Please note that many card details have changed since the initial writing, with some being discontinued.

When it comes to credit card rewards, there’s an age-old debate about which kind of rewards are better: cash back or travel.

We at creditcardGenius have a preference for travel rewards.

Why?

We’ve proven that they offer the best total rewards. We literally wrote the algorithm on credit card rewards in Canada.

In fact, our top travel card offers up to double the annual rewards of our top cash back card. To see for yourself, check out the

That’s not to say that cash back rewards aren’t right for many people – they can be – but only for some people some of the time.

Recently, The Lean House Effect published an article arguing that cash back is the only way to go for credit card rewards. How they came to that conclusion left us completely dumbfounded. Their math and their methodology is just flat out wrong.

Normally we’d let that slide by, but this article got a lot of exposure causing many people to walk away with a completely skewed and misinformed opinion about credit card rewards. That just didn’t seem right.

Instead, we’ll go over the article point by point showing you what went wrong while revealing the truth about cash back vs. travel rewards credit cards.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Where their analysis went wrong

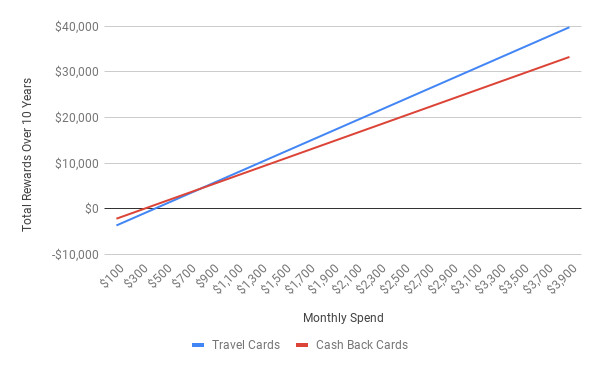

We’ll start by showing you 5 areas where their analysis went wrong. Then we’ll go through some easy tables and graphs to demonstrate how big of a difference using the correct numbers really makes, like this one:

1) They only looked at 10 cards

First, the list of cards they chose is small and seemingly random…

Why only 10 cards?

Why exclude many of the top-ranked travel cards including the #1 card in Canada, the

Why insist on the conclusion that there are only 2 cards you should even consider, when everyone’s situation is different?

You shouldn’t limit yourself to choosing between 2 cards, even if you’re hell-bent on cash back rewards.

To do a real comparison, more cards should be included.

When we do an analysis, we compare over 190 cards – giving you more choice and a better picture of the rewards they provide. Using the tools available on our site, you’ll see that there are many potential cards that could be right for you, and we’ll help you narrow it down fast.

In fact, we’re so confident we can help you find your top card, we guarantee it.

2) They excluded rewards from bonus spending categories

Here’s a direct quote from their article:

Note: All cards have additional bonuses like extra points on gas or groceries or a better cash back rate on certain bills. Let’s assume that the additional bonus rates don’t affect your rewards materially and that all cards have comparable bonus rewards. It’s also worth noting that these offerings often tie you down to certain partners (i.e. “twice the points at participating retailers”), which is terrible for your consumer choice. In summary, we should not be choosing cards based on these bonus rewards.

You absolutely should count the bonus rewards you get on certain spending categories.

They make it sound like most bonus rewards are only available at a specific store, when the truth is you usually get the bonus at all grocery stores, gas stations, restaurants, or whatever the case may be.

This really gave the cash back cards an unfair advantage, because most of the ones they chose have high flat earning rates and no bonuses. But 3 of the travel cards give bonuses on broad categories like gas, groceries, and drugstores. That’s a lot of rewards on everyday spending not accounted for.

We do understand not including bonus categories on cards that only offer them on select purchases, but there’s only one of those cards in their 10-card list, the

And, in any case, our rewards calculator even has the ability to enter in spending for specific retailers. The “Store” spending field allows you to enter what you estimate your monthly spending to be at these types of one-off stores. Every card in our database that offers that type of bonus will apply the spending correctly to that store and award the correct bonus.

