Travel at least every other year or more frequently? Travel rewards offer the best, highest value rewards you can get.

To get the best of the best in rewards value, you might want to check out airline programs.

And while they can be difficult and require a lot of flexibility, you’ll generally always come out on top with smart usage and a little know how.

And to help you get this know how, here’s our official guide to the best credit cards with airline miles.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Best credit cards with airline miles

| Credit Card | Why You Want It | Welcome Bonus | Annual Fee | Apply |

|---|---|---|---|---|

| American Express Platinum Card® | Transfer points to 6 different airlines and the best perks | 100,000 points (terms) | $799 | Apply Now |

| WestJet RBC World Elite Mastercard | Annual companion voucher and free checked bags | $120 WestJet Dollars | $139 | |

| WestJet RBC Mastercard | Low annual fee of $39 and an annual companion voucher | $30 WestJet Dollars | $39 | |

| Marriott Bonvoy™ American Express® Card | Transfer points to 40 airlines | 110,000 points (terms) | $120 | Apply Now |

Airline credit cards explained

So how do Airline credit cards work?

All purchases you make on the card earn you miles (or points) in the program. Once your monthly statement comes out, the miles you earned get totalled and added to your connected account with your chosen program.

If the card is affiliated with the program itself, you may also get more privileges when flying with the airline. These include things like companion vouchers, free checked bags, and priority check-in, to name a few.

How to compare different airline credit cards

So, how do you compare these cards?

The best way is to use our compare cards page. Set the top slider to “Travel+” and the page will show all of these cards.

Enter your spending and see how they compare, both on total rewards and by our genius rating. Our Genius Rating takes into account over 126 features and tailors the score based on your preferences.

To see how we got the value of the rewards, each individual card page has the value of the various rewards available, with the best travel value being selected as our displayed rewards. Other redemption options are also listed, and the typical value you can see for each one.

How to supercharge your airline miles

Beyond using your credit card, how can you earn miles?

The fastest way is by actually flying with the airline. Paying with your credit card while also earning points on the ticket is the fastest way possible.

Many hotel and car rental agencies will allow you to collect miles or points (or transfer theirs) for various airlines in lieu of their own programs. This can be an easy way to increase the amount of miles you earn every trip without spending more on flights.

With the exception of Aeroplan, these methods are the only ways to accumulate airline miles faster.

Aeroplan is a unique program because they have a couple of retail partners you can earn with, the biggest one being Home Hardware. They also have their own e-store, where you can use their shopping links to earn points while shopping at select online merchants.

Aeroplan also runs regular promotions to earn bonus points as well.

4 Airline rewards programs

Which airline programs issue credit cards for the Canadian market?

Here’s an overview of the various programs.

Aeroplan

The program belonging to Canada’s largest airline, Aeroplan lets you use miles on Air Canada, as well as 40 Star Alliance carriers to get you almost anywhere on Earth.

How do you redeem miles for flights? You need a set number of miles, depending on where you want to fly – these are called Fixed Mileage flights.

For Air Canada flights only, there are also Market Fare flights, where the number of miles you need varies based on the price of the flights themselves.

You can find more details on the difference between the 2 on this Aeroplan page.

But, as shown above, not all Aeroplan redemptions are created equal. They’re definitely best used for economy flights within North America, or business class seats to anywhere in the world.

How many miles do you need for a flight? Here’s a link to the Aeroplan flight redemption chart.

WestJet

Canada’s second-largest airline operates WestJet Rewards.

Unlike the previous 2 programs where you have to redeem a set amount of miles to fly somewhere, WestJet operates a simpler program. You earn dollars which can be used to pay for the base airfare of any flight, not only those operated by WestJet, but also their partners. Here are these partners:

- Delta,

- Air France,

- KLM, and

- Qantas.

RBC issues 2 different WestJet Mastercards.

Amex Membership Rewards

Let’s state the obvious here – Amex Membership Rewards is not an airline program, but an in-house rewards program operated by American Express themselves.

