with its Pace It program, which (like the others) is not available in Quebec.

Unlike the others, CIBC is a little more complicated. First, the easy part. You’ll be charged a one-time fee of 2% of the purchase amount.

Then, every month you’ll be charged interest on the remaining balance. And the interest rate you pay depends on the length of your payment plan.

- 6 months – 6.99%

- 12 months – 7.99%

- 24 months – 8.99%

Calculating the exact amount you'll have to pay can be tricky, but CIBC has made it easier with the CIBC Pace It installment calculator.

For our $1,000, 12-month example, you'll pay a one-time fee of $20. Including interest, your monthly payment is $86.99, and in total, you’ll pay $1,063.88 on your purchase.

You’d save $53.50 compared to charging the entire purchase to a credit card that has a 20.99% interest rate.

CIBC credit cards

CIBC Pace It is only available on select credit cards. Here are some of the better ones.

Alternatives to buy now pay later credit cards in Canada

Are there alternatives to these issuers that offer buy now pay later plans? Of course there are.

Here are a few other things you can look at.

Low interest credit cards

Most credit cards have a typical interest rate of around 20%, which is obviously very high. But there are many credit cards with standard purchase rates of 13% or lower.

Most of them don’t offer rewards, so they’re completely focused on saving money through the lower rates – making them excellent alternatives to buy now pay later plans.

Here are some of the best low interest credit cards in Canada. You can also view more of them here.

Here is the standard interest rate on new purchases for each of them:

- MBNA True Line Mastercard = 12.99%

- MBNA True Line Gold Mastercard = 10.99%

- RBC Visa Classic Low Rate Option = 12.99%

Personal loans

Personal loans are another way to help with larger purchases. You’ll borrow a set amount you can use for anything you like, and have stable monthly payments over a pre-set period of time.

One option to find a loan is with LoanConnect. They’re essentially a loan search engine and will help you find the best personal loan for you.

LoanConnect

Lines of credit

You can also look into getting a line of credit. With a line of credit, you can take out as much or as little of it as you need. And you only pay back what you’ve actually borrowed.

In some cases, the minimum payment you need to make is to just pay the interest. But try to pay as much as you can – if you just pay the interest you’ll be paying the bank back forever.

Buy now pay later services

If you don’t have a credit card that qualifies for a specific BNPL plan, don’t worry, you can still access an installment payment plan through a different service.

These may charge higher fees than a bank, but Canadians can access installment plans through these service providers:

- AfterPay: Your purchases are split into four interest-free payments over six weeks. If you miss payments, you’re charged interest and fees.

- Klarna: Split your purchase into four interest-free payments and don’t pay any fees unless you miss payments.

- Affirm (used to be PayBright): Choose a flexible payment plan of 4 payments or monthly payments. No interest is charged on the shorter "Affirm Pay in 4" plan (four payments every two weeks), but interest rates vary for the more extended monthly payment plans. Interest ranges from 0% to 32%, so read the terms carefully.

- Sezzle: Break your purchase into four smaller payments, but be prepared to pay a service fee of up to 7.49% on top of interest.

FAQ

Which credit cards allow Buy Now, Pay Later?

Credit cards from major issuers like Amex, MBNA, Scotiabank, and CIBC offer buy now pay later plans in Canada. If you’re unsure if your credit card qualifies, contact your bank or read your card’s terms and conditions.

Does Costco Canada have payment plans?

Yes, if you have a CIBC Costco Mastercard, you can use CIBC’s Pace It Installment plan. And, if you need a higher credit limit to make the purchase, you can request a credit increase through customer service.

Is Buy Now, Pay Later accepted for bad credit?

This is entirely up to the card issuer or servicer. They’ll usually do a soft credit check, and if they notice that your score needs some work, you might be accepted but face higher interest rates.

How is buy now pay later different from credit card interest?

Instead of charging a big purchase to your card and paying interest on it, with buy now pay later, you enter into an agreement where your card issuer charges the purchase in smaller installments so you can save on interest.

Is using a credit card installment plan worth it?

As you make all the installment payments, BMPL plans can make big purchases possible and save you on interest costs in the long run. However, watch that you don’t overspend and ensure you make your payments on time.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×2 Award winner

×2 Award winner

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 4 comments