Redeeming points and miles for free flights. There aren’t many experiences that feel as rewarding as this…

But, it’s not always perfect. And for programs where points or miles only cover the base airfare, you’re sometimes left with a high taxes and fees bill to pay – and a sour taste in your mouth.

Why does this happen? Well, it’s actually not the taxes and fees that are commonly the problem, but a 3rd charge you may have to pay – fuel surcharges, also commonly known as carrier surcharges.

Depending on your airline and your destination, this can be pretty expensive and really take a bite out of the value of your rewards.

Do all flights have fuel surcharges? No they don’t – it’s actually a mixed bag. It’s all up to the airlines.

So, here’s your guide to avoiding carrier surcharges – the airlines to use, the ones to avoid, and the best programs for avoiding fuel surcharges.

And while this will be focused on airline programs, the information found here also applies to rewards programs that have flight charts.

In Canada, these are:

- the Amex Fixed Points Travel Program,

- the CIBC Aventura Airline Redemption Chart, and

- the RBC Air Travel Redemption Schedule.

Why? When you use these charts, you also have to pay any taxes, fees, and carrier charges with them.

Related: Fly For Free Faster: Credit Cards With Airline Miles

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

3 tips to skip airline fuel surcharges

Alright, so how do you avoid these charges?

Here are our tips on saving even more on reward flights.

Tip 1: Research your rewards flight program options

Knowing what reward programs charge carrier surcharges and which ones don’t is the best place to start. Some programs pass on these charges, and others don’t.

The best option is Aeroplan. They simply don’t have carrier surcharges on any of their reward flights, regardless of carrier.

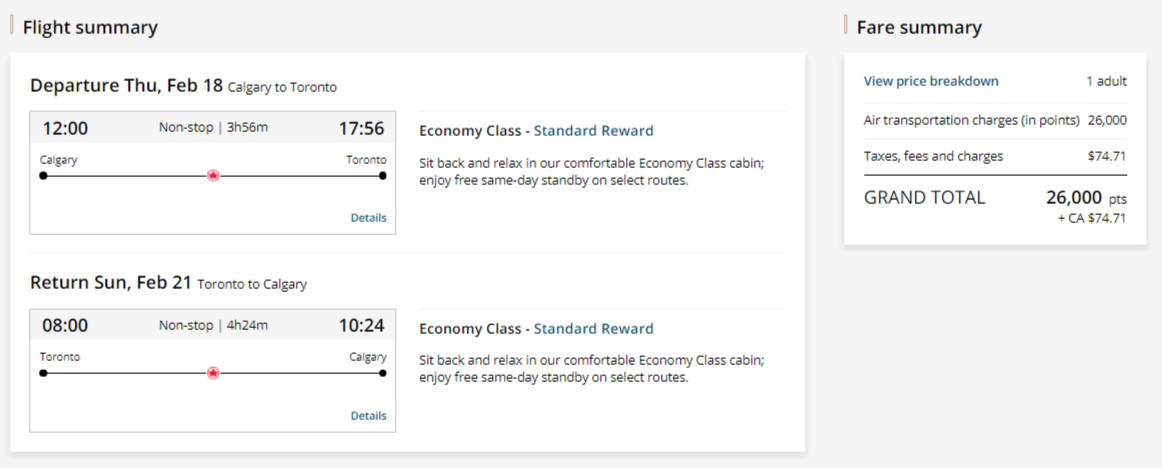

Here’s an example of a rewards flight from Calgary to Toronto:

A mere $75 in taxes and fees.