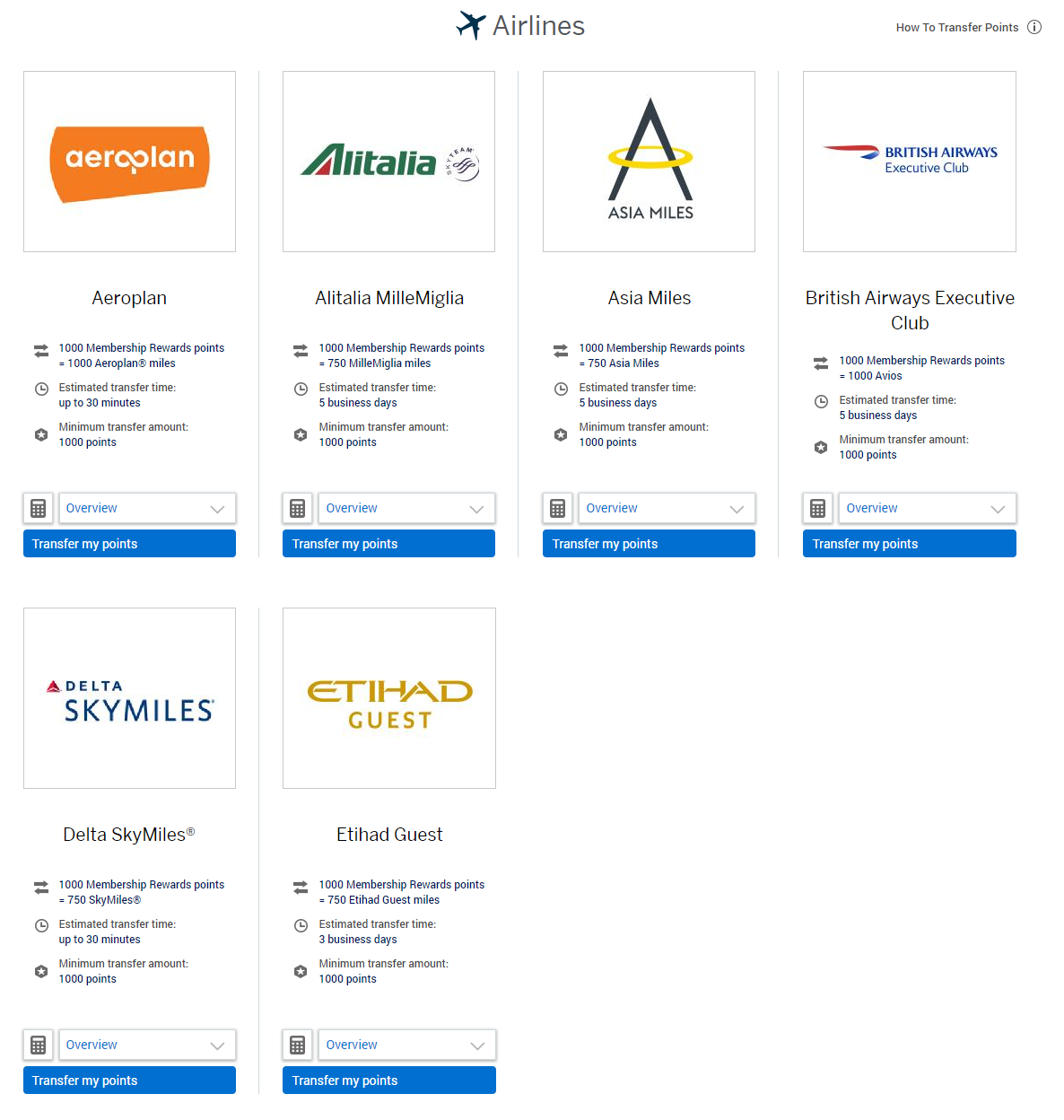

But, one of the ways you can use your points? By transferring them to airlines – 6 in fact.

Here are the various transfer options:

While they’re not all at a 1:1 ratio, the most common option used would be Aeroplan, to which Membership Rewards points are transferred at a 1:1 ratio.

So, in fact it can be the best choice available, as you get many options you can choose from. However, since these cards don’t actually belong to any one airline program, you won’t gain any airline-specific benefits.

Amex issues 1 personal card that can transfer points to their airline partners.

Bonus: Marriott Bonvoy

Similar to Membership Rewards, Marriott Bonvoy isn’t an airline program.

But, you can transfer your points to over 40 different airlines, most of them at a 3:1 ratio, including Aeroplan. You can see the full list of airlines and their transfer ratios here.

The best part? Transfer your points in increments of 60,000, and you’ll get a 25% transfer bonus as well.

For example, say you transfer 45,000 points to Aeroplan, you would wind up with 15,000 Aeroplan miles. Increase that to 60,000 though, and you’d get 20,000 Aeroplan miles, plus the 25% bonus of 5,000 miles, for a total of 25,000 miles, effectively lowering the ratio to 2.4:1.

