If you’ve done any online shopping, you’ve probably come across the option to use Affirm. This buy now pay later (BNPL) financing company used to go by the name Paybright but was acquired and rebranded in 2021.

With Affirm, you can easily qualify for a payment plan and instantly see terms and rates. We’ll dive into the details of the plans, plus consider who Affirm is best for and whether it’s a good choice for your next big purchase.

Key Takeaways

- Affirm is a buy now, pay later fintech company that splits payments into more manageable chunks.

- You can pay 4 installments every 2 weeks or monthly for a variable amount of time for larger purchases.

- Affirm has no hidden fees and offers no-interest options.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What is Affirm?

Affirm is a buy now pay later plan that some merchants offer. This flexible payment option makes it easier to purchase products and pay them back on a schedule that works for you and your budget.

Prior to 2021, Affirm was known as Paybright.

How does Affirm work?

Affirm essentially offers you a short-term loan with a specific interest rate, though sometimes you’ll find promotions with 0% interest.

If you shop with a merchant that has partnered with Affirm, you can select it as your payment option on the checkout page. Pop in your phone number, choose the payment plan, and Affirm will do a soft credit pull.

Affirm asks for details like:

- Your name

- Date of birth

- Email address

- Phone number

They ask for your age to ensure you’re over the age of majority and a Canadian resident. If you’re not, you won't be eligible to use Affirm.

Other requirements include a working credit card or Visa debit and, ideally, a good credit score, which will help you get better interest rates.

It’s important to note that buy now pay later plans can contribute to spending beyond your means. Carefully consider your purchases and payments to ensure that you can afford them.

Affirm financing options

When you’re ready to check out, choose Affirm and you’ll see your options.

- Affirm Pay in 4 splits your total purchase into 4 payments. There is no interest and no processing fees. Once your first installment is approved, your product will be shipped to you or ready for pick up in-store.

- Monthly payments do include interest charges, though rates can vary. You’ll see the interest rate and fees when you set up your monthly payment plan. The company is vague about whether or not it does a hard credit pull, noting that "only some Affirm loan types are eligible to be reported to Experian." It doesn’t mention reporting to Canadian credit bureaus.

If you choose to do monthly payments, you’re required to pay the tax and any items not eligible for Affirm immediately.

Pro Tip: Sign up for automatic payments to ensure you never miss one.

How to qualify for Affirm

Affirm checks your eligibility as you move through the shopping process.

- The purchases in your cart must be eligible for payment through Affirm

- You must also be the age of majority in your province and a Canadian citizen or resident

- You must use Canadian bank account, debit card, or credit card to process the transactions

Finally, Affirm does a credit check to determine your eligibility. If you’re approved, you’ll see the interest rate(s) and potential fees for your payment plan options.

What stores use Affirm?

Affirm Canada has partner merchants in numerous categories, including home furnishings, electronics, fashion and beauty, hobby, automotive, and sporting goods.

Some examples of Affirm merchants include:

- Apple

- Samsung

- Amazon

- Hudson's Bay

- RONA

- Dyson

- Foot Locker

- SharkClean

- Peloton

- Giant Bicycle

- Newegg

- CheapOair

- Browns

Should you use Affirm?

Affirm certainly makes it easier to get big-ticket items that might otherwise require saving or carrying a credit card balance. Because of that, though, it comes with some risks.

Affirm is best for people who are good at tracking their finances and making payments on time.

If you’re prone to impulse purchases, Affirm might make it too easy to shop for things you can’t really afford. If you have poor credit, you might see higher interest rates – and if you miss a payment, you could harm your credit score.

The bottom line: If you’re going to use buy now pay later plans, do so sparingly. While a purchase here or there can be helpful, multiple installments can become difficult to manage and can hurt you financially.

Our experience with Affirm

Our editor used Affirm to split up payments of her new mobile phone over 24 months. It was an unexpected purchase and one she hadn’t budgeted for, so the installments have helped her stay on track financially while paying off the phone.

Here’s what she found.

