One avenue for investing that is getting more popular is direct investing. The big reason why? The fees. They are much lower than other investing platforms, including robo advisors.

With direct investing, you’re in complete control of your portfolio. You choose the investments you want to buy, and make your own changes as you see fit.

So how much does it cost to trade? What fees are involved? Here’s what’s available, from both the big banks and discount brokers.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Direct investing explained

What is direct investing? It’s as the name implies. You do the investing. You decide what you want to invest in. You choose the funds, stocks, ETFs, or bonds you want, and make adjustments as you go.

Want to buy a bunch of stocks? Go for it. Have a bad feeling and want to sell a few things? Do it.

There’s no one to guide you – you’re on your own.

And with this expanded power you have, comes lower fees. Since you’re doing all the work, you don’t have to pay an investment manager, a company that has to look over algorithms, or anyone else.

Fees typically charged

So what kinds of fees are there?

Here’s the most common fees you’ll have to be on the lookout for.

Fees per trade

When you go to make a trade, you’ll have to pay a fee, whether you’re buying or selling.

How much you have to pay depends on the platform. There are some that actually charge no fees, and can be as high as $9.95 per trade. Some of them do offer discounts if you’re an active trader. To qualify, you have to meet a certain number of trades per quarter.

The fee can also vary based on what type of fund you’re purchasing. Some direct investing platforms will charge a different fee for ETFs, stocks, mutual funds, etc.

Inactivity fees

If you don’t trade very often, you may get dinged with an inactivity fee. It’s not charged by many brokers though, and it only gets applied if you don’t make at least one trade in a quarter.

Withdrawal fees

If you’re looking to pull your money out of your portfolio, you may be charged a fee. This fee is typically $150.

If you’re saving for the long term, this probably won’t matter too much. If you want to switch brokers however, that’s a fee you’ll have to keep in mind.

Minimum account fee

This last fee is generally only charged by the big banks. If you don’t keep a certain amount in your account, you’ll be charged a quarterly fee.

Whether or not you have to pay can also depend on the type of account. Certain registered accounts won’t have this.

What the big banks have to offer for direct investing

You’ve got many options for direct investing.

We’ll start with what the big 5 banks have to offer. The platforms are largely similar, the only real difference between them are the fees and the exact kind of investments you can access.

The big bank platforms offer a wealth of knowledge and information at your disposal. They also offer the widest variety of investment types. And there’s always the personal touch of talking to someone should you need it. But like anything with a big bank, you end up paying for it through fees.

And, all the prices shown here are if you do everything online. If you go through an investment representative, the fees are higher.

CIBC direct investing

Investor’s Edge is the direct investment arm of CIBC.

Available in both registered and non-registered accounts, here are your investment choices:

- stocks,

- ETFs,

- options,

- mutual funds,

- fixed income, and

- GICs.

CIBC Investor’s Edge charges the lowest fees for online equity trades (stocks and ETFs), at $6.95. For active traders who make more than 150 trades per quarter, it’s an even lower $4.95. There are no fees for purchasing mutual funds.

Are there minimum account balances? Yes, but only for non-registered accounts, as well as RRSPs. For RRSPs, you’ll need to maintain a market balance of $25,000, or you’ll pay an annual fee of $100.

For non-registered accounts, you’ll pay a $100 annual fee if your market balance is less than $10,000.

CIBC Investor's Edge

TD Direct investing

TD Direct investing is TD’s platform for direct investing.

They offer all kinds of different accounts, including registered and non registered accounts.

And here are the main types of investments you can sink your money into:

- stocks,

- ETFs,

- mutual funds,

- fixed income,

- GICs, and

- options.

As for their fees, they charge a flat $9.99 fee per trade for Canadian and U.S. stocks. If you make more than 150 trades per quarter, you qualify for their active trader fee of $7.

But those only apply to stocks and ETFs. There are no fees to purchase mutual funds and fixed income products.

TD also charges a minimum account fee of $25 per quarter if you have total assets of less than $15,000 in your direct investment account.

