TD has an extensive list of credit card options. Of those, only two are cash back cards.

The TD Cash Back Visa Infinite Card is a premium option that includes some insurance (and a premium annual fee) while the TD Cash Back Visa Card is a no fee card, which earns you very little. There are better options elsewhere.

We’ve picked our favourite alternatives to each card, so you can find the best cash back credit cards offering rewards and benefits or for no annual fee.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

TD cash back credit cards at a glance

TD has an extensive list of credit card offerings, but only 2 are cash back cards. Here’s a quick overview of them along with top alternatives.

| Name | Annual fee | Rewards | Pros | Cons |

|---|---|---|---|---|

| TD Cash Back Visa Infinite | $139 | * 3% cash back on gas, groceries, EV charging, public transit, digital gaming, and recurring bills * 1% cash back on all other purchases | * 10% cash back on eligible purchases for the first 3 months, up to $3,500 in spend * First year fee rebate * Free roadside assistance | * High income requirements of $60,000 personal or $100,000 household * Low insurance coverage for a Visa Infinite, with 7 types included |

| TD Cash Back Visa | $0 | * Earn 1% cash back on gas, groceries, EV charging, public transit, digital gaming, and recurring bills. * Earn 0.5% cash back per $1 spent on all other purchases. | * Up to $50 bonus cash back *No annual fee | * 0.5% cash back on all other purchases * Limited insurance included |

| BMO CashBack World Elite Mastercard | $120 | * 5% cash back on groceries, up to $500 in monthly spend * 4% cash back on transit, up to $300 in monthly spend * 3% cash back on gas, up to $300 in monthly spend * 2% cash back on recurring bills, up to $500 in monthly spend * 1% cash back on all other purchases | * Up to 10% cash back for the first 3 months, up to $2,600 in spend. Plus, get $75 when you spend $25,000 in the first year * 13 types of insurance included * Redeem cash back on demand * Save up to 7 cents per litre at Shell | * Low monthly spend caps on bonus categories * High income requirements of either $80,000 personal or $150,000 household |

| Scotiabank Momentum Visa Infinite | $120 | * 4% cash back on groceries and recurring bill payments * 2% cash back on gas, transit, rideshares, and food delivery * 1% cash back on all other purchases | * 10% cash back for the first 3 months, up to $2,000 in spend * No annual fee in the first year * 11 types of insurance included | * High income requirements of $60,000 personal or $100,000 household * Rewards only paid out once per year as a statement credit |

| Amex SimplyCash Preferred | $119.88 | * 4% cash back on gas and groceries * 2% cash back on all other purchases | * 10 types of insurance included * 10% cash back for the first 3 months, up to $2,000 in spend. Plus, earn $50 when you make a purchase in month 13 | * Lower acceptance as an American Express card * Cash back only paid out once per year |

| Amex SimplyCash | $0 | * 2% cash back on gas * 2% cash back on groceries (up to $300 cash back annually) * 1.25% cash back on all other purchases | * 5% cash back for the first 3 months, up to $2,000 in spend * No annual fee | * Lower acceptance as an American Express * Limited insurance included * Cash back only paid out once per year |

| BMO CashBack Mastercard | $0 | * 3% cash back on groceries (up to $500 per month) * 1% cash back on recurring bill payments (up to $500 per month) * 0.5% cash back on all other purchases | * 5% cash back for the first 3 months, up to $2,500 in spend * No annual fee * Save up to 7 cents per litre at Shell | * Only earns 0.5% cash back on non-category purchases * Limited insurance included |

| Tangerine Money-Back Mastercard | $0 | * 2% cash back on purchases in up to 3 Money-Back Categories * 0.5% cash back on all other purchases | * Earn an extra 10% cash back for the first two months, up to $1,000 spent * 1.95% interest on balance transfers for the first six months * No annual fee | * Only earns 0.5% cash back on non-category purchases * Limited insurance included |

TD Cash Back Visa Infinite

Let’s start with the premium TD option – the TD Cash Back Visa Infinite. It has a decent cash back earn rate. You’ll get:

- 3% cash back on gas, groceries, EV charging, public transit, digital gaming, and recurring bills

- 1% cash back on all other purchases

This comes with a generous welcome bonus of up to 10% cash back on your first three months of spending, capped at $350 in cash back. Oh, and the card’s annual fee is waived for the first year.

While this card is decent, we think you can do better in terms of cash back rewards. Here are three great alternatives.

BMO CashBack World Elite Mastercard

Why it's better: The

- 5% cash back on groceries, up to $500 in monthly spend

- 4% cash back on transit, up to $300 in monthly spend

- 3% cash back on gas, up to $300 in monthly spend

- 2% cash back on recurring bills, up to $500 in monthly spend

- 1% cash back on all other purchases

This BMO card also gives you World Elite Mastercard benefits and more generous insurance coverage, all of which are helpful for those interested in travel. We also love the fact that the annual fee is waived for the first year.

