If you haven’t been to a No Frills store in awhile (or ever), you should really take the time to stop in for a look. Not only will you find great deals on everyday staples, the stores we’ve been in have had some of the nicest produce around.

While these stores aren’t as common as some of the larger chains, you can find No Frills across Canada, including in all 10 provinces (although they’re not in any of the 3 territories that we could find).

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Shopping at No Frills

If you’re lucky enough to live near a No Frills store, you should visit at least once to take a look. You might be surprised at what you find.

And you should also go through the No Frills flyer once a week, just to see if there are any deals you can use.

As we demonstrate below, No Frills prices are on par with Walmart’s, so it’s definitely worth the time.

No Frills flyer

Once only available with your local newspaper or flyer bundle, the No Frills flyer is now also available online.

To find it, go to the No Frills flyer page on their website, punch in your postal code, and select your nearest store. You’ll find digital copies of any current flyers, and previews of any upcoming No Frills flyers if they’re available, including any special holiday flyers.

New No Frills flyers are usually available on Thursdays, so set a reminder to check in weekly to find the latest grocery deals.

You can also find your local No Frills flyer in your PC Optimum app, in the “Flyers” tab.

No Frills online and PC Express

Did you know that you can also order from some No Frills stores online? It’s true.

You see, No Frills is a Loblaws supermarket, and if it’s available at your local store, you can take advantage of the PC Express service to place your order online for curb-side pick up.

Unfortunately, the PC Express service doesn’t seem to be available at all No Frills stores yet, so you’ll have to check online to see if your local shop offers this service yet.

No Frills delivery

Unfortunately, there is no No Frills delivery service at this time.

We were also unable to find any locations in the Instacart app, so it looks like even Instacart isn’t an option for No Frills delivery.

No Frills apps

While No Frills doesn’t have an app of its own, since this grocery chain is part of the larger Loblaws conglomerate, you can use other apps to access the No Frills flyer, or to shop at No Frills online.

- The No Frills Flyer is available in the PC Optimum app, under the “Flyers” tab.

- You can shop at No Frills through the PC Express app, and schedule your curbside pickup.

Both of these apps are available at the Apple Store and Google Play, and are a convenient way to do a little No Frills shopping while you’re on the go.

No Frills pharmacy and medical clinic

Some No Frills stores have in-store pharmacies and medical clinics as well. For example, the Shediac, New Brunswick location has a full service pharmacy that offers:

- prescription refills,

- blood pressure monitoring,

- food allergy management assistance,

- diabetes risk assessments,

- seasonal flu shots, and more.

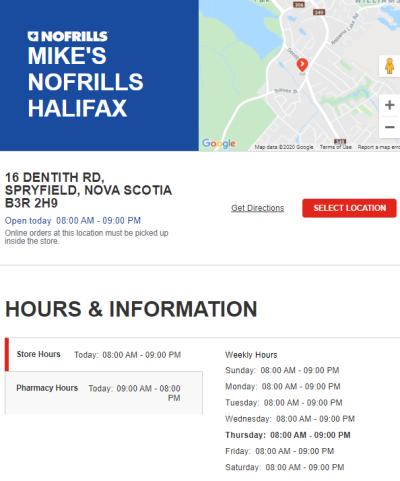

Unfortunately, not all locations offer medical clinic services, including the store in Shediac. Also, if your store does have a pharmacy and/or medical clinic, the hours for those services may be different than the regular No Frills hours.

No Frills locations

There are over 200 No Frills locations in Canada, with at least one in each of the 10 provinces. Unfortunately, they don’t seem to have expanded into any of the 3 territories at this point.

The majority of No Frills locations are in Ontario and Alberta, with fewer stores located in the east and west of Canada. For example, PEI has only one, located in Charlottetown.

On the other hand, major cities – such as Toronto, Winnipeg, Edmonton, Calgary, and Vancouver – have multiple No Frills locations to choose from.

No Frills hours

No Frills hours depend on your location, of course, but they’re generally open from 8am to 9pm, 7 days a week.

If your local store also has an in-store pharmacy or medical clinic, be aware those services’ hours may be different than the regular No Frills hours.

