The COVID-19-induced recession is a thing of the past – and for now, so is the related period of high-inflation. The Bank Of Canada is no longer increasing interest rates, with talks of a potential decrease in the future.

A recession could still come back. If you have credit card debt, we have some top balance transfer offers for you to look at ‒ plus 8 other ways you can stay financially ahead.

Key Takeaways

- The COVID-19 pandemic induced a severe recession.

- Post-pandemic inflation was high but has come back under control.

- Some ways to recession-proof yourself include eliminating debt and holding off on major purchases.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

3 common causes of a recession

First things first: What is a recession anyway?

A recession happens when the economy has 2 economic quarters in a row with a negative growth percentage. This is reflected in a decrease of our Gross Domestic Product (GDP), which is the total value of goods produced and services provided in a country during one year.

However, the current decline has been steep. With over a million jobs lost, and an estimated contraction of the economy of 18% in March and April of 2020, the downturn has been steep enough to declare that a recession was already here in May of last year.

Causes of recessions are many and can be quite complex. These causes are often grouped into 1 of 3 categories:

1) Overvaluation (a.k.a. Bubbles)

Think housing in the 2008 housing recession, or the overvaluation of stocks in 1929. This type of recession is often preceded by overconfident, risky investments and high interest rates.

These are relatively predictable, but often the problem is that there appears to be a lot of money to be made off these risky assets, and warnings are not enough of an incentive to stop.

2) Supply-side shock

An example is the oil crisis in 1973. These are hard to predict, as they’re often caused by some natural disaster, war, or human action (such as a monopoly asserting market power, as in the oil crisis in 1973).

A recession caused by the coronavirus resulted in a supply side shock since the virus produced massive loss of productivity that cannot easily be made up elsewhere, since many have been forced into quarantine starting mid-March. The severity of the supply-side shock, however, depends on how resilient our supply chain is, and which parts of it get hit by the shock.

3) Demand-side weakness

Demand-side weakness is often described as a lack of consumer confidence. This is rarely the trigger of a recession, but often comes into play when some other shock causes layoffs.

If the population doesn’t have adequate savings or a strong social safety net, demand-side weakness makes recovery very difficult. Things like stagnant wages, low household savings, and high consumer debt don’t predict recessions, but they do predict how difficult the recovery will be when a recession hits.

5 symptoms of a recession

Here are some symptoms that can indicate a recession could is starting:

- rise in unemployment,

- rise in bankruptcies, defaults, or foreclosures,

- falling interest rates,

- lower consumer spending and consumer confidence,

- falling asset prices, including the cost of homes and dips in the stock market.

All of these things have to do with how much money people have. If you have less of it, you’re not spending or contributing as much to the economy – and it’s reflected in the above factors.

Falling interest rates are the exception here, as they save you money on future loans (especially mortgages). Central banks will lower interest rates as a way to get more money into the economy if they think a Canada recession is on the horizon. This is their attempt to help combat the possibility and reverse the numbers.

How the COVID-19 pandemic triggered a recession

Even though we typically need to go through 2 quarters of negative GDP before a recession can technically be declared, the symptoms had been clear enough – and we were officially in one shortly after the pandemic started.

1) Rise in unemployment

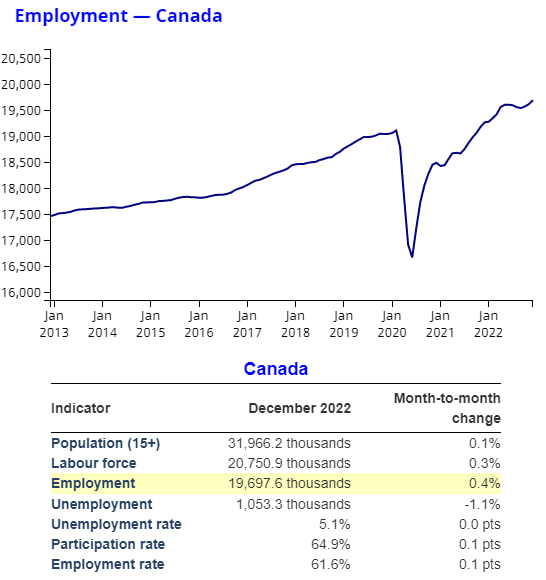

We’ve already seen workers with their hours cut, reduced to 0, or outright let go across Canada. Thankfully the government introduced several emergency programs to help stem the tide of unemployment.