Scotiabank Momentum Visa Infinite

Why it’s better: If you want a card that rewards you for groceries and all your recurring bills, the

- 4% cash back on groceries and recurring bill payments

- 2% cash back on gas, transit, rideshares, and food delivery

- 1% cash back on all other purchases

While it’s got similar perks to the BMO card (including great insurance coverage and a hefty welcome bonus), it’s a bit easier to qualify for the Scotia card.

Amex SimplyCash Preferred

Why it’s better: The

- 4% cash back on gas and groceries

- 2% cash back on all other purchases

So, if you don’t like keeping track of your spending by category or juggling multiple credit cards, the Amex SimplyCash Preferred should be in your wallet. We should also point out that this card is the easiest to qualify for.

TD Cash Back Visa

If you don’t want to pay an annual fee to use a TD cash back card, your other option is the TD Cash Back Visa. This card is usually recommended to students since there’s no annual fee and no income requirements.

You’ll earn:

- Earn 1% cash back on gas, groceries, EV charging, public transit, digital gaming, and recurring bills.

- Earn 0.5% cash back per $1 spent on all other purchases.

If that doesn’t seem like a lot, it’s because it isn’t. There are better no fee cash back credit cards to choose from. Take a look.

Amex SimplyCash

Why it’s better: The

- 2% cash back on gas

- 2% cash back on groceries (up to $300 cash back annually)

- 1.25% cash back on all other purchases

This card is also no fee, but you’ll get travel accident coverage and a bigger welcome bonus as well as the standard set of Amex perks.

BMO CashBack Mastercard

Why it’s better: The

- 3% cash back on groceries (up to $500 per month)

- 1% cash back on recurring bill payments (up to $500 per month)

- 0.5% cash back on all other purchases

Although the base earn rate is similar to the TD card, BMO has a good balance transfer offer of 0.99% for 9 months.

High rewards and a balance transfer offer for no annual fee makes for a winning combination.

Tangerine Money-Back Mastercard

Why it’s better: If you want a no fee card that puts you in control of how you earn enhanced cash back, the

Choose two categories that earn 2% back or pick three if you deposit your rewards into a Tangerine Savings Account. All other purchases earn you 0.5% back.

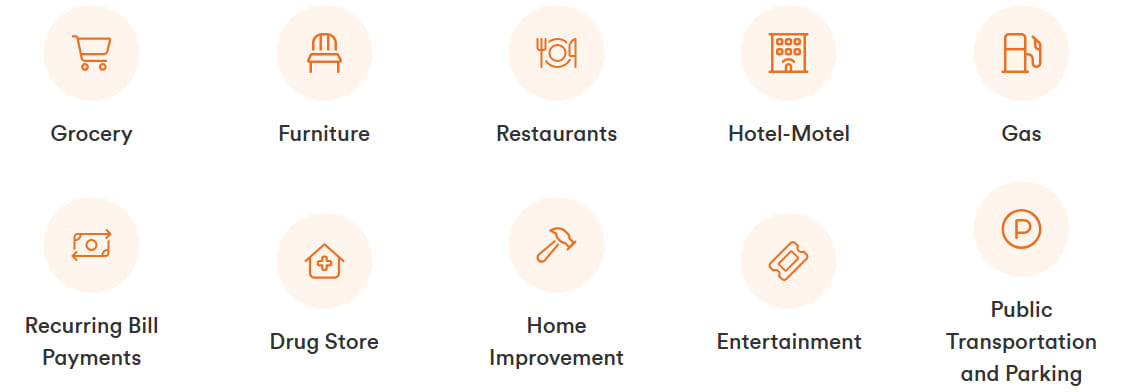

Here are your choices:

If you want a few more perks (with the same earn rates), you can also look at theTangerine® Money-Back World Mastercard®*. For standard World Mastercard income requirements of either $60,000 personal or $100,000 household, you get a few extra benefits and better insurance coverage.

FAQ

What is the best credit card from TD Bank?

We’ve got an extensive list of the best TD credit cards by category, but overall, the TD Aeroplan Visa Infinite Privilege credit card is the best TD option in Canada.

Which TD credit card has no annual fee?

The TD Rewards Visa Card band TD Cash Back Visa Card are two TD cards that have no annual fee, so any cash back you get is pure profit.

What is the best cash back credit card in Canada?

We calculated the average rate of return for your best cash back options and found the MBNA Rewards World Elite Mastercard offers the highest average, with 2.37% back. Unfortunately, the top TD Rewards cards offer Aeroplan points, not cash back.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×1 Award winner

×1 Award winner

$50 GeniusCash + Earn up to $100 in bonus cash back.

$50 GeniusCash + Earn up to $100 in bonus cash back.

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 4 comments