RBC Direct investing

RBC Direct investing is just one of Royal Bank’s investing tools.

RBC has a full lineup of investment choices, including:

- stocks,

- ETFs,

- mutual funds,

- fixed income, and

- options.

RBC charges $9.95 per transaction to purchase stocks and ETFs. If you’re an active investor, and make more than 150 trades per quarter, it drops down to $6.95 per transaction.

There are no fees to purchase mutual funds or fixed income products.

There is also a minimum account balance required to avoid a quarterly charge. You’ll need to maintain assets of $15,000 with RBC Direct Investing to waive the $25 fee. This fee can be waived under certain criteria, such as having an RBC VIP Banking package.

One cool feature of RBC Direct Investing – they offer practice accounts. RBC will give you $100,000 in practice money to see if this service is right for you, and learn what goes into do-it-yourself investing.

Scotiabank direct investing

iTrade is Scotiabank’s direct investing platform.

Here are the different types of investments you can get, which are available in both registered and non-registered accounts:

- stocks,

- ETFs,

- mutual funds,

- options,

- bonds,

- new issues,

- precious metals, and

- GICs.

With Scotia iTRADE, you’ll pay $9.99 per equity trade, which includes stocks and ETFs. There are no changes for purchasing mutual funds.

Like the other platforms we’ve seen so far, you’ll qualify for active trader status when you complete more than 150 trades in a quarter. But, you’ll only pay $4.99 per trade.

Scotia iTRADE also has minimum account fees. If you don’t maintain a balance of $15,000, you’ll be charged a $25 fee every quarter.

iTRADE also has low activity fees on their investment accounts (they aren’t charged on registered accounts). If you don’t make at least one trade every 3 months, you’ll be charged a $25 fee.

Scotiabank also offers $100,000 practice accounts, so you can get your feet wet before getting into the real thing.

BMO direct investing

Finally, we have BMO InvestorLine Self-Directed.

Here’s the direct investments you can get, in both registered and investment accounts:

- stocks,

- ETFs,

- options,

- mutual funds

- GICs, and

- bonds.

When purchasing stocks and ETFs, you’re looking at a fee of $9.95. Mutual funds have no fees for purchasing.

Unlike the other big banks, BMO Investorline has no active trader discount on their trading fees.

And there is a minimum account requirement. For non-registered accounts, you’ll need to maintain an account balance of at least $15,000 if you want to avoid the $25 quarterly fee. But this doesn’t apply to registered accounts.

It’s even higher for registered accounts. For them, you’ll need to maintain a minimum balance of $25,000 to avoid an annual fee. The annual fee varies by the type of registered account, and can be either $50 to $100.

Discount brokers for direct investing

So as you can see, there are still fees to pay.

So if you can live without going to a big bank, here are a couple of discount brokers you can use. The fees are lower, and there are no minimum balances to worry about.

Of course, there’s another price to pay for this. There’s fewer investments to choose from, and customer service will be entirely online.

Wealthsimple Trade

We’ll start with Wealthsimple Trade. Wealthsimple started out as a robo advisor (now called Wealthsimple Invest), but has since branched out and started a direct investment arm.

There are much more limited accounts here – you can get a personal, TFSA, or RRSP account.

And you can only invest in stocks and ETFs.

But the fees? Good luck finding any. There’s no cost to making any trades, and there’s no account minimums.

If you can live with these basic tools, you’ll save even more money. Legal disclaimer.

Wealthsimple Self-Directed Investing

Questrade

Questrade also offers self directed investing. And like Wealthsimple, doesn’t have the full range of options, offering only personal accounts, as well as RRSP and TFSA accounts.

But there are more choices as to what you want for investments. Here are some of the major options you can choose from:

- stocks,

- ETFs,

- options,

- mutual funds,

- GICs, and

- bonds.

Pricing is a little unique at Questrade. For stocks, you’ll pay 1 cent per share, with a minimum fee of $4.95, and a max fee of $9.95. ETFs are free to buy, but there’s a fee to sell them, which is the same as stocks.

