Frequent flyers have more options than ever when it comes to choosing a credit card to earn travel rewards. If you’re a Flying Blue member, you might be interested in the Air France KLM World Elite Mastercard offered by Brim Financial. To help you decide if it’s worth it, we’ll cover the card’s earning rate, rewards, cost, and more – plus highlight a card that earns you better rewards and benefits.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Overview of the Air France KLM World Elite MasterCard

The Air France KLM World Elite MasterCard has only been around for a few years, but it’s a great way for Flying Blue members to earn extra miles.

Here’s what you’ll earn for rewards on non-travel purchases:

- 2 miles per $2 spent at restaurants and bars

- 1 mile per $1 spent on all other purchases

If you book a flight on Air France or KLM, you’ll earn an extra 5 miles per 1 Euro spent. This is on top of what you would earn as a regular Flying Blue member.

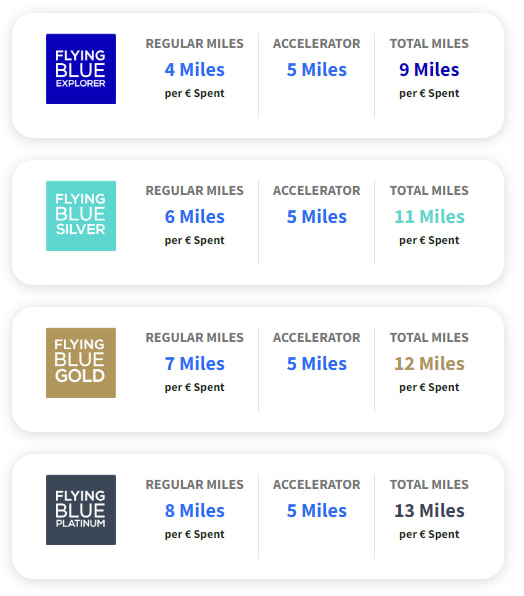

Take a look at how that point maximizer optimizes your earnings based on your Flying Blue status:

And since this is a Brim Mastercard, you can earn bonus miles when shopping with Brim's retail partners. In this case, up to 30 miles per $1 spent.

Pros:

- Up to 2 miles per $1 spent on purchases

- Bonus miles on Air France and KLM travel

- 30 Flying Blue XP on your anniversary

- 13 types of insurance

Cons:

- Limited reward options

- Annual fee of $132

- Income requirements of $80,000 personal or $150,000 household

Air France KLM WEM benefits

If you’re hoping for lots of travel upgrades or benefits with the Air France KLM card, you’ll probably be disappointed.

You will get a 30 XP bonus every year and an extensive World Elite insurance package with 13 types of coverage:

Air France KLM World Elite MasterCard

| Extended Warranty | 1 year |

| Purchase Protection | 90 days |

| Mobile Device | $1,000 |

| Event Ticket Cancellation | $1,000 |

| Travel Accident | $500,000 |

| Emergency Medical Term | 15 days |

| Emergency Medical Maximum Coverage | $5,000,000 |

| Emergency Medical over 65 | 3 days |

| Trip Cancellation | $2,000 |

| Trip Interruption | $5,000 |

| Flight Delay | $500 |

| Baggage Delay | $1,000 |

| Lost or Stolen Baggage | $1,000 |

| Hotel Burglary | $2,500 |

| Rental Car Theft & Damage | Yes |

Please review your insurance certificate for details, exclusions and limitations of your coverage.

This card doesn’t waive foreign exchange fees or automatically elevate your program status. You’ll actually find that other World Elite Mastercards offer better benefits.

How can you redeem your miles?

You’ve got 5 redemption options for your Flying Blue Miles: flights, hotels, travel upgrades, merchandise, and charity.

Flights

With an average of 2.89 cents per mile (CPM), booking a flight with Air France or KLM is one of your best redemption options. You’ll have to fly out of 1 of the 6 Canadian airports where Air France/KLM operates – but you have access to a global network of destinations.

To maximize your miles, try to book with Air France and look for off-peak or promo reward flights since these have about 7% more value than KLM peak reward flights.

