Active trader on the stock market? Get wind of some changes in stock prices you want to take advantage of? Or maybe your gut tells you it’s time to sell something? Stock trading apps make it easy to buy and sell shares.

There are many questions to answer when it comes to trading stocks. What is the best stock app for trading? Can you do it for free? And what is stock trading?

Here are the answers to these questions.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What is stock trading?

Put simply, stock trading is the act of buying and selling shares in companies that are made available through the stock market.

Stocks are an investment in a publicly-traded company against the future profitability of that company. If you purchase a company’s stocks, you own part of that company and have some claim to a share of that company’s future profits.

There are 2 ways to get a return on your investment when trading stocks:

- if the stock price goes up, you can sell it for more than you paid for it, or

- you can hang on to the stock and eventually collect dividends (part of the company’s profits).

Not all companies will pay dividends, but many do, and they’re usually paid out on a quarterly basis.

For the most part, when people talk about “stock trading,” they’re talking about buying and selling stocks in the short-term in an attempt to make money off changes in the price of the stock, rather than buying stocks and holding on to them for the long term.

Active trading vs. day trading

If you’re buying and selling a relatively large number of stocks to make profits in the short term, you’re effectively an active trader. If you make enough trades within a certain period (usually within a quarter), you can even get a discount on your trading fees from most platforms.

A day trader is a type of active trader that focuses on the very short term, usually buying and selling the same stock within a single trading day. Day traders by and large don’t hold any stocks overnight.

Until fairly recently, day traders were almost exclusively professionals. Easy-to-use online stock trading apps have changed that, however, and more and more previously casual traders are becoming active traders and day traders.

How to get started with stock trading

There are a number of different ways to get into stock trading, of course, with some being riskier than others.

Invest through a wealth management company

Traditionally, the easiest way to invest in stocks and other products is by giving your money to a wealth management business and letting them take care of everything. Beyond receiving a quarterly report, getting tax forms, and maybe touching base with your wealth manager once or twice a year, this is a pretty hands-off activity.

Wealth management companies, by and large, are only interested in dealing with the very rich, putting this option out of reach for the majority of Canadians.

Invest through a robo-advisor

A more recent version of this – robo-advisors – are a bit more accessible to regular people.

Robo-advisors are similar to investing through a wealth manager, in that you give them your money and they’ll take care of everything for you. Where they’re very, very different, however, is that robo-advisors are largely automated, driven by an algorithm rather than by humans.

That isn’t to say they’re entirely automated, of course – most robo-advisors have humans who provide oversight and make sure that things run smoothly – but at their core, robo-advisors are automated software systems.

DIY investing with a stock trading app

If you’re not interested in a totally hands-off approach, and you want to do your own investing, it’s incredibly easy to do so these days through a plethora of DIY trading apps. We’ll be looking at some of these online stock trading apps here.

What are stock trading apps?

Stock trading apps let you buy and sell stocks without having to deal with other humans at all. You open the app on your phone or computer, issue buy or sell orders, and those orders are executed on your behalf by the company that runs the app you’re using.

It really isn’t any more complicated than that. But there are some things you need to be aware of when you dive into using these sorts of apps.

What to look out for with stock trading apps

If DIY investing through a stock trading app is something you’re interested in, there are a few drawbacks you should keep an eye out for as you’re getting started.

Risks

First and foremost, as with most investments, you could lose all your money.

There is no guarantee that you’ll make money, and a significant risk that you’ll lose everything. Stock trading is not for the faint of heart, and you should never gamble this way with money you can’t afford to lose.

We’ll say it again, for emphasis: you could lose all your money.

Just be very, very certain that you know exactly what you’re getting yourself into before depositing any money into a self-directed investment account.

Fees

In order to start buying and selling stocks, of course, you have to have some money in your trading account. And while most banks won’t charge you anything to put money into your trading account, you may be surprised by unexpected fees when it comes time to transfer money out of your account.

If you’re transferring money from one trading platform to another, some companies will cover those transfer fees for you, so you’ll want to keep an eye out for offers like that.

Trade delays

While professional traders have monumental banks of computers colocated with the major stock exchanges…you don’t. Professional traders can lose enormous amounts of money with even fraction of a second delays between ordering a trade and that trade actually taking place.