To be sure, check the website or phone your local store for the most up-to-date information about No Frills hours and services.

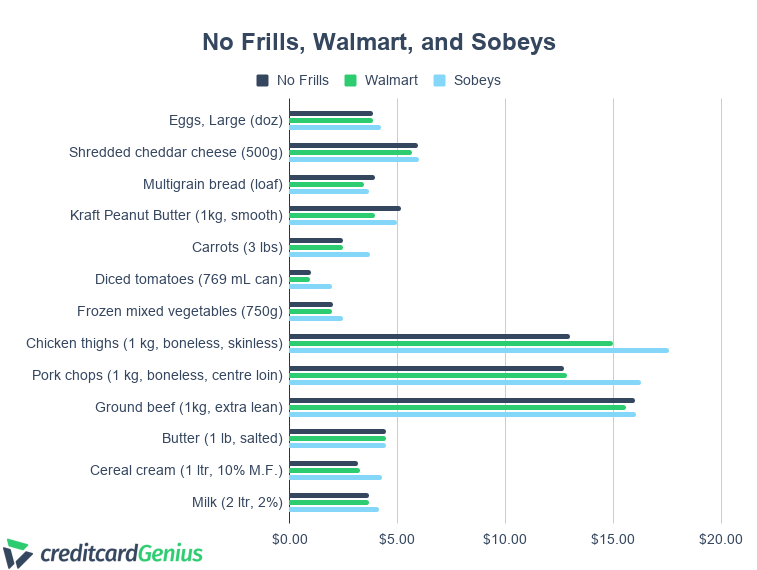

No Frills vs. Walmart vs. Sobeys

Wondering how No Frills prices compare to Walmart and Sobeys? Let’s take a look.

For this we put together a fairly typical grocery list and did a side by side comparison of the regular prices each store displayed online through their shopping portal (rounding up meat quantities for simplicity).

| Product | No Frills | Walmart | Sobeys |

|---|---|---|---|

| Eggs, Large (doz) | $3.87 | $3.87 | $4.25 |

| Shredded cheddar cheese (320g) | $5.97 | $5.67 | $5.99 |

| Multigrain bread (loaf) | $3.97 | $3.47 | $3.69 |

| Kraft Peanut Butter (1kg, smooth) | $5.17 | $3.96 | $4.99 |

| Carrots (3 lbs) | $2.47 | $2.47 | $3.74 |

| Diced tomatoes (769 mL can) | $1.00 | $0.97 | $1.99 |

| Frozen mixed vegetables (750g) | $2.00 | $1.98 | $2.49 |

| Chicken thighs (1 kg, boneless, skinless) | $12.99 | $14.97 | $17.61 |

| Pork chops (1 kg, boneless, centre loin) | $12.72 | $12.86 | $16.30 |

| Ground beef (1kg, extra lean) | $16.00 | $15.60 | $16.08 |

| Butter (1 lb, salted) | $4.47 | $4.47 | $4.49 |

| Cereal cream (1 ltr, 10% M.F.) | $3.17 | $3.28 | $4.29 |

| Milk (2 ltr, 2%) | $3.68 | $3.68 | $4.17 |

| Total: | $77.48 | $77.25 | $90.08 |

As you can see, for the basics, No Frills comes in almost exactly the same as Walmart. Sobeys on the other hand, didn’t do as well, with their meat prices being particularly high in comparison.

While No Frills and Walmart are neck and neck (seriously, less than a $0.25 difference), Sobeys total came in almost 15% higher.

That’s a significant difference, particularly when you’re talking about some pretty basic, everyday staples.

It’s clear that if you have a No Frills or Walmart convenient to where you live, it might be worth the trip if you want to save more on groceries.

On the other hand…we didn’t optimize here at all. Normally we shop the flyer, build a menu plan and shopping list around what happens to be on sale that week, and stock up on non-perishables when they’re a particularly good deal.

Which brings us to our next topic…

6 ways to save money at No Frills

Groceries are often one of the biggest ticket items on our monthly budget. We all have to eat, after all.

But with a bit of planning and a couple of basic strategies, you can save a huge amount of money on groceries over the course of a year.

Shopping at a discount supermarket is a great start, of course, but you can save even more at No Frills with these basic tips.