Related: Canada’s Overall Best Credit Card

3) The point values they used were artificially low

Another item bringing down the value of the travel reward cards in their analysis are the point values they used to determine the cash value of the travel rewards for each card. The author obtained their point values from Ratehub:

The value of each type of points was determined for Scotia Rewards, Air Miles and Aeroplan from RateHub, and Avion here.

Here are the values that were used for the travel card calculations:

- Aeroplan – 0.99 cents

- AIR MILES – 12.1 cents

- RBC Avion Rewards – 1.14 cents

- Scotia Rewards – 1 cent

Other than Scotia Rewards (which is correct), these are very low-ball values – and the Aeroplan number in the article isn’t even what RateHub posts on their site (they have 1.2 cents per mile listed, not 0.99 cents).

RateHub biases towards a lower point value as well, often choosing low-value flights without any effort to maximize reward value. If you’re going to use rewards, why not put at least a little effort into focusing on flights and routes with half-decent value? On top of that, some of Ratehub’s research is very old. In the case of Aeroplan, it’s actually 5 years old.

All of our point value research is regularly updated and has been updated as of 2019.

Aeroplan’s real point value

Let’s look closer at Aeroplan in particular.

Our typical value for 1 Aeroplan mile is 2.5 cents. That number comes from surveying 20 flights within Canada or to the U.S, with each flight being surveyed 3 ways:

- Fixed Mileage business class,

- Fixed Mileage economy, and

- Market Fare economy tickets.

Why Canada and U.S. Flights? Because these flights offer some of the best value for your Aeroplan miles.

Point values can soar much higher than 2.5 cents though if you employ advanced techniques like focusing on: popular routes, peak times, business or first class tickets, open jaw, free stopovers, remote airports, and more. Values up to 10 cents per mile and beyond are certainly possible.

We also surveyed 11 other flights to the rest of the world, and when flying economy the value isn’t even close. Europe is especially bad, with most flights giving a value of less than 1 cent per mile.

If your plans are to fly economy to Europe, Aeroplan is not a good choice and there are other redemption options within the program that provide better value.

Point values for all major Canadian travel rewards programs

We’ve done the research and published guides on 15 rewards programs, including Aeroplan, and we dissect the best ways to use your points for all of them.

Here are our flight point values for the 4 rewards programs mentioned by the Lean House Effect:

And for the

This is because this card offers a 15% discount on the number of miles needed to redeem for a flight within North America – the best way to use your miles. This raises the value per mile for collectors with this card from the usual 17.2 cents per mile to 20.2 cents each.

Related: Capital One Credit Cards: Head To Head Against Some Of The Best Credit Cards In Canada

4) They subtracted taxes and fees from the rewards values TWICE

[G]et 33,000 Air Miles, convert them into anywhere from 7 to 16 flights in North America, fork out an additional $129 to $163 in taxes and fees on each flight, and create a hole in their savings of somewhere between -$1,148 and -$2064.

For programs like Aeroplan and AIR MILES, there’s a taxes and fees bill you have to pay to get your free travel rewards.

However, the rewards numbers in the article deducted taxes and fees from the total rewards earned…but sadly this isn’t how point values work. You’ve heard of double-dipping when it comes to rewards, well this is double-deducting. Something you should never do with points math.

Our point values (as well as RateHub’s) already take into account the taxes and fees. We subtract what you have to pay from what the reward actually costs during the point value calculation, so doing it again afterwards is just wrong.

