Companion vouchers can dramatically reduce travel costs. While each card and provider has different terms, companion vouchers essentially function as 2-for-1 deals: You purchase one ticket as usual, then pay only a fixed amount for your travel companion (plus taxes and fees).

Thanks to my American Express Aeroplan Reserve Card – one of the best Aeroplan cards available – I recently saved $1,358 on an upcoming trip to Costa Rica using two companion vouchers that come with the card. Here’s how I did it – and how you can, too.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

The American Express Aeroplan Reserve Card companion voucher

The companion voucher – or "Companion Pass," as Air Canada calls it – that I used is available on select Aeroplan credit cards:

- American Express Aeroplan Reserve Card

- TD Aeroplan Visa Infinite Privilege Credit Card

- CIBC Aeroplan Visa Infinite Privilege Card

- American Express Aeroplan Business Reserve Card

There are some rules that apply, though.

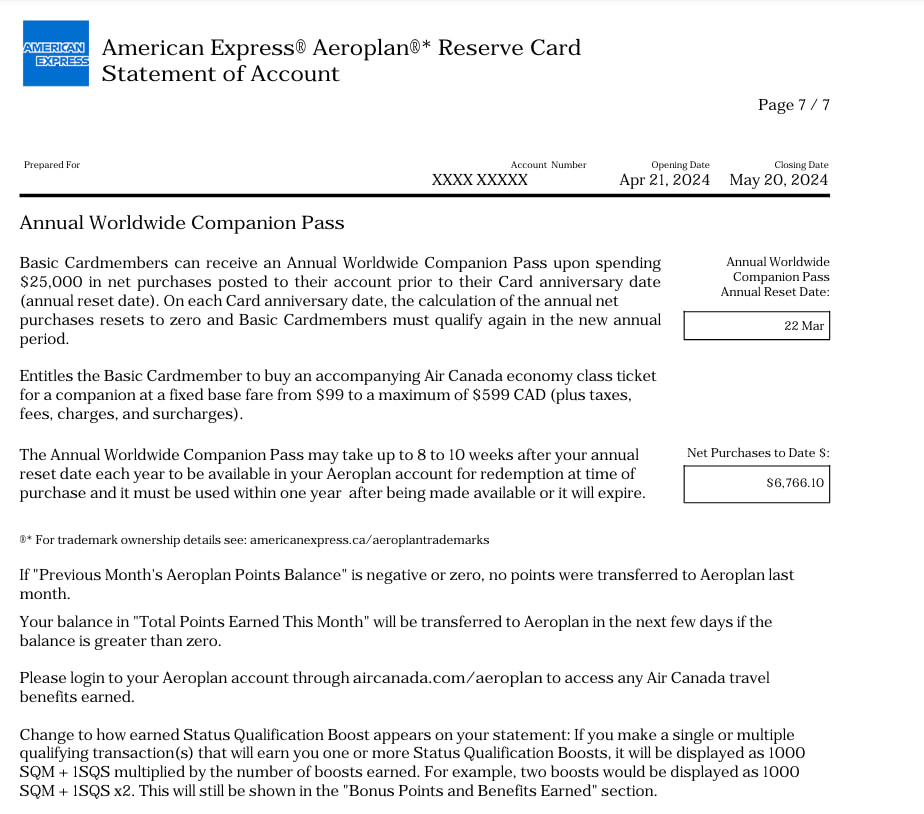

You must earn it by spending $25,000 in one year (the period between when you pay annual fees). If you have the American Express Aeroplan Reserve Card, Amex has a section on your monthly statement showing your progress and the date by which you must spend that money. TD and CIBC probably have something similar.

There is a waiting period. I've earned two companion passes and I received both of them 8 weeks after March 22.

The passes are valid for one year. Once you've earned a pass, you have one year to make a flight booking. And since Air Canada allows you to book flights up to a year in advance, you essentially have two years to complete your trip from the date you earn the pass.