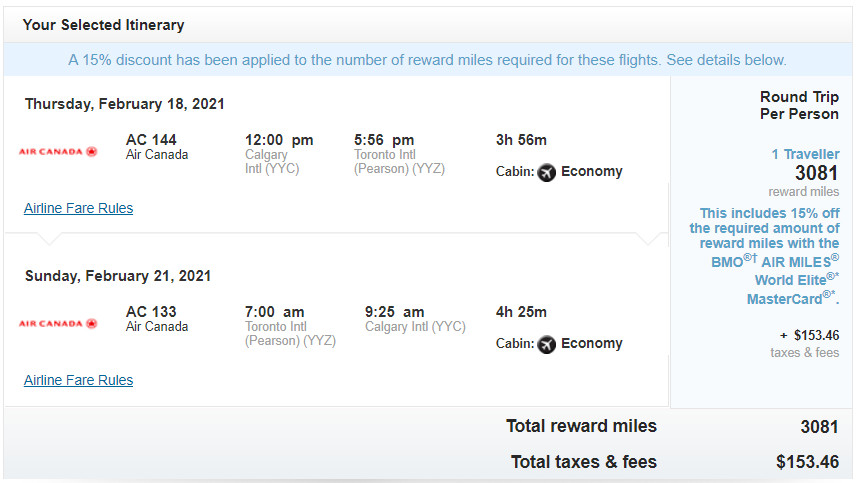

Now, let’s see what Air Miles looks like for very similar flights.

You’re paying nearly double in taxes and fees, which also includes a booking fee charged by Air Miles.

WestJet flights were no better, charging a near identical amount for this route.

So while Air Miles is very popular as it’s easy to earn rewards, it will also cost you more to use them.

If you’re flying outside the country, all U.S. airlines charge very little in taxes and fees, as you’ll see in our next tip.

Tip 2: Leave direct from a U.S. airport

For more savings, consider driving down to a border city, and fly from there on your rewards.

If your flight is within the United States, you’ll only pay $11.20 USD in taxes and fees, which works out to about $15 CAD.

Don’t believe us? Let’s look at some flights between Detroit and Seattle.

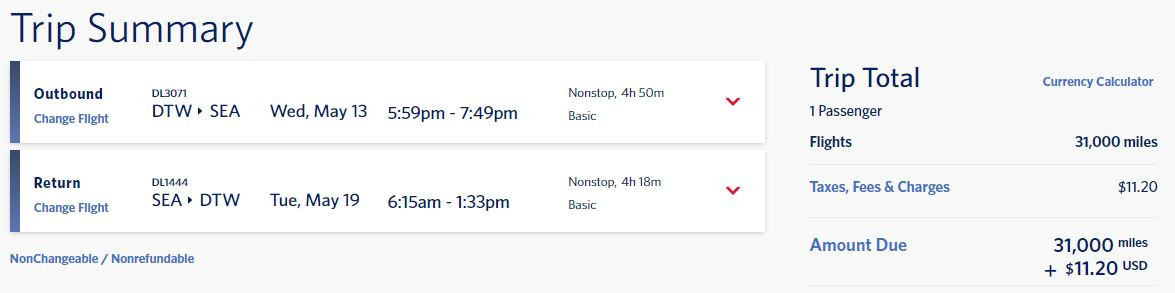

Here’s what Delta SkyMiles would charge:

There’s also the option of Alaska Airlines:

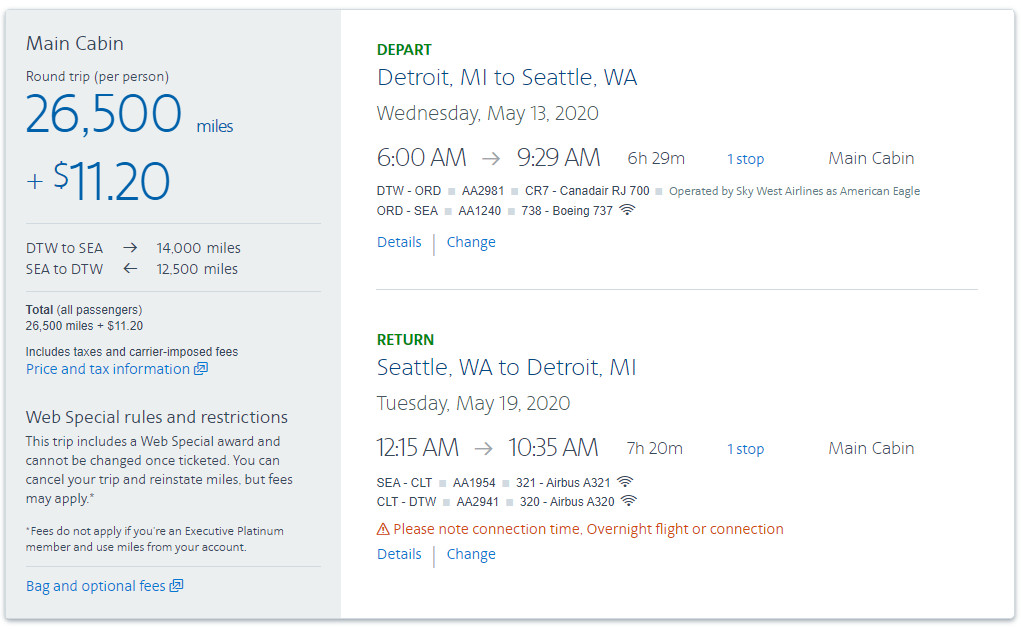

And American Airlines (although the flights aren’t direct):

How can you book rewards flights on these airlines? Not through AIR MILES, since it only allows bookings that either start or end in Canada…

You can find out more in the best rewards section below.

Tip 3: Know your transfer options

Depending on who you collect your points with, you may have access to transfer options to other programs.

But if you’re smart with your transfers, you can get around these.

Amex Membership Rewards and Marriott Bonvoy are 2 examples in Canada, which we’ll go into detail later.

The most expensive airline fuel charges

So what airlines should you try and avoid?

Here are the bigger ones with frequent flights into Canada that you need to be wary of.

British Airways

British Airways is another large carrier that charges high taxes and fees.

That doesn’t mean their partners do though. For example, American Airlines has pretty low fees. Cathay Pacific is also lower, though not as low as some others.

You can learn more about British Airways Executive Club here.

Lufthansa

Air Canada’s largest European partner is unfortunately a culprit as well. Many options you see for flights to Europe may involve Lufthansa, and they have the same huge rates as Air Canada.

However, depending on where you’re flying in Europe, you may have to take them for some part of your journey. Just try and make sure it’s not your flight across the Atlantic.

WestJet

Sadly, one of our major carriers is here.

As we saw earlier, WestJet also has some carrier surcharges you’ll have to pay.

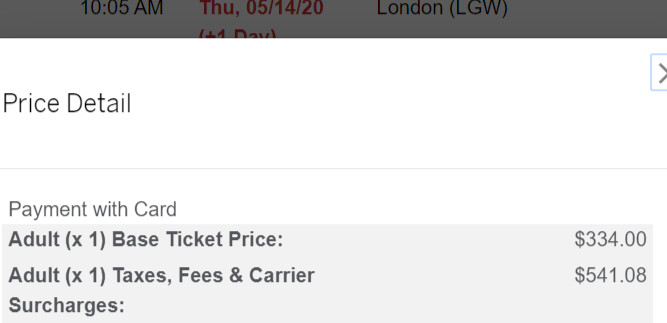

As an example, here’s the price breakdown for a flight from Toronto to London:

Again, it’s not as much as other airlines, but it’s still another $320 you’ll have to pay with either WestJet Rewards or through a flight chart like the Amex Fixed Points Travel program.

Best rewards programs for no fuel surcharges

So what programs are best for getting around huge fuel surcharges?

Here are the top options in Canada for you to consider, and the credit cards associated with each program.

Aeroplan

The Aeroplan program is one of the best programs when it comes to avoiding fuel surcharges. That wasn’t always the case, but with the new Aeroplan program, these fees are no longer charged on any rewards flight.

That also extends to partner airlines like Lufthansa. Lufthansa has very high carrier surcharges, but you won’t pay them thanks to Aeroplan. However, for partner flight bookings you have to pay a booking fee of $39 (a small pittance compared to what you’re saving).

To avoid carrier surcharges on reward flights, Aeroplan is the easiest way to do so.