The Statistics Canada employment numbers, which had previously been strong, started to come down in March, and bottomed out in June.

However, employment rates have fully recovered, and continue to increase.

2) Rise in bankruptcies, defaults, or foreclosures

With people out of work and the debt load and house prices in Canada at record highs in many regions of the country, it was only a matter of time before mortgage and loan defaults, bankruptcies and foreclosures started racking up.

We'd already seen a decrease in new home listings and home sales in major markets but considering the huge real estate bubble many Canadian cities were in, the declines so far haven’t been drastic, and in fact most of the declines have now been reversed.

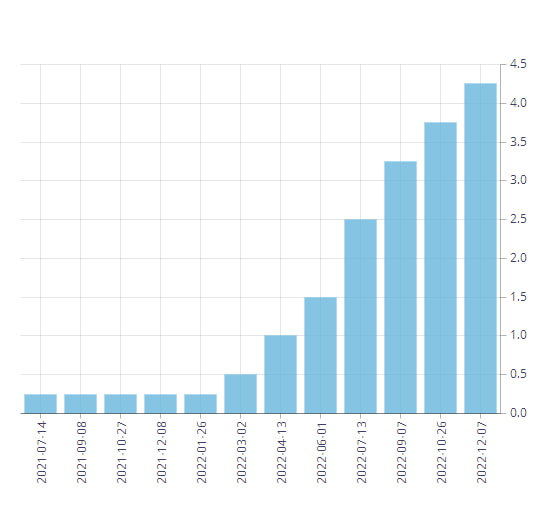

3) Falling interest rates

The Bank of Canada made 3 emergency “Policy Interest Rate” cuts amounting to a 1.5% decrease in interest rates shortly after the pandemic started.

Post-pandemic, interest rates have climbed beyond where they were prior to the pandemic in an effort to combat inflation.

Nearly all banks and lenders have followed suit in increasing their interest rates on savings accounts and loans. This is typical because their own interest rates are based on the Bank of Canada rate.

4) Lower consumer spending and consumer confidence

The immediate impact of the coronavirus is actually a large increase in spending on consumable goods like food and household products. But, at this time, the initial panic buying and hoarding has subsided.

All of this fear and reduction in consumer spending power caused the consumer confidence index to plummet in April 2020.

However, since bottoming out in April 2020, the index has started to climb back up. It was at its pre-pandemic peak until the Omicron wave started to hit, when it started to decrease again

5) Falling asset prices

Real estate and home ownership is almost sacred in Canada, which is why house prices have been so astronomically high for such a long period. People were starting to succumb to the thinking that “real estate always rises,” and that home ownership would never be affordable for many.

If there is anything that can pop our current real estate bubble, the fallout from the coronavirus is definitely it.

That said, the government stepped in by buying $50-billion in mortgage debt. However, this move is more meant to protect the financial system (and prevent a housing recession) in the face of consumer defaults and mortgage non-payment so they can keep operating and lending to those who need it.

As to housing prices themselves? Early on, housing prices in the Greater Toronto Area declined 11.3% in April. However, in Vancouver, while the number of sales went down, prices only saw a slight decrease.

Overall in Canada, while the number of sales were down, prices have remained largely flat to this point.

But that has started to reverse. In July of 2020, housing prices in the Toronto area increased 17% compared to where they were at the same point last year.

Looking at all of Canada, housing market sales and average value are looking much better than they were at the start of the pandemic. Total transactions are similar, and the average house price has increased 20%, which has been aided by low interest rates.

What economists were predicting before the coronavirus pandemic

So what were economists predicting coming into 2020?