5) Savings from travel rewards CAN be invested too

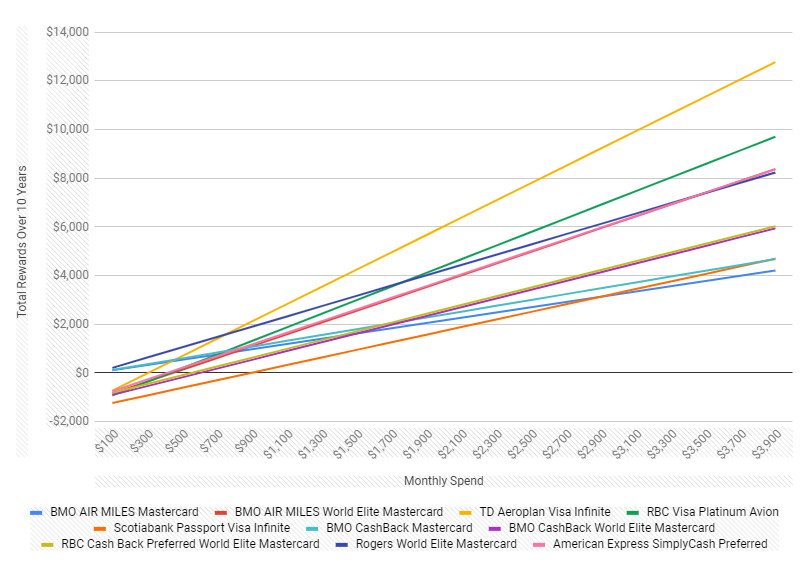

Comparison of 10 different credit cards for someone that spends $2,500/month on average and invests their savings.

While this statement makes it seem as though all rewards were invested, it was really only the cash back rewards invested at a rate of around 6%. This gives a ridiculous advantage to the cash back cards that the travel cards would obviously struggle to overcome.

Let’s be real. It’s not like your cash back credit card automatically deposits your rewards straight into your investment account where it continues to grow at 6% for all time. Almost all cash back cards (save a few) give your cash back as a statement credit, and usually only once per year. This means you still have to actually manually make a deposit into your investment account.

There’s no reason why this can’t be done with travel rewards as well. When you redeem your rewards, you can find out how much you saved on your flight or other reward and add that amount into your investment account – the same exact thing you’ll have to do for statement credits.

The real cash back vs travel rewards numbers

So, what are the real numbers for the 10 cards they chose seemingly at random?

Taking everything we’ve said above into account, here’s the new chart that includes our rewards calculations, their rewards calculations, and the difference between the two.

We’ve kept the same monthly spend of $2,500 but applied our typical spending breakdown so cards with bonus spending category multipliers will rightfully get factored into the equation:

- General spend: $875

- Gas: $250

- Groceries: $437.50

- Drugstores: $125

- Restaurants: $187.50

- Recurring bills: $375

- Travel: $125

- Specific stores (if the card has them): $125

All the numbers you see are generated from our compare cards page. The first 5 cards listed are travel cards, the next 5 are cash back.

| Credit Card | Annual fee | Sign-Up bonus | Annual Rewards | Our 1 year value | Our 10 year value | Their 10 year value | Difference in 10 year value |

|---|---|---|---|---|---|---|---|

| $0 | $163 | $271 | $434 | $2,873 | $1,912 | $961 | |

| $120, first year free | $404 | $636 | $1,040 | $5,684 | $2,913 | $2,771 | |

| $139, first year fee rebate | $750 | $891 | $1,641 | $8,580 | $2,137 | $6,443 | |

| $120 | $350 | $737 | $967 | $6,520 | $2,391 | $4,129 | |

| $139 | $250 | $390 | $501 | $2,810 | $1,860 | $900 | |

| Travel Cards Average | $100 | $393 | $585 | $927 | $5,293 | $2,243 | $3,051 |

| $0 | $99 | $318 | $417 | $3,279 | $4,292 | -$1,013 | |

| $120, first year free | $170 | $450 | $620 | $3,590 | $5,037 | -$1,477 | |

| $99 | $0 | $461 | $362 | $3,620 | $4,850 | -$1,230 | |

| $0 | $25 | $529 | $554 | $5,315 | $7,254 | -$1,939 | |

| $99 | $320 | $600 | $821 | $5,330 | $7,253 | -$1,923 | |

| Cash Back Cards Average | $64 | $123 | $472 | $555 | $4,227 | $5,737 | -$1,510 |

Quite the difference in results, don’t you think?

