Everyone loves a great sign-up bonus – but it’s even better if it’s permanent. We love sharing the deals we get, especially with our fellow credit card fanatics (like you).

Earning 25,000 points just for making a purchase, an extra 5,000 for switching to e-statements, and on top of that, calling the bank and asking: “Could you also waive the annual fee, pretty please?”

Ah, the rush.

But there’s nothing worse than when your friend tells you “Yeah, I went to go do that…but the offer ended a few months ago.”

We’re here to share deals that are here for a good time and a long time. Cards you can write home about and make sure everyone can get the most out of.

That being said, it’s true that some of the cards mentioned here have limited time offers, but these are on top of the welcome bonuses that are here to stay.

Here’s a chart for a quick comparison of the cards listed below so you can find an annual fee, minimum income requirement, and welcome bonus that works for you:

| Travel credit card | Annual fee | Minimum personal income requirement | Sign-up bonus | Apply now |

|---|---|---|---|---|

| American Express Platinum Card | $799 | N/A | 100,000 points (terms) | Apply now |

| American Express Gold Rewards Card | $250 | N/A | 60,000 points (terms) | Apply now |

| BMO AIR MILES World Elite Mastercard | $120 (first year free) | $80,000 personal, $150,000 household | 9,000 AIR MILES (terms) | Apply now |

| RBC Avion Visa Infinite Privilege | $399 | $200,000 | 70,000 points (terms) | Apply now |

| American Express Cobalt Card | $155.88 ($12.99 monthly) | N/A | 15,000 points (terms) | Apply now |

American Express Platinum Card

American Express is often known for their sign-up bonuses and luxury cards, but the

Again, that’s $2,000 going towards your next vacation.

It also offers you:

- 3 points per dollar spent on eligible dining purchases,

- 2 points per dollar spent on eligible travel, and

- 1 point per dollar spent on everything else.

Show your card at over 1,200 lounges worldwide, and you’ll get unlimited access – this is the best of the best when it comes to lounge access. You also get a $200 annual travel credit that can be redeemed for any travel.

The downsides?

The high annual fee of $799 and the fact that it’s a charge card, which means the balance must be paid in full every month. So if you tend to keep a balance, this might not be the card for you.

American Express Gold Rewards Card

GC: $125

With a very reasonable $250 annual fee, the

You can transfer your points at a 1:1 ratio to Aeroplan or Avios miles and get a 3x rewards value, or pay for any travel or card purchase with points straight from your card with a lowered reward value.

This card also offers 2 points per $1 spent on:

- gas,

- groceries,

- drugstore, and

- travel purchases.

Again, this is a charge card – but if you only use your card on what you know you can pay back, you don’t have to be worried.

BMO AIR MILES World Elite Mastercard

GC: $150

We call the

You’ll earn 9,000 bonus AIR MILES after spending $20,000 in the first year, and an additional $1,000 at wholesale clubs and grocery stores.

To add to this great bonus (which is worth roughly $1,143), you’ll also get a 15% discount on Air Miles flights within North America.

With VIP access to airport lounges worldwide with Mastercard Airport Experiences, and 1 mile for every $12 spent on ALL purchases…

This could be the card for you.

Did we mention the $120 annual fee is waived for the first year?

RBC Avion Visa Infinite Privilege

The RBC Avion Visa Infinite Privilege is rated our top insurance card, but it also has a killer welcome bonus of 70,000 points worth up to $1,631 in free flights.

Plus you earn 1.25 points for every dollar you spend, and you can convert points to miles at a 1:1 ratio to 3 airline rewards programs.

It has a hefty $399 annual fee, but if you’re worried about insurance, it has a lot to offer you:

RBC Avion Visa Infinite Privilege Please review your insurance certificate for details, exclusions and limitations of your coverage.Extended Warranty 2 years Purchase Protection 120 days Mobile Device $1,500 Travel Accident $500,000 Emergency Medical Term 31 days Emergency Medical over 65 7 days Trip Cancellation $2,500 Trip Interruption $5,000 Flight Delay $1,000 Baggage Delay $750 Lost or Stolen Baggage $2,500 Hotel Burglary $3,000 Rental Car Theft & Damage Yes

We know a lot of people would consider the annual fee worth the extensive insurance coverage, but remember that it also has a $200,000 personal income requirement.

American Express Cobalt Card

The

It’s the best groceries, bar, and restaurant card in Canada, earning you 5 points for every $1 spent on eligible purchases in these categories.

But if you’re a traveller or like to drive, it’ll also earn you 2 points for every $1 on eligible gas, transit, and travel purchases. And for your streaming services, you’ll earn 3 points per $1 spent on them.

You’ll also earn 1 point for every dollar spent on other purchases, and instead of an annual fee, it’s $12.99 per month.

Oh yeah, we forgot – you’re here for the huge welcome bonuses. Well, what about 15,000 points after spending $750 every month for the first year. That’s worth about $300.

Give your spouse an extra card for the low fee of $0, and between the both of you, you’ll meet that monthly spending limit to get your points in no time.

You can redeem these points for any purchase you make to the card instantly, including the essential grocery order or gas fill-up. Or if you save up a bit you can more than double your point value by redeeming for travel via the Fixed Points Travel Program.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Which welcome bonus will you take advantage of today?

Each of these cards have a lot to offer you – it really depends on what kind of annual fee you’re willing to pay.

Are there any cards on this list that stands out to you? Or have you taken advantage of a huge sign-up bonus lately?

Let us know in the comments below.

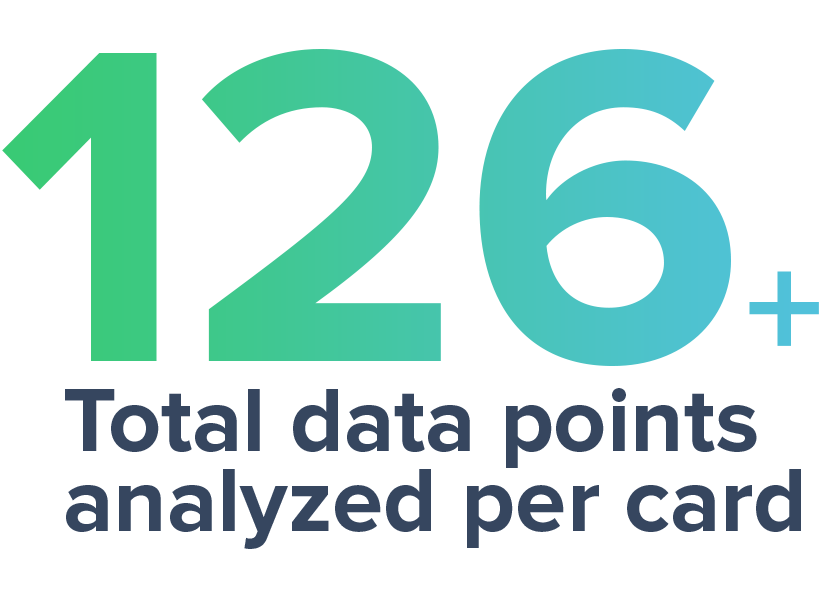

creditcardGenius is the only tool that compares 126+ features of 229 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 229 cards is for you.

×2 Award winner

×2 Award winner

$125 GeniusCash + Up to 60,000 Welcome Bonus Membership Rewards® points.*

$125 GeniusCash + Up to 60,000 Welcome Bonus Membership Rewards® points.*

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.