Checking out

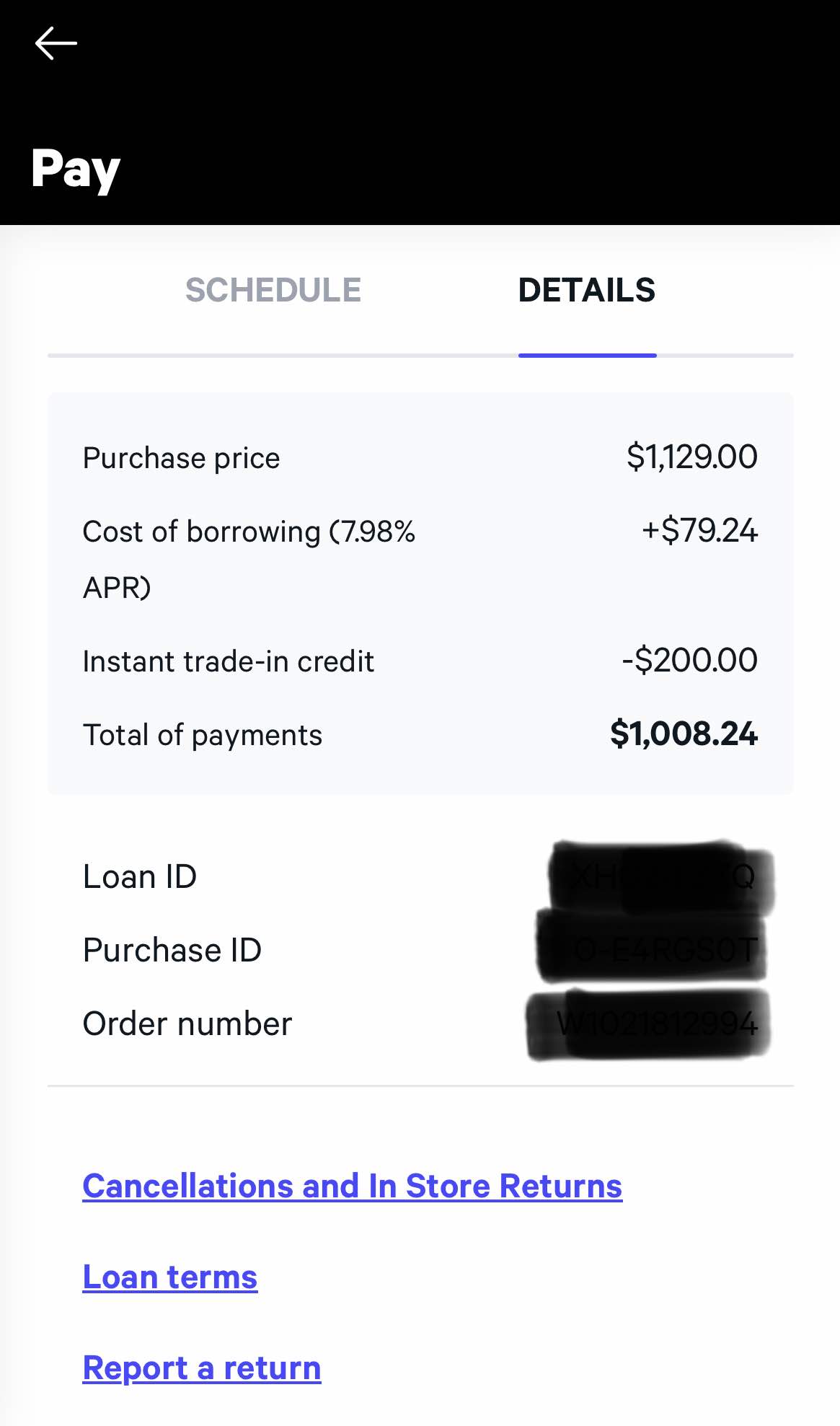

Once I was ready to check out of the Apple Store, I chose Affirm as my method of payment. I had to provide a few details and was instantly approved. I saw the interest rate and total monthly payment.

Since my whole purchase was eligible for Affirm, I only had to pay the taxes immediately.