If mutual funds are your game, you’ll pay $9.95 per trade. There are no fees for bonds and GICs, but you need to make a minimum purchase of $5,000.

There are no minimum account or inactivity fees, however you will need to set $1,000 in your account before you can begin trading.

Questrade

Comparing fees for direct investing

Here’s all the basic fees side-by-side, for easier comparison.

| Company | Transaction Fees | Account Fees |

|---|---|---|

| CIBC Investor’s Edge | * Stocks: $4.95 – $6.95 * ETFs: $4.95 – $6.95 * Mutual Funds: None |

* Inactivity: None * Minimum balance to waive account fee: $10,000 to $25,000, depending on the account type |

| TD Direct Investing | * Stocks: $7 – $9.99 * ETFs: $7 – $9.99 * Mutual Funds: None |

* Inactivity: None * Minimum balance to waive account fee: $15,000 |

| RBC Direct Investing | * Stocks: $6.95 – $9.95 * ETFs: $6.95 – $9.95 * Mutual Funds: None |

* Inactivity: None * Minimum balance to waive account fee: $15,000 |

| Scotia iTRADE | * Stocks:$4.99 – $9.99 * ETFs: $4.99 – $9.99 * Mutual Funds: None |

* Inactivity: $25 * Minimum balance to waive account fee: $15,000 |

| BMO InvestorLine Self-Directed | * Stocks: $9.95 * ETFs: $9.95 * Mutual Funds: None |

* Inactivity: None * Minimum balance to waive account fee: $15,000 to $25,000, depending on the account type |

| Wealthsimple Trade | * Stocks: None * ETFs: None * Mutual Funds: N/A |

* Inactivity: None * Minimum balance to waive account fee: None |

| Questrade Self Directed | * Stocks: $4.95 – $9.95 * ETFs: None ($4.95 – $9.95 to sell) * Mutual Funds: $9.95 |

* Inactivity: None * Minimum balance to waive account fee: None |

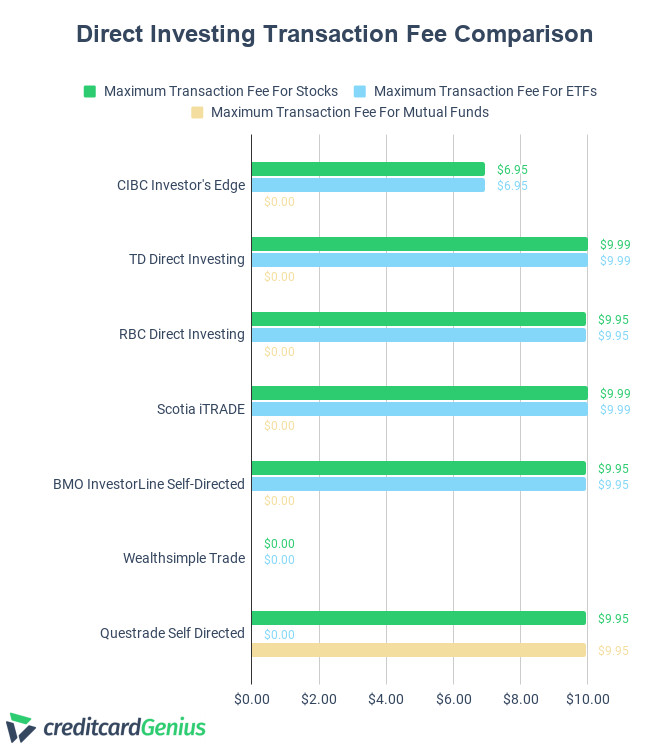

Transaction fees

Maybe the most important thing – the transaction fees.

Here’s what you’ll pay for fees for the 3 main investment types.

Wealthsimple stands out with not having any fees, although you can’t buy any mutual funds from them.

Among the big banks, CIBC Investor’s Edge stands out with its low fee of $6.95 per trade, much lower than the typical $10 the other banks charge.