1. Shop the No Frills flyer

Almost all grocery stores have weekly sales and specials, which usually start on Thursdays.

If you cook at home a lot (and, if you want to save money on food, you should), the best way to maximize your savings is to buy items that are on sale as much as possible.

Menu planning

Try to make a habit of planning a week’s worth of meals based on what’s on sale at your favourite grocery store (or stores) that week.

For example, our local No Frills flyer has the following meat, chicken, and fish items on sale:

- Atlantic salmon fillets ($4.97/lb),

- chicken thighs ($2.47/lb) ,

- beef short ribs (flanken cut, $8.47/lb), and

- pork half loin roast ($2.47/lb).

Also on sale are:

- carrots (2lbs for $1.97),

- yellow onions (3lbs for $1.97),

- english cucumbers ($1.67 ea),

- cauliflower ($3.97 ea),

- red mangoes ($1.27 ea),

- apple cider ($4.97 for 3 litres), and

- organic field greens ($4.97 for a 312g package).

Given this list of ingredients, we’d make a menu plan that looked something like this:

- baked salmon with mango and onion salsa and a simple salad,

- cider-braised pork loin roast with roast cauliflower and carrots,

- korean-style grilled beef short ribs with kimchi and steamed rice, and

- onion-braised chicken thighs with cucumber salad and quick fried rice.

This is just an example, of course. And while not everything we’d need to make all of that is on sale, most of the extra items (olive oil, vinegar, soy sauce, kimchi, rice, etc.) are standard staples that we stock up on when they’re on sale.

Which brings us to our next tip…

Stock up on non-perishables when they’re on sale

This is another strategy where shopping the No Frills flyer can save you an enormous amount of money over the course of a year.

Is there a giant bag of rice on sale? Buy one and stash it away in your pantry. Rice keeps for months without any extra attention.

See a crazy good deal on tinned items? Canned goods will last up to a year (or longer), so buying them when they’re on 30% or 50% off is just a smart thing to do.

Use a lot of olive oil? Buy the big 3 litre jugs when you spot them in the flyer, and use those to fill up a smaller bottle you keep on the counter by the stove.

And flyers don’t just advertise food items. I can’t think of the last time we paid full price for things like:

- dish soap,

- garbage bags,

- tin foil,

- toilet paper, or

- laundry detergent.

If you have some extra space in your basement, your pantry, or under your stairs, stocking up on non-perishable (or less perishable) items that are on sale is always a good strategy for saving money.

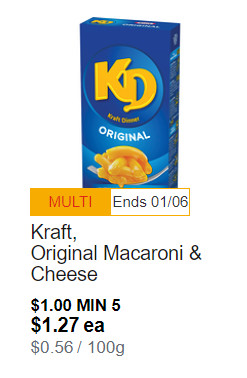

2. Stock up with No Frills multi-buy deals

This is another way to save even more money at No Frills (and other Loblaws grocery stores).

When you’re looking through the No Frills flyer or are shopping in the store, you’ll see little “multi-buy” labels that give you a discount for purchasing multiples of the same items.

One example we found today is a multi-buy deal for Kraft Dinner. Not exactly the most expensive item on our grocery list, but if it’s the sort of thing you eat regularly, you can save 21% if you purchase 5 or more boxes.

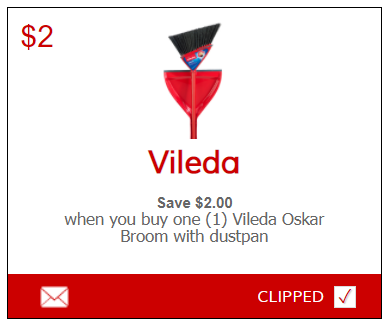

3. Use No Frills digital coupons

Couponing is another way to save money on groceries, and if you’re an avid couponer, No Frills is going to be right up your alley.

And, while their coupons are only good for in-store shopping (meaning they can’t be used for online orders and PC Express), they are available online for printing out and taking with you to the store.

The best way to ensure you make the best use of these coupons is to check for them online when you’re checking the No Frills flyer for this week’s sales.

