If you’re about to make a big purchase with a credit card and are considering credit card financing, you have a few different options.

Your credit card may offer installment plans. You could simply turn to a low interest credit card. And a couple of stores in Canada offer credit cards with cheap (and in 1 case free) financing with their own credit cards.

Here’s what you need to know about your credit card financing options.

Key Takeaways

- There are a few ways you can finance large purchases with a credit card.

- Installment plans are available with many major issuers and you can turn purchases of more than $100 into smaller payments over set terms.

- You can also turn to low interest credit cards which offer lower interest rates.

- A few stores in Canada offer credit cards that offer financing.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Credit card installment plans

Many credit card issuers are now offering installment plans. For a set fee, you can spread out the cost of larger purchases – typically $100 or more, though the exact minimum amount will vary by issuer. How long you can spread out your purchase will also vary.

Residents of Quebec: Some credit card issuers won't allow you to do installment plans while others will charge a general interest rate and not a fee. Some will only let you do installments if a fee isn't required. The details you see here apply to the rest of Canada.

For the most part, low interest and business credit cards will not be eligible for installments – but there are exceptions.

Here's an example of getting one set up from Scotiabank involving the Scotiabank Passport Visa Infinite Card.

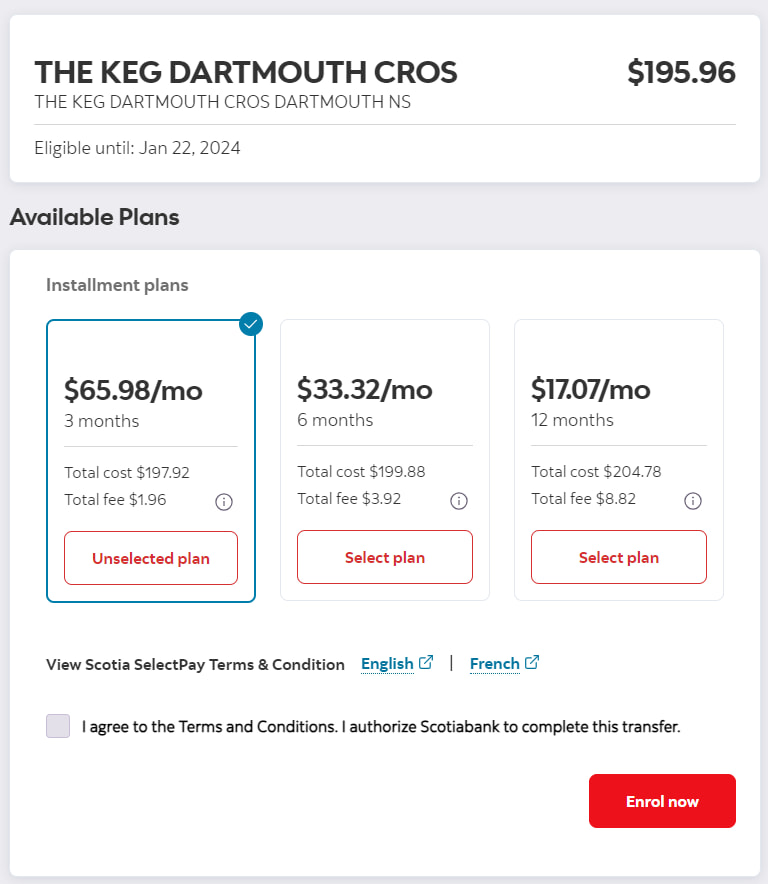

- Scotiabank calls installment plans "Scotia SelectPay" and cardholders can choose from 3, 6, or 12-month installment plans.

- The fee is based on the original purchase amount and varies based on which term you select – in this example it ranges from 1% for 3 months to 4.5% for 12 months.

To set up an installment plan for an eligible purchase, head to additional services.

Then, click on Scotia SelectPay.

You’ll be able to see a list of your eligible purchases. Here's what it would look like for this one.

Once you click on the purchase, you’ll see the plan options. Simply select the one you want and click enrol now.

With Scotiabank, that's it! For a small fee you can spread out larger payments over a few months.