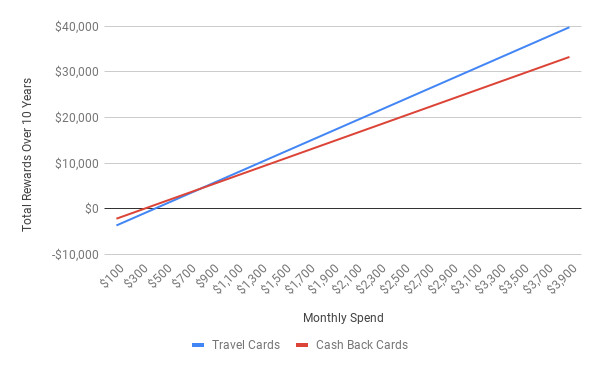

All the travel cards saw a huge jump in rewards – especially the

And while there are a couple of travel cards that don’t give better value than the cash back rewards cards, the better travel cards clearly outperform the cash back cards by a sizeable margin. Our average 1-year rewards value for all 5 travel cards is $5,293, while the 5 cash back cards were only $4,199. Not to mention the sign-up bonuses are larger as well.

*Note: Chart excludes welcome bonuses, but factors in annual fees.

And here’s the comparison combining the cash and travel cards together.

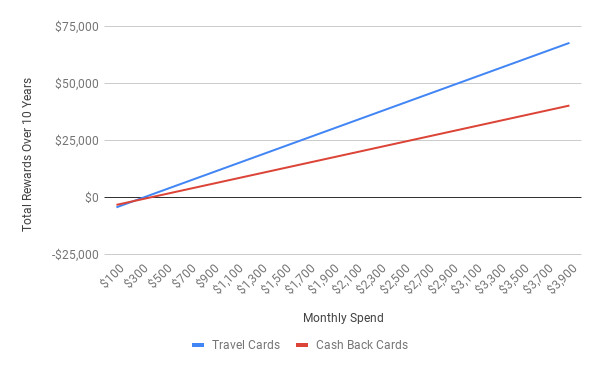

Of course, these aren’t the only credit cards available. Let’s compare our top 5 travel and cash back cards by net annual rewards using the same $2,500 monthly spend – after all we can’t exclude our #1 credit card from the comparison.

| Credit Card | Annual Fee | Sign-Up bonus | Annual Rewards | CCG 1 year value | CCG 10 year value |

|---|---|---|---|---|---|

| $120 | $525 | $1,129 | $1,534 | $10,615 | |

| American Express Gold Rewards (Discontinued) | $150 | $625 | $1,031 | $1,506 | $9,435 |

| $120 | $750 | $891 | $1,641 | $8,580 | |

| American Express Aeroplan Plus Gold Card (Discontinued) | $120 | $375 | $875 | $1,130 | $7,925 |

| $120 | $344 | $833 | $1,057 | $7,474 | |

| Travel Card Average | $126 | $524 | $952 | $1,374 | $8,806 |

| $0 | $25 | $529 | $554 | $5,315 | |

| $99 | $320 | $600 | $821 | $5,330 | |

| $120, first year free | $160 | $623 | $783 | $5,310 | |

| $99 | $0 | $563 | $464 | $4,640 | |

| $120, first year free | $163 | $555 | $718 | $4,633 | |

| Cash Back Cards Average | $88 | $134 | $574 | $668 | $5,046 |

When comparing our top 5 travel and cash back cards averages, the 10-year value has a larger difference between travel and cash back cards – almost $4,000.

By looking at the best of the best there really is a stark difference between the top travel and cash back cards – in fact, it’s almost double the difference.