Top Aeroplan credit cards

Related: Best Aeroplan Credit Cards In Canada

Amex Membership Rewards points

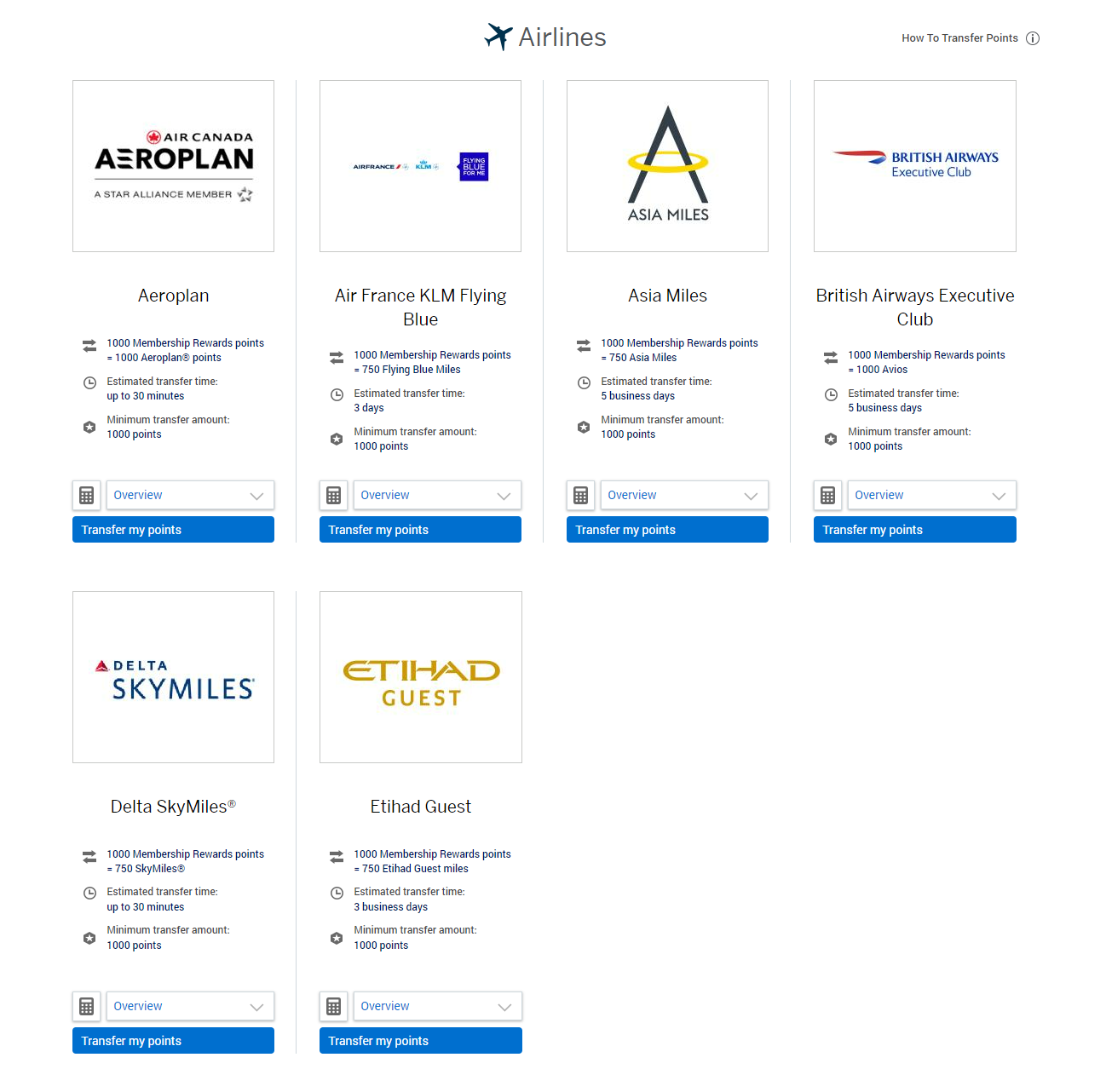

It’s not an airline program, but if you collect American Express Membership Rewards, you can transfer your points to 6 different airline options.

What are they? And at what rates do they transfer points? Here they are:

Aeroplan is here, transferring at a 1:1 ratio. So too is British Airways Executive Club, which also transfers at a 1:1 ratio.