How the American Express Aeroplan Reserve Card companion voucher works

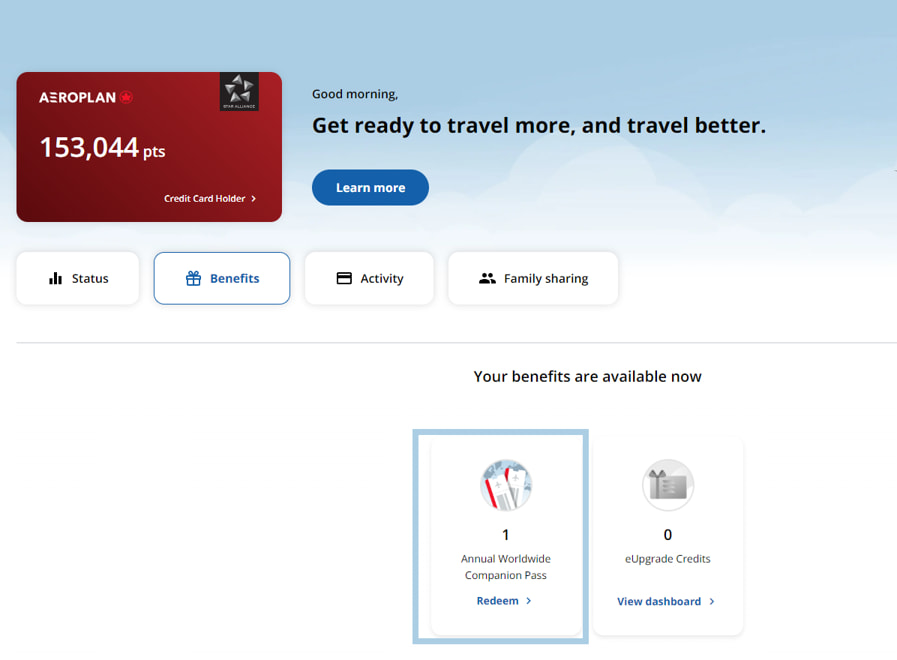

You’ll want to begin by verifying that you actually have the companion pass by checking your Aeroplan account – I never received an email or notification that it was available to use.

Once you’ve logged in to your account, click on the "Benefits" tab. This is where you’ll find your voucher.

To redeem the voucher, you’ll need to make a booking through Air Canada. While they say you can use the app, my experience tells me that you must use a web browser.

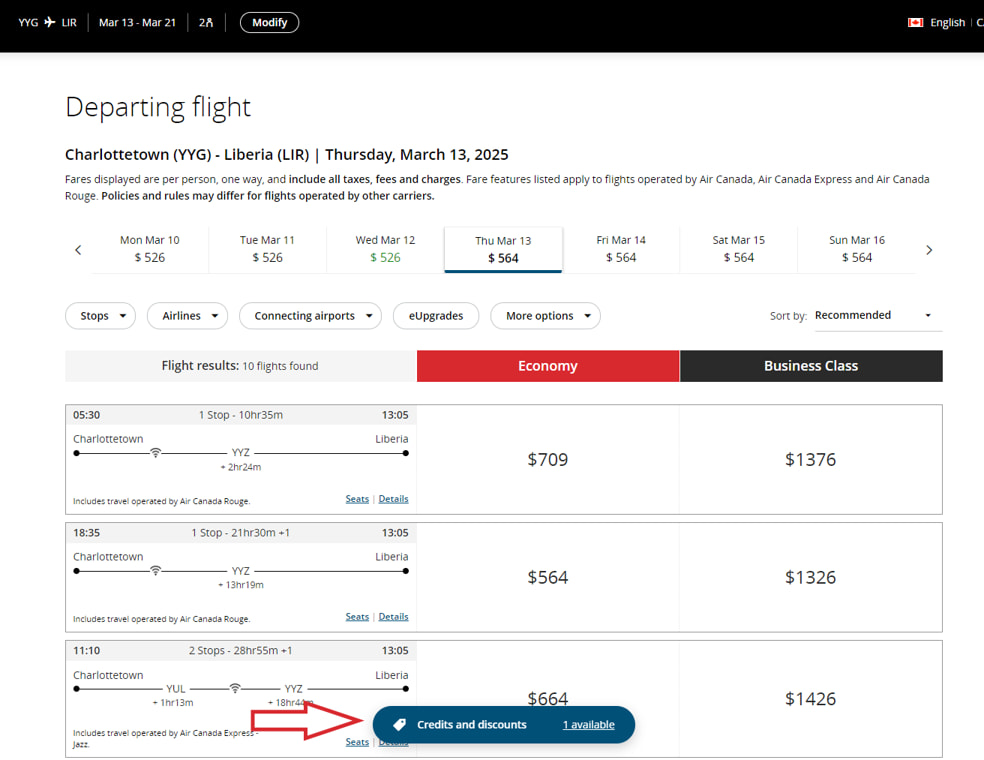

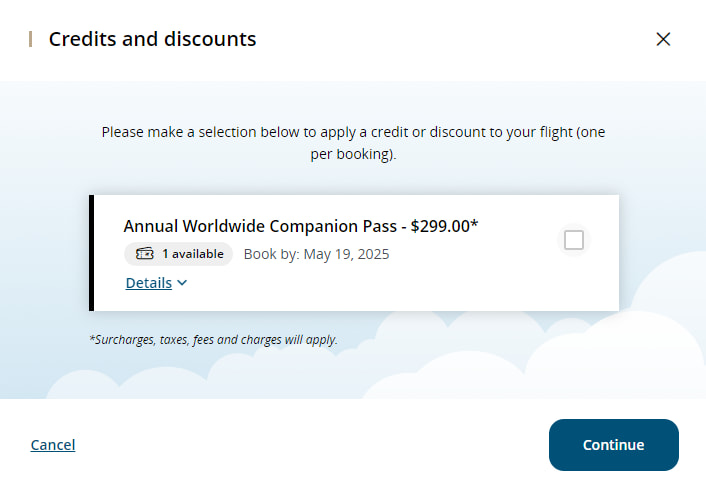

On the first page of the search results, you'll see a credits and discounts box at the bottom of the screen.