Here are the details on the issuers that offer this and the fees involved.

1. Scotiabank

Let's finish our review of Scotiabank. With Scotia SelectPay, you can choose between terms of 3, 6, or 12 months. Your monthly payment is the total purchase amount plus the fee divided by the total term.

Scotiabank doesn’t clearly explain their fees online. In the example above, the fee is based on the length of the installment plan.

- 1% of the amount for a 3-month term

- 2% of the amount for a 6-month term

- 4.5% of the amount for a 12-month term

Eligible Scotiabank credit cards

Not all Scotiabank credit cards are eligible for installment plans. Only Scotiabank Visa cardholders can access Scotia SelectPay. If you have a Scotiabank Amex card, they aren't eligible.

Here are the eligible cards:

- Scotiabank Passport Visa Infinite Card

- Scotiabank Scene+ Visa Card

- Scotia Momentum Visa Infinite Card

- Scotia Momentum Visa Card

- Scotia Momentum No-Fee Visa Card

- Scotiabank Value Visa Card

Let's review the quick details on what the Scotiabank Passport Visa Infinite Card offers – the card from our example. A Scene+ credit card, here's what it earns for rewards on purchases:

- 3 Scene+ points per $1 spent at Sobeys, Safeway, FreshCo and more

- 2 Scene+ points per $1 spent on groceries, restaurants, entertainment, and daily transit

- 1 Scene+ point per $1 on all other purchases

It's also chock full of features for the traveller. They include:

- no foreign exchange fees,

- Visa Airport Companion membership with 6 free passes, and

- 11 types of insurance.

2. American Express

American Express offers installment plans with Plan It. This is not available everywhere – cardholders in Quebec, Nova Scotia, Nunavut, and Prince Edward Island are not eligible for installment plans with American Express.

Amex Plan It charges a fee spread out over your payment plan. The company doesn’t disclose the fee, which will vary based on your actual purchase. Purchases must be at least $100 to qualify and you can spread out your payments over 3, 6, or 12 months.

Eligible Amex credit cards

Here are the Amex credit cards that are eligible for Plan It installment plans.

- American Express Cobalt Card

- SimplyCash Card from American Express

- SimplyCash Preferred Card from American Express

- American Express Green Card

- American Express Gold Rewards Card

- American Express Essential Credit Card

- Marriott Bonvoy American Express Card

- American Express Aeroplan Card

That means the best credit card in Canada has an avenue to spread out larger payments with the American Express Cobalt Card.

Earning high value Amex Membership Rewards, here's what you'll earn for purchases:

- 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month)

- 3 points per $1 spent on eligible streaming services

- 2 points per $1 spent on eligible gas, transit, and ride share purchases

- 1 point per $1 spent on foreign currency purchases

- 1 point per $1 spent on all other purchases

Combined with each point being worth up to 2 cents, it's a stunning return of up to 10% on your purchases.

3. BMO

Installment plans for credit cards with BMO are through BMO PaySmart. To qualify, purchases must be at least $100.

The fee you'll pay is 0.9% of the amount borrowed. But this amount gets applied every month, and is not spread out over the course of your term. So if your purchase was $100, every month you're paying 90 cents.

You can choose between terms or 3, 6, or 12 months.

Eligible BMO credit cards

All BMO credit cards are eligible for PaySmart. These cards include:

- BMO eclipse Visa Infinite Card

- BMO eclipse Visa Infinite Privilege Card

- BMO eclipse rise Visa Card

- BMO AIR MILES World Elite Mastercard

- BMO AIR MILES Mastercard

- BMO CashBack World Elite Mastercard

- BMO CashBack Mastercard

Let's take a look at a no annual fee card – the BMO eclipse rise Visa Card. As a BMO Rewards card, here's what it earns on purchases:

- 5 BMO Rewards points for every $2 spent on dining, groceries, and reccurring bills

- 1 point per $2 spent on all other purchases

On top of that you can earn 2,500 bonus points if you pay your bill on time and in full for 12 straight months, and another 2,500 bonus points when you redeem 12,000 points towards statement credits in a year.