Brett House, Vice President & Deputy Chief Economist at Scotiabank, didn’t think we would see one this year. He predicted a year of mediocre growth, but no recession. Check out his CBC segment here.

But on the other hand, last October David Rosenberg, chief economist at Gluskin Sheff & Associates, thought there would be an 80% chance of a recession coming to Canada this year.

Even just looking at these 2 sources, there wasn’t any agreement – one thought we’d be fine, and the other thought we would certainly see a recession.

People have been calling for a stock market crash and recession for years now. So, until recently, there was definitely a lack of clarity on whether 2020 would be the year.

These are the economic indicators and statistics people were looking at near the end of 2019 and early 2020 to try and predict the future:

Canadian economic forecast

So what was Canada’s economic forecast? The Canadian Outlook Economic Forecast had these main highlights (Winter 2020 summary):

- real GDP to grow by 1.8% in 2020, and 1.9% the next year,

- slow global growth that will challenge our trade sector,

- the Bank of Canada likely won’t make any interest rate changes in 2020.

Though the trade sector may face some obstacles, they don’t expect negative growth for our GDP – one of the main symptoms of a recession.

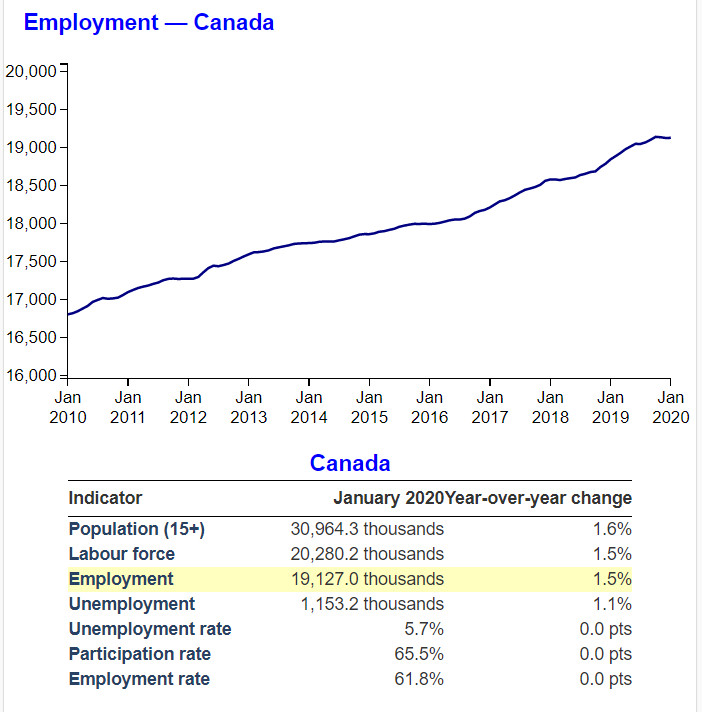

Canadian labour market was looking steady

Our unemployment rate plays a big part in whether or not we see a recession. After all, the more people who are out there working, the more who can contribute to our economy.

Early in 2020, the numbers were holding steady.

Our economy added 34,500 net jobs in January 2020, while our unemployment rate fell to 5.5%.

Looking a little further, Stats Canada was showing a largely increasing employment trend when looking at the top 44 census metropolitan areas in Canada.

And overall, the number of people being employed was on the rise, as shown by this graph:

Canada’s housing market in 2020

So what about our housing market?

Early 2020 showed that prices were expected to increase as well.

The market correction for the federal government’s mortgage stress test had passed, and more buyers were stepping back into real estate.

In the last quarter of 2019, housing prices increased by 2.2%, as interest rates remained low and labour markets strengthened.

What happened post pandemic

Once the pandemic-induced recession was over, we ran into a new problem: inflation.

Thanks to those low interest rates, inflation exploded and forced the Bank of Canada to quickly increase interest rates to bring it back under control.