Click on it and you can activate your voucher. You’ll then get a price to use it for the itinerary that you’re looking at. Note that this is the only time you can do this – you won't be able to apply the voucher when selecting your next flight or at checkout. If you forgot to do this step, simply start your search over again.

Where and how you can use your voucher

You can use your companion voucher anywhere Air Canada flies and with any level of economy fare – with some restrictions:

- Cannot be used with premium cabin fares.

- Cannot be used on itineraries with flights operated by airline partners. All flights must be operated by Air Canada (including Express and Rouge).

- Cannot be used in conjunction with Aeroplan reward flights.

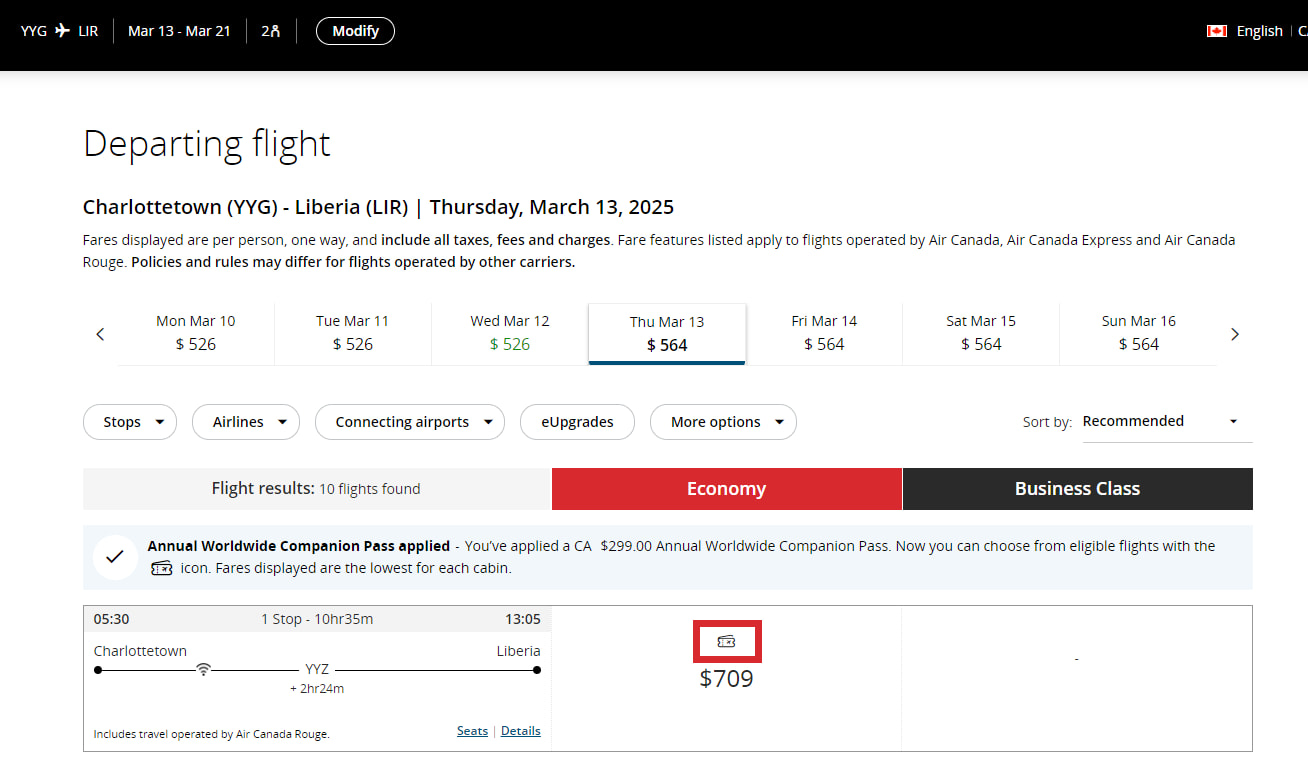

If the flight you’re looking at is eligible, you'll see an icon above the price. If that icon isn't there, you won’t be able to apply your Companion Pass.

