If you're low on funds, taking out a cash advance from your credit card is a quick solution, but it comes with costly fees and high interest rates that can make it more expensive in the long run. Before you make that move, let’s explore why cash advances should be a last resort and introduce more affordable alternatives like personal lines of credit or low-interest credit cards. We’ll also go over the best options for getting the cash you need without breaking the bank.

Key Takeaways

- You can withdraw cash from an ATM using a credit card.

- Credit card cash advances are expensive, with interest rates at around 23% that start accruing right away.

- If you need emergency cash, consider using a line of credit or a low interest credit card.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What is a cash advance?

A cash advance is a type of transaction you can make on a credit card. It allows you to get cash from an ATM using your available credit.

Unlike typical credit card purchases, which begin earning interest after a grace period, you’ll start accruing interest at your card's cash advance interest rate as soon as you withdraw your money.

How to withdraw money from a credit card

Getting a cash withdrawal is as easy as using your debit card at the ATM. Here’s what you do to withdraw money from a credit card at an ATM:

- Insert your card into the machine and enter your PIN

- Select the account to withdraw from and get your cash back

- The amount you withdraw will be removed from your credit limit

Remember: To do a cash withdrawal from a credit card, your card must be on the same network as the ATM. Visa and Mastercard are widely accepted at most ATMs, but Amex can be trickier. You can use their ATM locator to find one near you.

Cash advance vs. balance transfer

You may have received offers for no-fee balance transfers. A balance transfer works similarly to a cash advance. With a balance transfer, you send money to your bank account using your card’s credit limit.