With these rate increases, inflation has come back down – not quite to where the Bank of Canada wants it, but closer to their 2% target. The Bank of Canada may begin cutting interest rates in 2024.

For the time being, we are in the clear when it comes to a recession. But things can change and we may end up back in one at some point.

9 ways to recession-proof yourself

If we ever find Canada in a recession again in the future, the time is now to start preparing yourself for it so the consequences don’t come back to bite you.

However, now is still a good time to learn how to recession-proof yourself for both now and the future:

1. Get rid of credit card debt fast

Here are 4 top balance transfer credit cards to take a look at if you have some credit card debt sticking around. There are some rules when it comes to balance transfer credit cards, which you can find here.

One key rule to remember? You can’t transfer a balance to a credit card from the same bank. The balance transfer card you get has to be from a different bank than the one you’re currently carrying a balance with. This also includes credit cards from issuers owned by other banks, like how MBNA is owned by TD.

| Credit Card | Balance Transfer Offer | Annual Fee, Income Requirements | Apply Now |

|---|---|---|---|

| MBNA True Line Mastercard |  $135 GeniusCash + 0% interest on balance transfers for 12 months (terms) $135 GeniusCash + 0% interest on balance transfers for 12 months (terms) |

* $0 annual fee * None |

Apply Now |

| CIBC Select Visa | 0% interest on balance transfers for 10 months (terms) | * $0 annual fee * None |

Apply Now |

| Scotiabank Value Visa | 0.99% interest on balance transfers for 9 months (terms) | * $29 annual fee * $12,000 personal | Apply Now |

| BMO Preferred Rate Mastercard | 0.99% interest on balance transfers for 9 months (terms) | * $0 annual fee * $15,000 personal |

Apply Now |

The best balance transfer offer in Canada belongs to MBNA with the

The offer – 0% for 12 months. That’s a long time you won’t have to pay interest. Just note it has a slightly higher transfer fee of 3%.

And this low rate is for no annual fee or income requirements.

CIBC has an excellent balance transfer offer with the

The offer is excellent – 0% for 10 months. Not quite as long as the card above, but it also has a lower transfer fee at 1%.

Just note this card has a small annual fee of $29.

Scotiabank's low-interest card has an excellent balance transfer offer in the

The annual fee for this card is $29.

BMO’s low interest credit card also has an excellent balance transfer offer – the

The offer? 0.99% for 9 months, with a transfer fee of 2%.

As for the permanent rates it offers:

- 13.99% on purchases,

- 15.99% on balance transfer, and

- 15.99% on cash advances.

The annual fee is $29 and the first year is free.

Want to see more balance transfer offers? Here are the top balance transfer offers currently available.

2. Avoid credit card debt in the first place

We love credit cards, but only if they’re used responsibly. If you find you frequently spend more than you can pay and can’t make your payments, a credit card may not be for you.

One great alternative? A prepaid card. Our top prepaid cards function like credit cards, and offer rewards on purchases. And it’s all while only spending money you load onto the card, avoiding interest charges.

Since you’re using your own money, you don’t need a credit check to get one, making them good cards for anyone who has poor credit.

If this sounds like music to your ears, here’s one option to consider.

The

This card earns up to 2% cash back on your purchases, has no foreign exchange fees, and you'll only pay a monthly fee of $9.

3. Have an emergency fund ready and a secured line of credit

Having an emergency fund stashed away goes a long way towards helping weather a recession.

A basic rule to follow is having 3 months of net income saved, to give yourself time to find new work or wait for a layoff to end.

For a worst case scenario, having a secured line of credit as a backup will give you some emergency money if you need it.

4. Diversify your skills and make yourself indispensable at work

Recessions can lead to job losses and layoffs. You don’t want this to be you, but sometimes there’s no avoiding it.

However, here are a few things you can do to make sure you’re the one who doesn’t get let go:

- Prove your worth and demonstrate your direct impact on the bottom line.

- Increase your skills and study after hours.

- Be the best at something no one else can do.

- Take on more responsibility and go the extra mile.