And you can lose money on those delays as well. Be sure to read everything you can about your stock trading app before getting started, so you’re fully aware of its limitations and restrictions.

Do any banks have stock trading apps?

All of Canada’s Big 5 banks offer self-directed stock trading platforms you can use to manage your own investments.

But there are a couple of things you should be aware of before diving in:

- they charge very high per-trade fees, and

- their customer service is reportedly (and universally) abysmal.

Case in point: when the whole “GameStop” trading frenzy happened in January 2021, clients reported being on hold for hours waiting to speak with customer service representatives. A frustrating experience at the best of times, made even worse when there’s money at stake.

So, with high fees and (reportedly) horrible customer service, you may want to investigate some alternative options before making a final decision.

Best stock app in Canada – a review of your options

Canadians have a plethora of online stock trading apps to choose from, including those offered by the big banks as well as some smaller, more modern newcomers. But which are the best stock apps?

As with many things, the best stock apps depend entirely on what you’re looking for.

Here we’ll review what’s offered by each of the Big 5 banks, plus Wealthsimple Trade and Questrade.

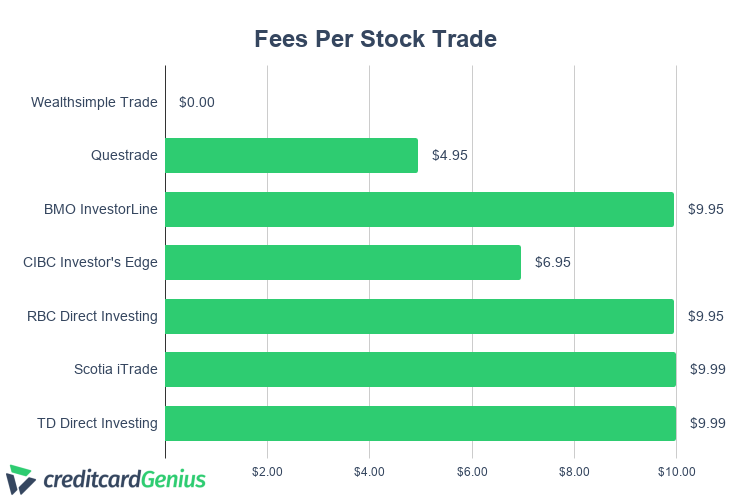

| App | Fees per stock trade | Best for | Special features |

|---|---|---|---|

| Wealthsimple Trade | $0.00 | People who are just getting started, mostly doing simple trades, and who don’t need all the bells and whistles. | * No fees * No account minimums |

| CIBC Investor’s Edge | $6.95 | New investors, active investors, and students. | * Student pricing * Active trader pricing * Live help for new investors * Free investment tools and research |

| Questrade | 1 cent per share, minimum fee of $4.95, max of $9.95 | Active traders who are looking for more advanced data and analytics. | * Low fees * Fixed and variable pricing for active traders * Advanced market data packages for the U.S. and Canada * More investing options available |

| BMO InvestorLine | $9.95 | A good option for either new or advanced traders, as long as you’re willing to pay the fees. | * Advanced tools for active traders * Demos and tutorials for new users |

| RBC Direct Investing | $9.95 | New traders who want to learn the ropes before actually risking any money. | * Free practice accounts to try out investing, risk-free * Active trader program with lower fees and more robust tools |

| Scotia iTrade | $9.99 | New users, young investors, active traders. | * Practice accounts so you can learn the ropes * Young investor incentives * Active trader pricing |

| TD Direct Investing | $9.99 | Intermediate or advanced traders who are looking for advanced tools and research. | * Licensed support representatives * Real-time market data and quotes * Educational resources and “Masterclass” workshops |

While you’re able to buy and sell more than just stocks on all of these platforms, stocks have been the most popular option of late. Stocks also tend to have easy to understand fees, albeit often higher than you might expect.

Here’s what these fees look like, compared side by side.

Wealthsimple Trade

Wealthsimple Trade is one of the least expensive self-directed investing apps we’re looking at in this article.

You’re limited in what you can invest in, with only stocks and ETFs available through Wealthsimple Trade, making it a bit limited for more advanced traders. That said, however, there are thousands of stocks available, from major U.S. and Canadian exchanges.