With an average Aeroplan mile worth 2.5 cents each, it actually makes for the best option to use your Marriott points – 1.04 cents per point versus 0.97 cents when redeemed for hotel stays.

To make these transfers even better, Aeroplan occasionally has deals like this one where you can earn another 30% bonus miles as well.

Airline credit cards

For all the programs mentioned, here are the credit cards you can get for each one.

Amex Membership Rewards Cards

There are 4 Membership Rewards cards that can transfer points to airlines.

American Express Cobalt

The best choice to earn Amex Membership rewards is with the

Why this one? It simply earns the most points out of any of these cards:

- 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month)

- 3 points per $1 spent on eligible streaming services

- 2 points per $1 spent on eligible gas, transit, and ride share purchases

- 1 point per $1 spent on foreign currency purchases

- 1 point per $1 spent on all other purchases

Plus, it has the lowest fee of any Membership Rewards card at $191.88.

GC: $100

American Express Gold Rewards

Your next choice is the

It also comes with high earn rates on all your purchases:

- 2 points for every $1 spent on gas, groceries, drugstores, and travel

- 1 point for every $1 spent on all other purchases

While it has a higher annual fee of $250, it comes with some premium perks, which include:

- $100 annual travel credit, and

- Priority Pass Membership, with 4 free passes to Plaza Premium Lounges in Canada.

American Express Platinum Card

For red carpet treatment and lavish perks, the

First it comes with a huge welcome bonus of 100,000 points after spending $10,000 in the first 3 months and making a purchase between months 15 to 17. But the earn rates aren’t quite as robust:

- 3 points per $1 on eligible dining,

- 2 points per $1 on eligible travel, and

- 1 point per $1 on all other purchases.

But that’s okay since what you’re REALLY getting this card for are the perks. Here’s just a taste of what it offers:

- annual $200 travel credit,

- automatic advanced status in 4 hotel programs, including Marriott Bonvoy,

- access to the Hotel Collection and Fine Hotels and Resorts,

- unlimited lounge visits for the cardholder and a guest at Priority Pass lounges, and

- international airline program for discounts on premium economy and business class seats.

It truly offers great benefits for its $799 annual fee.

American Express Green Card

Finally, there’s the

You’ll earn a simple 1 point per $1 spent on all purchases.

It lacks premium perks, but it makes up for it by being completely free to keep in your wallet.

RBC WestJet Mastercards

As for Canada’s 2nd largest airline, WestJet has partnered with RBC to offer 2 cards.

WestJet RBC World Elite Mastercard

The premium offering is the WestJet RBC World Elite Mastercard.

First off, you can earn $120 WestJet dollars after your first purchase.

You’ll also earn 1.5% back in WestJet Dollars on all purchases, which increases to 2% on WestJet purchases.

Plus it comes with its famous companion voucher – ranging from $119 to $399 plus taxes and fees – as well as free checked bags for the cardholder and 8 others travelling on the same reservation.

Related: WestJet RBC World Elite Mastercard: Deep Dive Review

WestJet RBC Mastercard

For a lower annual fee of $39, there’s also the WestJet RBC Mastercard.

Earn $50 WestJet Dollars after your first purchase, and earn 1% in WestJet Dollars on all purchases, which increases to 1.5% on WestJet purchases.

It also includes a companion voucher for flights within Canada, which cost $199 plus taxes and fees to use.

Marriott Bonvoy cards

Marriott Bonvoy has only one personal card in Canada – the

To get you started, you can earn 110,000 points after spending $6,000 in the first 6 months and making a purcahse in month 15.

And, you’ll earn 2 points per $1 spent on all purchases, which is accelerated to 5 points per $1 spent at Marriott properties.

It also comes with great Marriott Bonvoy perks to use as well:

- annual free night voucher for a stay worth up to 35,000 points,

- automatic silver elite status, and

- 15 elite night credits every year.

Related: Marriott Bonvoy Amex Canada Review & Point Value Analysis

In summary

Airline miles offer high-value rewards that can get you the biggest return on your spending.

And, just because a card doesn’t have an airline logo on it, doesn’t mean you can’t get airline miles from your points (although these cards don’t have any airline benefits).

Do you have a favourite airline credit card?

Let us know in the comments below.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×9 Award winner

×9 Award winner  $100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

$100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.