On the website, they’re under the “Flyer & Deals” menu. Just click on “Coupons,” select your province, and check the boxes on the coupons you want to use. Easy peasy.

4. Collect PC Optimum points

Of course, since No Frills is a Loblaws joint, you can collect PC Optimum points when you’re shopping there.

While you won’t be able to collect points on every dollar you spend, if you look for PC Optimum point offers in the flyer, online, or while you’re shopping in-store, you’ll be able to rack up some extra points in no time.

For example, this Fructis Garnier Shampoo. Not only are you saving 20% off the regular price, you’ll also earn some valuable PC Optimum points to boot.

Unfortunately the online flyer doesn’t tell you how many PC Optimum points you’ll earn with this purchase, but you should be able to see the numbers when you’re shopping in the store.

How to collect PC Optimum points

Not sure how to get started collecting PC Optimum points? It’s both easy and free.

All you need to do is head over to the PC Optimum website and sign up for an account. At that point you can download the PC Optimum app to your phone, sign into your account, and get the cashier to scan the app when you’re checking out.

You can also get a physical PC Optimum card that you can link to your account. These are most commonly available at most Shoppers Drug Mart locations.

Once you sign up for a PC Optimum account, you can receive handy weekly newsletters from them advising you of any special offers that may be available in the near future. These are also all displayed in your account on the website.

We strongly recommend watching for these special offers, because they can seriously boost your PC Optimum earn rate and save you loads of money over time.

How to spend PC Optimum points

Using your PC Optimum points is as easy as collecting them.

When checking out at a shop that accepts PC Optimum points as payment, simply scan your card and ask to have however many points from your collection applied to your payment.

PC Optimum points are worth 0.1 cent each, so if you have 50,000 PC Optimum points, that’s worth $50.

How to maximize PC Optimum points

PC Optimum is one of the most popular loyalty rewards programs in Canada, and for good reason. PC Optimum points are easy to collect, and there are loads of ways to boost your earn rate to make the most of your rewards.

In fact, we’ve written an extensive and detailed guide to maximizing the PC Optimum rewards program that’s definitely worth checking out.

Want to save even more when shopping at No Frills? Read our guide to maximizing your PC Optimum rewards.

5. No Frills price match policy

Price matching policies seem to be going the way of the dinosaurs these days, but No Frills still has a price match policy that you can take advantage of to save even more money and time.

They call it the No Frills Won’t Be Beat price match policy, and the concept is simple: if a major supermarket competitor within the geographical area offers a lower price on any item that they carry, you can simply show them the advertisement or receipt, and they will sell you the same item at that same price.

The benefit here is convenience, for the most part. Technically you could just drive to the other store and buy the item at the lower price, but by using the price match policy at No Frills, you’ll save yourself the time and the gas required for that trip.

There are some limitations, of course, but you can read all about those over on the No Frills price match policy page that we’ve linked above.

6. Use a cash back credit card

And we would be remiss if we didn’t tell you about one of our favourite ways to save money at the grocery store: Cash back credit cards.

While there’s a vast array of credit cards available to Canadian shoppers, one of the best and easiest ways to save money is with a cash back credit card.

It’s a really simple idea: you use your credit card to make purchases, and you get a certain percentage of cash back for each.

Of course, once you get into the nitty gritty, there are a few more things to sort out, such as:

- whether you’re willing to pay an annual fee,

- if you want a flat rate cash back credit card, or one with bonus earning categories, and

- what other credit card perks and benefits you might be interested in.

So, let’s take a look at some of our favourite cash back credit card options for shopping – and saving money – at No Frills.

Best credit card to use at No Frills

As we’ve already mentioned, No Frills is a Loblaws grocery chain. Given that, you might think that a PC Financial Mastercard may be the best credit card to use at No Frills, since they’re issued by Loblaws’ bank (PC Financial), and allow you to boost your PC Optimum rewards earn rate.

But, let’s take a look at what the basic PC Financial Mastercard has to offer.

| Annual fee: | $0 |

| Type of reward: | PC Optimum points |

| Reward details: | * 10 points for every $1 spent at Loblaws grocery stores * 25 points for every $1 spent at Shoppers Drug Mart * At least 30 points per litre of fuel at Esso gas stations * 20 points for every $1 spent on PC Travel purchases * 10 points for every $1 spent everywhere else |

| Average rate of return %: | 1.1% |

| Purchase interest rate: | 20.97% |

| Income requirement: | None |

The PC Financial Mastercard is a pretty basic credit card that gives you a way to boost your PC Optimum points, but not much else.