But there’s also a specific comparison to address…

Unfair Comparison: BMO Air Miles World Elite Mastercard vs. Rogers World Elite

The

Unfortunately, it’s not a fair fight. While the

Let’s look at the numbers a little closer.

Our 10 year number shows that the AIR MILES card gives $369 more rewards over that span. One other thing this card does is increase the value of every AIR MILE you own with its 15% discount on the miles needed for a flight within North America. It’s included in our table numbers, and raises the normal 17.2 cents per mile value up to 20.2.

Now, compare the Rogers World Elite to the

At the end of the day, if you travel at least once every 2 years, getting a top travel card will save you more than the best cash back cards.

More than just rewards: credit card insurance and perks

But rewards isn’t the only arena where travel cards outperform cash back cards – they usually come with better travel insurance and perks as well.

While a few cash back cards offer great travel insurance, it’s definitely a domain where travel cards reign king. Even a no fee travel card like the

But perks is where things start to get really interesting. They provide benefits for making travelling life easier or other ways to save you money.

This includes things like:

A great example of this is the

But, its main perk is it provides an annual free night worth up to 35,000 points at Marriott hotels every year you have the card. That free night voucher is worth up to $340 alone – more than offsetting its annual fee of $120.

Perks like these are mostly found on travel cards, yet another reason they’re tops in our books.

We did agree with some of their arguments

The Lean House Effect article did make some valid points that we wholeheartedly agree with. Here’s where they were spot on:

1) Always pay your bills in full to avoid interest charges

Warning: If you do not think you’ll be able to pay off your credit card in full every month, do not get any credit card, no matter what. There is no rewards program that merits the interest rate that you’ll be charged for carrying a balance, even one month per year.

Absolutely. There’s no amount of rewards you’ll earn that can offset credit card interest payments on a large balance. If you can’t make your payments on time, or tend to carry a balance, credit cards in general are not for you.

Tip: If you do have credit card debt, a low interest credit card like the

2) The best way to redeem travel rewards is for travel

If you’re using a points card, then you are almost certainly going to spend the points on flights. Of course, all the points programs allow you to spend them on a new TV or toaster oven, but the best value for your points is clearly to spend them on flights. Using your points for anything else is just burning money and limiting your consumer choice to the things that they’ve put in front of you.

This is also true. When you earn travel rewards, you’ll usually be given plenty of other ways to use your points besides travel, with options for things like gift cards, merchandise, statement credits, and more. Believe it or not though, the toaster oven isn’t always available.

It may seem obvious, but you’ll almost always get the best value for your points when redeemed for travel rewards – even more so with flights. Luckily, we tell you what all your reward options are worth through our extensive guides to 15 of Canada’s major reward programs.

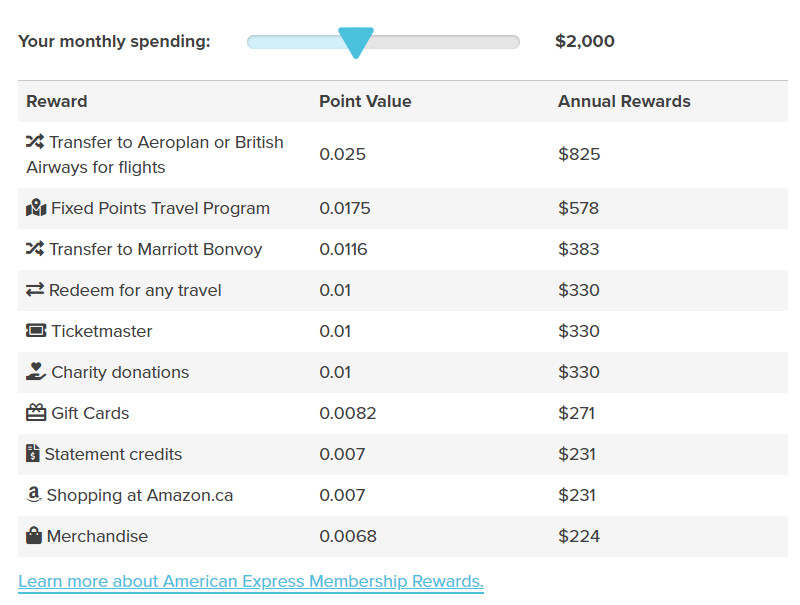

And, on our overview page we have for each card in our database, you can even see what each redemption option is worth to you over the run of a year based on your monthly spending.