One more thing I learned: the primary cardholder doesn't have to be on the itinerary. You can use the voucher for a trip that involves other travellers. Though the terms on the Amex site say that the primary cardholder must be travelling, Air Canada didn't block me from using a voucher with two other family members.

Learn more: Air Canada’s annual worldwide companion pass

How I saved $1,356 using the American Express Aeroplan Reserve Card Companion Pass

To get those savings, I had some rather fortuitous timing.

I had one pass that was going to expire in a few weeks, so I booked the first two people for my travelling party of four. I earned the new pass a few weeks later and promptly booked the other two travellers.

Here's how I booked the second one – and what I saved.

The trip

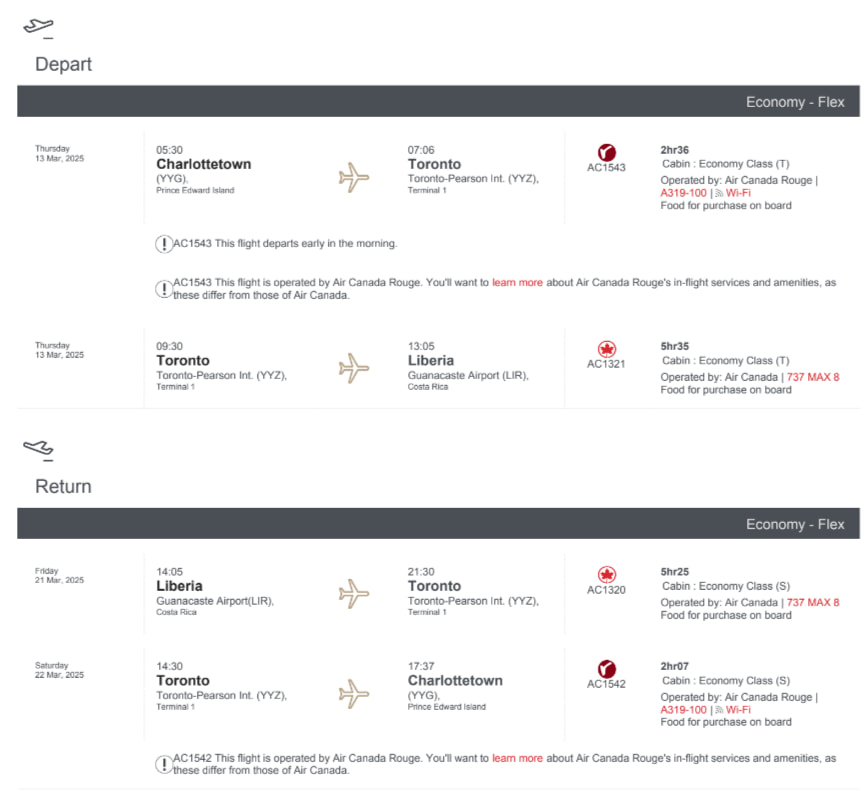

The route: Charlottetown, PEI to Liberia, Costa Rica

The dates: March 13–21, 2025

Our trip was tailor-made for using this Companion Pass. We’re travelling during March break and Air Canada is the only airline that can get us to Costa Rica without booking multiple airlines on separate tickets – so of course, Air Canada charges a premium for it (which is why I booked so far in advance).

Here's our final itinerary:

Making my booking

To shed some light on what’s possible in terms of savings, I compared standard fares to the fares with the voucher applied.

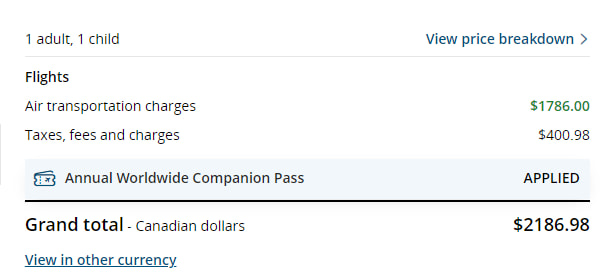

Here's the standard fare for one adult and one child:

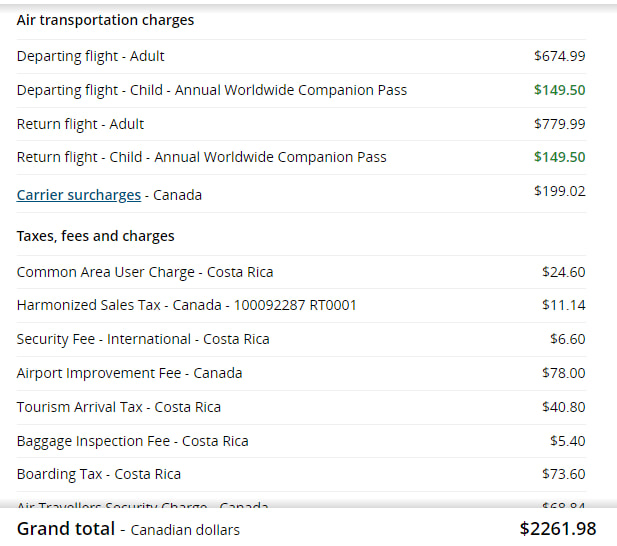

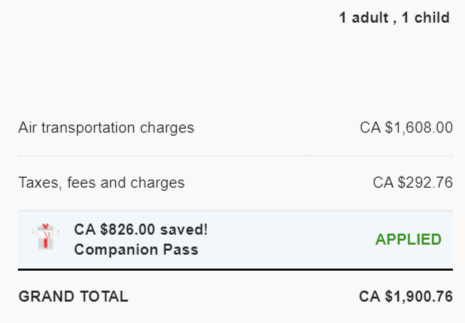

Here’s how the cost changes when you apply the companion voucher – a savings of $655.

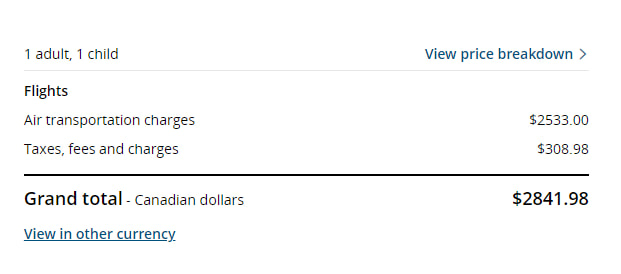

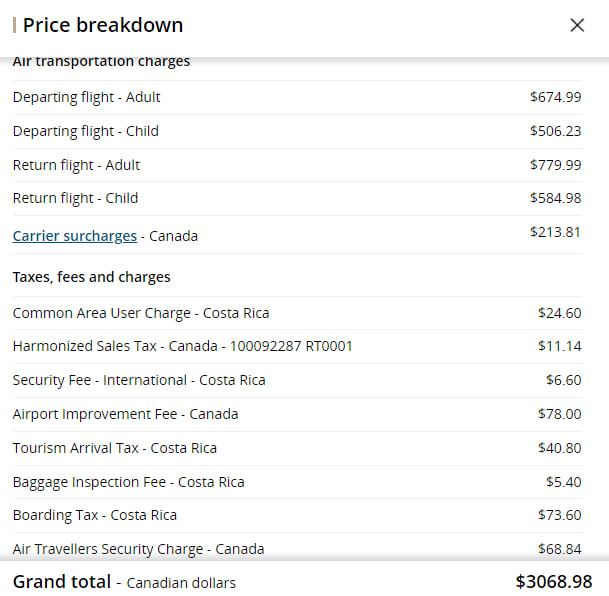

Here's the full cost for the flex fare, including a breakdown of the taxes and fees. Note that Air Canada charges less for children under 12.

And here’s what I ultimately paid, receiving even higher savings of $807. This is because the extra cost for the flex fare is free with the companion pass.

Summary of savings

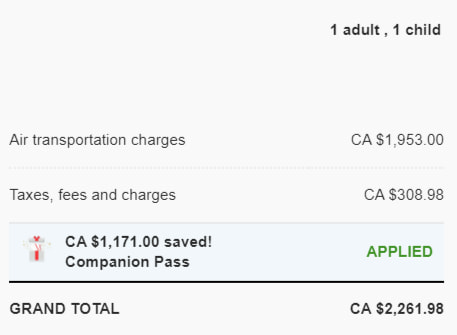

My email from Air Canada shows higher savings of $1,171 – but this would only be the case if I purchased two adult tickets. Since I’m travelling with kids and they have a reduced fare, I’m saving a little less.

Remember: that’s the savings for my second booking only. I made a previous booking with the soon-expiring companion pass. With that one, Air Canada gave me savings of $826.

Again, though, my actual savings were lower since I booked a child fare. I saved $549 on my first booking.

And while the savings on my second ticket were higher, the ticket also cost more. That’s how companion vouchers work, though – the pricier the flight, the more you’ll save by using one.

The bottom line: I saved $1,356. If I’d made a booking for four adults, my savings would have been $1,997.

What I've saved in the 2 years I've had the American Express Aeroplan Reserve Card

It’s true: $1,356 is some pretty sweet savings. But we have to keep in mind that the credit card costs $599 per year – which means I've paid $1,797 in fees so far.

The cost exceeds what I’ve saved with the vouchers. But I’ve received other savings, so let’s add that up.

- Companion voucher. The companion voucher savings start me out at $1,356, as we broke down above.