5. Hold off on major purchases, vacations, or splurges you might otherwise make

It goes without saying if a recession is on the horizon and you’re concerned, hold off on a big purchase, vacation, or any other splurge – you may need that cash later.

6. Fast-track your mortgage payments

One of the largest sources of debt in any household is a mortgage. However, unless you’re nearing the end of payments, you likely won’t be able to make your mortgage go away that easily.

So, if you have a mortgage that offers the ability to prepay a certain amount every year, making some extra payments every now and again can help shave a few years off your mortgage. This will afford you more financial flexibility both during a recession and later in life.

In the event that you lose your job during a recession, many banks and lenders will allow you to skip mortgage payments if you are ahead of schedule. The more you’re ahead, the more payments you can skip. Check with your mortgage lender to see if this applies to you.

Variable vs. fixed interest rates

When you’re getting your first mortgage (or renewing your current one), make sure to consider variable rate mortgages as well.

While there’s some risk involved in getting a variable rate mortgage, as interest rates could rise and leave you paying more, they almost always have lower interest rates than a fixed rate mortgage. Fixed rate mortgages are usually higher as banks include some extra margins built in for fluctuations in rates.

In fact, most of the time, you’ll save money by having a variable over a fixed rate mortgage. Interest rates don’t change very often, and your interest rate will almost always be lower.

We’re unfortunately in one of those times when a variable rate mortgage was not the better choice, as the Bank Of Canada has made several large increases to their overnight rate in the past year.

7. If you’re nervous about a recession, it’s time to reassess your risk tolerance

Does the simple thought of a recession or stock market crash make you nervous? It may be time to reassess your risk tolerance.

Consider switching to lower risk investments. You’ll give up the larger earnings you make with more aggressive portfolios, but your losses will be smaller as well.

Unfortunately, now that the stock markets have already crashed, switching now might not be the best move as you would be locking in your losses and missing out on the nearly inevitable recovery that has always happened after previous recessions.

Seek out professional financial advice for guidance before making any rash decisions.

8. Check your investment asset allocation and diversify

When investing, it’s important not to put all your eggs in one basket. If you only invest in Canadian stocks, or limit yourself to a few different segments of the economy, and there’s a downturn in the market – you’re really going to lose value in your portfolio.

Make sure you have a diverse array of investments. Not everything is going to tank in value, and you’ll be able to weather any storm much better.

9. Ensure your company can weather a recession

Worried about your business? Depending on what you do and what market you’re in, a recession can easily affect you with losses of revenue.

Keeping a large emergency fund to cover expenses (at least 6 months) is a good idea to keep you afloat. And make sure you’re diversified enough to minimize any decline in revenue as well.

Also make sure you take advantage of the large array of government programs targeted at business to help keep your staff employed.

Your thoughts

Talks about recessions can be chilling for many, and this one has been particularly steep and the recovery could take some time.

The best thing you can do is prepare for the “what ifs” – but it also isn’t worth worrying about it nonstop. We can’t predict the future and everything that comes.

Currently there is no recession, but one could come in 2023. Let us know in the comments what you've done to prepare ahead of time or what you're doing last minute to weather the current storm.

FAQ

Is Canada in a recession in 2023?

At the moment, Canada is not in a recession. The pandemic is long gone and inflation has begun to come back under control.

What are some things I can do to help weather a recession?

We have 9 things that you can do to help weather a recession – the biggest one being to eliminate debt. Eliminating debt can help you avoid higher interest rates and help save you money.

What is the best balance transfer offer to help eliminate credit card debt?

Our top balance transfer offer is with the MBNA True Line Mastercard, which has a promotional balance transfer offer of 0% for 12 months, with a 1% transfer fee. If your balance is with a credit card from TD or MBNA, we suggest looking at the CIBC Select Visa Card, which has an offer of 0% for 10 months, with a lower transfer fee of 1%.

creditcardGenius is the only tool that compares 126+ features of 229 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 229 cards is for you.

×2 Award winner

×2 Award winner

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 10 comments