While the credit card has no annual fee, the basic rewards earn rate is a mere 10 points per $1 spent. This is a 1% rate of return, which is more standard than it is impressive.

And you can only redeem those points for purchases at participating Loblaws stores, making these rewards significantly more limited than regular cash back, which you can use to pay for purchases anywhere you shop.

Also, the PC Financial Mastercard doesn’t come with any of the other perks and benefits that are fairly standard on other credit cards, such as complimentary insurance coverages, purchase protection, and extended warranty protection.

There are 2 other versions of the PC Financial Mastercard available – the PC Financial World Mastercard, and the PC Financial World Elite Mastercard. You can read more about these more premium credit cards in our detailed review.

4 top no fee cash back credit card alternatives

While the PC Mastercard can certainly boost your PC Optimum earn rate, there are other credit cards that can save you some serious money on groceries, including at No Frills.

Here we go over a few options, including the best cash back credit card in Canada that has a staggering 4% permanent earn rate on groceries, plus a trio of no fee credit card options for those who don’t want to pay an annual fee.

Let’s take a look.

| Credit Card | Average Earn Rate on Groceries | Annual Fee | Apply for Card |

|---|---|---|---|

| Scotia Momentum Visa Infinite |

4% | $120 | Apply now |

| BMO CashBack Mastercard | 3% | $0 | Apply now |

| MBNA Smart Cash Platinum Plus Mastercard |

2% | $0 | Apply now |

| Brim Mastercard | 1% | $0 | Apply now |

1. 4% cash back on groceries from the best cash back credit card in Canada

The

First off, you start with a generous welcome bonus of 10% cash back for the first 3 months, up to $2,000 in spend. After that you’ll earn:

- 4% cash back on groceries and recurring bills (up to $25,000 spent annually),

- 2% cash back on gas and transit purchases (up to $25,000 spent annually), and

- 1% cash back on all other purchases.

There are few cash back credit cards that offer a 4% earn rate on 2 common everyday categories, plus 2% on all of your commuting expenses.

On top of rewards, this premium cash back credit card also comes with 11 types of insurance, a suite of luxe Visa Infinite benefits, and the ability to get its annual fee waived permanently with a Scotiabank Ultimate Package.

Either way, your first year fee is waived regardless, so you can take this card out for a test drive to see how well it may perform for you.

Unfortunately, as a Visa Infinite card, it has pretty steep income requirements of $60,000 personal, or $100,000 household.

2. 5% bonus cash back earn rate and 1.99% on balance transfers

If your grocery budget is below $500 per month, the

With an introductory earn rate of 5% cash back for the first 3 months, up to $2,500 in spend – you’ll get your cash back earnings off to a solid start. After that, you’ll earn:

- 3% cash back on groceries (up to $500 spent per month),

- 1% cash back on recurring bill payments (up to $500 spent per month), and

- 0.5% cash back on all other purchases.

If you have some stubborn high interest credit card debt lingering around on another card, you could take advantage of the BMO CashBack Mastercard’s intro offer of 1.99% interest on balance transfers for 9 months.

But beware: if you take advantage of the balance transfer offer, you shouldn’t use this credit card for new purchases until you have paid the balance transfer off in full. If you do, you’ll end up paying the higher standard interest rate on those purchases and undo all the hard work you’ve done to reduce them.

3. 2% cash back on groceries and some added peace of mind

Looking for a good cash back credit card for groceries that also comes with some added peace of mind? The

You’ll start with an introductory bonus of 5% cash back on gas and grocery purchases for the first 6 months (to a combined total of $500 spent per month). After that, your earnings will be:

- 2% cash back on gas and groceries, up to a combined $500 spent per month, and

- 0.5% cash back on all other purchases.