4. CIBC

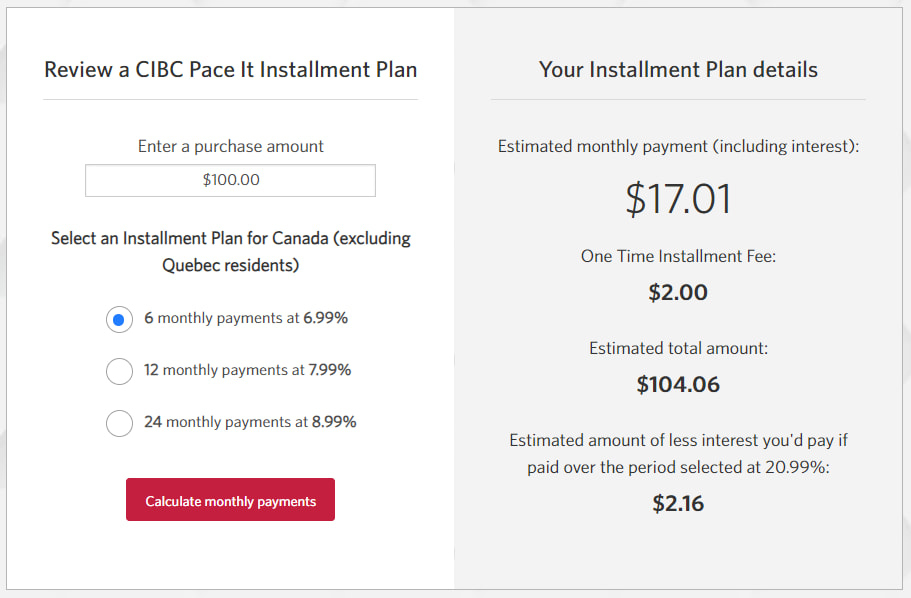

CIBC credit cards offer access to CIBC Pace It. There are 2 components to getting an installment plan for a CIBC credit:

- A 2% installment fee based on the total amount

- Interest on your installment amount, which will vary based on the term you select

Here's an example of what $100 would cost you.

Eligible CIBC credit cards

CIBC Pace It is available on all CIBC credit cards except the CIBC Select Visa Card and the Fido Mastercard. So that means the full lineup of Dividend and Aventura cards can access Pace It.

Here's what the CIBC Aventura Visa Infinite Card has to offer. Earning CIBC Aventura Rewards, here's what you'll get when you make purchases:

- 2 points per $1 spent on travel booked through the CIBC Rewards Centre

- 1.5 points per $1 spent on eligible gas, groceries, EV charging, and drugstores

- 1 point per $1 spent on all other purchases

It also offers 4 free airport lounge passes per year and comes with 12 types of insurance.

5. MBNA

MBNA Payment Plans are available to most MBNA credit cards and apply to any purchase more than $100.

Here are term lengths you can choose from, along with the one time fee you'll incur:

- 6 months – 4%

- 12 months – 6%

- 18 months – 8%

Eligible MBNA credit cards

All MBNA credit cards except the low-interest cards are eligible for MBNA Payment Plans:

- MBNA Rewards World Elite Mastercard

- MBNA Rewards Platinum Plus Mastercard

- MBNA Smart Cash Platinum Plus Mastercard

- MBNA Smart Cash World Mastercard

The best of the bunch is the MBNA Rewards World Elite Mastercard. You'll earn plenty of flexible MBNA Rewards at these rates:

- 5 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $50,000 spent annually per category)

- 1 point per $1 spent on all other purchases

On top of that you'll earn 10% bonus points every year on your birthday and get 12 types of insurance.

6. TD

TD owns MBNA, so it should be no surprise that TD's installment plans work exactly like MBNA’s.