Here’s an example for the

With a quick glance you’ll see that you can take the easy way by redeeming your points for gift cards or a simple statement credit – but you’ll also see that your reward value quadruples if you transfer your points to Aeroplan.

So yes, redeeming for travel is almost always the better way to redeem your points. When in doubt, check out our overview page for your card, or simply redeem for flights and travel to get the most from your points.

3) Cash back may be better for the environment

From an environmental perspective, if everyone switches to cash back then there will hopefully be less flying. If you are going to fly the same amount with a cash back card, then your environmental footprint will be the same as with a points card and you’ll have some extra money to spend while on vacation. However, you may decide that, this year instead of flying, you’ll put that money toward a down payment on an electric car and go on a road trip instead. Or you’ll visit your parents via the train and have a more pleasant experience instead of always flying. If all you have is air miles then of course you’re going to always be flying, but if you have the option to spend your money elsewhere then you’ll likely have a smaller environmental footprint and a larger bank account.

Another good point – flying is one of the worst things you can do for your carbon footprint. And if you’re not collecting travel rewards, you may be inclined to travel less, reducing your personal footprint.

4) Don’t limit yourself just to credit cards from your bank

If you would prefer to just choose from the credit cards at your bank so that everything is in one online banking dashboard, I get that, but you’ll be forfeiting some savings for convenience.

Yup, limiting yourself to only credit cards that your bank offers can severely limit the rewards you get from your cards – that’s true for both cash and travel rewards.

Keep an open mind and look at all issuers and see what they have to offer. Besides, setting up a bill payment through your online banking to pay off your credit card from a different issuer can be done in just a few clicks anyway.

Finding the best credit card for you

So how do you find the best card for you? We have plenty of tools to help you find your perfect match.

1) Our Annual Credit Card Rankings

Every year we research and track more than 126 features of nearly every credit card on the Canadian market. We then feed that into our unbiased algorithm that crunches the numbers to find what cards are truly best.

We break it down into 24 different categories, so you’re sure to find a top card that fits your needs.

2) Our Credit Card Comparison Tool

Our compare cards page has all sorts of tools and filters for you to use.

You can customize your monthly spending, change what’s important to you with our easy-to-use sliders, and set your credit score and income so you’ll only see credit cards that are within your reach.

The cards displayed are all updated in real time as you change your settings. You’ll quickly see how much each card will net you in rewards each year for easy comparison. Click Learn More to get a detailed breakdown on each card in the list.

Keep in mind, unlike other sites, cash back cards are never actually excluded because even when you choose Travel+, you can still redeem your cash rewards for travel.

3) Take The Quiz: Your Top Card Guaranteed

If that wasn’t enough, you can also take the creditcardGenius quiz.

Take our 3-minute quiz and put your credit cards to the test.

There’s lots to explore on our site, and you’ll become a credit card genius in no time, earning more rewards on all of your purchases.

So what’s the truth about cash back vs. travel rewards?

Certainly, there’s a lot to like about cash back cards. You know what you’re getting for your rewards, and you’ll get cash you can use however you like. Not to mention you don’t have to worry about complicated rewards programs with varying values.

But to say that cash back credit cards are the only cards you should get and they’re vastly superior to travel cards is just misleading. Travel cards offer superior rewards, insurance, and perks. Period.

And to limit yourself to only 2 credit cards to choose from is not great for your wallet either. You could be missing out on plenty of rewards.

What are your thoughts on the subject?

Let us know in the comments below.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 4 comments