The hidden bonus of this credit card? It comes with 7 different types of insurance coverage, including:

MBNA Smart Cash Platinum Plus® Mastercard® Please review your insurance certificate for details, exclusions and limitations of your coverage.Extended Warranty 1 year Purchase Protection 90 days Travel Accident $1,000,000 Trip Interruption $2,000 Rental Car Theft & Damage Yes Rental Car Accident $200,000 Rental Car Personal Effects $1,000

If you make use of these insurance coverages, they can save you a lot of money over time.

4. Flat rate cash back credit card with rare insurance coverage

The

With this card, you’ll earn 1 point for every $1 spent, everywhere you shop, with no caps or categories to worry about.

And Brim Rewards points can be used to pay for any of those purchases, at a value of 1 cent per point. This gives you a 1% rate of return on every single purchase you make.

Unlike PC Optimum points, this cash back can be used to pay for any purchase made on the credit card, not just new purchases made at participating Loblaws retailers.

Added features of this card include:

- up to $200 in bonus rewards after first purchases with participating retailers,

- bonus rewards for shopping online at over 150 participating stores, and

- 5 types of complimentary insurance, including rare mobile device insurance and event ticket cancellation coverage.

All in all a solid set of perks and features, and all for no annual fee.

5 credit cards head to head

Let’s see how these 5 credit cards stack up, side by side.

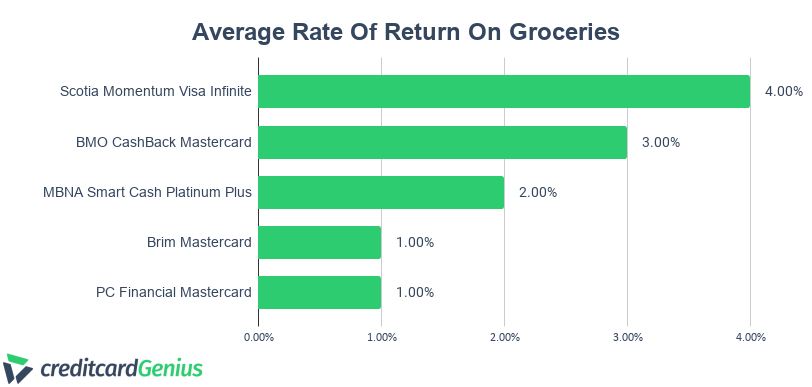

Average rate of return on groceries

Since we’re talking about saving money on groceries, one of the most important factors in play is the average rate of return on your grocery spending.

These numbers are all based on a $500 monthly spend on groceries – if you spend more than $500 a month at the grocery store, you’ll find your rate of return will drop for the MBNA and Brim cards, but the Scotia card will maintain a 4% earn rate on groceries up to $25,000 spent annually.

The PC Financial Mastercard earns 10 PC Optimum points for every $1 spent. Here it’s clear that the Scotia Momentum Visa Infinite is well in the lead.

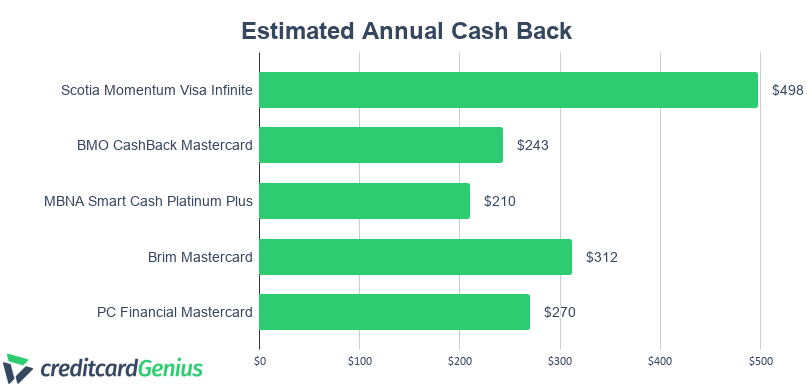

Estimated annual cash back earned

The numbers for the estimated annual cash back earned for each of these credit cards is based on a hypothetical $2,000 monthly spend. Here the Scotia Momentum Visa Infinite is in the lead, as it gives you between 1% and 4% cash back on all of your spending.

Your numbers may vary, however, so if you want to see how various credit cards would work for you based on your actual spending, you can play with those numbers over on our credit cards comparison page.