- Free checked bags. I’ve used this perk several times – 4 checked bags to/from Toronto and Cancun (which is 12 free bags total). At $35 per bag, that’s a savings of $420.

- Flight delay claims. If you’ve read my flight delay story, you’ll recall that I was reimbursed $755 thanks to my card’s higher coverage level of $1,000 (most cards max out at $500). I have another claim in processing worth $636 for an Aeroplan points booking. That’s a total of $1,391 in expenses I’ve gotten back.

- Amex Offers. I’ve saved quite a bit with Amex Offers, some of which weren’t available on all Amex cards. These include a free year of Disney+ ($120), savings at a Fairmont hotel ($70), and 6 months of Disney+ ($60) for a total of $250.

- Welcome bonuses. I earned a giant welcome bonus and received 81,169 Aeroplan points worth about $1,623 if I get 2 cents per point (which I did on my last trip to Cancun).

- Points on purchases. My day-to-day purchases for the last two years have earned me 119,515 thanks to some major projects I have going on. I’ve yet to use these but they’re potentially worth $2,390.

Adding those up, we’ve got a total savings of $7,428.

And that doesn’t include what I've saved on reward flights thanks to Preferred Pricing or taking advantage of priority services.

I've more than made up the annual fees so far. Let's just say that at this time, I don't plan on moving on from this card – especially since I'm sitting on 153,000 Aeroplan points that can be used towards my next adventure.

One thing I'd like changed with the American Express Aeroplan Reserve Card

With that said, there's one big downside to this card: the spend requirement to get the companion pass.

Other credit cards in Canada offer them automatically and I'd like to see that here – especially considering the annual fee of $599.

I’ve earned the voucher every year but if I don't next year, I won't be afraid to quit while I'm ahead with this card. The voucher is key to keeping the savings rolling in offsetting that $599.

Premium Aeroplan credit cards

A few cards offer this companion voucher, all of which belong to the upper tier of Aeroplan credit cards. Let’s look at the major two: the American Express Aeroplan Reserve Card and the TD Aeroplan Visa Infinite Privilege Credit Card.

Note: The CIBC Aeroplan Visa Infinite Privilege Card is nearly identical to the TD Aeroplan Visa Infinite Privilege Credit Card. There's also a business credit card that offers this voucher – the American Express Aeroplan Business Reserve Card.

| Aeroplan credit card | Welcome bonus | Earn rates | Annual fee and income requirements | Apply now |

|---|---|---|---|---|

| American Express Aeroplan Reserve Card |  $150 GeniusCash + Up to 85,000 bonus points (terms) $150 GeniusCash + Up to 85,000 bonus points (terms) | 2.79% | * $599 * None | Apply now |

| TD Aeroplan Visa Infinite Privilege Credit Card | Up to 85,000 bonus points (terms) | 2.78% | * $599 * $150K personal or $200K household | Apply now |

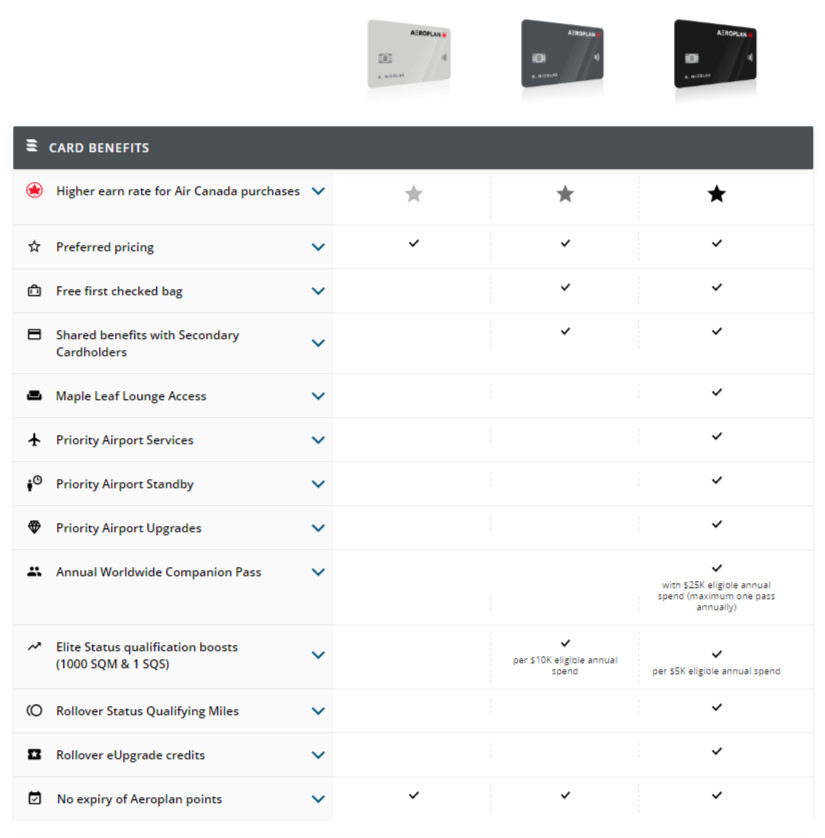

Both cards are metal credit cards and have the same annual fee of $599. They also offer the same Air Canada benefits. Here's a chart showing all the benefits offered by the three tiers of Aeroplan cards, with these cards belonging to the upper tier:

But the similarities end there. These cards have different earn rates, insurance coverages, and other perks.