Hotels

Log in to Flying Blue’s Hotels For Miles travel platform to redeem miles for hotel stays. Although you can book with any of the 400,000+ properties, your miles won’t go very far. Miles for hotels are valued at an average of 0.68 CPM, but the program allows you to combine cash and miles when booking.

Travel upgrades

Once you’ve booked travel with Air France or KLM, you can contact Flying Blue’s customer service and put miles towards extras like cabin upgrades, seat selection fees, in-flight meals, Wi-Fi, airport lounge access, and sustainable fuel donations.

Although the miles required vary depending on your exact flight information, we estimate that travel upgrades are valued at around 4 CPM – one of the best redemption options on the list.

Donation

If you love the feeling of giving your miles to charitable causes, you’ve got options. KLM gives you the chance to donate to environmental, social development, children, healthcare, and education charities.

Choose from around 25 organizations and help them reach their KLM fundraising goal. At our last estimate, we figured charitable points averaged 2.89 CPM.

Merchandise

This is our least favourite redemption option since the value of the miles is dismal. Depending on which merchandise rewards platform you use, you’ll only get 0.11 to 0.55 CPM. You can combine miles with cash, but again, we’d avoid this since your miles are worth even less this way.

Is the Air France KLM World Elite Mastercard worth it?

Our honest opinion is that this card is disappointing.

The rewards are decent, earning you a minimum of 1 mile spent everywhere and more on restaurants and Air France/KLM flights. Flying Blue miles are worth an average of 2.89 cents each, which gives you a return of nearly 4% on your purchases. That's excellent for a World Elite Mastercard.

That said, the benefits are lacking. Sure, it has a good insurance package, but this is a WEM that belongs to an airline program. It offers bonus XP points towards the next level status with Flying Blue – and it's not even enough to get an immediate upgraded status. You also won’t get additional airline perks or benefits, like checked bags or priority services.

Alternative card options

It’s no secret that the American Express Cobalt Card is always at the top of our favourite credit card lists – and it beats the Air France KLM World Elite MasterCard hands down. You’ll get up to 15,000 welcome bonus points, 10 types of insurance coverage, and up to 5 points per $1 spent on the card.

You can transfer your Amex Membership Rewards to the Flying Blue program at a 1:0.75 ratio, but you’ll enjoy more flexibility with other redemption options. You can transfer to Aeroplan 1:1, redeem points for travel with the Fixed Points Travel Program, put points towards Ticketmaster purchases, get statement credits, purchase gift cards, donate to charity, shop at Amazon.ca, or buy merchandise.

Here are some other credit cards that earn Amex Membership Rewards and include more rewards, travel options, and travel perks than the Air France KLM card.

| Credit card | Current offer | Rewards | Annual fee | Learn more |

|---|---|---|---|---|

| American Express Cobalt Card |  $100 GeniusCash + Up to 15,000 bonus points (terms) $100 GeniusCash + Up to 15,000 bonus points (terms) | * 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month) * 3 points per $1 spent on eligible streaming services * 2 points per $1 spent on eligible gas, transit, and ride share purchases * 1 point per $1 spent on foreign currency purchases * 1 point per $1 spent on all other purchases | $191.88 | Learn More |

| American Express Gold Rewards Card | Up to 60,000 bonus points (terms) | * 2 points for every $1 spent on gas, groceries, drugstores, and travel * 1 point for every $1 spent on all other purchases | $250 | Learn More |

| American Express Platinum Card | Up to 100,000 bonus points (terms) | * 2 points per $1 spent on restaurants and travel * 1 point per $1 spent on all other purchases | $799 | Learn More |

| American Express Green Card | 10,000 bonus points (terms)) | * 1 point per $1 spent on all purchases | $0 | Learn More |

FAQ

Does the Air France KLM World Elite Mastercard have foreign transaction fees?

Yes, you’ll pay a 2.5% foreign transaction fee on purchases made outside of Canadian dollars.

What benefits do I get with my World Elite Mastercard?

You won’t get many benefits with this World Elite Mastercard. You’ll get 30 XP every year and a great insurance package.

What is the income requirement for World Elite?

World Elite Mastercards require $80,000 in personal income or $150,000 in household income.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×9 Award winner

×9 Award winner

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 2 comments