Aeroplan is here, transferring at a 1:1 ratio. So too is British Airways Executive Club, which also transfers at a 1:1 ratio.

And while British Airways has high taxes and fees, you can redeem their points on American Airlines, and any other airline that is part of the OneWorld alliance, which has low fees on reward flights.

There’s also Delta SkyMiles, which transfers at a 4:3 ratio. And while not ideal, not only does Delta have low fees, but so do all OneWorld alliance as well, which includes Air France and KLM.

Fixed Points Travel Program

Or, instead of transferring to an airline partner, you can also use Amex’s Fixed Points Travel Program. Book any flight on any airline and use points to cover the base airfare. You have to pay any taxes, fees, and carrier surcharges.

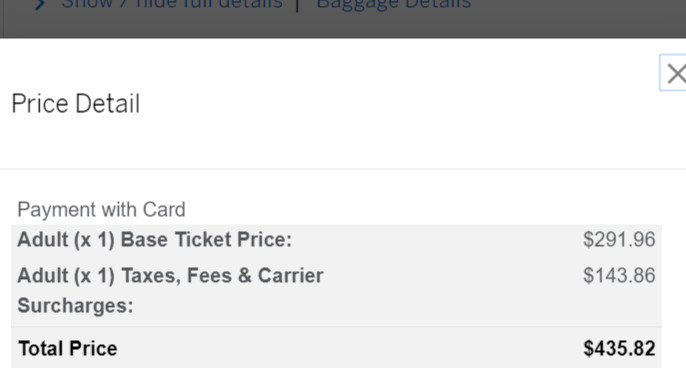

How can you tell what you’d have to pay? Simply make a booking through Amex travel, and click on price breakdown on the first flight you want to book.

Here it is for the WestJet flights we looked at from Calgary to Houston:

$144 is less than what we saw earlier, which means Amex isn’t passing on the fuel surcharges.

However, on our WestJet flights from Toronto to London, the fuel surcharges are back:

If you collect Amex Membership rewards, this can also be a great way to book a flight.

You can find more details on how everything works in our Membership Rewards guide.

Amex Membership Rewards credit cards

American Express Platinum® Card American Express Cobalt® Card American Express® Gold Rewards Card American Express® Green Card

United MileagePlus (via Marriott Bonvoy)

While on the surface it may seem similar to Aeroplan, United MileagePlus has one key difference – they don’t charge any carrier surcharges, regardless of airline.

But, other than flying on United or Star Alliance carriers, there’s only one way to get United MileagePlus miles in Canada – transferring from Marriott Bonvoy.

Marriott Bonvoy points transfer at a 3:1 ratio to MileagePlus. When you transfer to United, Marriott also gives you 10% bonus miles on top.

To make things even sweeter, when you transfer to any of their airline partners in 60,000 points increments, you’ll get another 25% bonus miles on top of that.

So say you transfer over 60,000 points, you’d get:

- 20,000 base miles,

- 10% bonus miles from transferring to United for another 2,000 miles, and

- another 5,000 miles from Marriott as part of the transfer.

That’s a total of 27,000 miles from transferring 60,000 points, cutting the transfer ratio down to 2.2:1.

Marriott Bonvoy has over 40 airline partners you can transfer points to. So check them out here and see if there are any others you could make use of.

Most other major U.S. Airlines are here, including Delta, American, Alaska, and Southwest, as well as top international carriers like Emirates, Air France, KLM, and Qantas – all of which have low taxes and fees.

Related: Marriott Bonvoy Amex Canada Review & Point Value Analysis

Marriott credit cards

There’s only one Marriott personal card in Canada, the

However, Amex Membership Rewards will let you transfer your Amex points to Marriott Bonvoy at a 5:6 ratio.

These cards are:

We want to hear from you

There you have it – tips and strategies to lower those taxes, fees, and carrier surcharges bill.

You’ve got the airlines to avoid, the ones to fly on, and general tips to help get the most out of your airline miles.

Have any tips to share? Are there carriers we missed that charge low taxes and fees?

Let everyone know in the comments below and share the knowledge.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 3 comments