American Express Aeroplan Reserve Card

We'll start with my card, the American Express Aeroplan Reserve Card. It has no income requirements and earns some solid rewards on purchases:

- 3 points per $1 spent on Air Canada

- 2 points per $1 spent on dining and food delivery purchases in Canada

- 1.25 points per $1 spent on all other purchases

If you spend $2,000 per month, that works out to 50,175 Aeroplan points.

It also includes 11 types of insurance coverage, broken down as follows:

American Express® Aeroplan®* Reserve Card

| Extended Warranty | 1 year |

| Purchase Protection | 90 days |

| Travel Accident | $500,000 |

| Emergency Medical Term | 15 days |

| Emergency Medical Maximum Coverage | $5,000,000 |

| Trip Cancellation | $1,500 |

| Trip Interruption | $1,500 |

| Flight Delay | $1,000 |

| Baggage Delay | $1,000 |

| Lost or Stolen Baggage | $1,000 |

| Hotel Burglary | $1,000 |

| Rental Car Theft & Damage | Yes |

Please review your insurance certificate for details, exclusions and limitations of your coverage.

And finally, here are some of the other perks you’ll enjoy:

- Benefits at Toronto-Pearson, including priority security screening

- Access to Amex Offers and Front Of The Line

- Priority Pass membership (no free passes)

TD Aeroplan Visa Infinite Privilege Credit Card

The other major Aeroplan card offering a companion pass is the TD Aeroplan Visa Infinite Privilege Credit Card. This card has high income requirements of $150,000 personal or $200,000 household. It also has a different rewards structure, offering more rewards on your everyday basics:

- 2 points per $1 spent on Air Canada

- 1.5 points per $1 spent on eligible gas, electric vehicle charging, groceries, travel & transit and dining

- 1.25 points per $1 spent on all other purchases

That works out to earning 49,950 Aeroplan points per year if you spend $2,000 per month.

The TD Aeroplan Visa Infinite Privilege Credit Card includes slightly less in terms of insurance, offering 12 types:

TD® Aeroplan® Visa* Infinite Privilege* Credit Card

| Extended Warranty | 2 years |

| Purchase Protection | 120 days |

| Mobile Device | $1,500 |

| Travel Accident | $500,000 |

| Emergency Medical Term | 31 days |

| Emergency Medical Maximum Coverage | $5,000,000 |

| Emergency Medical over 65 | 4 days |

| Trip Cancellation | $2,500 |

| Trip Interruption | $5,000 |

| Flight Delay | $1,000 |

| Baggage Delay | $1,000 |

| Lost or Stolen Baggage | $2,500 |

| Hotel Burglary | $2,500 |

| Rental Car Theft & Damage | Yes |

Please review your insurance certificate for details, exclusions and limitations of your coverage.

Other perks include:

- Visa Airport Companion membership and 6 free passes

- Priority airport benefits in Montreal, Ottawa, Toronto-Billy Bishop, and Vancouver

Other credit cards with companion vouchers

The list of credit cards in Canada that offer companion vouchers is very small.

WestJet is the leader here since both WestJet credit cards include companion vouchers. And unlike the Aeroplan cards noted above, you don't need to spend anything to earn them – you’ll receive them after paying your annual fee.

- The WestJet RBC World Elite Mastercard includes a voucher that you can use anywhere WestJet flies

- The WestJet RBC Mastercard companion voucher is only good for travel within Canada and the Continental U.S.

The other option is the RBC British Airways Visa Infinite – but it works differently. You need to spend $30,000 to get the voucher and you can only apply it to reward flights, which means you’ll need to save up lots of points before you can even consider using it. That said, the voucher can be applied to a solo traveller for 50% fewer Avios.

Here’s a rundown of these cards.

| Credit card | Welcome bonus | Earn rates | Annual fee and income requirements |

|---|---|---|---|

| WestJet RBC World Elite Mastercard | 70,000 WestJet points (terms) | 1.66% | * $139 * $80K personal/$150K household |

| WestJet RBC Mastercard | 15,000 WestJet points (terms) | 1.03% | * $39 * None |

| RBC British Airways Visa Infinite | Up to 60,000 bonus points (terms) | 2.06% | * $165 * $60K personal and $100K household |

Have you used a companion voucher?