And if mutual funds are what you’re after, the big banks are actually your best bet, as Wealthsimple doesn’t offer them, and Questrade is the only platform that charges for purchasing them.

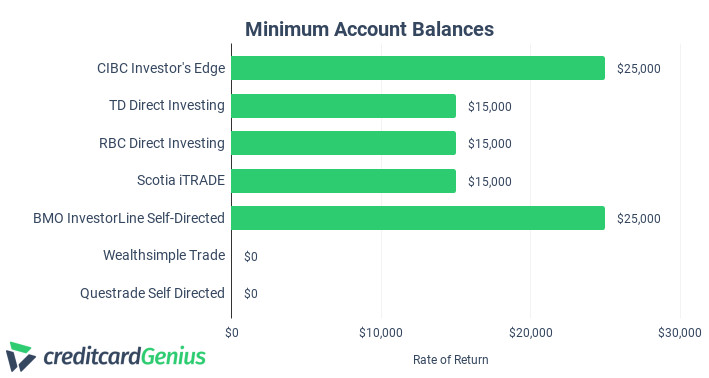

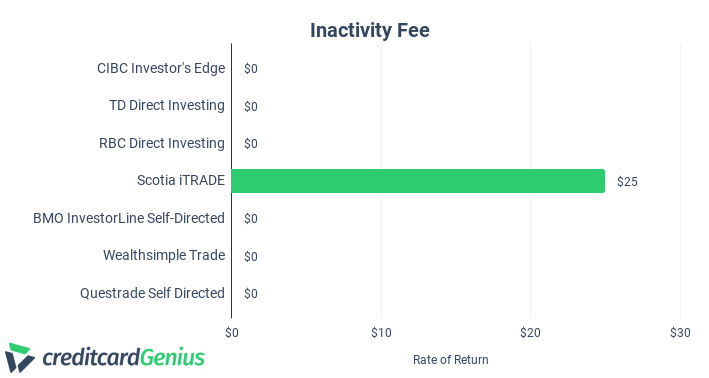

Account management fees

There are 2 key management fees to think about – if they charge a fee for not maintaining a minimum balance, and if you don’t trade enough and your account is inactive.

First, here’s the minimum balance you’ll need to maintain for these accounts so you can avoid either a quarterly or monthly fee.

The online brokers don’t have minimum account balances, potentially saving you a little bit more money.

As to inactivity fees? These are just charged by one of these brokers.

Scotiabank is the only one to charge a fee, which you’ll see if you don’t make at least one trade per quarter.

Want to add your credit card rewards to your retirement fund? Here’s how you can increase your retirement fund with the cash back you earn.

Robo advisors to consider

If direct investing seems like it may be a bit much for you, but you still want lower fees, we suggest thinking about a robo advisor.

These are fund-and-forget investment portfolios. They have defined portfolios, and an algorithm takes care of investing your money, reinvesting dividends, and balancing your portfolio.

The companies that provide them charge a small fee, upwards of 0.5% of what you have invested. A fee to pay, but is much smaller than what an investment manager would charge.

Here are some top robo advisors you can look at.

FAQ

What is direct investing?

With direct investing, you get to decide what you’re investing in – you’re in complete control. Pick and choose what stocks, ETFs, mutual funds, or whatever else your brokerage offers to invest in, and make your own changes on the way. You can also get personal or registered accounts, like RRSPs.

What fees are involved with direct investing?

The primary fees involved with direct investing are transaction fees. You’ll pay a small amount every time you make a trade. Some accounts also charge an account fee if your balance isn’t over a set amount.

Who offers direct investing?

Direct investing is offered by the big banks (like RBC), as well as online brokers, like Wealthsimple and Questrade.

What’s the cheapest way to invest your own money?

Generally, investing with a discount broker is the cheapest way to invest your money. They charge fewer fees, as their presence is entirely online.

Should I go with a big bank or discount broker?

This all depends on what you’re after. If you just need the basics and want a simple service, we suggest using a discount broker. But to access more investments, better investment tools, and want more of a personal touch if you need help, a big bank would be better.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.