And Wealthsimple Trade’s mobile app is streamlined and well designed, making it easy for new users to get started.

But the best part? There are no fees to buy and trade stocks. If you trade all the time, this could lead to some significant savings.

Pros: Commission-free trading and no account minimums.

Cons: One major drawback is that price quotes on Wealthsimple Trade have a 15 minute delay, so prices aren’t necessarily current. This is an app for individual, casual traders, not high volume professionals. Legal disclaimer.

Wealthsimple Self-Directed Investing

CIBC Investor’s Edge

CIBC‘s self-directed investment platform – CIBC Investor’s Edge – is an interesting hybrid model, in that it offers loads of research and tools for advanced traders, but also offers advice and educational resources for newbies.

The fees are lower than what other big banks charge. You’ll only pay $6.95 per trade. If you’re an active trader, with more than 150 trades per quarter, that comes down to $4.95 per trade.

With lower than average fees, and discounts for both active traders and students, CIBC’s platform may be a good choice for people looking to get into trading, but who would like a little extra hand-holding while they get started.

Pros: Lower fees, with student and active trader discounts. Free research, tools, and advice. No minimum investment.

Cons: Fees are lower, but can still add up fast. And while there’s no minimum investment, many account types have annual fees if your balance is under a certain level, so be sure to read the fine print before signing up.

CIBC Investor's Edge

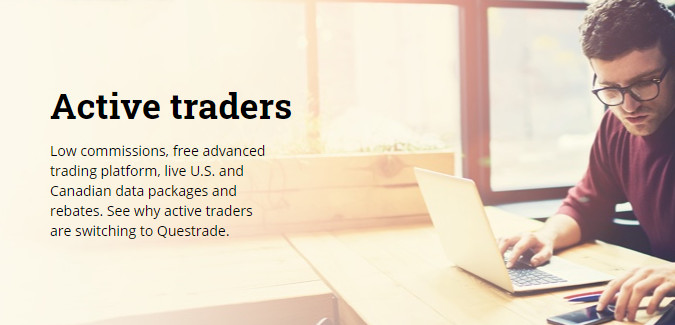

Questrade

Questrade, like Wealthsimple, offers both a robo-advisor (for those of you who prefer a more hands-off approach), and a self-directed platform for people interested in managing their portfolios themselves.

Questrade is a more advanced and robust platform for trading than Wealthsimple offers right now, with advanced tools, research, and data available.

You can also invest in a much wider range of products, including ETFs, options, stocks, mutual funds, IPOs, international equities, and precious metals.

And if you’re an active trader, Questrade has discounts available to you either as fixed or variable fees. Which is best for you depends on what type and volume of trading you’ll be doing.

If you’re into trading stocks, you’ll pay a price of 1 cent per share, with a minimum fee of $0.95 and a maximum of $9.95.

Pros: Excellent collection of investing and trading tools. Commission free ETFs, no annual RRSP or TFSA account fees, and a wide range of other investment options.

Con: Minimum investment requirement of $1,000. There’s also an inactivity fee of $24.95 per quarter if your balance falls below that minimum, or you haven’t placed a trade in the previous 3 months.

Questrade

BMO InvestorLine

BMO Self-Directed InvestorLine is another step up in terms of complexity and requirements. This is a fully DIY investment platform with a $5,000 minimum investment (except for RESP or TFSA accounts). Live support is available if you need it, and you can do trades through a representative if you’re not comfortable using the tools yourself. But be warned: commission fees apply in this case, and can add up very quickly.

With research covering both U.S. and Canadian equities, advanced analysis tools, and performance tracking, Bank of Montreal’s InvestorLine is really targeted more at advanced and active traders, and might be a bit overwhelming for anyone new to trading.

Pros: Top research, analysis, and tracking tools. Live advice and personal help available if needed.

Cons: High fees, high minimum investment, and a steep inactivity fee per quarter for non-registered accounts.