This is my story about using a companion voucher – but we’d love to hear yours!

Have you used a companion voucher? How much did you save? Has my story got you thinking about getting a credit card that offers a voucher?

Let us know in the comments below.

FAQ

What is a companion voucher?

A companion voucher is essentially a 2-for-1 ticket. Book one ticket and get a second ticket for another traveller for a fee plus taxes and fees.

How do you earn a companion voucher on Aeroplan credit cards?

Aeroplan credit cards in the high tier come with a companion voucher, called a Companion Pass. To get access to it, you’re required to spend $25,000 in one year.

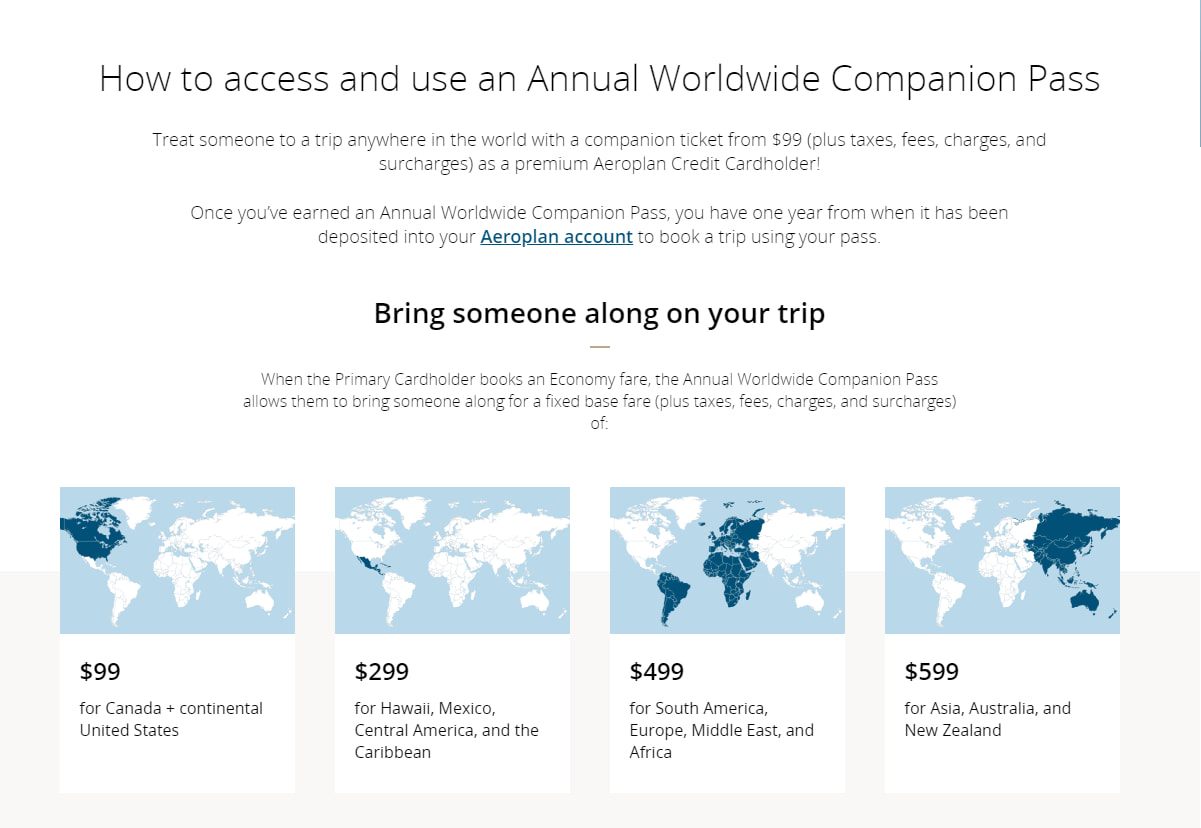

What does it cost to use an Air Canada Companion Pass?

You can use an Air Canada Companion Pass anywhere Air Canada flies. This is what it costs to use based on where you fly:

- $99 for Canada and the Continental U.S. (including Alaska)

- $299 for Hawaii, Mexico, Caribbean, and Central America

- $499 for South America, Europe, Middle East, Africa

- $599 for the rest of the world

What other benefits are included with the American Express Aeroplan Reserve Card?

There is a long list of benefits that are included with the American Express Aeroplan Reserve Card, including unlimited Maple Leaf lounge access; priority check-in, boarding, and baggage handling; free first checked bags for up to 8 travelling on the same reservation; and preferred pricing on Aeroplan reward flights.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×3 Award winner

×3 Award winner

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.