On credit card purchases of more than $100, you can pay a lump sum fee depending on your term length:

- 6 months – 4%

- 12 months – 6%

- 18 months – 8%

Eligible TD credit cards

All TD credit cards are eligible unless they have an interest rate of 8.99% or less. Here’s the rundown:

- TD Aeroplan Visa Infinite Card

- TD Aeroplan Visa Infinite Privilege Credit Card

- TD First Class Travel Visa Infinite Card

- TD Platinum Travel Visa Card

- TD Cash Back Visa Infinite Card

- TD Cash Back Visa Card

- TD Rewards Visa Card

- TD Low Rate Visa Card

Let's take a look at a cash back card in the TD Cash Back Visa Infinite Card. This is what you'll earn back on every purchase you make:

- 3% cash back on gas, groceries, EV charging, public transit, digital gaming, and recurring bills

- 1% cash back on all other purchases

It also happens to be a rare credit card that includes roadside assistance.

Low interest credit cards

You can also take a look at a low interest credit card. Every purchase you make is subject to a lower interest rate than what most credit cards typically offer.

Here's a summary of the best low interest credit cards in Canada.

| Credit Card | Interest Rates | Special Features | Annual Fee, Income Requirements |

|---|---|---|---|

| MBNA True Line Gold Mastercard | * Purchase: 10.99% * Cash Advance: 24.99% * Balance Transfer: 13.99% | None | * $39 * None |

| MBNA True Line Mastercard | * Purchase: 12.99% * Cash Advance: 24.99% * Balance Transfer: 17.99% | Balance transfer offer of 0% for 12 months | * $39 * None |

| Scotiabank Value Visa Card | * Purchase: 13.99% * Cash Advance: 13.99% * Balance Transfer: 13.99% | Balance transfer offer of 0.99% for 9 months | * $39 * $12K personal |

| BMO Preferred Rate Mastercard | * Purchase: 13.99% * Cash Advance: 15.99% * Balance Transfer: 15.99% | Balance transfer offer of 0.99% for 9 months | * $39 * $15K personal |

Many of these cards also have balance transfer promotions, which can help you pay down credit card debt a little faster.

Installment plans vs. low interest credit cards

Comparing your options for your specific purchase and card is the only way to determine the most financially savvy choice.

Let's use our earlier example from Scotiabank to compare what you would pay if you used the MBNA True Line Gold Mastercard instead.

- Installment plan: On $195.96, we paid $1.96 for a fee for a 3 month term. This results in a monthly payment of $65.98.

- Low interest credit card: If we fully pay that off in 3 months while paying 8.99% interest, we’ll pay $66.30 per month with $2.94 in interest.

In this case, the installment plan is the better option. And while the amount is small, the low interest card would have cost you 50% more in fees and interest.

Store credit cards with financing

A few stores in Canada offer credit cards with special financing options. Here are two major ones:

- Canadian Tire: All Canadian Tire credit cards offer no fee or interest financing on purchases of more than $150 at any Canadian Tire store (including Sport Chek and Mark's) for 24 months – all you have to do is pay with your Canadian Tire Mastercard. The cashier will typically ask if you want to take advantage of the offer, but if not, ask for it.

- Home Depot: The Home Depot Project Loan card comes with 0% financing for the first 6 months. If you haven't paid for your purchase in full by then, you'll still get a low rate of 7.99% for the next 5 months.

Your credit card financing stories

There are plenty of ways to get financing from credit cards. Any stories about credit card financing you'd like to share?

Leave them in the comment below.

FAQ

What are credit card installment plans?

Credit card installment plans are available with most major credit card companies. They’re a way to spread out the cost of larger purchases, typically $100 or more. You'll pay a set fee to take advantage of an installment plan, and you may need to pay interest on the total purchase amount.

What are some options when it comes to credit card financing?

If you need credit card financing, your options include installment plans if your issuer offers them, low interest credit cards, and store credit cards with financing options.

Do any stores offer credit cards with financing options?

Canadian Tire and Home Depot offer store credit cards with financing options for large purchases.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×1 Award winner

×1 Award winner  $80 GeniusCash + Up to 60k bonus Scene+ points in year 1 + 6 free airport lounge passes.*

$80 GeniusCash + Up to 60k bonus Scene+ points in year 1 + 6 free airport lounge passes.*

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 1 comments