Overpaying your credit card statement, receiving a refund, or reversing a fraudulent purchase can lead to a negative balance on your credit card. Because the bank owes you money, you can either request a deposit or treat the negative balance as a temporary credit limit increase.

Key Takeaways

- A negative balance means your credit card has been overpaid and the bank owes you money.

- A negative credit card balance is usually the result of a chargeback, overpayment, or refund.

- You can ask your bank to deposit the negative balance in your account or use it as a temporary credit limit increase for large purchases.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What is a negative credit card balance?

The typical credit card balance shows every cent you owe your credit card issuer. If you pay more than what you owe, your balance will reflect the overpayment amount and add a minus symbol or parentheses – hence the term "negative balance."

A credit card balance reflects the money you owe your bank, e.g., "$100.00." A negative balance reflects the money your bank owes you, as in “–$100.00 or ($100.00).”

A negative balance temporarily increases your credit card’s spending limit (in practice, not on paper). While it can be useful, we don’t recommend routinely creating a negative credit card balance – it’s far simpler (and better for your credit score) to ask for a traditional credit limit increase.

Is having a negative credit card balance bad?

A negative credit card balance isn’t bad and has no lasting consequences. It just means some of your money has been relocated temporarily to your credit card. If it’s a significant amount and you need the cash, you can ask the credit card issuer for a refund.

Does a negative credit card balance affect my credit score?

Having a negative credit card balance doesn’t affect your credit score. Your credit card balance will be reported to the credit bureau as zero.

How to use a negative balance on your credit card

If you have a negative balance on your credit card, you have 4 options:

- Continue as normal: Using the card in question will subtract from the negative balance until there’s nothing left.

- Ask for a refund: Your bank can refund the negative balance via cheque or direct deposit.

- Make a large purchase: A negative balance increases your credit card’s spending limit by a proportional amount, so you can make a large purchase without asking your bank to increase the limits on your card.

- Withdraw a cash advance: Most credit cards charge interest fees the instant you request a cash advance. With a negative balance, your cash advance is repaid immediately, allowing you to avoid any interest fees.

A negative balance is useful for avoiding over-limit fees (which average $27 in Canada) or withdrawing cash at any ATM that accepts your card’s payment network – a handy trick in foreign countries that don’t support your bank.

Pros and cons of a negative balance

Think of a negative balance as another tool in your credit arsenal – useful, but deserving of respect and proper understanding:

| A negative balance can… | But a negative balance can also… |

|---|---|

| Allow you to withdraw cash at any ATM that supports your card’s payment network | Lead you to pay large ATM fees on cash advances |

| Be easily created by overpaying your credit card | Take several days to a week for your credit card issuer to reverse |

| Give you more useable credit without affecting your credit score | Prevent you from closing your credit card until it has been repaid |

| Immediately repay any cash advances you make | Tie up cash on your credit card |

| Temporarily increase your credit card spending limit | Fail to boost your credit score, unlike a traditional spending limit increase |

How to get a negative credit card balance

There are 3 ways to get a negative credit card balance, either accidentally or on purpose:

- Apply a statement credit

- Overpay your credit card

- Receive a refund or chargeback

The same principle applies in all 3 scenarios: for the bank to owe you money, you must first pay the bank.

1. Apply a statement credit

Some cash back and rewards credit cards enable you to shrink your credit card balance with dollars or points. If your rebate is greater than what you owe the bank, you’ll end up with a negative balance.

2. Overpay your credit card

The easiest way to get a negative balance is to overpay your credit card. For example, if you pay your credit card balance just before your bank processes a refund, you’ll receive a negative balance equal to the refund amount.

Or, you could take your latest credit card statement, check the amount owing, and pay $200.00 more to get a –$200.00 negative balance to use on a big purchase.

Current credit card balance + pending transactions + excess payment = negative balance equal to excess payment

3. Receive a refund or chargeback

Your credit card balance shows you what you owe your bank at the time. If you pay off your credit card and your card later receives a refund or chargeback, voilà – you’ve got a negative balance!