The PC Financial Mastercard makes a strong showing in this comparison, but remember: You can only use your PC Optimum points to make purchases at participating Loblaws stores. The other cash back credit cards are more flexible, in that you can use your rewards to pay for purchases, regardless of where you shop.

Welcome bonus comparison

Credit card welcome bonuses are only a one-shot benefit, but they’re still worth looking at.

While the Brim Mastercard has $0 in this chart, you can use that credit card to earn up to $200 in bonus rewards when you make first purchases at participating retailers. We don’t count this as a standard “welcome bonus,” however, because it can be a bit tricky to actually make full use of this deal.

The PC Financial Mastercard is currently offering 20,000 PC Optimum points as a welcome bonus, but once you do the math, it turns out that’s only worth $20 in the end. The other credit cards have welcome bonuses worth far more.

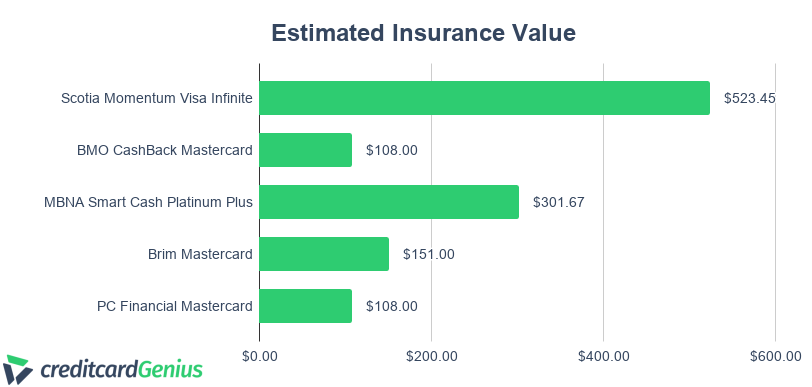

Estimated insurance value

In order to come up with the estimated value of the various insurance packages credit cards include, we did an extensive and detailed study of credit card insurance, to analyze what each included.

Here’s how these credit cards fared.

As we mentioned above, the MBNA Smart Cash Platinum Plus comes with a solid package of included insurance coverage whose estimated value is worth quite a bit, once you take a closer look. Of course the Scotia Momentum Visa Infinite takes the cake here, with an insurance package estimated to be worth over $520.

Bottom line

When it comes right down to it, we all want to save as much as we can at the grocery store.

No Frills is a discount supermarket chain that is well worth taking advantage of, if you’re lucky enough to have one convenient to where you live.

And if you shop the No Frills flyer, build menu plans around what’s on sale, stock up on non-perishables when you can, maximize your PC Optimum points, and buy all your groceries with a cash back credit card, you can save hundreds (or thousands!) of dollars a year.

We hope this guide can help you stretch your grocery dollar a little bit farther.

Do you have tips for saving more money at No Frills? Share them in the comments!

FAQ

Does No Frills take Visa?

No Frills accepts Visa and Mastercard credit cards. You can read about what no fee cash back credit cards we recommend for shopping at No Frills here.

Does No Frills have online shopping?

You can order groceries online at some No Frills locations through their website, but as this is part of the PC Express service, you will have to go to the store to get your order through curb-side pickup.

Are No Frills and Superstore the same?

No Frills and Superstore are both grocery chains owned by the Loblaws conglomerate. Because of this, you can earn PC Optimum points at both.

How can you save money at No Frills?

We’ve compiled a list of 6 tips for saving money at No Frills. Have money saving tips we haven’t included? Leave a comment here and join the conversation.

What are No Frills hours?

No Frills hours are generally 8am to 9pm, 7 days a week. Note, however, that in-store services such as the pharmacy or medical clinic (if your local store offers these) may have different hours than the regular grocery store No Frills hours.

Can I get No Frills delivery?

Right now there is no No Frills delivery service available. Some No Frills locations offer online ordering for curb-side pickup through the PC Express service and app, but you’ll have to check the No Frills website to see if this service is available at your local store.

Wondering if a PC Financial Mastercard is right for you? Check out our detailed review.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×2 Award winner

×2 Award winner

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 1 comments