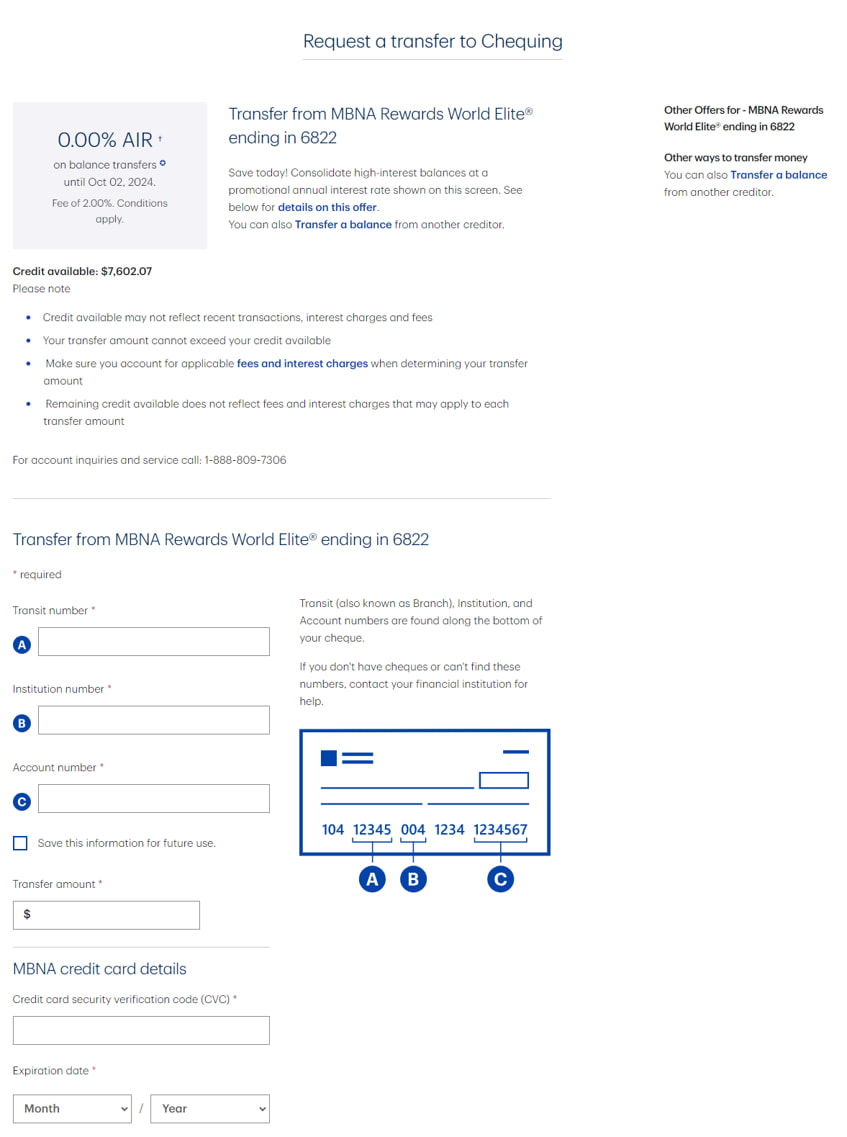

With MBNA, for example, you can request a funds transfer to the chequing account of your choice.

Once it's in your chequing account, you can withdraw it from an ATM using your debit card. It's a less efficient method, but it’s an option you might consider if you get a balance transfer offer.

Keep in mind: This is a balance transfer, not a cash advance. While the interest rates are usually the same, you may get balance transfer offers occasionally (as shown in the screenshot).

What to consider before getting a cash advance

Cash advances work differently than making credit card purchases. In general, avoiding taking a cash advance whenever possible is advisable. Here’s why:

- No interest grace period: You’ll be charged credit card interest immediately on any cash advances, and the interest rate is almost always higher than that of purchases, at around 23%. If you do a cash advance, you'll see an interest charge on your next credit card statement even if you paid the previous statement balance in full.

- Cash advance fee: Cash advance fees vary by credit card company but are typically set fees between $3 to $5. Some providers charge a percentage of the cash withdrawn, between 1% and 3%. And that's on top of any ATM fees you’re subject to.

Like regular purchases, cash advances count toward your credit card limit. The more cash you withdraw, the less available credit you’ll have, and the more you’ll increase your credit utilization ratio, which can affect your credit report and score.

Alternatives to getting a cash advance

If you’re not thrilled about the high interest rates and cash advance fees, you have a couple of better options:

- Low-interest credit card: If you use credit cards to get cash, consider applying for a low-interest credit card. With these cards, you’ll save money in interest, which can help you pay off your balance more quickly.

- Personal line of credit: A personal line of credit is a type of personal loan – you can access it whenever you need cash. You’ll typically be able to withdraw cash from the line of credit using your debit card at an ATM. The interest rate will vary based on your bank and credit score.

- Buy now pay later programs: If you need to make a large purchase, find out if you can use a buy now pay later (BNPL) plan. This breaks the large purchase into smaller installments. You’re charged multiple times but at smaller amounts, which can make it easier to pay for the purchase.

Here’s when a cash advance makes sense

A cash advance should usually be a last resort. But there’s one instance when you can get cash from your credit card without the exorbitant interest: when you have a negative balance on your credit card.

Think of it as prepaying your credit card. If your credit card balance is negative, the cash advance you make simply comes out of your negative balance. You won’t be charged any interest (though the fees still apply), and you won’t be running up your available credit.

Travelling abroad? Your debit card might not work at an ATM, but your Visa or Mastercard will. If you use your credit card or get cash advances while travelling, consider getting a credit card with no foreign exchange fees, like the Scotiabank Passport Visa Infinite Card.

FAQ

Is it worth withdrawing cash from a credit card?

If you’re dealing with a financial emergency and a cash advance is your last resort, then it can make sense to do so. However, it can cost you more in the long run and you have better options available.

Is there a charge to withdraw money from a credit card?

Yes, you’ll typically be charged a flat $3 to $5 fee or a percentage-based fee in addition to the higher cash advance interest rate.

Why am I being charged a cash advance fee?

Cash advances are considered high risk transactions. Credit card issuers charge you for the convenience of accessing cash and the higher risk of lending it to you.

How much cash can I withdraw from a credit card?

The amount of cash you can withdraw depends on your card issuer’s terms and your own credit limit. Typically, card issuers also have rules about how many cash advances you can do in a day or week.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×1 Award winner

×1 Award winner  $80 GeniusCash + Up to 60k bonus Scene+ points in year 1 + 6 free airport lounge passes.*

$80 GeniusCash + Up to 60k bonus Scene+ points in year 1 + 6 free airport lounge passes.*

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.