Your credit card balance could be overpaid if:

- A store or utility issues you a refund

- Your bank credits you a fee waiver

- Your bank issues you a refund for a fraudulent charge

- You request a chargeback from your card’s payment network

For example, let’s say your school overcharges your credit card by $50 for tuition. The school can’t modify or cancel the original transaction – instead, it creates a new transaction and issues your credit card a refund of $50.

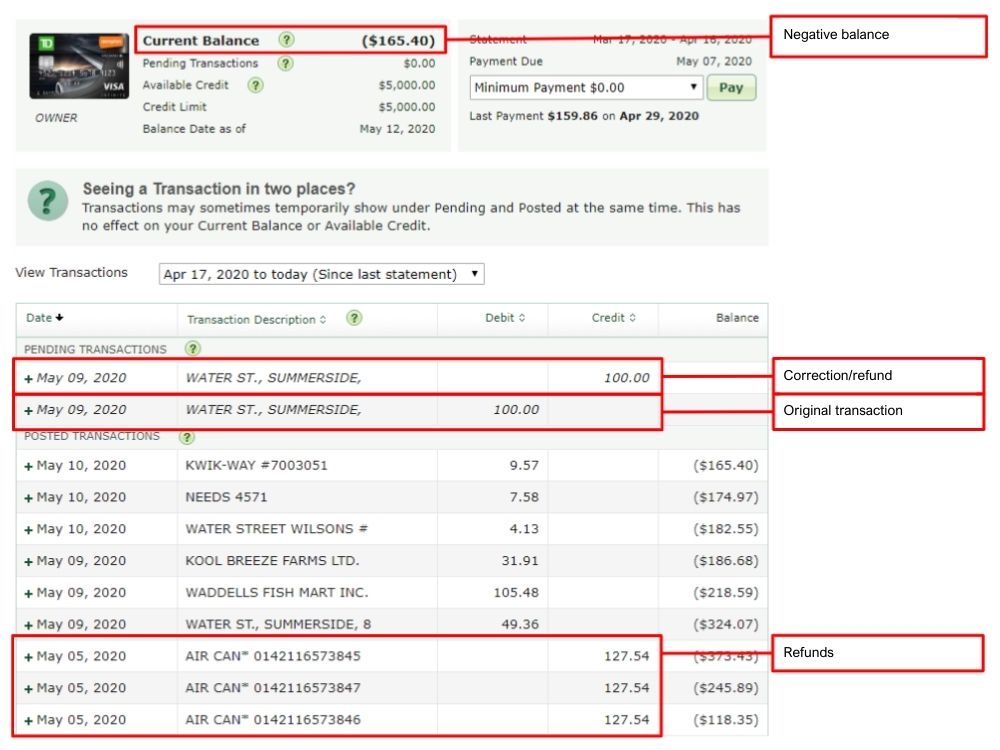

The TD® Aeroplan® Visa Infinite* Card in the image below has a negative balance because "AIR CAN*" and “WATER ST.,SUMMERSIDE” initiated several refunds:

Credit card chargebacks are refunds issued by your card’s payment network rather than the original vendor.

American Express, Mastercard, and Visa don’t like to give away money – to get a chargeback, you must first open a dispute and prove the original charge is the result of fraud, or you didn’t receive the goods or services promised. We always recommend requesting a refund from the original merchant before requesting a chargeback.

Credit cardholders may request a refund from a store or a chargeback from their card’s payment network, but they can’t initiate either one on their own.

FAQ

What is a negative balance on a credit card?

You end up with a negative balance on your credit card when you pay more than the balance owed. Effectively, the bank owes you money instead of you owing them. The purchases you make afterward will chip away at the negative balance until it’s back to zero.

What happens if my credit card balance is negative?

Nothing happens if your credit card balance is negative – but it means that the bank owes you money. You can use up that money by making purchases on the card or you can ask the bank to issue you a refund for the negative balance.

How do I cancel a credit card with a negative balance?

Before you cancel a credit card with a negative balance, you should get the money back. You can do that by making purchases using the card or requesting a refund from the bank.

Should I have a negative balance on my credit card or go for a credit limit increase?

If you need regular access to more credit, it’s a good idea to ask for a credit limit increase. But if the bank has rejected your request for an increase, a negative balance on your credit card might be a short-term solution for large purchases that would otherwise exceed your credit limit.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 19 comments