RBC Direct Investing

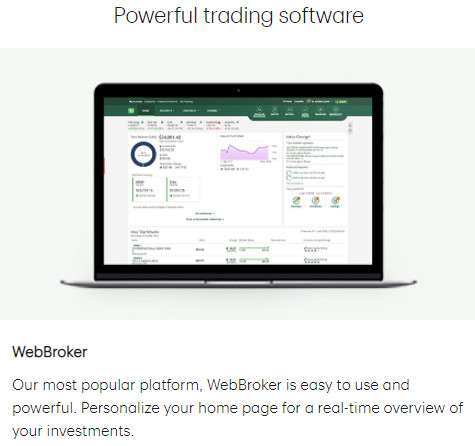

Royal Bank of Canada’s self-directed trading platform looks like it’s designed for both newcomers and advanced traders alike, but with high trading fees, account maintenance fees, and transfer rebates that only kick in if you transfer more than $15,000…it’s pretty clearly designed for more advanced users.

One fairly unique feature they offer for new users is the ability to set up a practice account, so you can learn how to trade with RBC Direct Investing without risking any actual money.

Pros: Free practice account for people who want to get their feet wet without risking any money. Active trader accounts for people who do more than 150 trades per quarter.

Cons: High trading fees and account maintenance fees. No minimum investments, but the maintenance fees require a minimum of $15,000 invested through RBC Direct Investing to be waived.

Scotia iTrade

Like RBC Direct Investing, Scotia iTrade offers free practice accounts so you can learn the ropes before diving in with any actual cash. You’ll also find a solid array of research, tools, and support, which is useful for traders of any experience levels.

Also like RBC, Scotiabank’s DIY investing platform has high per trade fees, and quarterly inactivity fees (that can be waived in some circumstances).

Pros: No minimum investment. Free practice accounts. Active trader pricing. Solid tools and research. Socially-responsible investment options.

Cons: High per trade fees and inactivity fees. Recent reports of sub-par customer service response times.

TD Direct Investing

Finally, there’s TD Direct Investing. Like the self-directed investment platforms offered by most of the Big Five banks, TD Bank’s has high per transaction fees and quarterly inactivity fees. It also lacks any sort of practice accounts, and doesn’t offer socially responsible investment options.

Its active trader discount is also less than on other platforms, making it sort of a questionable choice for anyone, regardless of their personal trading comfort and volume.

Pros: Free learning and research tools. A variety of trading apps available, depending on what you’re looking for. Interactive training sessions are available for those who need them.

Cons: High (highest) transaction fees, quarterly maintenance fees, and middling active trader discount. No practice accounts available, and no socially responsible investing options.

Bottom line

DIY investing is increasingly popular these days, giving regular Canadians the opportunity to directly manage their own investments. While this may not suit everyone’s tastes, and while there is a lot of risk involved, more Canadians are taking the plunge.

Do you have self-directed investments through any of these stock trading platforms?

What do you think about them? Are they easy to use? Good customer service?

Or do you suggest people avoid them?

Let us know what you think in the comments!

Looking for more ways to build a nest egg? Learn about compounding your cash back rewards.

FAQ

What is the best app for stock trading in Canada?

The best app for you depends entirely on what you’re looking for. If you prefer a lightweight mobile app that lets you make simple, no fee, casual trades, Wealthsimple Trade might be right for you. If you’re a more active trader, or would like more robust tools and research, Questrade offers these along with lower transaction fees than the Big 5. For a big bank app, CIBC Investor’s Edge has plenty of tools, and the lowest trading fees of any big bank app. Learn more about these here.

What is the best stock trading app for beginners in Canada?

If you know nothing about trading at all, both RBC and Scotiabank offer free practice investment accounts on their platforms that will let you get your feet wet without risking any actual money. If you have a general idea of what you want to do and just want a simple, straightforward, no fee app for doing it, Wealthsimple Trade could be a better choice.

How can I trade stocks for free in Canada?

Wealthsimple Trade offers no fee stock trading in Canada. All other trading apps have fees every time a trade is made.

What’s the best free trading app in Canada?

The best free stock trading app that also charges no transaction fees or commission fees is Wealthsimple Trade. It’s a simple app that is well suited for people who are just getting started. Be warned however: no matter which stock trading platforms you choose, there is always the chance that you could lose all your money.

Are trading apps safe?

Stock trading apps in Canada are safe, but that isn’t to say they’re without risk. As with any non-guaranteed investments, you could lose any money you invest, regardless of how or where you invest it. Be sure you know exactly what you’re getting into before risking any money. If it’s lost, there’s no getting it back.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 4 comments