Confirming the payment plan

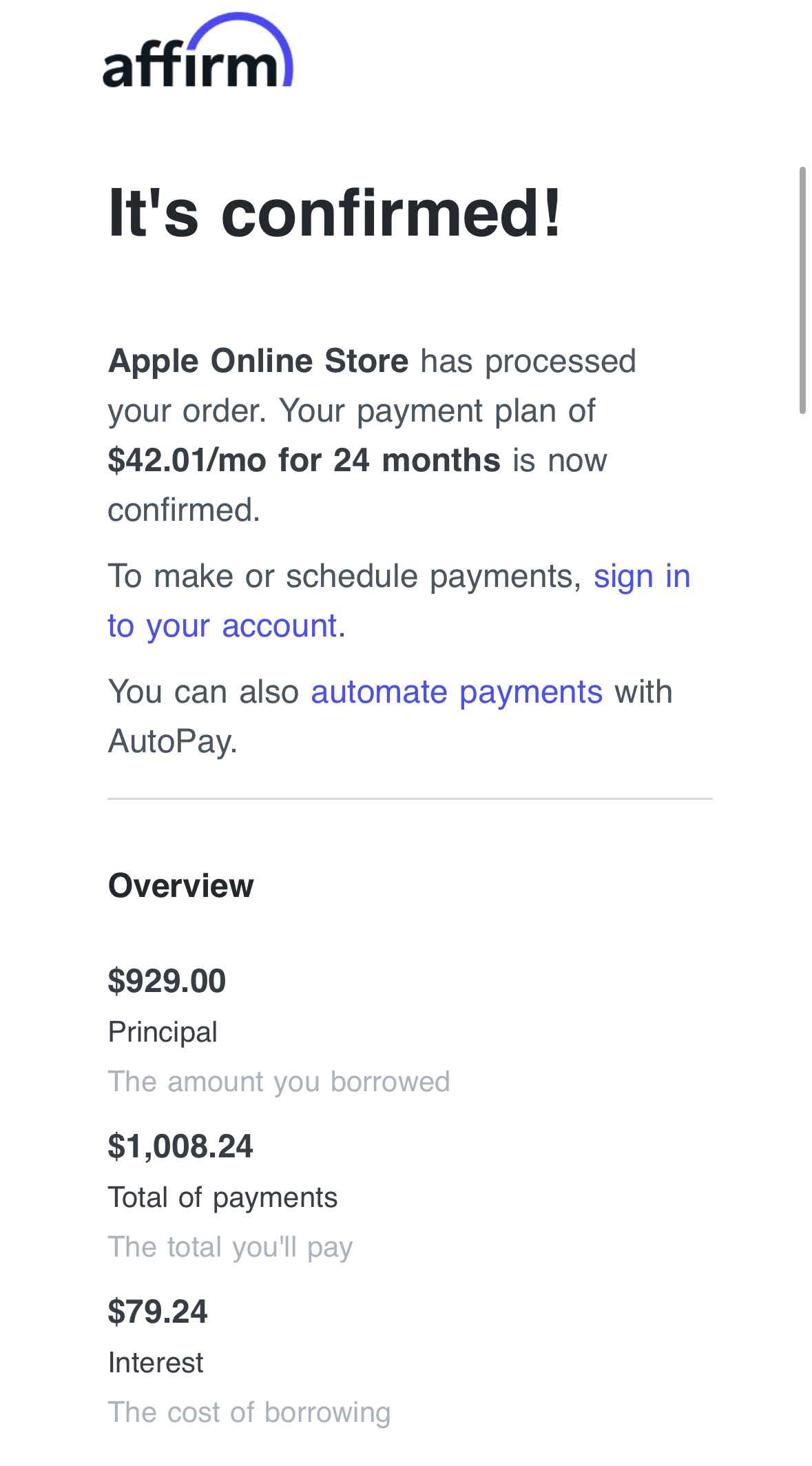

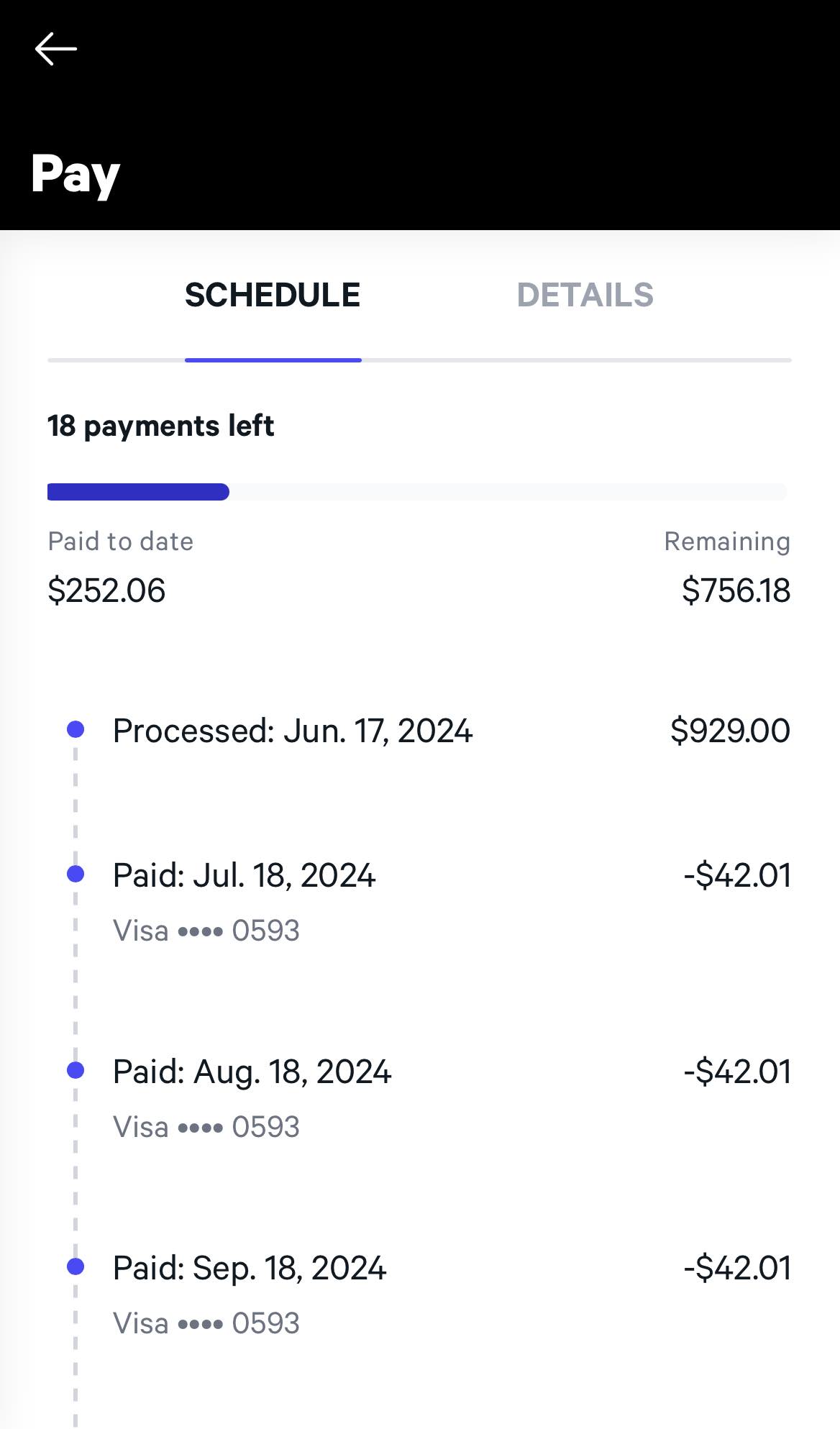

I received a confirmation email from Affirm with the details of my payment plan, including a link to sign in to view my plan and/or set up automatic payments (which I did!). It included a schedule of all payments, broken down into principal and interest. I can view the same information in my Affirm profile.

Monthly payments

Since I automated my payments, I don’t have to do anything except ensure that my account has sufficient funds to cover the payment on the 18th of each month. Affirm sends me a reminder email and text message a few days before the payment is due to come out of the account.

I can make extra principal payments or pay the remaining balance anytime through my Affirm account.

Affirm alternatives

Don’t feel like Affirm is your only BNPL option – many credit cards offer similar plans. You’ll likely pay a small fee to set up the payment plan and a percentage of the purchase amount as a monthly fee.

Why set up an installment plan instead of just charging the purchase to your credit card and paying it off as you’re able? When you set up a BNPL plan with your credit card, you’ll usually get much lower interest rates.

The average credit card interest rate in Canada is around 20% but BNPL interest rates typically range from 5% to 10%. You’ll save on interest and have a specific schedule to pay the purchase off.

Note: In many cases, the installment is added to your minimum monthly payment. Miss a payment and you might be liable to pay the entire payment plan amount immediately.

FAQ

Does Affirm affect your credit score?

Financing a purchase using Affirm does not negatively impact your credit score but failing to make your payments may result in a penalty.

Is Affirm available to Canadians?

Yes, Affirm is available to Canadian citizens and permanent residents who are of the age of majority in their province. Affirm requires a Canadian bank account, debit card, or credit card to process the transactions.

What is the downside of Affirm?

Affirm isn’t available with every merchant and can easily result in spending beyond your means. Take care to ensure that you don’t set up multiple installment plans that could be unaffordable, overwhelming, or otherwise difficult for you to manage. If you can’t make your payments, it could negatively impact your credit score.

Is Affirm a legit company?

Affirm Holdings is a recognized business in Canada. Although it has a 1.75/5 customer service rating, it received an A+ rating from Better Business Bureau. TrustPilot verified the company and its site shows a 3/5 customer service rating for Affirm.

creditcardGenius is the only tool that compares 126+ features of 231 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 231 cards is for you.

GC:

GC:

$100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

$100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.